Tuesday, May 24, 2016

Is Saudi Arabia Going Broke?

By Brandon Turbeville

By Brandon TurbevilleAny informed observer, by now, should be fully aware that the Saudis are hurting financially. That is, they are hurting as much as any degenerate hedonistic ruling class of genetic royalty can be. But, while Saudi princes roll around in money and women and unspeakably depraved forms of entertainment and while they oversee a nation of slaves and prisoners, the bank accounts of the Kingdom of Saudi Arabia are now at a low point.

After years of decadence and willingness to lavishly fund terror and propaganda all across the world and after agreeing to work with the United States in a suicidal attempt to hurt Russia at the oil export pump, Saudi Arabia is finally starting to realize that there may actually be a bottom to their bank accounts.

As payment from the state, contractors would receive

bond-like instruments which they could hold until maturity or sell on to

banks, the people said, asking not to be identified because the

information is private. Companies have received some payments in cash

and the rest could come in the “I-owe-you” notes, the people said,

adding that no decisions have been made on the measures.

Saudi Arabia has slowed payments to contractors and suppliers, tapped foreign reserves and borrowed from local and international banks in response to the decline in crude oil, which accounts for the bulk of its revenue.

Even Moody’s the notorious lying agency that gave derivatives in the United States good credit ratings before the collapse, downgraded the Saudi long-term issuing rate from A1 to Aa3. Bloomberg reports,

Even Moody’s the notorious lying agency that gave derivatives in the United States good credit ratings before the collapse, downgraded the Saudi long-term issuing rate from A1 to Aa3. Bloomberg reports,

Saudi Arabia’s economic growth is slowing as revenue from oil exports declines. Gross domestic product will likely expand 1.5 percent this year, the slowest pace since the global financial crisis, according to a Bloomberg survey of economists.

“Until there is greater clarity on this situation some negativity and increased speculation from investors and other market participants should be expected,” said Chavan Bhogaita, head of market insight and strategy at National Bank of Abu Dhabi.

As Bloomberg reports,

Saudi Arabia has told banks in the country that it is considering giving contractors IOUs to settle some outstanding bills, according to people with knowledge of the discussions.

This news comes as Saudi Arabia is threatening to sell off hundreds of billions of dollars of U.S. assets if Congress passes a bill that would allow families of the victims of 9/11 to sue the KSA. Although President Obama has already threatened to veto the bill, such threats were most likely hollow to begin with. After the news of the Saudi financial condition, however, it is even less likely that the Saudis would go through with their threat.

Of course, we still expect Obama to veto the bill.

Image Credit

Brandon Turbeville – article archive here – is the author of seven books, Codex Alimentarius — The End of Health Freedom, 7 Real Conspiracies, Five Sense Solutions and Dispatches From a Dissident, volume 1 and volume 2, The Road to Damascus: The Anglo-American Assault on Syria, and The Difference it Makes: 36 Reasons Why Hillary Clinton Should Never Be President. Turbeville has published over 650 articles on a wide variety of subjects including health, economics, government corruption, and civil liberties. Brandon Turbeville’s radio show Truth on The Tracks can be found every Monday night 9 pm EST at UCYTV. His website is BrandonTurbeville.com He is available for radio and TV interviews. Please contact activistpost (at) gmail.com.

This article may be freely shared in part or in full with author attribution and source link.

VENEZUELA DESCENDS INTO CHAOS… EUROPE AND US NEXT

by JEFF BERWICK

It has been less than two months since I visited Caracas, Venezuela. While things were already very bad when I was there, they are now worse.

Power shortages have deepened (and this in an oil rich country!); food is becoming scarce (some people have resorted to eating dogs and cats); people lie on concrete slabs in hospitals without medicine (if you thought medical care was bad, just wait until it’s free!); and riots and looting are growing worse.

I went to see the end stages of socialism, complete with hyperinflation. I wanted to see where Europe and the US are headed.

I didn’t find much interest in gold and silver, let alone much buying, even though it was obviously a good idea. And, forget bitcoin. No one knew what it was… except for the government that predictably has banned it.

Bizarrely, large parts of Caracas still hang pictures of Hugo Chavez and still consider him to be a hero!

I met a few people who were open to rational discussions. They were making about about $20 a month and could barely survive.

“Why don’t you go somewhere else?” I asked them. “Colombia is close. And Trinidad & Tobago, Aruba, Argentina or Chile. All with economies that are functioning and sometimes doing very well.”

The general response was, “I don’t know anyone there.”

Very strange. Why choose to live in squalor and desperation just because the environment is familiar to you?

This is a mentality I often see in America. Elsewhere, too. Stressed, people have a tendency to live like serfs, never venturing far from their birthplace.

It’s really not necessary in this era of the internet. Spend five minutes on Facebook and you know some people.

In fact, our global reach includes TDV Groups (also known as the Vigilante Expat Network). If you’re a subscriber, you can converse with other dollar vigilantes anywhere in the world. They are a great bunch. I know from experience, they’ll practically pick you up at the airport and help you get situated if you decide to visit or move.

It’s just one of the many benefits of being a Dollar Vigilante newsletter subscriber (see more here).

The scary thing about Venezuela is that all the conditions already exist, and are nearly the same, in Europe right now. And the only difference between where the US is headed and Venezuela, is the US hasn’t outlawed guns… yet. Otherwise whatever I saw and experienced in Venezeula was already familiar to me from my travels in the US and Europe. (It’s one reason I got out and went to live in Acapulco.)

I was in Venezuela seven years ago and it was generally fine. A beautiful place to visit full of bustling shops, restaurants, bars and hotels. Two months ago when I returned, I was visiting the murder capital of the world. As I wrote, we had to carry backpacks of money to pay for lunch at the few restaurants that were open. We were told to not wear sunglasses or use our mobile phones or we’d get robbed. Our hotel barricaded the doors at night to keep criminals out.

Venezuela: Meet the destiny of Europe and the US.

Both Europe and the US are already tumbling further into socialism. Nearly half of all millennials in the US say they like socialism over capitalism.

Just look at Joseph Stiglitz, the Nobel Prize winner in Economics (Keynesian/Globalist economics that is), who is one of the most respected economists in the US… He wrote The Price of Inequality and, excuse me as I hold back from vomiting, Making Globalization Work. He’s also the former vice-president of the World Bank.

The West is headed the way of Venezuela. In fact, it’s all part of the Globalist one world socialist government plan being quickly put into place this Jubilee Year.

You can see it in Europe, where unrestrained Islamic immigration is being aimed at creating chaos within established cultures. And in the US, where the possibility of a Hillary victory would firmly establish a Venezuela-style paradise.

This Jubilee Year is all about putting in place the final foundation for the world’s oncoming globalism. Venezuela is just a little bit ahead of the curve. For a video on this Jubilee Year and its growing damages, please see HERE. And for our White Paper, please see HERE.

I had the opportunity to interview one of the only anarcho-capitalists in Venezuela for my program, Anarchast. It took us nearly two months to put it live because I insisted on paying Daniel to translate it. It took him nearly two months because of the nearly constant power outages.

Have a look at this conversation I had with one of the few people in Venezuela who understands economics. See how quickly things fall apart under socialism and how the US, Europe, and many other places in the West are not far behind following Venezuela’s path:

It has been less than two months since I visited Caracas, Venezuela. While things were already very bad when I was there, they are now worse.

Power shortages have deepened (and this in an oil rich country!); food is becoming scarce (some people have resorted to eating dogs and cats); people lie on concrete slabs in hospitals without medicine (if you thought medical care was bad, just wait until it’s free!); and riots and looting are growing worse.

I went to see the end stages of socialism, complete with hyperinflation. I wanted to see where Europe and the US are headed.

In hindsight, it was shocking to

see how few people in Venezuela understood what was going on. You’d

think in this day and age, they’d just watch a few Youtube videos (like

some of ours) and realize the reality: Almost all their problems are a

direct result of government and central banking.

Yet, hardly anyone understood. Your average person was miserable,

that was for sure. But they didn’t know what was causing their misery.I didn’t find much interest in gold and silver, let alone much buying, even though it was obviously a good idea. And, forget bitcoin. No one knew what it was… except for the government that predictably has banned it.

Bizarrely, large parts of Caracas still hang pictures of Hugo Chavez and still consider him to be a hero!

I met a few people who were open to rational discussions. They were making about about $20 a month and could barely survive.

“Why don’t you go somewhere else?” I asked them. “Colombia is close. And Trinidad & Tobago, Aruba, Argentina or Chile. All with economies that are functioning and sometimes doing very well.”

The general response was, “I don’t know anyone there.”

Very strange. Why choose to live in squalor and desperation just because the environment is familiar to you?

This is a mentality I often see in America. Elsewhere, too. Stressed, people have a tendency to live like serfs, never venturing far from their birthplace.

It’s really not necessary in this era of the internet. Spend five minutes on Facebook and you know some people.

In fact, our global reach includes TDV Groups (also known as the Vigilante Expat Network). If you’re a subscriber, you can converse with other dollar vigilantes anywhere in the world. They are a great bunch. I know from experience, they’ll practically pick you up at the airport and help you get situated if you decide to visit or move.

It’s just one of the many benefits of being a Dollar Vigilante newsletter subscriber (see more here).

The scary thing about Venezuela is that all the conditions already exist, and are nearly the same, in Europe right now. And the only difference between where the US is headed and Venezuela, is the US hasn’t outlawed guns… yet. Otherwise whatever I saw and experienced in Venezeula was already familiar to me from my travels in the US and Europe. (It’s one reason I got out and went to live in Acapulco.)

I was in Venezuela seven years ago and it was generally fine. A beautiful place to visit full of bustling shops, restaurants, bars and hotels. Two months ago when I returned, I was visiting the murder capital of the world. As I wrote, we had to carry backpacks of money to pay for lunch at the few restaurants that were open. We were told to not wear sunglasses or use our mobile phones or we’d get robbed. Our hotel barricaded the doors at night to keep criminals out.

Venezuela: Meet the destiny of Europe and the US.

Both Europe and the US are already tumbling further into socialism. Nearly half of all millennials in the US say they like socialism over capitalism.

Just look at Joseph Stiglitz, the Nobel Prize winner in Economics (Keynesian/Globalist economics that is), who is one of the most respected economists in the US… He wrote The Price of Inequality and, excuse me as I hold back from vomiting, Making Globalization Work. He’s also the former vice-president of the World Bank.

“Venezuelan President Hugo Chavez appears to have had success in bringing health and education to the people in the poor neighborhoods of Caracas, to those who previously saw few benefits of the countries oil wealth,” he said.And, look at this tweet from one of the top politicians in England from only three years ago!

In his latest book “Making Globalization Work,” Stiglitz argues that left governments such as in Venezuela, “have frequently been castigated and called ‘populist’ because they promote the distribution of benefits of education and health to the poor.”

“It is not only important to have sustainable growth,” Stiglitz continued during his speech, “but to ensure the best distribution of economic growth, for the benefit of all citizens.”

The West is headed the way of Venezuela. In fact, it’s all part of the Globalist one world socialist government plan being quickly put into place this Jubilee Year.

You can see it in Europe, where unrestrained Islamic immigration is being aimed at creating chaos within established cultures. And in the US, where the possibility of a Hillary victory would firmly establish a Venezuela-style paradise.

This Jubilee Year is all about putting in place the final foundation for the world’s oncoming globalism. Venezuela is just a little bit ahead of the curve. For a video on this Jubilee Year and its growing damages, please see HERE. And for our White Paper, please see HERE.

I had the opportunity to interview one of the only anarcho-capitalists in Venezuela for my program, Anarchast. It took us nearly two months to put it live because I insisted on paying Daniel to translate it. It took him nearly two months because of the nearly constant power outages.

Have a look at this conversation I had with one of the few people in Venezuela who understands economics. See how quickly things fall apart under socialism and how the US, Europe, and many other places in the West are not far behind following Venezuela’s path:

No wonder they want us to Remain: Germany fears Brexit because they would lose £35BILLION

A GERMAN bank has predicted Britain leaving the EU will cost the German economy almost £35BILLION - plunging the country into financial disrepair.

By Rebecca Perring GETTY

GETTY The future of German companies will be thrown into doubt in the event of Britain freeing itself from the shackles of Brussels as 2,500 businesses have branches across the UK.

As Remain and Leave camps drum up support for their campaigns here in the UK, DZ Bank says Brexit would cost the Germany economy £34.8bn by 2017 alone and the country could fall into recession.

German experts predicted Britain leaving Europe would act as a “slow poison” to their countries economy.

GETTY

GETTY Meanwhile, the UK is also said to be an important export market – in 2015 Germany exported goods of a value of £70bn to Britain.

Markus Kerber, CEO of Bundesverbandes der Deutschen Industrie (BDI-federal association of German industry) warned a negotiation process, in the event of Britain severing ties with the EU, would take years.

He said: “I believe the damage caused by Brexit would be big for both sides.

“A fierce competition will ensue.”

Mr Kerber warned companies would be competing against each other to access market and regulatory standards if Britain opts to Leave the 28-member bloc.

GETTY

GETTY More than 2,500 German companies have branches in the UK, while around 3,000 British companies have branches in Germany.

Ahead of the UK are only USA, China and France who are serving Germany as export countries.

Meanwhile the CEO of German Stock Exchange DAX said Brexit would lead to distortion, despite it being unclear whether it will have trade benefits and new regulations for goods, human resources and profits.

In Germany it is also feared a withdrawal will lead to more expenditure, more bureaucracy, higher costs, worse access to trade market.

GETTY

GETTY But there is one business sector that would definitely profit from Brexit - advisors and solicitors would have to prepare companies for the new market and could be included to charge a lot of money for their advice.

The intervention comes as no surprise after sources close to German Chancellor Angela Merkel revealed she had branded the EU referendum as an unnecessary risk.

Mrs Merkel privately said Britain backing Brexit would be the “ultimate disaster” but has chosen to remain quiet so as not to infuriate Remain campaigners.

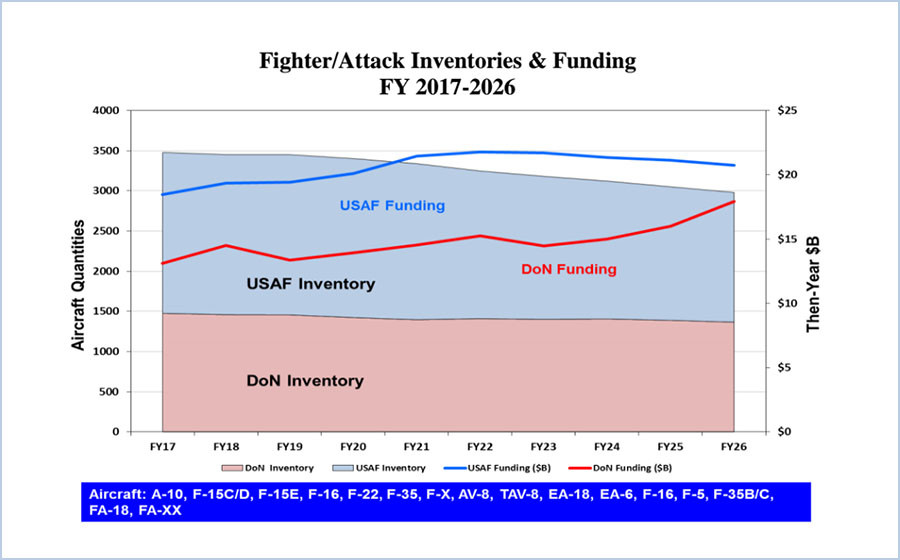

US Air Force warns it will run out of money for planes by 2021

The F-35 Lightning II. © Tom Reynolds / Lockheed Martin Corp / Reuters

If current budget caps remain in place, the US Air Force will be

unable to maintain the number of fighters mandated by Congress after

2021, the Pentagon said in a 30-year aviation report for all branches of

the US military.

Last year’s National

Defense Authorization Act (NDAA) included the requirement that the Air

Force should maintain 1,900 fighter aircraft in its inventory. The USAF

currently has 1,280 active fighters and 691 in reserve, for a total of

1,971. However, between the need to retire aging fighters and the high

cost of new jets, the Air Force says it will lack funding to comply with

the mandate as early as 2021.“The Air Force has insufficient resources to maintain the FY 2016 NDAA mandated number of fighter aircraft (1900) beyond the 2017-2021 FYDP,” the Department of Defense said in the report on 30-year aviation inventory and funding plans.

The 36-page report was submitted in March and made public Monday by Defense News. It cost “approximately $1,135,159” to prepare.

Source: 2016 Department of Defense Annual Aviation Report

The Air Force “plans to procure 243 F-35As from FY 2017 to FY 2021,” the report noted. To meet the mandated numbers, the F-15 and F-16 fleet will need to be modernized, while current plans to retire the A-10 by 2022 “are subject to change.”

Part of the problem is that the F-22 is no longer in production, while the F-35 is just too expensive to buy in any large numbers. Current calculations have the cost of the F-35 program at somewhere close to $1.5 trillion over its lifetime, with the cost of each plane exceeding $100 million.

Last month, the House of Representatives commissioned a study on restarting the F-22 production. The Air Force is opposed to the idea, while the plane’s manufacturer, Lockheed Martin, has shifted its resources to the F-35 program.

Only 195 F-22s were ever built – of which only 187 were considered operational – at a price tag of $150 million each.

Greek parliament pushes through more austerity measures to unlock bailout cash

A protester burns a fake one hundred Euro banknote

during a demonstration against a new package of tax hikes and reforms in

Athens, Greece, May 22, 2016 © Michalis Karagiannis / Reuters

In the midst of huge public protests, Athens has approved more budget

cuts, tax increases and a new privatization fund to manage almost all

state property in order to get further rescue loans from European

creditors.

The government hopes to incorporate an extra €1.8 billion in revenue

and get the next tranche of much-needed bailout funds to pay IMF loans,

bonds held by the ECB coming due in July, and decreasing state debt.

Greece's European creditors are expected to disburse €11 billion ($12.3 billion) following an assessment of the country's third bailout program. Under the terms of the bailout deal agreed last year, the international lenders will provide as much as €86 billion in aid.

“Greeks have already paid a lot, but this is probably the first time the possibility of these sacrifices being the last is so evident,” said Prime Minister Alexis Tsipras to Parliament before the vote. The PM expects the country’s economy to grow three percent next year.

The reforms involve new taxes on alcohol, tobacco, fuel, internet usage, cars, hotel stays, as well as an increase in the basic value-added tax rate from 23 to 24 percent.

Greece's European creditors are expected to disburse €11 billion ($12.3 billion) following an assessment of the country's third bailout program. Under the terms of the bailout deal agreed last year, the international lenders will provide as much as €86 billion in aid.

“Greeks have already paid a lot, but this is probably the first time the possibility of these sacrifices being the last is so evident,” said Prime Minister Alexis Tsipras to Parliament before the vote. The PM expects the country’s economy to grow three percent next year.

The reforms involve new taxes on alcohol, tobacco, fuel, internet usage, cars, hotel stays, as well as an increase in the basic value-added tax rate from 23 to 24 percent.

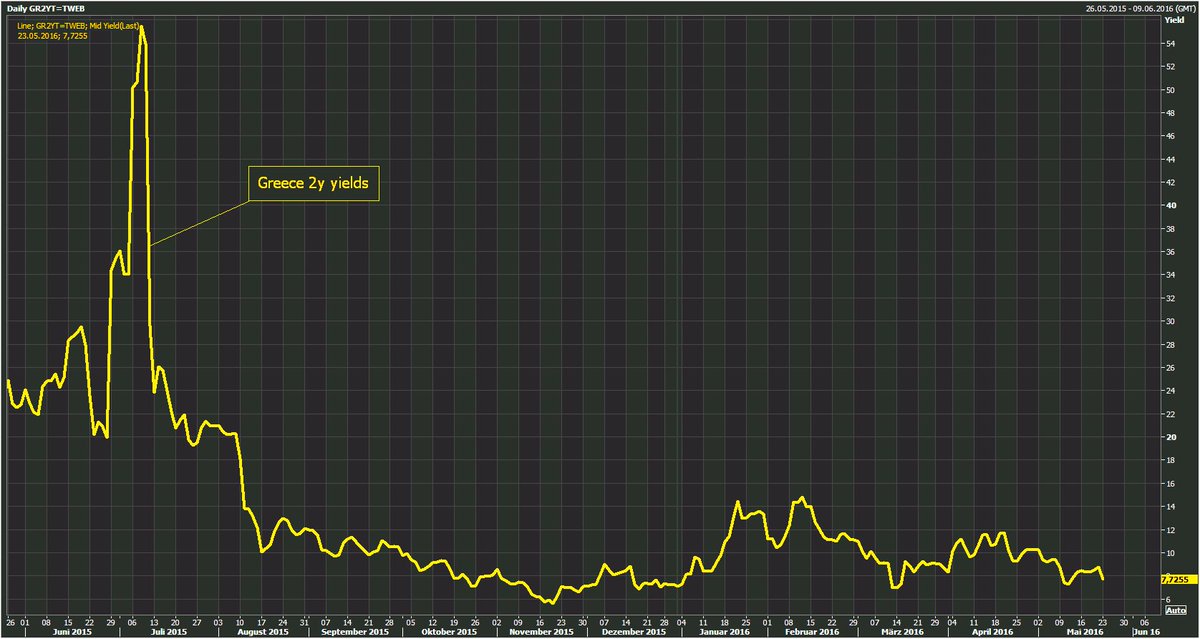

#Greece's 2y yields drop more than 100bps after austerity vote.

The measures also aim to free up the sale of non-performing loans owned

by Greek banks and to establish a privatization fund controlling the

country’s assets. The fund, controlled by the country's creditors, is

expected to ease the sale of public companies.

Demonstrations in #Syntagma Square in Protest of the omnibus bill related to Austerity Measures #Athens #Greece

The bill was supported by 153 members of the Syriza-coalition with 145

MPs voting against. The step came ahead of a Eurogroup meeting on

Tuesday that is expected to unlock another tranche of money for

debt-ridden Greece.

As austerity debate nears end, a homeless man walks through an underpass, holding bottle of wine #Greece

Under its current deal with the European Union, Athens is to bring in

a primary budget surplus to 3.5 percent of gross domestic product (GDP)

by 2018.

READ MORE: Berlin eases objections on Greek debt relief deal

Earlier this month, the Greek parliament passed reforms of the pension and income tax systems to save Athens another €3.6 billion.

The unpopular reforms have resulted in protests across the country. Thousands gathered outside the parliament building in Athens on Sunday to rally against the measures. Transport workers staged a 48-hour-strike in protest of the new tax hikes.

READ MORE: Berlin eases objections on Greek debt relief deal

Earlier this month, the Greek parliament passed reforms of the pension and income tax systems to save Athens another €3.6 billion.

The unpopular reforms have resulted in protests across the country. Thousands gathered outside the parliament building in Athens on Sunday to rally against the measures. Transport workers staged a 48-hour-strike in protest of the new tax hikes.

Video: The Financial Invasion of Greece

Economist Michael Hudson says IMF’s concern about Greek debt is

bogus, this is full scale financial war, forcing Greece give up ports,

pensions, properties and …

Via Youtube

Via Youtube

Wall Street Is Bracing for a Retail Bloodbath (SHLD, BBY, TIF, COST)

(Kyle Woodley) Anyone hoping for a slowdown in the retail malaise of the past couple of weeks can’t be encouraged by what’s on deck for the next few days.

Sears, Best Buy and Tiffany’s earnings? Good luck.

Earlier this month, department stores like Macy’s (ticker: M) and Kohl’s Corp. (KSS) were shredded. Then last week, belle-of-the-ball stock Home Depot (HD) couldn’t catch a break, nor could already-beaten-and-battered Target Corp. (TGT). Wal-Mart Stores (WMT) provided the week’s respite, but by and large, retailers have been getting killed.

Is there any chance of a letup with this week’s reports? Let’s take a look.

Sears Holdings Corp. (SHLD). There’s one good thing that can be said about Sears’ stock chart: It’d sure be fun to sled down.

Sears is off more than 30 percent in the past month and roughly 85

percent since 2012. And anyone looking for signs of a turnaround likely

won’t come in Sears’ first-quarter earnings report.

That’s because the only iron that SHLD really has in the fire right

now is that it’s testing a 10,000-square-foot appliance-only store in

Colorado. To its credit, the store boasts a couple of snazzy features

such as large interactive displays that let you place appliances in a

mock kitchen, as well as five-minute guaranteed in-store pickup.

Otherwise, Sears is just trying to keep shrinking its way to success,

with the company announcing last month that it’s closing 68 Kmart

stores and 10 Sears stores.

When it reports Thursday before the bell Sears is projected to

announce quarterly revenues down 10.6 percent for the quarter,

contributing to full-year estimates of $22.25 billion – nearly half of

2013’s figure. The only saving grace of an estimated $3.20 loss per

share is that the figure would be better than the year-ago period’s

$3.48 loss. But don’t call it a comeback – for the current fiscal year,

losses are expected to expand from $8.94 per share to $15.07.

Maybe SHLD stock gets a bump on a beat, but considering that Sears

actually has rallied the past couple of days as it approaches earnings …

maybe not.

Best Buy Co. (BBY). For as much as we’re told that Amazon.com (AMZN)

is killing Best Buy – and yes, this year’s $39 billion in expected

revenues is 20 percent lower than 2011 levels – BBY isn’t in the state

of perpetual decline that you’d expect. Amid a lot of whipsawing, the

stock is actually sitting around prices it saw in 2010 and 2011 – not

exactly what the dire narrative would suggest.

You can thank the company’s “Renew Blue” efforts – including

improving the company’s e-commerce performance, cutting costs and

growing its relationships with vendors – under CEO Hubert Joly, who has

slapped down a lot of naysayers.

Joly has also been able to get a handle on managing expectations. BBY

has beat Street estimates for 13 straight quarters, and another such

performance amid a rotten earnings season for retail could give Best Buy

a short-term shot in the arm.

For the record, Best Buy’s earnings, out Tuesday morning, are

expected to decline slightly, from 37 cents to 35 cents, on revenues

expected to shrink 3 percent to $8.29 billion.

Costco Wholesale Corp. (COST).

Costco had long been one of the most dependable, consistently

performing stocks in retail for years. However, shares are off roughly

15 percent from December 2015 highs amid a laundry list of bad news.

In early December, Costco reported its slowest membership growth in

years – 1.9 percent in fee revenue improvement for the quarter, versus a

range of 4.5 percent to 7.7 percent on average during the previous four

years. COST shares have been hampered further in 2016 thanks to a

significant earnings decline for its fiscal second quarter, as well as a

thin 1 percent improvement in comps for March that came in under

expectations.

But take heart, Costco bulls. COST stock

is expected to see earnings growth this quarter, by 4 percent to $1.22,

on revenues expected to improve the same amount. Meanwhile, the company

is in the middle of a $3 billion capital expenditure program to

increase its number of warehouses by 32, the most it has debuted in more

than a decade. That’s causing short-term pain, but it could produce

some serious long-term gain.

If you’re looking for anything that could turn the stock around this

week, watch those membership figures, as they tend to rock the boat more

than just about any other metric.

Tiffany & Co. (TIF).

Tiffany’s upcoming earnings report got a lot more interesting recently

when Ralph Nicoletti stepped down suddenly as chief financial officer on

May 13 – just a couple of weeks before the company’s first-quarter

earnings report.

That has analysts preparing for (more) bad news out of the struggling luxury retailer. A Barron’s report says that Wells Fargo analyst Ike Boruchow “told clients that Nicoletti’s departure for Newell Brands (NWL)

after only two years bodes poorly for the jewelry and luxury goods

retailer.” However, Benzinga points out that Nicoletti’s exit follows

short stints at Cigna (CI) and Alberto-Culver, so maybe this is much ado about nothing.

Either way, the road ahead for TIF stock looks rough. Analysts are

expecting first-quarter revenues to decline nearly 5 percent to $914.94

million, with earnings dropping 16 percent. This follows a January

report in which Tiffany said it would be cutting jobs after a weak

holiday performance, and a woeful fourth-quarter report that included a

forecast for 15 to 20 percent earnings contraction for the first quarter

of this year, followed by 5 to 10 percent declines in the second

quarter.

Yes, this is in part because of a strong dollar amid Tiffany’s

international-heavy business, but also amid consumers’ general trend

away from many established luxury brands, from Coach (COH) to Burberry to Ralph Lauren Corp. (RL), and even newer entry Michael Kors Holdings (KORS).

Given that even higher-end retailers like Nordstrom (JWN) struggled in the first quarter, don’t expect much out of Tiffany when it reports Wednesday morning.

HP (HPQ). We’re now a couple of quarters removed from the split of HP from Hewlett-Packard Enterprise (HPE), we’re starting to get a clearer picture of what life is like for HPQ.

That picture isn’t swell, which is exactly what you’d expect from a

business dependent on PC sales and printer interest. The previous

quarter saw HPQ’s revenues and earnings both decline 12 percent

year-over-year amid a “tough” environment for PC sales, and that sure

didn’t change in the first quarter. PC sales declined 13 percent from

last year, according to research firm Canalys, reaching figures not seen

since the second quarter of 2011. A separate Gartner report on PC

shipments saw figures decline 9.6 percent in the first quarter to 64.8

million units.

That makes it difficult to enter Wednesday evening’s earnings release

with any amount of positivity. The numbers to beat this quarter:

earnings of 38 cents per share on revenues of $11.73 billion.

If you’re looking for some reason to get excited about HPQ stock,

look toward its hail Mary offering in 3D printing, with a pair of

products for business customers – a market that should be juicier than

the as-of-now weak consumer market.

Fake gold bars! What's next?

By Dan Eden for viewzone.com

It's one thing to counterfeit a twenty or hundred dollar bill. The amount of financial damage is usually limited to a specific region and only affects dozens of people and thousands of dollars. Secret Service agents quickly notify the banks on how to recognize these phony bills and retail outlets usually have procedures in place (such as special pens to test the paper) to stop their proliferation.

But what about gold? This is the most sacred of all commodities because it is thought to be the most trusted, reliable and valuable means of saving wealth.

A recent discovery -- in October of 2009 -- has been suppressed by the main stream media but has been circulating among the "big money" brokers and financial kingpins and is just now being revealed to the public. It involves the gold in Fort Knox -- the US Treasury gold -- that is the equity of our national wealth. In short, millions (with an "m") of gold bars are fake!

Who did this? Apparently our own government.

Background

In

October of 2009 the Chinese received a shipment of gold bars. Gold is

regularly exchanges between countries to pay debts and to settle the

so-called balance of trade. Most gold is exchanged and stored in vaults

under the supervision of a special organization based in London, the

London Bullion Market Association (or LBMA). When the shipment was

received, the Chinese government asked that special tests be performed

to guarantee the purity and weight of the gold bars. In this test, four

small holed are drilled into the gold bars and the metal is then

analyzed.

In

October of 2009 the Chinese received a shipment of gold bars. Gold is

regularly exchanges between countries to pay debts and to settle the

so-called balance of trade. Most gold is exchanged and stored in vaults

under the supervision of a special organization based in London, the

London Bullion Market Association (or LBMA). When the shipment was

received, the Chinese government asked that special tests be performed

to guarantee the purity and weight of the gold bars. In this test, four

small holed are drilled into the gold bars and the metal is then

analyzed.

Officials were shocked to learn that the bars were fake. They contained cores of tungsten with only a outer coating of real gold. What's more, these gold bars, containing serial numbers for tracking, originated in the US and had been stored in Fort Knox for years. There were reportedly between 5,600 to 5,700 bars, weighing 400 oz. each, in the shipment!

At first many gold experts assumed the fake gold originated in China, the world's best knock-off producers. The Chinese were quick to investigate and issued a statement that implicated the US in the scheme.

What the Chinese uncovered:

Roughly 15 years ago -- during the Clinton Administration [think Robert Rubin, Sir Alan Greenspan and Lawrence Summers] -- between 1.3 and 1.5 million 400 oz tungsten blanks were allegedly manufactured by a very high-end, sophisticated refiner in the USA [more than 16 Thousand metric tonnes]. Subsequently, 640,000 of these tungsten blanks received their gold plating and WERE shipped to Ft. Knox and remain there to this day.

According to the Chinese investigation, the balance of this 1.3 million

to 1.5 million 400 oz tungsten cache was also gold plated and then

allegedly "sold" into the international market. Apparently, the global

market is literally "stuffed full of 400 oz salted bars". Perhaps as

much as 600-billion dollars worth.

An obscure news item originally published in the N.Y. Post [written by Jennifer Anderson] in late Jan. 04 perhaps makes sense now.

No one knows whatever happened to Stuart Smith. After his offices were raided he took "administrative leave" from the NYMEX and he has never been heard from since. Amazingly, there never was any follow up on in the media on the original story as well as ZERO developments ever stemming from D.A. Morgenthau’s office who executed the search warrant.

Are we to believe that NYMEX offices were raided, the Sr. V.P. of operations then takes leave -- all for nothing?

The revelations of fake gold bars also explains another highly unusual story that also happened in 2004:

After reviewing their prospectus yet again, it becomes pretty clear that

GLD was established to purposefully deflect investment dollars away

from legitimate gold pursuits and to create a stealth, cesspool /

catch-all, slush-fund and a likely destination for many of these fake

tungsten bars where they would never see the light of day -- hidden

behind the following legalese "shield" from the law:

Earlier this year GATA filed a second Freedom of Information Act (FOIA) request with the Federal Reserve System for documents from 1990 to date having to do with gold swaps, gold swapped, or proposed gold swaps.

On

Aug. 5, The Federal Reserve responded to this FOIA request by adding

two more documents to those disclosed to GATA in April 2008 from the

earlier FOIA request. These documents totaled 173 pages, many parts of

which were redacted (blacked out). The Fed's response also noted that

there were 137 pages of documents not disclosed that were alleged to be

exempt from disclosure.

On

Aug. 5, The Federal Reserve responded to this FOIA request by adding

two more documents to those disclosed to GATA in April 2008 from the

earlier FOIA request. These documents totaled 173 pages, many parts of

which were redacted (blacked out). The Fed's response also noted that

there were 137 pages of documents not disclosed that were alleged to be

exempt from disclosure.

GATA appealed this determination on Aug. 20. The appeal asked for more information to substantiate the legitimacy of the claimed exemptions from disclosure and an explanation on why some documents, such as one posted on the Federal Reserve Web site that discusses gold swaps, were not included in the Aug. 5 document release.

In a Sept. 17, 2009, letter on Federal Reserve System letterhead, Federal Reserve governor Kevin M. Warsh completely denied GATA's appeal. The entire text of this letter can be examined at http://www.gata.org/files/GATAFedResponse-09-17-2009.pdf.

The first paragraph on the third page is the most revealing.

The above statement is an admission that the Federal Reserve has been

involved with the fake gold bar swaps and that it refuses to disclose

any information about its activities!

Why use tungsten?

If you are going to print fake money you need to have the special paper, otherwise the bills don't feel right and can be easily detected by special pens that most merchants and banks use. Likewise, if you are going to fake gold bars you had better be sure they have the same weight and properties of real gold.

In early 2008 millions of dollars in gold at the central bank of Ethiopia turned out to be fake. What were supposed to be bars of solid gold turned out to be nothing more than gold-plated steel. They tried to sell the stuff to South Africa and it was sent back when the South Africans noticed this little problem.

The

problem with making good-quality fake gold is that gold is remarkably

dense. It's almost twice the density of lead, and two-and-a-half times

more dense than steel. You don't usually notice this because small gold

rings and the like don't weigh enough to make it obvious, but if you've

ever held a larger bar of gold, it's absolutely unmistakable: The stuff

is very, very heavy.

The

problem with making good-quality fake gold is that gold is remarkably

dense. It's almost twice the density of lead, and two-and-a-half times

more dense than steel. You don't usually notice this because small gold

rings and the like don't weigh enough to make it obvious, but if you've

ever held a larger bar of gold, it's absolutely unmistakable: The stuff

is very, very heavy.

The standard gold bar for bank-to-bank trade, known as a "London good delivery bar" weighs 400 troy ounces (over thirty-three pounds), yet is no bigger than a paperback novel. A bar of steel the same size would weigh only thirteen and a half pounds.

According to gold expert, Theo Gray, the problem is that there are very few metals that are as dense as gold, and with only two exceptions they all cost as much or more than gold.

The first exception is depleted uranium, which is cheap if you're a government, but hard for individuals to get. It's also radioactive, which could be a bit of an issue.

The second exception is a real winner: tungsten. Tungsten is vastly cheaper than gold (maybe $30 dollars a pound compared to $12,000 a pound for gold right now). And remarkably, it has exactly the same density as gold, to three decimal places. The main differences are that it's the wrong color, and that it's much, much harder than gold. (Very pure gold is quite soft, you can dent it with a fingernail.)

A top-of-the-line fake gold bar should match the color, surface hardness, density, chemical, and nuclear properties of gold perfectly. To do this, you could could start with a tungsten slug about 1/8-inch smaller in each dimension than the gold bar you want, then cast a 1/16-inch layer of real pure gold all around it. This bar would feel right in the hand, it would have a dead ring when knocked as gold should, it would test right chemically, it would weigh *exactly* the right amount, and though I don't know this for sure, I think it would also pass an x-ray fluorescence scan, the 1/16" layer of pure gold being enough to stop the x-rays from reaching any tungsten. You'd pretty much have to drill it to find out it's fake.

Such a top-quality fake London good delivery bar would cost about $50,000 to produce because it's got a lot of real gold in it, but you'd still make a nice profit considering that a real one is worth closer to $400,000.

What's going to happen now?

Politicians like Ron Paul have been demanding that the Federal Reserve be more transparent and open up their records for public scrutiny. But the Fed has consistently refused, stating that these disclosures would undermine its operation. Yes, it certainly would!

The manufacture of fake gold bars goes back years and, because of this,

it is not likely that the originator of this scheme will ever be

revealed or brought to justice. Meanwhile the world is just beginning to

learn that much of its national reserves of gold may be fake. If more

testing reveals that this gold was guaranteed by Fort Knox and the US

Treasury then perhaps they will demand an exchange for "real" gold --

wouldn't you?

This is all happening at a time when the US economy is at its lowest and most vulnerable. The effects could be devastating.

Some investors are already selling gold commodities before these facts are widely known. They are investing instead in silver -- the next best metal. This will undoubtedly drive silver prices up.

According to Jim Willie, 24 year market analyst and Ph.D in statistics, "The bust cometh, and it will be spectacular. The stories told in the press will be peculiar, since not told objectively. The headlines might be a comedy, with phony reports of foreign subterfuge, when the perpetrators are home grown."

This is yet another story in the decline of America and capitalism -- a decline based on greed, deception and fraud.

UPDATE MARCH 5, 2010

Largest Private Refinery Discovers Gold-Plated Tungsten Bar

By Patrick A. Heller

Gold Plated Tungsten BarRecently, the German television station ProSieben ran a news story covering W. C. Heraeus in Hanau, Germany, the world's largest privately owned refinery. In the story, Wilfried Horner, the head of the gold foundry, shows a 500 gram bar (16.0755 troy ounces) received from an unidentified bank. The bar had the right physical dimensions to be an authentic gold bar, but one of the Heraeus employees suspected something funny. After the bar was cut in half, you can see that the inside is tungsten, with only a coating of gold on the outside.

You can watch this news story on You Tube, where it was posted February 28, at http://www.youtube.com/watch?v=ZKczs-7BFRI.

Last fall, Rob Kirby of Kirby Analytics in Toronto reported that China's central bank had discovered some 400-ounce gold-plated tungsten bars among those it had recently received from bonded warehouses. It was later learned that at least four counterfeit bars were found and that all had come from sources in the United States. As suspicions grow about counterfeit bars among those held in bonded warehouses for delivery against either COMEX or London Bullion Market Association contracts or shares of exchange traded funds, investors could panic. So, you can understand that there has been almost a total blackout on news coverage on this story.

It's one thing to counterfeit a twenty or hundred dollar bill. The amount of financial damage is usually limited to a specific region and only affects dozens of people and thousands of dollars. Secret Service agents quickly notify the banks on how to recognize these phony bills and retail outlets usually have procedures in place (such as special pens to test the paper) to stop their proliferation.

But what about gold? This is the most sacred of all commodities because it is thought to be the most trusted, reliable and valuable means of saving wealth.

A recent discovery -- in October of 2009 -- has been suppressed by the main stream media but has been circulating among the "big money" brokers and financial kingpins and is just now being revealed to the public. It involves the gold in Fort Knox -- the US Treasury gold -- that is the equity of our national wealth. In short, millions (with an "m") of gold bars are fake!

Who did this? Apparently our own government.

Background

In

October of 2009 the Chinese received a shipment of gold bars. Gold is

regularly exchanges between countries to pay debts and to settle the

so-called balance of trade. Most gold is exchanged and stored in vaults

under the supervision of a special organization based in London, the

London Bullion Market Association (or LBMA). When the shipment was

received, the Chinese government asked that special tests be performed

to guarantee the purity and weight of the gold bars. In this test, four

small holed are drilled into the gold bars and the metal is then

analyzed.

In

October of 2009 the Chinese received a shipment of gold bars. Gold is

regularly exchanges between countries to pay debts and to settle the

so-called balance of trade. Most gold is exchanged and stored in vaults

under the supervision of a special organization based in London, the

London Bullion Market Association (or LBMA). When the shipment was

received, the Chinese government asked that special tests be performed

to guarantee the purity and weight of the gold bars. In this test, four

small holed are drilled into the gold bars and the metal is then

analyzed.Officials were shocked to learn that the bars were fake. They contained cores of tungsten with only a outer coating of real gold. What's more, these gold bars, containing serial numbers for tracking, originated in the US and had been stored in Fort Knox for years. There were reportedly between 5,600 to 5,700 bars, weighing 400 oz. each, in the shipment!

At first many gold experts assumed the fake gold originated in China, the world's best knock-off producers. The Chinese were quick to investigate and issued a statement that implicated the US in the scheme.

What the Chinese uncovered:

Roughly 15 years ago -- during the Clinton Administration [think Robert Rubin, Sir Alan Greenspan and Lawrence Summers] -- between 1.3 and 1.5 million 400 oz tungsten blanks were allegedly manufactured by a very high-end, sophisticated refiner in the USA [more than 16 Thousand metric tonnes]. Subsequently, 640,000 of these tungsten blanks received their gold plating and WERE shipped to Ft. Knox and remain there to this day.

An obscure news item originally published in the N.Y. Post [written by Jennifer Anderson] in late Jan. 04 perhaps makes sense now.

DA investigating NYMEX executiveThe offices of the Senior Vice President of Operations -- NYMEX -- is exactly where you would go to find the records [serial number and smelter of origin] for EVERY GOLD BAR ever PHYSICALLY settled on the exchange. They are required to keep these records. These precise records would show the lineage of all the physical gold settled on the exchange and hence "prove" that the amount of gold in question could not have possibly come from the U.S. mining operations -- because the amounts in question coming from U.S. smelters would undoubtedly be vastly bigger than domestic mine production.

Manhattan, New York, --Feb. 2, 2004. A top executive at the New York Mercantile Exchange is being investigated by the Manhattan district attorney. Sources close to the exchange said that Stuart Smith, senior vice president of operations at the exchange, was served with a search warrant by the district attorney's office last week. Details of the investigation have not been disclosed, but a NYMEX spokeswoman said it was unrelated to any of the exchange's markets. She declined to comment further other than to say that charges had not been brought. A spokeswoman for the Manhattan district attorney's office also declined comment."

No one knows whatever happened to Stuart Smith. After his offices were raided he took "administrative leave" from the NYMEX and he has never been heard from since. Amazingly, there never was any follow up on in the media on the original story as well as ZERO developments ever stemming from D.A. Morgenthau’s office who executed the search warrant.

Are we to believe that NYMEX offices were raided, the Sr. V.P. of operations then takes leave -- all for nothing?

The revelations of fake gold bars also explains another highly unusual story that also happened in 2004:

LONDON, April 14, 2004 (Reuters) -- NM Rothschild & Sons Ltd., the London-based unit of investment bank Rothschild [ROT.UL], will withdraw from trading commodities, including gold, in London as it reviews its operations, it said on Wednesday.Interestingly, GATA's Bill Murphy speculated about this back in 2004;

"Why is Rothschild leaving the gold business at this time my colleagues and I conjectured today? Just a guess on my part, but [I] suspect something is amiss. They know a big scandal is coming and they don't want to be a part of it... [The] Rothschild wants out before the proverbial "S" hits the fan." -- BILL MURPHY, LEMETROPOLE, 4-18-2004

What is the GATA?

The Gold Antitrust Action Committee (GATA) is an organisation which has

been nipping at the heels of the US Treasury Federal Reserve for

several years now. The basis of GATA's accusations is that these

institutions, in coordination with other complicit central banks and the

large gold-trading investment banks in the US, have been manipulating

the price of gold for decades.

What is the GLD?  GLD is a short form for Good London Delivery. GLD is a short form for Good London Delivery.The London Bullion Market Association (LBMA) has defined "good delivery" as a delivery from an entity which is listed on their delivery list or meets the standards for said list and whose bars have passed testing requirements established by the associatin and updated from time to time. The bars have to be pure for AU in an area of 995.0 to 999.9 per 1000. Weight, Shape, Appearance, Marks and Weight Stamps are regulated as follows: Weight: minimum 350 fine ounces AU; maximum 430 fine ounces AU, gross weight of a bar is expressed in troy ounces, in multiples of 0.025, rounded down to the nearest 0.025 of an troy ounce. Dimensions: the recommended dimensions for a Good Delivery gold bar are: Top Surface: 255 x 81 mm; Bottom Surface: 236 x 57 mm; Thickness: 37 mm. Fineness: the minimum 995.0 parts per thousand fine gold. Marks: Serial number; Assay stamp of refiner; Fineness (to four significant figures); Year of manufacture (expressed in four digits). |

[Excerpt from the GLD prospectus on page 11]The Federal Reserve knows but is apparently part of the scheme

"Gold bars allocated to the Trust in connection with the creation of a Basket may not meet the London Good Delivery Standards and, if a Basket is issued against such gold, the Trust may suffer a loss. Neither the Trustee nor the Custodian independently confirms the fineness of the gold bars allocated to the Trust in connection with the creation of a Basket. The gold bars allocated to the Trust by the Custodian may be different from the reported fineness or weight required by the LBMA’s standards for gold bars delivered in settlement of a gold trade, or the London Good Delivery Standards, the standards required by the Trust. If the Trustee nevertheless issues a Basket against such gold, and if the Custodian fails to satisfy its obligation to credit the Trust the amount of any deficiency, the Trust may suffer a loss."

Earlier this year GATA filed a second Freedom of Information Act (FOIA) request with the Federal Reserve System for documents from 1990 to date having to do with gold swaps, gold swapped, or proposed gold swaps.

On

Aug. 5, The Federal Reserve responded to this FOIA request by adding

two more documents to those disclosed to GATA in April 2008 from the

earlier FOIA request. These documents totaled 173 pages, many parts of

which were redacted (blacked out). The Fed's response also noted that

there were 137 pages of documents not disclosed that were alleged to be

exempt from disclosure.

On

Aug. 5, The Federal Reserve responded to this FOIA request by adding

two more documents to those disclosed to GATA in April 2008 from the

earlier FOIA request. These documents totaled 173 pages, many parts of

which were redacted (blacked out). The Fed's response also noted that

there were 137 pages of documents not disclosed that were alleged to be

exempt from disclosure.GATA appealed this determination on Aug. 20. The appeal asked for more information to substantiate the legitimacy of the claimed exemptions from disclosure and an explanation on why some documents, such as one posted on the Federal Reserve Web site that discusses gold swaps, were not included in the Aug. 5 document release.

In a Sept. 17, 2009, letter on Federal Reserve System letterhead, Federal Reserve governor Kevin M. Warsh completely denied GATA's appeal. The entire text of this letter can be examined at http://www.gata.org/files/GATAFedResponse-09-17-2009.pdf.

The first paragraph on the third page is the most revealing.

"In connection with your appeal, I have confirmed that the information withheld under exemption 4 consists of confidential commercial or financial information relating to the operations of the Federal Reserve Banks that was obtained within the meaning of exemption 4. This includes information relating to swap arrangements with foreign banks on behalf of the Federal Reserve System and is not the type of information that is customarily disclosed to the public. This information was properly withheld from you."

Why use tungsten?

If you are going to print fake money you need to have the special paper, otherwise the bills don't feel right and can be easily detected by special pens that most merchants and banks use. Likewise, if you are going to fake gold bars you had better be sure they have the same weight and properties of real gold.

In early 2008 millions of dollars in gold at the central bank of Ethiopia turned out to be fake. What were supposed to be bars of solid gold turned out to be nothing more than gold-plated steel. They tried to sell the stuff to South Africa and it was sent back when the South Africans noticed this little problem.

The standard gold bar for bank-to-bank trade, known as a "London good delivery bar" weighs 400 troy ounces (over thirty-three pounds), yet is no bigger than a paperback novel. A bar of steel the same size would weigh only thirteen and a half pounds.

According to gold expert, Theo Gray, the problem is that there are very few metals that are as dense as gold, and with only two exceptions they all cost as much or more than gold.

The first exception is depleted uranium, which is cheap if you're a government, but hard for individuals to get. It's also radioactive, which could be a bit of an issue.

The second exception is a real winner: tungsten. Tungsten is vastly cheaper than gold (maybe $30 dollars a pound compared to $12,000 a pound for gold right now). And remarkably, it has exactly the same density as gold, to three decimal places. The main differences are that it's the wrong color, and that it's much, much harder than gold. (Very pure gold is quite soft, you can dent it with a fingernail.)

A top-of-the-line fake gold bar should match the color, surface hardness, density, chemical, and nuclear properties of gold perfectly. To do this, you could could start with a tungsten slug about 1/8-inch smaller in each dimension than the gold bar you want, then cast a 1/16-inch layer of real pure gold all around it. This bar would feel right in the hand, it would have a dead ring when knocked as gold should, it would test right chemically, it would weigh *exactly* the right amount, and though I don't know this for sure, I think it would also pass an x-ray fluorescence scan, the 1/16" layer of pure gold being enough to stop the x-rays from reaching any tungsten. You'd pretty much have to drill it to find out it's fake.

Such a top-quality fake London good delivery bar would cost about $50,000 to produce because it's got a lot of real gold in it, but you'd still make a nice profit considering that a real one is worth closer to $400,000.

What's going to happen now?

Politicians like Ron Paul have been demanding that the Federal Reserve be more transparent and open up their records for public scrutiny. But the Fed has consistently refused, stating that these disclosures would undermine its operation. Yes, it certainly would!

UPDATE: Audit of Fed Reserve Amendment Passes!In

an unprecedented defeat for the Federal Reserve, an amendment to audit

the multi-trillion dollar institution was approved by the House Finance

Committee with an overwhelming and bipartisan 43-26 vote on Thursday

afternoon despite harried last-minute lobbying from top Fed officials

and the surprise opposition of Chairman Barney Frank (D-Mass.), who had

previously been a supporter. UPDATE: Audit of Fed Reserve Amendment Passes!In

an unprecedented defeat for the Federal Reserve, an amendment to audit

the multi-trillion dollar institution was approved by the House Finance

Committee with an overwhelming and bipartisan 43-26 vote on Thursday

afternoon despite harried last-minute lobbying from top Fed officials

and the surprise opposition of Chairman Barney Frank (D-Mass.), who had

previously been a supporter.

The measure, cosponsored by Reps. Ron Paul (R-Texas) and Alan Grayson (D-Fla.), authorizes the Government Accountability Office to conduct a wide-ranging audit of the Fed's opaque deals with foreign central banks and major U.S. financial institutions. The Fed has never had a real audit in its history and little is known of what it does with the trillions of dollars at its disposal. |

This is all happening at a time when the US economy is at its lowest and most vulnerable. The effects could be devastating.

Some investors are already selling gold commodities before these facts are widely known. They are investing instead in silver -- the next best metal. This will undoubtedly drive silver prices up.

According to Jim Willie, 24 year market analyst and Ph.D in statistics, "The bust cometh, and it will be spectacular. The stories told in the press will be peculiar, since not told objectively. The headlines might be a comedy, with phony reports of foreign subterfuge, when the perpetrators are home grown."

This is yet another story in the decline of America and capitalism -- a decline based on greed, deception and fraud.

UPDATE MARCH 5, 2010

Largest Private Refinery Discovers Gold-Plated Tungsten Bar

By Patrick A. Heller

Gold Plated Tungsten BarRecently, the German television station ProSieben ran a news story covering W. C. Heraeus in Hanau, Germany, the world's largest privately owned refinery. In the story, Wilfried Horner, the head of the gold foundry, shows a 500 gram bar (16.0755 troy ounces) received from an unidentified bank. The bar had the right physical dimensions to be an authentic gold bar, but one of the Heraeus employees suspected something funny. After the bar was cut in half, you can see that the inside is tungsten, with only a coating of gold on the outside.

You can watch this news story on You Tube, where it was posted February 28, at http://www.youtube.com/watch?v=ZKczs-7BFRI.

Last fall, Rob Kirby of Kirby Analytics in Toronto reported that China's central bank had discovered some 400-ounce gold-plated tungsten bars among those it had recently received from bonded warehouses. It was later learned that at least four counterfeit bars were found and that all had come from sources in the United States. As suspicions grow about counterfeit bars among those held in bonded warehouses for delivery against either COMEX or London Bullion Market Association contracts or shares of exchange traded funds, investors could panic. So, you can understand that there has been almost a total blackout on news coverage on this story.

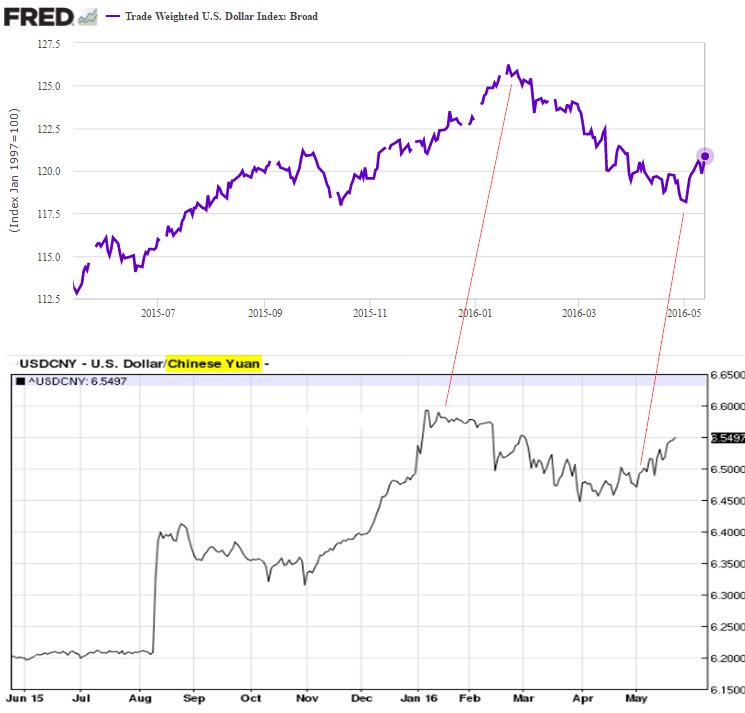

Chart: The strengthening US dollar renews concerns of accelerating capital outflows from China

Chart: The strengthening US dollar renews concerns of accelerating capital outflows from China -

Delinquent Debt At Levels Worse Than 2008: “Exact Same Thing Is Happening Again”

Editor’s Comment: It is clear that things are nothing more than a house of cards. There was no financial recovery, the banks are bigger and more powerful than ever, and the stability of average people continues to slip away. The biggest problems surrounding 2008 are happening all over again… they let it happen.

Why are the banks not being prosecuted criminally and broken up? Oh yeah, Justice Dept. people like Eric Holder leave their government jobs to work for the banks… they are too big to jail because they are the true owners.

Hold on to whatever you’ve got.

Business Debt Delinquencies Are Now Higher Than When Lehman Brothers Collapsed In 2008

by Michael Snyder

You are about to see more very clear evidence that a new economic crisis has already begun. During economic recoveries, business debt delinquencies generally fall, and during times of economic recession business debt delinquencies generally rise. In fact, you will see below that business debt delinquencies shot up dramatically just prior to the last two recessions, and the exact same thing is happening again right now. In 2008, business debt delinquencies increased at a very frightening pace just before Lehman Brothers collapsed, and this was a very clear sign that big trouble was ahead. Unfortunately for us, in 2016 business debt delinquencies have already shot up above the level they were sitting at just before the collapse of Lehman Brothers, and every time debt delinquencies have ever gotten this high the U.S. economy has always fallen into recession.

In article after article, I have shown that key indicators for the U.S. economy started falling in either late 2014 or at some point during 2015. Well, business debt delinquencies are another example of this phenomenon. According to Wolf Richter, business debt delinquencies have shot up an astounding 137 percent since the fourth quarter of 2014…

Delinquencies of commercial and industrial loans at all banks, after hitting a low point in Q4 2014 of $11.7 billion, have begun to balloon (they’re delinquent when they’re 30 days or more past due). Initially, this was due to the oil & gas fiasco, but increasingly it’s due to trouble in many other sectors, including retail.And we never see this kind of rise unless the U.S. economy is heading into a recession. Here is more from Wolf Richter…

Between Q4 2014 and Q1 2016, delinquencies spiked 137% to $27.8 billion.

Note how, in this chart by the Board of Governors of the Fed, delinquencies of C&I loans start rising before recessions (shaded areas). I added the red marks to point out where we stand in relationship to the Lehman moment:To me, this couldn’t be any clearer.

Business loan delinquencies are a leading indicator of big economic trouble.

Just like the U.S. government and just like U.S. consumers, U.S. businesses are absolutely drowning in debt.

In fact, a report that was just released found that debt at U.S. companies has been growing at a pace that is 50 times faster than the rate that cash has been growing.

Just imagine what it would mean for your family if your debt was growing 50 times faster than your bank account. Needless to say, this is an extremely troubling development…

Well, American companies may just have a mountain’s worth of problems, according to a new report from Andrew Chang and David Tesher of S&P Global Ratings.And the really bad news is that banks all across the country are starting to tighten credit to businesses.

“At the same time, the imbalance between cash and debt outstanding we reported on last year has gotten even worse: Debt outstanding increased 50x that of cash in 2015,” wrote Chang and Tesher.

“Total debt rose by roughly $850 billion to $6.6 trillion last year, dwarfing the 1% cash growth ($17 billion).”

In other words, they are beginning to become much more reluctant to loan money to businesses because debts are going bad at such an alarming rate.

When the flow of credit to the business community starts to slow down, it is inevitable that the overall economy slows down as well. It is just basic economics. So the deterioration of the U.S. economy that we have witnessed so far is just the beginning of a process that is going to take quite a while to play out.

And let us not forget that most of the rest of the world is already is much worse shape than we are. Most global financial markets are officially in bear market territory right now, and some nations are already experiencing full-blown economic depression.

Now that the early chapters of the “next crisis” are here, most American families find themselves ill-equipped to deal with another major downturn. In fact, USA Today is reporting that approximately two-thirds of the country is currently living paycheck to paycheck…

Two-thirds of Americans would have difficulty coming up with the money to cover a $1,000 emergency, according to an exclusive poll, a signal that despite years after the Great Recession, Americans’ finances remain precarious as ever.What are these people going to do when they lose their jobs or their businesses go under?

These difficulties span all incomes, according to the poll conducted by The Associated Press-NORC Center for Public Affairs Research. Three-quarters of people in households making less than $50,000 a year and two-thirds of those making between $50,000 and $100,000 would have difficulty coming up with $1,000 to cover an unexpected bill.

If you have any doubt that the U.S. economy is already in recession mode, just look at this chart over and over.

For months, I have been warning that the same patterns that immediately preceded previous recessions were happening once again, and this rise in debt delinquencies is another striking example of this phenomenon.

This stuff isn’t complicated. Anyone that is willing to be honest with themselves should be able to see it. As a society, we have been making very, very bad decisions for a very, very long period of time, and what we are watching unfold right now are the inevitable consequences of those decisions.

*About the author: Michael Snyder is the founder and publisher of The Economic Collapse Blog. Michael’s controversial new book about Bible prophecy entitled “The Rapture Verdict” is available in paperback and for the Kindle on Amazon.com.

De-Petrodollar-ization Esclates - China Imports Record Amount Of Russian Oil In April

We have reported for years that Russia and China have been doing everything they can to displace the use (and influence) of the US dollar.

The US of course, either oblivious or too arrogant to care, has continued to bring Russia and China together by annoying both equally with its incessant meddling. Recall that recently both China and Russia have had to warn the US about its insistence on flying reconnaissance planes too close to their borders.

Of course, as the US has been playing geopolitical games, China and Russia have been working on strengthening their relationship with one another. At the end of 2015, China had become Russia's biggest oil customer, and as of April, Russian oil shipments to China hit a record high. Russia has also surpassed Saudi Arabia as the biggest crude exporter to China.

There is an underlying theme here that cannot be ignored.

Whatever the US has been focusing on, whether it's commissioning $4.4 billion warships, wargaming in the name of "regional stability", or arguing over LGBT rights and confederate flags, it is neither productive, nor helping its global economic standing. One day when the USD is no longer the reserve currency, and all of the games the Federal Reserve plays to allow fiscal policy to go unchecked are no longer an option, we suspect that it will wish it had done things quite differently.

The US of course, either oblivious or too arrogant to care, has continued to bring Russia and China together by annoying both equally with its incessant meddling. Recall that recently both China and Russia have had to warn the US about its insistence on flying reconnaissance planes too close to their borders.

Of course, as the US has been playing geopolitical games, China and Russia have been working on strengthening their relationship with one another. At the end of 2015, China had become Russia's biggest oil customer, and as of April, Russian oil shipments to China hit a record high. Russia has also surpassed Saudi Arabia as the biggest crude exporter to China.

Russia Today has more

Beijing has ramped up imports of Russian oil by 52.4 percent last month compared to a year earlier. China's General Administration of Customs calculated a record 4.81 million tons.Russian exports to China have doubled over the past five years, and supply is expected to continue to be strong. Transneft's Vice-President Sergey Andropov said that China is expected to import 27 million tons of Russian crude this year via the Eastern Siberia-Pacific Ocean (ESPO) pipeline. The volume underscores the significance of contracts signed in 2009 by Rosneft, Transneft, and China National Petroleum Corporation to have Russia supply oil to China through the ESPO.

In March, China bought 4.65 million tons of oil from Russia.

Russia, Saudi Arabia and Angola were China’s three major oil suppliers last month.

April imports from Saudi Arabia fell by 22 percent year-on-year to 4.12 million tons. In March, China imported 3.98 million tons of oil from the country.

China increased year-on-year oil imports from Angola last month by 39 percent to 3.98 million tons. Imports from Iran in April fell by 5.1 percent yoy to 2.76 million tons.

An International Energy Agency report showed that at the end of 2015 Russia overtook Saudi Arabia as the biggest crude exporter to China.

Russian exports to China have more than doubled over the past five years, up by 550,000 barrels a day. Moscow and Beijing have significantly increased energy cooperation, with a wide range of multibillion dollar projects.* * *

Russian oil transport monopoly Transneft’s Vice-President Sergey Andropov said in March that China is ready to import 27 million tons of Russian crude this year via the Eastern Siberia-Pacific Ocean (ESPO) pipeline. Supplies to China through the ESPO pipeline started in 2011 after Rosneft, Transneft and China National Petroleum Corporation (CNPC) signed contracts two years earlier. Currently five million tons of crude are supplied through the pipeline annually, and this is expected to rise to 15 million tons a year.

Experts say Chinese imports of Russian oil are likely to stay high over the coming years due to long-term crude supply contracts and rising demand from the world's second biggest oil consumer.

There is an underlying theme here that cannot be ignored.

Whatever the US has been focusing on, whether it's commissioning $4.4 billion warships, wargaming in the name of "regional stability", or arguing over LGBT rights and confederate flags, it is neither productive, nor helping its global economic standing. One day when the USD is no longer the reserve currency, and all of the games the Federal Reserve plays to allow fiscal policy to go unchecked are no longer an option, we suspect that it will wish it had done things quite differently.

Tough question for Clinton on economy: Are you better off?

Getty Images

By Jordan Fabian - 05/22/16 06:00 AM EDT

Is the country better off than it was eight years ago? For Democrats, the answer is tricky.President Obama and likely Democratic presidential nominee Hillary Clinton have not always been on the same page when talking about the economy, at times sending a mixed message to voters ahead of the November elections.

Obama has emerged as an unabashed cheerleader of the economic recovery during his time in office, seeking to cement a legacy as the president who dug the country out of the Great Recession.

Clinton frequently praises Obama, but she’s more apt to mention that people are still hurting, bowing to the reality that nearly seven in 10 Americans believe the country is on the wrong track.

She has even made comments that are implicitly critical of the performance of the economy on the president’s watch.

The disparity indicates that Democrats face a tough task in presenting a united front on the economy, an issue that voters rank as their top priority.

Party leaders will be looking to avoid a repeat of 2012 in the lead-up to their convention in late July.

Martin O’Malley — then Maryland’s governor and an Obama surrogate — caused a public relations fiasco for his own party that year when he said Americans were not better off than they were before Obama took office.

The comment forced the Obama campaign into damage-control mode in the days before its convention in Charlotte as it sought to hammer home the message that the country was on the right track.

Democrats again will have to pull off a high-wire act to persuade jittery voters being courted by presumptive Republican nominee Donald Trump. The businessman has built an enthusiastic following by promising to bring back the country’s economic glory days.

“Despite the progress that has been made, and it has been a lot, it’s still difficult to talk about the economy,” said Democratic strategist Jim Manley, who supports Clinton. “The fact is, there are still people hurting out there.”

Manley accused Republicans of “distorting reality” when it comes to the recovery, but he added, “I don’t blame people for hearing a slightly mixed message” from Democrats.

The mixed message stands in contrast to Trump’s clear-cut promise to “Make America Great Again,” and could fuel the GOP’s argument that Clinton is essentially running for Obama’s third term.

“Simply repeating what focus groups tell her to say won’t paper over the fact she is running on another four years of Obamanomics," said Republican National Committee spokesman Michael Short

Brandon Rottinghaus, a presidential historian at the University of Houston, said it’s a common problem facing candidates who have run to succeed a two-term incumbent.

“It’s a tough situation and it’s not that easy to pull off,” he said. “Even in a good economy, you need to defend yourself against claims that things could be better.”

Obama has rarely missed an opportunity to talk up positive economic indicators during his final year in office.

The unemployment rate is at 5 percent — down from 10 percent at the height of the recession in 2009 — and wage growth has started to tick upward.

“By almost every measure, America is better, and the world is better, than it was 50 years ago, or 30 years ago, or even eight years ago,” Obama said last Sunday during a commencement address at Rutgers University.

The president has acknowledged that more work needs to be done on the economy. But he’s said on multiple occasions he doesn’t get enough credit for lifting the economy out of its Recession-era depths.

Vice President Biden said in a February interview that Clinton and her rival in the Democratic race, Sen. Bernie Sanders (I-Vt.), “are making a big mistake” by not campaigning more forcefully on the White House’s record.

“Even my own folks say, jeez, Joe, you got 60-70 percent of the American people think we’re going in the wrong direction. Don’t try to buck it,” Biden said.” What do you mean, don’t try to buck it? If everybody doesn’t buck it, guess what, it’s gospel.”

But it’s unrealistic to expect Clinton to adopt the same message as Obama, according to supporters and independent experts.

While Obama is looking to shape his legacy, Clinton needs to win over voters, and not acknowledging the economic anxieties roiling the country could make her seem out of touch.

A recent Reuters/Ipsos found that 68 percent of adults believe the country is on the wrong track, including 51 percent of Democrats.

Even though two-thirds of people said their own household was doing well, just 42 percent of adults described the economy as good in a new Associated Press/NORC Center for Public Affairs Research poll.

There’s also the reality that the recovery hasn’t touched many corners of the country.

Long-term unemployment remains high, fewer Americans are working and slow wage growth has made it hard for many middle- and working-class families to make a living.

Clinton has tried to address those concerns. At an April campaign stop in Philadelphia, she told the story of a nurse who had wiped out her savings to pay for breast cancer treatments.

“She is speaking for so many people across our country who feel beaten down, left out and left behind,” Clinton said. “People who have worked hard and done their part, but just can’t seem to get ahead, and find it tough even to get by.”