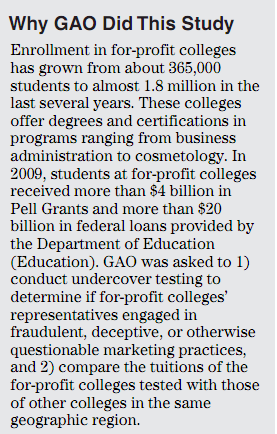

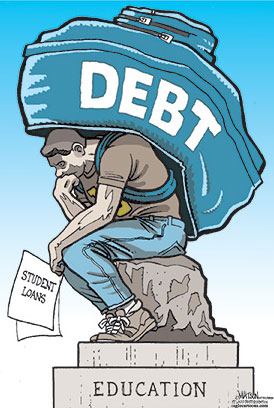

The explosive growth of student loan debt is troubling for a variety of obvious and not so obvious reasons. More needed attention is being drawn to higher education and questions are being sharply directed at the way college education is financed. The bubble in higher education has similar parallels to the bubble experienced in housing. Owning a home is a good thing and has been part of our national identity for close to a century. Yet during the mania very few questioned the method of financing this otherwise solid financial investment. It all depends on how you finance the purchase. The same dilemma is occurring with pursuing a college degree. Very few will argue that going to college is a bad idea. Knowledge is power as we all know. Yet is it necessary to go to a school just because they added a $10 million Olympic sized pool? The additional bells and whistles are similar to the peak bubble days in California where sellers tried to convince buyers that the new whirlpool and granite counter tops added tens of thousands of dollars in value. Value by what standard? Most of the mania was fueled by easy access to debt greased by Wall Street and backed by the government. The fact that we are approaching $1 trillion in student loan debt is staggering.

The chart of the student loan bubble

Source: Federal Reserve

The Federal Reserve now publishes a small snapshot of student loan debt encompassing debt covered by the Federal Government and Sallie Mae. The above chart should cause anyone to pause and consider what is happening. You can even run a quick measure to see where things stand today:

1990 GDP: $5.7 trillion

2000 GDP: $9.9 trillion

2009 GDP: $14.1 trillion

Now we can measure this against the student debt portion provided by the Federal Reserve data:

Fed/Sallie Mae student loan debt data:

1990: $19 billion (0.33 percent of GDP)

2000: $84 billion (0.84 percent of GDP)

2011: $355 billion (2.5 percent of GDP)

Now keep in mind that we are only looking at the small fraction of loans covered by the above data. As stated before total student loan debt including debt from private banks is closer to $1 trillion which is over 7 percent of GDP. College tuition and fees are certainly outstripping inflation by many measures. What is troubling about this trend is that it is being financed by debt backed by the government. Banks are willing to loan money knowing the government is on the hook if students fail. The spin is also disturbing. The evaporation of blue collar industries does make college a more important tool for future economic success if one wishes to enter the middle class (i.e., purchase a home and save a bit of money to avoid eating off the dollar menu every day).

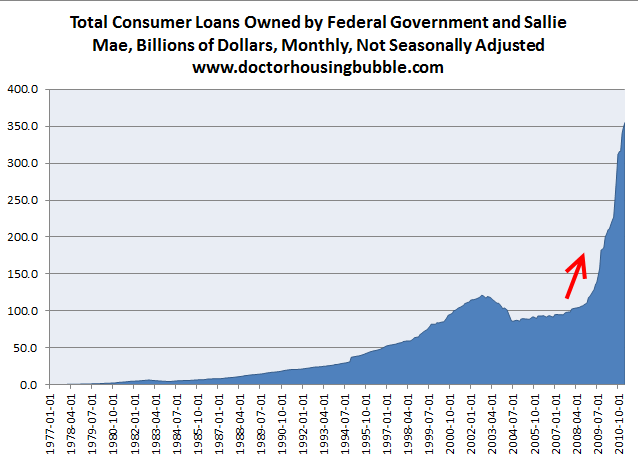

Just like in housing, every home benefitted during the housing bubble. A large portion of the money is being funneled to for-profit colleges. The Government Accountability Office put out a report showing the costs of various programs at different schools:

Source: GAO

Now look at the difference here. Take web page design. At a public college this should cost you $2,000. A reasonable amount of money. Yet the for-profit college is charging over $20,000! These institutions are nothing more than the Real Colleges of Genius that gouge students through deceptive loan practices and guess what? You remember that earlier chart showing the explosion of student loan debt owned by the government or Sallie Mae? A big player in that is coming from the for profits.

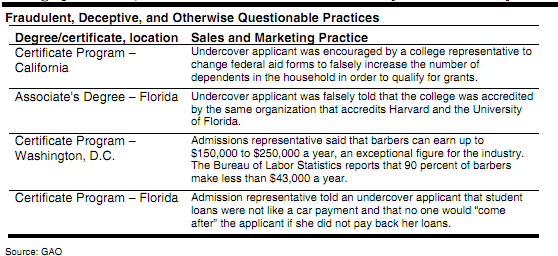

The GAO also found incredible amounts of fraud when they sent undercover agents to investigate these schools:

Same accreditation as Harvard? Barbers can earn up to $150,000 to $250,000 a year? This is the kind of misleading nonsense that is being financed with your government backed money. I think public colleges do serve a solid purpose and provide a great benefit. However the mania is exploding in these for-profit schools that are the subprime mortgage brokers of the college world. And this is where the growth is at:

Nice to sell a product where results are merely a marketing ploy and where close to 40 percent of students end up defaulting on their debt (debt that you cannot walk away from). The colleges don’t care because there is no accountability just like the mortgage brokers that pushed off junk loans to people during the housing bubble. Wall Street is happy because look at the above chart. And when it all goes boom it is the sucker taxpayer that is on the hook. This is the new model of economic growth in our nation. Wall Street has learned to turn everything into a bubble including education with the deep pockets of taxpayers. Yet measurable results are nowhere to be found. Wall Street doesn’t want money flowing into public schools because there is little profit to be had. The government here is merely the dumping ground for the bad loans as it is the case with the housing bubble.

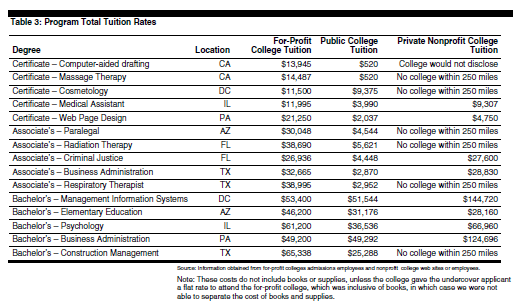

The GAO conducted the study because:

Think about the above. Many of the for-profit colleges derive 90 to 100 percent of their income because of federal student loans. Students are lured in with late night commercials or aggressive sales teams that simply do not care about the actual education a student will receive. It is all about churning sales and suckering people into a false mantra. “Every person should have a college degree” which rings eerily similar to “every person should own a home.” At what cost? The only reason this is happening is because of Wall Street and government backed loans. Thanks to this new model, the for-profits are operating in the new world of subprime colleges. Yet there is no walking away from student loan debt which puts an albatross on an entire generation of college students. Will these people even be able to purchase a home in the future? Will their degree actually increase their earnings potential? Here is a case of a student out in Los Angeles:

“(CNN Money) I moved to Los Angeles when I was 21 to pursue a career in screenwriting. Now, I’m 34 years old and still barely getting by.

I’m a television writers’ assistant, and I’ve worked on some great shows like Desperate Housewives — but since I’m on a freelance basis, my income is far from steady.

I’ve taken side jobs waitressing, writing dating ads, and even pet-sitting. Since I’m not making enough money to pay rent, I gave up my apartment and decided to couch-surf with a different friend each week for 52 weeks.

It’s been more than a year now, and I’m still basically, homeless. To make matters worse, I have $99,000 in student loans to pay off (don’t go to two private schools in a row!).

The good news is, even though I still barely have an income, I am extremely happy and have started to write a book about the whole experience. I’m calling it 52 Weeks, 52 Couches: How I Slept my Way Through Hollywood (Without Sleeping with Anybody) and I hope to sell it soon. In the meantime, I’ll continue surfing from job to job, and couch to couch.”

Nearly $100,000 in student loan debt and no secure job to be found. You tell me if we are in a student loan bubble?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.