Goldman Sachs and other bankers are gaming the system, driving the costs of commodities higher and higher with a derivative they made up just for this purpose “the Goldman Sachs Commodity Index”…just to make themselves more money.

Goldman Sachs and other bankers are gaming the system, driving the costs of commodities higher and higher with a derivative they made up just for this purpose “the Goldman Sachs Commodity Index”…just to make themselves more money.In 1991, Goldman bankers came up with a new kind of investment product, a derivative that tracked 24 raw materials, from precious metals and energy to coffee, cocoa, cattle, corn, hogs, soy, and wheat to be known henceforth as the Goldman Sachs Commodity Index (GSCI). For just under a decade, the GSCI remained a relatively static investment vehicle. Then, in 1999, the Commodities Futures Trading Commission deregulated futures markets. Bankers recognized a good system when they saw it, and dozens of speculative non-physical hedgers followed Goldman’s lead and joined the commodities index game, including Barclays, Deutsche Bank, Pimco, JP Morgan Chase, AIG, Bear Stearns, and Lehman Brothers “You had people who had no clue what commodities were all about suddenly buying commodities,” an analyst from the United States Department of Agriculture told me.2. Why does it cost so much to fill the gas tank? Must be Peak Oil right?

In the first 55 days of 2008, speculators poured $55 billion into commodity markets, and by July, $318 billion was roiling the markets. Food inflation has remained steady since.

Hard red spring wheat, which usually trades in the $4 to $6 dollar range per 60-pound bushel, broke all previous records as the futures contract climbed into the teens and kept on going until it topped $25. And so, from 2005 to 2008, the worldwide price of food rose 80 percent — and has kept rising.

- How Koch Became An Oil Speculation Powerhouse From Inventing Oil Derivatives To Deregulating The Market – October 6, 1986: First oil derivative is introduced to Wall Street by traders at Koch. Koch Industries executive Lawrence Kitchen devised the “first ever oil-indexed price swap between Koch Industries and Chase Manhattan Bank. “Documents reveal that Koch is also participating in the unregulated derivatives markets as a financial player, buying and selling speculative products that are increasingly contributing to the skyrocketing price of oil.

Excessive energy speculation today is at its highest levels ever, and even Goldman Sachs now admits that at least $27 of the price of crude oil is a result from reckless speculation rather than market fundamentals of supply and demand. Many experts interviewed by ThinkProgress argue that the figure is far higher, and out of control speculation has doubled the current price of crude oil. “

Excessive energy speculation today is at its highest levels ever, and even Goldman Sachs now admits that at least $27 of the price of crude oil is a result from reckless speculation rather than market fundamentals of supply and demand. Many experts interviewed by ThinkProgress argue that the figure is far higher, and out of control speculation has doubled the current price of crude oil. “ - U.S. Oil Exports Reach Record Highs; That’s Right…Exports

4. Why do my kid’s clothes and everythingelse cost so much these days? – See 1 & 2 above. The price of commodities and oil have a huge ripple effect, forcing everyone’s costs and prices up, driving inflation across the board.

5. Why do I have to keep scraping by every month to pay for ever increasing health insurance costs?

Record Profits Don’t Stop Health Insurer’s Record Rate Hikes. The absurd cost of healthcare is not open for discussion on our public airwaves. Some typical costs: $30,000 – $56,000 for a weekend stay in the hospital for tests only- no surgery. Another bill for $97,000 for a three day stay. The corporate media has made sure that all discussion of health care be about insurance- these ridiculous costs are never addressed. The obvious truth is that Health Care for profit is not working. Remove the profit from the equation and we will return to a humane system.6. Why am I so sick in the first place?

And people are going bankrupt and losing their houses, or dying because they can’t afford the bill, families break apart from the financial stress, and for what, or actually who…

CEOs explore new depths of satanic greed

George Paz – CEO of Express Scripts, Healthcare

Compensation: $51.5million

Net Income: $1.29billion

Stephen Hemsley- CEO of UnitedHealth Group

Compensation: $48.8million

Net Income: $4.93billion

Maybe it has something to do with who they are hiring at the government agencies that are supposed to protect our health?? Well Look who was hired to plan implementation of new food safety legislation at the Food and Drug Administration… Monsanto’s man Taylor returns to FDA in food-czar role7. Are your water rates going through the roof?

Monsanto Exec / Gov’t Official “pulls strings” to get neuro-toxin approved as a food additive- makes millions.

And clearly the Center for Disease Control has been looking out for our safety CDC Director Arrested for Child Molestation and Bestiality

- Water rates may double

- Water rates in DeWitt to rise up to 28 percent

- How can my water bill be 400 dollars? I live in fl …

- Three years ago a new meter was installed. Water bill went thru the roof. – Problem that the office you call about the water bill is just the billing dept and have nothing to do with the actual water dept.

- It goes on and on, in every state and every town…

- Survey Finds World Water Rates Rising

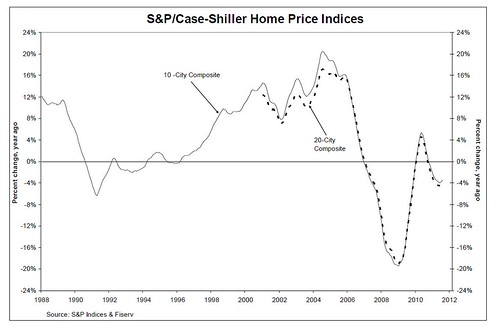

8. Why is there a “housing crisis”?

- Goldman Sachs on mortgage crisis: ‘Serious money’ to be made

- Goldman Sachs Misled Congress After Duping Clients Over CDOs … Goldman sold AAA bonds they knew were “sacks of shit”, then shorted the bonds. The bonds were MBS- mortage back securities, mortgages, thousands of family homes. The more people that lose their homes, the more money Goldman makes. GoldMansacks appears to be trying desperately to snatch the most evil company award from Monsanto, as if they’ll get a prize.

- The case against Goldman Sachs

- Banks That Created Fake Demand Made Financial Crisis Much Worse – A ProPublica analysis published this week examines the extent of the “fake demand” created by major banks that sold lucrative mortgage-backed securities, and how the institutions fueled the economic crisis with their self-dealing

- The Great Looting: Homeowners, Pensioners Robbed by Wall Street; Congress MIA - There is no doubt, the ‘foreclosure crisis’ was an engineered fraud enabling the banksters to scam money on both sides of the equation. Related: New Banking Chairman says Washington is there “to serve the banks“. Rep. wants foreclosure investigation to ignore robo-signer controversy.They used predatory lending practices to encourage people to get loans they couldn’t afford. They even cold-called people to get them to refinance a house that was already paid in full. Now a few years later they are trying to snatch that house out from under the family that has lived there for generations. And they did it on purpose! This happened over and over again. Why? The “securitization of loans” deal that allow the banks to bundle the bad loans, intentionally mislabel them AAA, then sell them to pension funds and other duped investors. Millions have lost big money in their pension funds because these fraudsters blatantly stole their money and the government did nothing about it.

- The People vs. Oncor: The Smart Meter Rebellion – SMART Meters overcharged customers when the interior temperature reached 100 degrees . The meters may have overcharged each customer over time hundreds or thousands of dollars, but PG&E will only rebate customers $40.00.

- Oncor (Goldman Sachs) to start Rolling Blackouts Across Texas … Enron Anyone? A Goldman Sachs Oncor? How cute.

- Utility rates surging nationwide

- Buggy ‘smart meters‘ open door to power-grid botnet

- Experts say smart meters are vulnerable to hacking

Across Europe countries are going “bankrupt” and governments are pushing bailouts and “austerity” measures on their citizens, stealing their retirement, enacting pay cuts, service cuts, all so they can pay the banksters interest. How are all of these major countries going bankrupt at the same time? Where did all the money go? In fact, there is no money shortage- these countries aren’t bankrupt- the governments and banksters have pilferred the treasuries and are now blaming it on the populace. For instance, here in America Senate Leader Bill Frist’s family business, Billion $$ behemoth Columbia Healthcare paid a $2 billion settlement for overcharging medicare… but nobody went to prison, and Columbia still has gov’t contracts. They stole our money, and got away with it.

Almost half the $14 trillion debt is owed to the Federal Reserve, which is a consortium of private banks- ie half of America’s debt is to the banksters that created the crisis in the first place.

This a worldwide brawl for the future of the planet. The worldwide 99% needs the US 99% to step up and fight.

Your house, food, gas, heat, health care, electricity, water- all of your major bills are being jacked by just a few of the 1%. Americans are being squeezed from every direction, deliberately. It truly is about The Fall of the Republic. That’s their goal here in America, where do you stand?