Wednesday, November 2, 2011

Home prices heading for triple-dip

According to Fiserv (FISV), a financial analytics company, home values are expected to fall another 3.6% by next June, pushing them to a new low of 35% below the peak reached in early 2006 and marking a triple dip in prices.

Several factors will be working against the housing market in the upcoming months, including an increase in foreclosure activity and sustained high unemployment, explained David Stiff, Fiserv's chief economist.

Should home values meet Fiserv's expectations, it would make it the third (and lowest) trough for home prices since the housing bubble burst.

The first post-bubble bottom was hit in 2009, when prices fell to 31% below peak. The First-Time Homebuyer Credit helped perk prices up by mid-2010, but by the time the credit expired, prices fell again.

In the second dip, which was reached last winter, prices were down 33%before staging a mild rally that was artificially spurred as banks slowed the processing of foreclosures following the robo-signing scandal, which found that loan servicers were rapidly signing foreclosures without properly vetting them.

Now that the scandal is mostly resolved, lenders are speeding more cases through the foreclosure pipeline and back onto the market, weighing on home prices even further.

Earlier this month, RealtyTrac reported the first quarterly increase in foreclosure filings in three quarters. Even more discouraging: new default notices were up 14%.

Home prices: Check your local real estate market forecast

There's also a "shadow inventory" of homes in foreclosure that have yet to go back onto the market.The specter that those foreclosed homes could flood the market at any time and drive prices significantly lower is a huge concern, said Mark Dotzour, an economist for Texas A&M University. "That's the elephant in the room," he said, noting that there are 6 million home currently in shadow inventory.

Naples, Fla., for example, is expected to take the biggest hit of any metro area, a price drop of another 18.9% by the end of next June, according to Fiserv. Home prices in the area have already fallen 61% from the peak.

Other cities expected to be hit hard include the not-so-lucky Las Vegas, which is expected to see home prices fall another 15.9% for a total loss of 66%; Riverside, Calif., is projected to fall another 14.8% (for a total decline of 61%); Miami is expected to decline by 13.2% (total loss: 57%), and Salinas, Calif. could drop by another 13% (for a total loss of 66%).

There will be some winners, however, led by Madera, Calif. and Carson City, Nev., which will each gain 15.5%. That's some consolation for hard-hit residents: The average home in each of these metro areas has lost more than half its value.

Other metro areas Fiserv expects to recover nicely are Yuma, Ariz. (up 9.5%), Yuba City, Calif. (9.2%) and Farmington, N.M. (8.3%).

A few individual metro areas will do better, with 31 of the 385 markets Fiserv monitors expected to pile up double-digit gains. Another 71 markets are expected to post increases of 5% or better.

I bought my dream retirement home -- cheap!

Many of the markets that will record the biggest increases are vacation or retirement communities that had taken some of the biggest hits during the bust.The biggest "winner" will be Ocala, Fla., with a 22.4% spike for the 12 months ending June 30, 2013. Ocala was one of the hardest hit communities in the U.S. over the past several years, with home prices falling some 50%.

Others anticipated gainers will be Napa, Calif., which Fiserv projects will improve by 20.9% over that same period; Panama City, Fla. (an estimated 18.2% jump) and Bremerton, Wash. and Carson City, Nev. (both expected to see home prices climb 17.9%).

Some cities will continue to fade, however. Fort Lauderdale, Fla.'s forecast is for a 9.2% drop through next June and another 6.7% the 12 months after that. Its neighbor, Miami, will endure 13.5% and 5.2% declines, respectively.

Wall St. and other "Occupy" Protests Should Re-Brand as "Anti-Oligarchy"

The "Occupy" protests and other demonstrations across the US and Europe are reported as being "anti-capitalist", "anti-banker", "anti-EU" or simply "anti-government".

But these labels will just not do.

The oligarchs who bring us our successive financial crises and wars will be getting rid of capitalism pretty soon.

Unfortunately they have no intention of disappearing with it.

We know that the entire financial system is going to collapse in fairly short order.

It must.

The 'more-debt' solution to irresolvable debt problems is a stalling strategy and everybody knows it.

A real solution to the nightmare that the financial oligarchs have created for us would end their system, so that ain't going to happen.......just yet.

First we are going to endure crises like we have never seen before.

Currencies will collapse.

There will be a major and very terrible war, a primary purpose of which will be to make survivors so desperate that they will be glad to accept anything on offer that delivers peace.

When it is over capitalism will go.......but the same people will remain in charge.

Therefore there is little point in branding oneself an 'anti-capitalist' (because Messrs. Rothschild and Rockefeller will soon be making common cause with you)

When the time comes we will be expected not to notice that the new, much better, much fairer system on offer will continue to be run by the same banking oligarchy that caused all the problems and nearly destroyed planet earth in the first place.

This trajectory is well laid out by Richard North in a recent article here.

We can expect a new Godless tyranny. A 'humanitarian' tyranny.

So let us be clear:

The system we call 'democracy' is really government by agents representing the interests of a financial oligarchy.

'Capitalism' is government by oligarchy.

(Wall-Street funded) Soviet 'Communism' was government by a tyrannical oligarchy.

All these disastrous systems were disasters because they were structurally designed to represented the interests of a ruling elite rather than the genuine interests of ordinary people.

So,

WHEN THE NEXT OLIGARCHICAL SYSTEM IS OFFERED TO US, ALL HUMANITY MUST RECOGNISE IT FOR WHAT IT IS AND REJECT IT.

TOTALLY.

What protesters need to set their minds and hearts against is the continuing dominating influence of a financial juggernaut that is, at its core, led by a small elite of extraordinarily powerful, corrupt and self-serving oligarchs.

Think it through, be clear about this and explain to everybody you meet.

Our system is not democratic, it is oligarchical and.....

WE ARE, FIRST AND FOREMOST, ANTI-OLIGARCHY.

Film on Oligarchy:

Part Two of this video here.

4 Simple Steps for Taking Your Money Out of the Vampire Banks

Banks Extract Fees On Unemployment Benefits

Out of work and living on a $189-a-week unemployment check, Rob Linville needs to watch every penny. Lately, he has been watching too many pennies disappear into the coffers of the bank that administers his unemployment check via a prepaid debit card.

The state of Oregon, where Linville lives, deposits his weekly benefits on a U.S. Bank prepaid debit card. The bank allows him to make four withdrawals per month free of charge. After that, he must pay $1.50 for each visit to the ATM and $3 to see a teller. Managing his basic expenses, including rent, bus fare and groceries, typically requires more than four withdrawals, he says. Unexpected needs -- Linville recently bought a sport coat for $20 to prepare for a job interview -- entail more. He's afraid to withdraw his full benefits in one shot, knowing that the bank could sock him with a $17.50 overdraft fee if he exceeds his balance. So he pulls out small amounts of cash as he needs it, incurring about $15 in fees in the last two months he says.

"I'm so broke," Linville said, his voice expressing resignation that this is simply how the world works. "But I don't really have any other options."

Across the nation, people receiving a range of state-furnished benefits -- from unemployment insurance and food stamps to cash assistance for poor families -- are facing similar options and reaching the same conclusion. In 41 states major banks and financial firms have secured contracts to provide access to public benefits via prepaid debit cards. And banks are increasingly extracting hefty cuts of these funds through an assortment of small fees. U.S. Bank, JP Morgan Chase, Wells Fargo, Bank of America and other institutions hold contracts to distribute these benefits on prepaid debit cards.

When Bank of America announced plans to charge regular banking customers a $5 monthly fee to use their debit card it created a wave of public criticism. But the lesser-known fees attached to prepaid debit cards are already extracting money from the most vulnerable Americans -- those unable to pay their bills and feed their families without public help -- in the midst of stubbornly high unemployment and soaring rates of poverty.

"The big banks have actually figured out a way to make unemployed workers a profit center, one that only grows as things get worse," said Angela Martin, executive director of Economic Fairness Oregon, a nonprofit advocacy group for low income and poor families.

A spokeswoman for U.S. Bancorp, the parent company of U.S. Bank, said unemployment recipients are clearly informed about the fees that pertain to their debit cards. She added that the cards provide a convenient and economical service, because they allow holders to use them to buy goods at stores and withdraw cash back without incurring a fee.

Prepaid debit cards often look a lot like the debit cards which many Americans are already familiar with. But the cards can carry a range of fees for basic banking activities such as visiting an ATM, making a purchase, checking one's balance or paying a bill online.

Six years ago, states distributed $55 billion in public benefits via prepaid debit cards, according to an estimate from Mercator Advisory Group, which monitors the consumer payment industry. By last year, that figure had ballooned to $133 billion. Mercator does not track how much of that money was handled by banks.

There are some hints of how much money is flowing from America's poorest families to banks. In 2008, California's welfare families paid $8 million in surcharges to access their cash welfare benefits, according to a Western Center on Law and Poverty analysis, which advocates for the poor. Surcharges paid by welfare recipients will exceed $16 million this year, the Center projects.

The revenue generated from providing access to public benefits on prepaid debit cards has become particularly important to banks this year, said Lauren Saunders, a managing attorney at the National Consumer Law Center in Washington, D.C. A 2010 federal law capped the swipe fees banks can collect from merchants when consumers use ordinary debit cards. But those caps do not apply to the prepaid debit cards used to withdraw unemployment benefits and other forms of cash assistance.

In several states, the public benefits debit card business involves a largely captive audience that must exert itself to find an alternative means of securing its money. A half dozen states force the unemployed to receive their benefits on prepaid debit cards, according to a May study released by the National Consumer Law Center.

In Oregon, jobless people who apply for unemployment benefits are automatically given their weekly benefits via a U.S. Bank ReliaCard unless they expressly opt out and furnish information about a personal bank account to establish a direct deposit.

Six Oregon residents interviewed by The Huffington Post said that when they applied for unemployment benefits online, the state's website did offer them the opportunity to set up a direct deposit instead of relying upon a prepaid debit card furnished by U.S. Bank. But the page on which they were offered the options did not clearly lay out the fees that can be incurred with the debit card option, they said. Another section of the Web site does list the fees, The Huffington Post found, but locating that information requires looking on a separate page.

Between July and September, U.S. Bancorp secured $357 million in revenue through the division that includes its prepaid cards, according to its most recent earnings statement. That was more than one-fourth of its total revenues. The bank refused to say how much of this revenue was comprised of fees from its handling of state unemployment benefits.

The fees are the sole source of revenue the bank derives by handling unemployment benefits and court-ordered child support payments in Oregon. The state does not pay the bank for issuing debit cards or administering the payments. Oregon's treasurer will begin negotiating a new contract in November. A request for proposals from other banks has not been issued.

For the state, the cards minimize the need to mail checks or manage transfers to myriad banks. Since 2007, Oregon has saved at least $11 million on printing, mailing and other costs associated with the unemployment program alone, said James Sinks, a spokesman for Oregon State Treasurer Ted Wheeler's office. State staff estimate that over the course of the contracts, about 40 percent of people in both programs have used ReliaCards, Sinks said. The remainder receive funds via direct deposit.

Sinks described the notion that fees are unfair, abusive or out of touch with consumer spending habits as "specious" and "laughable." People can always obtain cash without paying fees by making a purchase at a store where customers can request cash back.

"The card was negotiated the way that it was to make people's money available to them at the lowest cost," said Sinks. "Are there fees, yes. But there are ways for people to access their money for free and there are robust ways to do that. I don't believe that most people are paying fees."

But several unemployment benefit recipients in Oregon said it was quite difficult to switch to direct deposit after they learned of the fees on their prepaid debit cards. Many recipients complain that their unemployment benefits are so limited that even an unwanted pack of gum purchased to access their benefits without fees amounts to a consequential expense.

A woman in the southern Oregon town of Grants Pass who enrolled in the state's unemployment program in 2007 said she did not receive a notice of fees until several months after she incurred some $220 in surcharges. A Portland man who enrolled in August and receives $507 in benefits each week said he cannot find a U.S. Bank ATM or retail store where he can remove more than $200 at a time, forcing him to pay fees to get all of his funds.

Linville, who lost his job as a data entry clerk in August, said he was not aware of the fees when he signed up for the U.S. Bank card on Oregon's unemployment web site but later received a schedule of fees in the mail. He has a bank account but thought the U.S.Bank card would give him a way to pay bills immediately when his unemployment benefits arrived. Often, Linville is so short on cash that he pulls money off the card to pay bills on the same day they are due, he said. If he can, he pays the bill with the debit card, a retail purchase that does not carry a fee. But, that is not always an option.

"I try to use it the best way I can really," said Linville, 39. "But it's not that easy to plan a way around those fees. You just pay them and you move on to the next problem."

Dick Grasso With Joe Kernen On Occupy Wall Street: "I Understand The Anger, Banks Gave Capitalism A Bad Name"

Watch Video

CNBC Video - Oct. 28, 2011

Kernen has gotten religion. Grasso, the former head of the NYSE who left with more than $100 million, not so much. This is a very revealing interview. Kernen stands up for the anti-bailout complaints of Wall Street protesters, and attacks the bonus culture and lack of clawbacks. Don't skip this.

One protester dead in Oklahoma City, nine arrested in Portland

In a press advisory Monday, Occupy Oklahoma City organizers expressed their sadness at the passing of a homeless protester who went by the name “Street Poet.”

“The Poet was found dead in his tent at Kerr Park earlier this afternoon by other participants,” they wrote. “Police and emergency personnel were immediately contacted. Occupy OKC is withholding information concerning The Poet’s identity pending notification of his family by authorities.”

Oklahoma City police Capt. Dexter Nelson said that although the man appeared to be in his 20s, the death was not suspicious.

In a video posted to Facebook, Street Poet explained that he had been “traveling the road on foot doing poetry” since his dad kicked him out at the age of 16 or 17. Another video posted to Google Plus shows the man performing poetry.

“I’ll tell you right now, unless you crawl under that bridge and huddle up against the wall, take off them busted-ass shoes then you don’t know what I’ve been through or where I’ve been,” he said. “Knowing tomorrow, I’ll be in the same place again, drying my tears in the wind. You save me from my pain, but you don’t even know what pain is.”

Early Tuesday morning, police cleared an encampment of Occupy Portland protesters from Terry Schrunk Plaza. Nine protesters who refused to leave will face federal charges.

Officers with helmets and nightsticks surrounded the plaza to make sure protesters didn’t return as the camp was dismantled.

Protesters shouted “The whole world is watching” and “”The tents will go back” as they looked on.

“It definitely got a little tense, maybe heated,” Portland police spokesman Lt. Robert King told The Oregonian.

Other protest sites around the country were largely quiet.

The roommate of Iraq war veteran Scott Olsen, who was wounded during clashes with police in Oakland, said the former Marine “seems to be doing well” after a hospital visit yesterday. Keith Shannon told The Associated Press that Olsen still can’t speak but doctors expected him to make a full recovery. He is still suffering from a fractured skull caused by a police projectile.

Occupy Wall Street protester Felix Rivera-Pitre, who was videotaped being hit by New York Police Deputy Inspector Johnny Cardona, met with the District Attorney yesterday in hopes that assault charges will be filed.

“Had it been any regular white guy, instead of any angry white shirt, had committed that attack, that person at best would be able to plead out to assault,” attorney Ron Kuby said after meeting with the DA. “Three years’ probation and some serious court-ordered anger manager.”

Albany Mayor Jerry Jennings is still refusing to push law enforcement to arrest peaceful protesters camped out across from City Hall.

“If people don’t like it, they can vote me out,” Jennings said on his Talk 1300 radio show. “That’s the way it goes.”

Watch this video of Street Poet, uploaded Oct. 31, 2011.

Greece: A Very Important Event

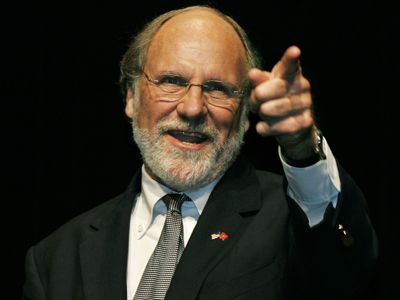

Regulators Investigating MF Global For $700 Million In Missing Client Funds - Was It Stolen By Management?

This is not looking good for former New Jersey Senator and Governor, and previously Goldman Sachs CEO Jon Corzine. More than $700 million of supposedly safeguarded client funds have gone missing from MF Global. If it was stolen from client accounts to support MF Global's trading positions, Jon Corzine should go to prison. And if it was stolen, and Corzine escapes without a Federal ID number and associated orange jumpsuit due to fundraising ties with Obama and Eric Holder, then the game is over.

The rule of law is dead.

---

NYT

Excerpt:

Federal regulators have discovered that hundreds of millions of dollars in customer money has gone missing from MF Global in recent days, prompting an investigation into the brokerage firm, which is run by Jon S. Corzine, the former New Jersey governor, several people briefed on the matter said on Monday.

The recognition that money was missing scuttled at the 11th hour an agreement to sell a major part of MF Global to a rival brokerage firm. MF Global had staked its survival on completing the deal. Instead, the New York-based firm filed for bankruptcy on Monday.

Regulators are examining whether MF Global diverted some customer funds to support its own trades as the firm teetered on the brink of collapse.

The discovery that money could not be located might simply reflect sloppy internal controls at MF Global. It is still unclear where the money went. At first, as much as $950 million was believed to be missing, but as the firm sorted through its bankruptcy, that figure fell to less than $700 million by late Monday, the people briefed on the matter said. Additional funds are expected to trickle in over the coming days.

But the investigation, which is in its earliest stages, may uncover something more intentional and troubling.

In any case, what led to the unaccounted-for cash could violate a tenet of Wall Street regulation: Customers’ funds must be kept separate from company money. One of the basic duties of any brokerage firm is to keep track of customer accounts on a daily basis.

Neither MF Global nor Mr. Corzine has been accused of any wrongdoing. Lawyers for MF Global did not respond to requests for comment.

Later on Monday, when explaining to regulators why the deal had fallen apart, MF Global disclosed the concerns over the missing money, according to a joint statement issued by the Commodity Futures Trading Commission and the Securities and Exchange Commission. Regulators, however, first suspected a potential shortfall days ago as they gathered at MF Global’s Midtown Manhattan headquarters, the people briefed on the matter said. It is not uncommon for some funds to be unaccounted for when a financial firm fails, but the magnitude in the case of MF Global was unnerving.

For now, there is confusion surrounding the missing MF Global funds. It is likely, one person briefed on the matter said, that some of the money may be “stuck in the system” as banks holding the customer funds hesitated last week to send MF Global the money.

But the firm has yet to produce evidence that all of the $600 million or $700 million outstanding is deposited with the banks, according to the people briefed on the matter. Regulators are looking into whether the customer funds were misallocated.

Continue reading...

---

Here's more on what this means from Zero Hedge:

And just like in the Lehman collapse where tens if not hundreds of international prime brokerage hedge fund clients, due to no fault of their own, found themselves insolvent after their cash ended up being caught at the London Lehman office (the details of how that money was illegally transferred from London to the US is a different topic entirely) and never to be seen again except to satisfy general unsecured claims, so thousands of MF clients are about to realize that money they thought they had, even if completely unencumbered with other assets, read pure cash, read money not at risk, is now gone forever, and they will have to wait years until the bankruptcy process determines if the claim deserves priority status to the unsecured bondholders. Best case: assume a 70% haircut on the money, if it is every to be seen again at all.

So who can be sued? Who can be blamed for this malicious and purposeful criminal act? Why everyone from the back office clerk presented in the thought experiment above, all the way up to the man at the very top, Jon himself, who, like in every other act of Wall Street impropriety will plead stupidity and deny he ever knew of this crime. Unfortunately, our criminal regulators, who will be just as complicit in clearing him of all wrongdoing, will aid and abet this latest destruction of faith in US capitalism.

What happens next? Why customers at all other brokerages, all other exchanges, afraid that their money will suffer the same fate as MF, even if they transact with perfect solvent clearers and agents, will proceed to pull their money, as they know they have nobody to trust but their own prudent and forward looking actions. Which in turn will start the kind of liquidity drain that killed not only Lehman, but froze money markets, and with that brought the complete capital markets to a standstill, only to be thawed after the Fed pledged multiples of the US GDP to rescue Wall Street in October of 2008.

And that, dear reader, is called unintended consequences, and how the bankruptcy of a small exchange can avalanche into a crippling Ice Nine of what is left of capital markets all over again, courtesy of crony capitalism, rampant criminality and a regulator and enforcement body that is more fascinated with midget porn than any regulating or enforcing of the very firms it hopes to get an assistant general counsel job from in a few short years.

---

Breaking: Bank of America Cancels $5 Debit Card Fee

Via:

"Bank of America Corp. is dropping its plan to charge customers $5 a month for making purchases with their debit cards, a person familiar with the situation said."

"The move is a dramatic retreat following decisions by several rivals in recent days to drop customer tests of the new fees. SunTrust Banks Inc. and Regions Financial Corp. also said Monday that they will stop charging customers for debit-card transactions.""Bank of America decided against the fees due to negative customer feedback on the plan and the moves by rivals, which left the Charlotte, N.C., lender as the only big bank planning to levy the fee on some customers next year."

Nashville Judge Tells Cops "You Have NO Lawful Basis To Arrest Occupy Pr...

Police and Other Officials Are Increasingly Refusing Unconstitutional Orders to Arrest Protesters

Last week, New York police defied governor Cuomo’s orders to arrest hundreds of “Occupy Albany” protesters.

Today, a Nashville judge refused the Tennessee governor’s orders to break up “Occupy Nashville”.

A Baltimore police union and two firefighters unions have written to Baltimore Mayor Stephanie Rawlings-Blake (who wants to shut down Occupy Baltimore) asking that the protests be allowed to continue.

And city employees from Irvine, California to Providence, Rhode Island have correctly said that – whether or not they agree with the protesters’ views – the protesters’ have the right of free speech and free assembly under the Constitution.

Perhaps this is the start of justice for 99% … instead of just the top 1%. See this, this, this, this, this, this and this.

Nevada Makes Illegal Foreclosures A Felony (LINKS)

- Nevada Makes Illegal Foreclosures A Felony

- Occupy Wall Street: Many Cities Leaving Protesters Alone [LATEST UPDATES]

- WNYC Radio Show Fires Journalist For Taking Part In Wall Street Protests

- Doctors: Scott Olsen suffered brain damage and is unable to speak

- Why Iran can’t stop covering Occupy Wall Street - Salon

- FLASHBACK: Oakland Paid $2M Settlement After Attacking Protesters In 2003

- Dylan Ratigan On Student Loan Nightmare

- Another Eurozone Country Bites The Dust

- ARIZONA - $1.6 Billion taxpayer bailout of police and fire pension fund

- German Court stops fast-track bailout fund

- Greek deal may imperil sovereign CDS market - Reuters

- Norway's Sovereign Wealth Fund Sold All U.S. Mortgage Bonds

- Bernie Madoff's pathetic story is reminder why Wall Street protesters occupy

- Contractors hired goons to issue death threats, beat and throw acid at workers who fought kickbacks

Occupy Congress?

Video - Deficit Committee Super Congress - Oct. 26, 2011

She got it half right. Taxing the rich won't fix a $1.4 trillion deficit, not even close. The problem in Washington is spending, much of it on the war machine. And closing loopholes that allow corporations like GE and Exxon to pay no income taxes would raise hundreds of billions annually. The 15% hedge fund tax loophole also needs to be scrapped.

Greece to hold referendum on EU debt deal

Greece is to hold a referendum on whether to accept the rescue package from the European Commission, European Central Bank and International Monetary Fund troika.

Responding to the riots that followed last week’s proposal, as well as dissent from within his own Socialist party, Prime Minister George Papandreou said: “The command of the Greek people will bind us. Do they want to adopt the new deal, or reject it? If the Greek people do not want it, it will not be adopted.”

“Heightened Greek uncertainty could propagate to other fragile euro countries, in particular Italy,” said Thomas Costerg, an economist at Standard Chartered Bank.

Mr Papandreou’s move is a high-stakes gamble designed to win greater legitimacy for austerity that’s proving deeply unpopular in a country where the economy is already forecast to shrink 5.5pc this year.

While polls show a majority of Greek voters see last week’s rescue package as a “negative”, they also signal that most would like to stay in the euro.

“I can no longer look at polls where the majority is against the agreement, the majority is against the programme, but a majority is also in favour of staying in the euro,” Evangelos Venizelos, the Greek finance minister, said on Monday.

Meanwhile, Willem Buiter, chief economist at Citigroup has called for the EU bail-out fund to be increased to €3 trillion. Writing in the Financial Times, Mr Buiter said that "the €1 trillion figure bandied around ... assumes that a 20pc or 25pc first loss guarantee would reduce Italian and Spanish borrowing costs on new debt issues to sustainable levels. It would not."

Marc Faber discusses bailouts on CNBC

Man, Economy, and Liberty | Murray N. Rothbard

Let Them Eat Cake: 10 Examples Of How The Elite Are Savagely Mocking The Poor

There is absolutely nothing wrong with working hard and making a lot of money, but there is something wrong with being completely arrogant and smug about it.

There is absolutely nothing wrong with working hard and making a lot of money, but there is something wrong with being completely arrogant and smug about it.Today, many among the elite are savagely mocking the poor, and that is a huge mistake. You shouldn’t kick people when they are down. There are tens of millions of Americans that are deeply frustrated about losing their homes, losing their jobs or barely being able to survive in this economy.

These frustrations have been one of the primary reasons for the rise of the Tea Party movement and the rise of the Occupy Wall Street movement. What these movements have in common is that people in both movements are sick and tired of the status quo and they want something to be done about our broken system.

There are huge numbers of families out there right now that have just about reached the end of their ropes. Instead of showing compassion, many of the ultra-wealthy have decided that it is funny to mock the poor and those that are suffering.

So how are all of these protesters going to respond to the “let them eat cake” attitude of the Wall Street elite? The protesters are being told that nothing that they can do will change anything and that they should be grateful for what Wall Street and the ultra-wealthy have done for them.

They are essentially being told that they should just shut up and go home. So will we see these protest movements become discouraged and die down, or will the patronizing attitudes of so many among the elite just inflame them even further?

Right now, there really are two different “Americas”. In one America, the stock market is surging, corporate profits are soaring and BMW is operating factories at 110% of capacity just to keep up with demand.

In the other America, unemployment is rampant, millions of families are being kicked out of their homes and more than 45 million Americans are on food stamps.

There is more economic frustration in this country today than there has been at any other time since the Great Depression. We are watching pressure build to very dangerous levels.

It is important to note that I certainly do not agree at all with the solutions being put forward by the organizers of the Occupy Wall Street protests. As I have written about previously, collectivism is one of our biggest problems, and more collectivism is not going to solve anything.

But it is definitely understandable that people are incredibly upset about this economy and that they want to protest. Most Americans realize that something is fundamentally wrong with our economic system.

Unfortunately, most of them do not understand how we have gotten to this point or what it is going to take to fix things. That is one of the reasons why I write about economic issues so much. We desperately need to educate America.

But what is undeniable is that there is a growing rage in this country that protest movements such as the Occupy Wall Street are giving a voice to.

Our system is badly broken. The people out there protesting in the streets may not understand much, but they do understand that something needs to change.

The Wall Street elite should be taking these protests as a signal that they need to get their house in order. The status quo just is not going to cut it. But instead of taking leadership and calling for significant change, many among the elite are openly mocking the protesters.

The incredible arrogance displayed by so many on Wall Street and by so many in Washington D.C. is absolutely appalling.

The following are 10 examples of how the elite are openly mocking the poor in America today….

#1 According to an article in The New York Times, poor families that lost their homes to foreclosure were openly mocked during a Halloween party thrown by the law firm of Steven J. Baum. This particular law firm represents many of the largest mortgage lenders in the United States….

The firm, which is located near Buffalo, is what is commonly referred to as a “foreclosure mill” firm, meaning it represents banks and mortgage servicers as they attempt to foreclose on homeowners and evict them from their homes. Steven J. Baum is, in fact, the largest such firm in New York; it represents virtually all the giant mortgage lenders, including Citigroup, JPMorgan Chase, Bank of America and Wells Fargo.Photos from this Halloween party are posted on The New York Times website. To say that they are appalling would be a huge understatement. The following is how The New York Times described one of the photos….

In one, two Baum employees are dressed like homeless people. One is holding a bottle of liquor. The other has a sign around her neck that reads: “3rd party squatter. I lost my home and I was never served.” My source said that “I was never served” is meant to mock “the typical excuse” of the homeowner trying to evade a foreclosure proceeding.#2 To many on Wall Street, the OWS protests are one big joke. In fact, Wall Street executives have been spotted sipping champagne while watching the Occupy Wall Street protests from their balconies.

#3 In response to the Occupy Chicago protests, signs were put up in the windows of the building where the Chicago Board of Trade is located that spelled out this sentence: “We Are The 1%“.

#4 Many columnists for major financial publications have had no fear of mocking the Occupy Wall Street protesters. For example, Doug Hirschhorn recently wrote the following for Forbes….

As your Occupation of Wall Street continues, you may want to grasp a few things. First, it is not going to change anything in the short term and probably not much in the long-term either.#5 Instead of attempting a balanced report on the Occupy Wall Street protests, Erin Burnett of CNN openly made fun of them during a recent broadcast. After being a stalwart on CNBC for so many years, Burnett has very close ties to Wall Street and apparently she does not like anyone criticizing her friends. You can see video of Burnett mocking the Occupy Wall Street movement right here.

I hate to be the bearer of that news, but money makes the world go round and “Wall Street” is all about money. Second, the top traders, banks and hedge funds are still going to out earn and generate substantial profits from speculating on the disconnects in the prices of things generated from all the moving parts in the global economy and it has nothing to do with why you lost your house or job or can’t find a job. If anything the successful ones are helping you, your pensions funds, retirement savings and the economy in general. If Wall Street stops. The world stops. Period.

#6 Barack Obama continues to mock the poor by telling them to cut back on vacations and little luxuries like going out to eat while at the same time sending his own family out on incredibly expensive vacations. The following is one example I noted in an article earlier this year….

Barack Obama recently made the following statement to American families that are struggling to survive in this economy: “If you’re a family trying to cut back, you might skip going out to dinner, or you might put off a vacation.” A few days after making that statement Obama sent his wife and children off on yet another vacation, this time to a luxury ski hotel in Vail, Colorado.Later on in that same article I mentioned another outrageously expensive vacation taken by the Obamas that was paid for by our taxes….

Back in August, Michelle Obama took her daughter Sasha and 40 of her friends for a vacation in Spain.During a time when so many millions of American families are deeply, deeply suffering it is truly appalling that the residents of the White House would be so insensitive.

So what was the bill to the taxpayers for that little jaunt across the pond?

It is estimated that vacation alone cost U.S. taxpayers $375,000.

#7 Republican presidential candidate Herman Cain recently declared that anyone that is unemployed or poor in America should only blame themselves….

“Don’t blame the big banks. If you don’t have a job and you’re not rich, blame yourself.”#8 Sometimes our politicians are so insensitive that it is almost hard to believe. In an interview with George Stephanopoulos of ABC News while she was still the Speaker of the House, Nancy Pelosi stated that we need poor people to have less children because it costs the government so much money to take care of them….

PELOSI: Well, the family planning services reduce cost. They reduce cost. The states are in terrible fiscal budget crises now and part of what we do for children’s health, education and some of those elements are to help the states meet their financial needs. One of those – one of the initiatives you mentioned, the contraception, will reduce costs to the states and to the federal government.#9 Warren Buffett has some interesting observations on class warfare. He is one of the few wealthy Americans that is willing to say what everyone else is thinking. Back in 2006, Buffett was quoted as saying the following in an article in The New York Times….

STEPHANOPOULOS: So no apologies for that?

PELOSI: No apologies. No. we have to deal with the consequences of the downturn in our economy.

“There’s class warfare, all right,” Mr. Buffett said, “but it’s my class, the rich class, that’s making war, and we’re winning.”Buffett was not taking pride in the fact that the elite have won, but there are many others among the elite that are very proud of what they have done and they are not afraid to look down on the poor.

The level of income inequality that we have in the United States today is absolutely amazing. According to data from a few years ago, the average household income for the top 0.01% of all Americans was $27,342,212. According to that same data, for the bottom 90% of all Americans the average household income was just $31,244.

#10 Every single day, our “representatives” in Washington D.C. are living the high life at our expense. It is amazing that out of the entire population of the United States, we continue to overwhelming elect rich people to Congress. As I noted in a recent article, more than half of all the members of Congress are millionaires, and the median wealth of a U.S. Senator in 2009 was 2.38 million dollars.

Without a doubt, the wealthy rule over us all and they intend to maintain control and perpetuate the system which has rewarded them so handsomely.

When necessary, they are not afraid to call in the police to bust some skulls. Sadly, we are already seeing some brutally violent confrontations between law enforcement authorities and Occupy Wall Street protesters in many areas of the country. The other day, I wrote about the horrific violence that took place in Oakland recently….

Unfortunately, the authorities are not just going to sit by and watch these protests happen. In fact, they are already clamping down hard in many areas of the nation. For example, police in Oakland recently used tear gas and rubber bullets to break up the Occupy protest in that city. When police opened fire, the streets of Oakland literally became a war zone for a few minutes. You can see shocking videos of the violence here, here and here.Power and wealth have become incredibly concentrated in the United States today. As one scientific study demonstrated recently, the elite control almost the entire global economy. In fact, the University of Zurich study discovered that there are just 147 gigantic corporations at the core of it all.

It is not a good thing that such a very small group of people completely dominates all the rest of us.

Once again, there is absolutely nothing wrong with working hard, making great contributions to society and becoming very wealthy.

However, what we have today is a fundamentally broken system that funnels most of the wealth and most of the power into the hands of the ultra-wealthy and the gigantic corporations that they own.

It would be great if the American people could come together and work to make some positive changes to our system.

But right now, it appears that strife, discord and hatred are going to continue to rapidly grow in this country. We have become a very divided nation and we are watching anger and frustration grow to very dangerous levels.

All of this is a recipe for mass chaos. Our country is marching toward a date with disaster and right now we show no signs of changing course.

Please pray for America.

We definitely need it.

OCW WAVE WILL SOON BECOME A TSUNAMI / WALL STREET BEWARE