Monday, June 22, 2015

Shanghai Index- 8th worst weekly decline in its history!

by Chris Kimble

image: http://blog.kimblechartingsolutions.com/wp-content/uploads/2015/06/joefridayshanghaideclinejune191-675x439.jpg

CLICK ON CHART TO ENLARGE

Joe Friday Just The Facts… The Shanghai index has had a rough week,

down 13.32%. This was the 8th worst weekly decline in the past 25-years.

CLICK ON CHART TO ENLARGE

Joe Friday Just The Facts… The Shanghai index has had a rough week,

down 13.32%. This was the 8th worst weekly decline in the past 25-years.

Any reasons this could be happening? Below looks at the Shanghai index over the past 20 years

image: http://blog.kimblechartingsolutions.com/wp-content/uploads/2015/06/shagnahi52weekrateofchangeatresistancejune19-675x405.jpg

CLICK ON CHART TO ENLARGE

Over the past 52 weeks, the Shanghai index was over over 130%. This

huge gain was only surpassed by the rally into the 2007 top. The

Shanghai index met dual resistance this week, one of them was at the top

of a 20-year channel and a resistance line drawn off key lows in 2006

and 2009.

CLICK ON CHART TO ENLARGE

Over the past 52 weeks, the Shanghai index was over over 130%. This

huge gain was only surpassed by the rally into the 2007 top. The

Shanghai index met dual resistance this week, one of them was at the top

of a 20-year channel and a resistance line drawn off key lows in 2006

and 2009.

Read more at http://investmentwatchblog.com/shanghai-index-8th-worst-weekly-decline-in-its-history/#d0J7UDHHF5IS0sRz.99

image: http://blog.kimblechartingsolutions.com/wp-content/uploads/2015/06/joefridayshanghaideclinejune191-675x439.jpg

CLICK ON CHART TO ENLARGE

Joe Friday Just The Facts… The Shanghai index has had a rough week,

down 13.32%. This was the 8th worst weekly decline in the past 25-years.

CLICK ON CHART TO ENLARGE

Joe Friday Just The Facts… The Shanghai index has had a rough week,

down 13.32%. This was the 8th worst weekly decline in the past 25-years.Any reasons this could be happening? Below looks at the Shanghai index over the past 20 years

image: http://blog.kimblechartingsolutions.com/wp-content/uploads/2015/06/shagnahi52weekrateofchangeatresistancejune19-675x405.jpg

CLICK ON CHART TO ENLARGE

Over the past 52 weeks, the Shanghai index was over over 130%. This

huge gain was only surpassed by the rally into the 2007 top. The

Shanghai index met dual resistance this week, one of them was at the top

of a 20-year channel and a resistance line drawn off key lows in 2006

and 2009.

CLICK ON CHART TO ENLARGE

Over the past 52 weeks, the Shanghai index was over over 130%. This

huge gain was only surpassed by the rally into the 2007 top. The

Shanghai index met dual resistance this week, one of them was at the top

of a 20-year channel and a resistance line drawn off key lows in 2006

and 2009.Read more at http://investmentwatchblog.com/shanghai-index-8th-worst-weekly-decline-in-its-history/#d0J7UDHHF5IS0sRz.99

Putin: €2bn Russia-Greece gas deal will help Athens pay its debt

A deal to jointly build an extension of the Turkish Stream gas

pipeline across Greece will help Athens to settle its multibillion euro

debt to international creditors, President Vladimir Putin said at the

St. Petersburg International Economic Forum.

Talking to the representatives of international media at the Forum, Putin said he didn’t see any support for Greece from the EU, RIA Novosti reports.

“If the EU wants Greece to pay its debt than it should be interested in the Greek economy growing,” Putin said. “The EU should be applauding us. What’s bad about creating new jobs in Greece?” he said, commenting on Russia’s preliminary gas deal with Greece.

On Friday, Russia and Greece signed a deal to set up a joint company for the construction of the Turkish Stream pipeline across Greek territory that will supply 47 billion cubic meters of gas a year.

Moscow has repeatedly said it was ready to help Greece, if necessary, but so far Athens hasn’t asked for direct financial help.

Tsipras’s government is now locked in tough negotiations with its international creditors – the IMF, the ECB and the European Commission – over its €240 billion debt to them. The total Greek debt now stands at €316 billion, with fears mounting that the country could default without a deal with creditors and leave the Eurozone, as well as the EU.

The panic is bringing the Greek banking system to the verge of a collapse, as record amounts of deposits have been withdrawn from the accounts this week. On Thursday alone, Greek depositors withdrew an estimated €1 billion from the banks, as another round of talks with creditorsfailedto produce results.

On June 22, the EU will hold a summit in Brussels where the EU officials will make another attempt to resolve the Greek crisis. On this day Greek banks may remain closed, according to ECB Executive Board member Benoit Coeure, Reuters reported Thursday.

Source: Russia Today, 20 June 2015

Talking to the representatives of international media at the Forum, Putin said he didn’t see any support for Greece from the EU, RIA Novosti reports.

“If the EU wants Greece to pay its debt than it should be interested in the Greek economy growing,” Putin said. “The EU should be applauding us. What’s bad about creating new jobs in Greece?” he said, commenting on Russia’s preliminary gas deal with Greece.

On Friday, Russia and Greece signed a deal to set up a joint company for the construction of the Turkish Stream pipeline across Greek territory that will supply 47 billion cubic meters of gas a year.

Moscow has repeatedly said it was ready to help Greece, if necessary, but so far Athens hasn’t asked for direct financial help.

Tsipras’s government is now locked in tough negotiations with its international creditors – the IMF, the ECB and the European Commission – over its €240 billion debt to them. The total Greek debt now stands at €316 billion, with fears mounting that the country could default without a deal with creditors and leave the Eurozone, as well as the EU.

The panic is bringing the Greek banking system to the verge of a collapse, as record amounts of deposits have been withdrawn from the accounts this week. On Thursday alone, Greek depositors withdrew an estimated €1 billion from the banks, as another round of talks with creditorsfailedto produce results.

On June 22, the EU will hold a summit in Brussels where the EU officials will make another attempt to resolve the Greek crisis. On this day Greek banks may remain closed, according to ECB Executive Board member Benoit Coeure, Reuters reported Thursday.

Source: Russia Today, 20 June 2015

“The Collateral Has Run Out” – JPM Warns ECB Will Use Greek “Nuclear Option” If No Monday Deal

Source: Zero Hedge

In Athens on Friday, the ATM lines began to formin earnest.

(via Corriere)

Although estimates vary, Kathimerini, citing Greek banking officials, puts Friday’s deposit outflow at €1.7 billion. If true, that would mark a serious step up from the estimated €1.2 billion that left the banking system on Thursday and serves to underscore just how critical the ECB’s emergency decision to lift the ELA cap by €1.8 billion truly was. “Banks expressed relief following Frankfurt’s reaction, acknowledging that Friday could have ended very differently without a new cash injection,” the Greek daily said, adding that the ECB’s expectation of “a positive outcome in Monday’s meeting”, suggests ELA could be frozen if the stalemate remains after leaders convene the ad hoc summit. Bloomberg has more on the summit:

Dorothea Lambros stood outside an HSBC branch in central Athens on Friday afternoon, an envelope stuffed with cash in one hand and a 38,000 euro ($43,000) cashier’s check in the other.Indeed, JP Morgan suggests that the central bank may have already shown some leniency in terms of how it treats Greek collateral. Further, analyst Nikolaos Panigirtzoglou and team estimate, based on offshore money market flows, that some €6 billion left Greek banks last week.

She was a few minutes too late to make her deposit at the London-based bank. She was too scared to take her life-savings back to her Greek bank. She worried it wouldn’t survive the weekend.

“I don’t know what happens on Monday,” said Lambros, a 58-year-old government employee.

Nobody does. Every shifting deadline, every last-gasp effort has built up to this: a nation that went to sleep on Friday not knowing what Monday will bring. A deal, or more brinkmanship. Shuttered banks and empty cash machines, or a few more days of euros in their pockets and drachmas in their past – – and maybe their future.

For Greeks, the fear is that Monday will be deja vu, a return to a past not that distant. Before the euro replaced the drachma in 2002, the Greeks were already a European bête noire, their currency mostly trapped inside their nation, where cash was king and checks a novelty.

Everything comes together on Monday. Greek Prime Minister Alexis Tsipras, back from a visit with Vladimir Putin in St. Petersburg, will spend his weekend coming up with a proposal to take to a Monday showdown with euro-area leaders.

A deal there is key. The bailout agreement that’s kept Greece from defaulting expires June 30. That’s the day Greece owes about 1.5 billion euros to the International Monetary Fund.

Without at least an understanding among the political chiefs, Greek banks will reach the limits of their available collateral for more ECB aid.

If no agreement is struck on Monday evening that paves the way for further ELA hikes, the ECB may do exactly what we warned on Monday. That is, resort to the “nuclear option” which would, as JPM puts it, make capital controls are “almost inevitable.” Here’s more:

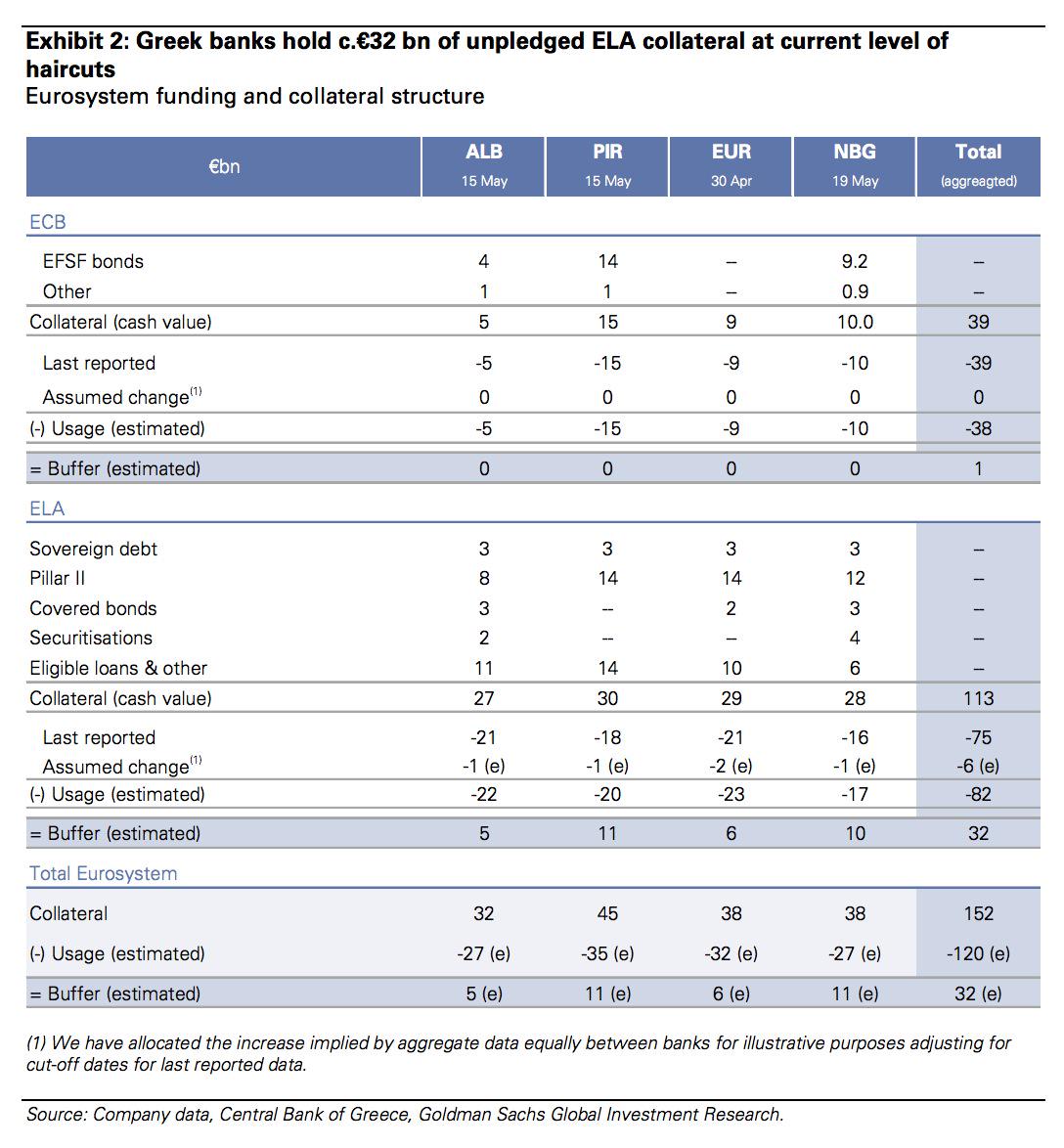

The escalation of the Greek crisis over the past week has caused an acceleration of Greek bank deposit outflows which in turn increased the likelihood of Greece introducing capital controls as soon as next week if Monday’s Eurozone leaders’ summit on Greece brings no deal. Indeed, our proxy of Greek bank deposit outflows, i.e. the purchases of offshore money market funds by Greek citizens is pointing to a material acceleration this week vs. the previous week.Here is the punchline: when the ECB hiked Greek ELA by €1.8 bilion in its Friday emergency meeting (an amount that was promptly soaked up by the €1,7 billion in Greek bank runs on Friday), it may have done so in breach of the Greek “borrowing base” because, according to JPM, with total ECB borrowings of €125, this means that Greece is now €4 billion above its maximum eligible collateral. The ECB surely knows this, and has breached its own borrowing base calculation for one of two reasons: because it knows the breach will be promptly limited or reversed on Monday, or there will be a deal. In other words, Greece is now officially living on borrowed time:

The €147m invested into offshore money market funds during the first four days of this week is equivalent to €5bn of deposit outflows based on the relationship between the two metrics during April (during April, around €155m was invested in offshore money market funds, which was accompanied by deposit outflows of around €5bn). Assuming a similar outflow pace for Friday brings the estimated deposit outflow for the full week to €6bn. In the previous week (i.e. the week commencing June 8th) around €40m was invested into offshore money market funds, which is equivalent to around €1.6bn of deposit outflows. So this week’s deposit outflows almost quadrupled relative to the previous week. Month-to-date €8bn of deposits has likely left the Greek banking system on our estimates, following €5bn in May and €5bn in April. As a result, the level of household and corporate deposits currently stands at just above €120bn.

As mentioned above this acceleration in the pace of deposit outflows is raising the chance that the Greek government will be forced to impose restrictions on the withdrawal of deposits if no deal is reached at the Eurozone summit on Monday. This is because Greek banks’ borrowing from the ECB has moved above the €121bn maximum we had previously estimated based on available collateral (€38bn using EFSF as collateral, €8bn using government securities as collateral & €75bn using credit claims as collateral). In particular, by assuming that Greek banks operate at c €1-2bn below the ELA limit as a buffer, we estimate that their current borrowing is €125bn. This is based on the ECB raising its ELA limit to €86bn on Friday this week from €84bn on Wednesday.

This €125bn of borrowing from the ECB is €4bn above our estimated maximum borrowing of €121bn, suggesting that the ECB has already showed flexibility with respect to the collateral constraints Greek banks are facing. We argued before that the ECB has the flexibility to adjust haircuts to allow Greek banks to borrow more from the Bank of Greece for a given amount of collateral. It can also start accepting government guaranteed bank bonds as collateral despite the ECB having rejected these bonds before as a source of acceptable collateral. Greek banks have been rolling over government guaranteed bank paper since March. For example Greek banks rolled over €33bn of government guaranteed bank debt over the past three months. However, we doubt the ECB will ever accept large amounts of government guaranteed bank debt, effectively of what it considers as collateral made “out of thin air”. And if no agreement is reached on Monday, then the ECB will have little reason to show further flexibility and it will likely freeze its ELA limit on Greek banks. As a result capital controls will become almost inevitable after Monday.All of this is now moot: as we explained previously, for the Greek banks it is now game over (really, the culmination of a 5 year process whose outcome was clear to all involved) and the only question is what brings the Greek financial system down: whether it is a liquidity implosion as a result of a bank run which one fails to see how even a “last minute deal”, or capital controls for that matter, can halt, or a slow burning solvency hit as Greek non-performing loans are now greater than those of Cyrpus were at the time when the Cypriot capital controls were imposed. As Bloomberg calculated last week, just the NPL losses are big enough now to wipe out the Big 4 Greek banks tangible capital.

JPM, for now, focuses on the liquidity aspect:

The deposit outflows from Greek banks show how dramatic the reversal of Greece’s liquidity position has been over the past six months. The €8bn that left the Greek banking system month-to-date has brought the cumulative deposit withdrawal to €44bn since last December. This €44bn has more than reversed the €14bn that had entered the Greek banking system between June 2012 and November 2014 (Figure 2). The €117bn of deposits lost cumulatively since the end of 2009 has brought the bank deposit to GDP ratio for Greece to 66%. This is well below the Eurozone average of 94%.And with more than three-quarters of the nearly €500 billion in outstanding foreign claims on Greece concentrated among foreign official institutions, any “contagion” will come will come not from the financial impact of Grexit, but from the psychological impact as the ECB’s countless lies of “political capital” and “irreversible union” crash like the European house of cards.

Would a Greek exit make the Eurozone look “healthier” as problem countries that do not obey rules are ousted? Or would markets rather question the ability of the Eurozone to cope with a bigger problem/country in the future if they cannot deal with a small problem/country such as Greece? Would a Greek exit make the Eurozone more stable by fostering more fiscal integration and debt mutualization over time? Or would the large losses from a Greek exit rather make creditor nations even more reluctant to proceed with much needed debt mutualization and fiscal transfers in the future? Would a Greece exit, and the punishment of Syriza as an unconventional political party, reduce the popularity of euroskeptic and unconventional political forces in Europe, as Greece becomes an example for other populations to avoid? Or would a Greek exit and the punishment of a country that refused to succumb to neverending austerity rather demonstrate the lack of flexibility, solidarity and cooperation giving more ground to euroskeptic parties across Europe?Again we see that the entire world is now wise to the game the troika is playing. This isn’t about Greece, it’s about Spain and Italy or any other “bigger” problem countries whose voters elect “euroskeptic” politicians. As a reminder, if and when the Greek problem shifts to other PIIG nations, then it will be truly a time to panic:

So much as US-Russian relations are, to quote Kremlin spokesman Dmitry Peskov, “sacrificed on the altar of election campaigns”, so too are relations between Greece and its European “partners” sacrificed for political aims. In the end, the entire Greek tragicomedy comes back to the simple fact that a currency union with no fiscal union is no union at all and will likely be nearly impossible to sustain. We’ll leave you with the following quote from Alexandre Lamfalussy, BIS veteran, first President of the EMI (the ECB before the ECB existed), and the “Father of the Euro”:

“It would seem to me very strange if we did not insist on the need to make appropriate arrangements that would allow for the the gradual emergence and the full operation once the EMU is completed of a community-wide macroeconomic fiscal policy which would be the natural compliment to the common monetary policy of the community.”

Shanghai Gold Exchange Sees Offtake of About 46 Tonnes of Gold For the Week

by Jess

There were 46.15 tonnes of gold withdrawn from the Shanghai Gold Exchange in the latest week.

This chart is from the data wrangler Nick Laird at sharelynx.com.

There were 46.15 tonnes of gold withdrawn from the Shanghai Gold Exchange in the latest week.

This chart is from the data wrangler Nick Laird at sharelynx.com.

Greek debt crisis is the Iraq War of finance

Guardians of financial stability are deliberately provoking a bank run and endangering Europe's system in their zeal to force Greece to its knees

The Parthenon in Athens Photo: ALAMY

Rarely in modern times have we witnessed

such a display of petulance and bad judgment by those supposed to be in

charge of global financial stability, and by those who set the tone for

the Western world.

The spectacle is

astonishing. The European Central Bank, the EMU bail-out fund, and the

International Monetary Fund, among others, are lashing out in fury

against an elected government that refuses to do what it is told. They

entirely duck their own responsibility for five years of policy blunders

that have led to this impasse.

They want to see these rebel Klephts

hanged from the columns of the Parthenon – or impaled as Ottoman forces

preferred, deeming them bandits - even if they degrade their own

institutions in the process.

If we want to date the moment when the

Atlantic liberal order lost its authority – and when the European

Project ceased to be a motivating historic force – this may well be it.

In a sense, the Greek crisis is the financial equivalent of the Iraq

War, totemic for the Left, and for Souverainistes on the Right, and

replete with its own “sexed up” dossiers.

Does anybody dispute that the ECB – via the Bank of Greece - is

actively inciting a bank run in a country where it is also the banking

regulator by issuing this report on Wednesday?

It warned of an "uncontrollable crisis" if there is no creditor deal, followed by soaring inflation, "an exponential rise in unemployment", and a "collapse of all that the Greek economy has achieved over the years of its EU, and especially its euro area, membership".

The guardian of financial stability is consciously and deliberately accelerating a financial crisis in an EMU member state - with possible risks of pan-EMU and broader global contagion – as a negotiating tactic to force Greece to the table.

It did so days after premier Alexis Tsipras accused the creditors of "laying traps" in the negotiations and acting with a political motive. He more or less accused them of trying to destroy an elected government and bring about regime change by financial coercion.

I leave it to lawyers to decide whether this report is a prima facie violation of the ECB’s primary duty under the EU treaties. It is certainly unusual. The ECB has just had to increase emergency liquidity to the Greek banks by €1.8bn (enough to last to Monday night) to offset the damage from rising deposit flight.

In its report, the Bank of Greece claimed that failure to meet creditor demands would “most likely” lead to the country’s ejection from the European Union. Let us be clear about the meaning of this. It is not the expression of an opinion. It is tantamount to a threat by the ECB to throw the Greeks out of the EU if they resist.

Greece's central bank in Athens

This is not the first time that the ECB has strayed far from its mandate. It forced the Irish state to make good the claims of junior bondholders of Anglo-Irish Bank, saddling Irish taxpayers with extra debt equal to 20pc of GDP.

This was done purely in order to save the European banking system at a time when the ECB was refusing to do the job itself, betraying the primary task of a central bank to act as a lender of last resort.

It sent secret letters to the elected leaders of Spain and Italy in August 2011 demanding detailed changes to internal laws for which it had no mandate or technical competence, even meddling in neuralgic issues of labour law that had previously led to the assassination of two Italian officials by the Red Brigades.

When Italy’s Silvio Berlusconi balked, the ECB switched off bond purchases, driving 10-year yields to 7.5pc. He was forced from office in a back-room coup d’etat, albeit one legitimised by the ageing ex-Stalinist EU fanatic who then happened to be president of Italy.

Lest we forget, it parachuted in its vice-president – Lucas Papademos – to take over Greece when premier George Papandreou merely suggested that he might submit the EMU bail-out package to a referendum, a wise idea in retrospect. That makes two coups d’etat. Now Syriza fears they are angling for a third.

The creditor power structure has lost its way. The IMF is in confusion. It is enforcing a contractionary austerity policy in Greece – with no debt relief, exchange cushion, or offsetting investment - that has been discredited by its own elite research department as scientifically unsound.

The Fund’s culpability in this fiasco is by now well known. As I argued last week, its own internal documents show that the original bail-out in 2010 was designed to rescue the EMU banking system and monetary union at a time when it had no defences against contagion. Greece was sacrificed.

One should have thought that the IMF would wish to lower the political temperature, given that its own credibility and long-term survival are at stake. But no, Christine Lagarde has upped the political ante by stating that Greece will fall into arrears immediately if it misses a €1.6bn payment to the Fund on June 30.

In my view, this is a discretionary escalation. The normal procedure is to notify the IMF Board after 30 days. This period is a de facto grace period, and in a number of past cases the arrears were cleared up quietly during the interval before the matter ever reached the Board.

The IMF could have let this process run in the case of Greece. It has chosen not to do so, ostensibly on the grounds that the sums are unusually large.

Klaus Regling, head of the eurozone bail-out fund (EFSF), entered on cue to hint strongly that his organisation would trigger cross-default clauses on its Greek bonds – 45pc of the Greek package – even though there is no necessary reason why it should do so. It is an optional matter for the EFSF board.

He seems to be threatening an EFSF default, even though the Greeks themselves are not doing so, a remarkable state of affairs.

It is obvious what is happening. The creditors are acting in concert. Instead of stopping to reflect for one moment on the deeper wisdom of their strategy, they are doubling down mechanically, appearing to assume that terror tactics will cow the Greeks at the twelfth hour.

Personally, I am a Burkean conservative with free market views. Ideologically, Syriza is not my cup tea. Yet we Burkeans do like democracy – and we don’t care for monetary juntas – even if it leads to the election of a radical-Left government.

As it happens, Edmund Burke would have found the plans presented to the Eurogroup last night by finance minister Yanis Varoufakis to be rational, reasonable, fair, and proportionate.

They include a debt swap with ECB bonds coming due in July and August exchanged for bonds from the bail-out fund. They would have longer maturities and lower interest rates, reflecting the market borrowing cost of the creditors.

Syriza said from the outset that it was eager to work on market reforms with the OECD, the leading authority. It wants to team up with the International Labour Organisation on Scandinavian style flexi-security and labour reforms, a valid alternative to the German-style Hartz IV reforms that have impoverished the bottom fifth of German society and which no Left-wing movement can stomach.

It wished to push through a more radical overhaul of the Greek state that anything yet done under five years of Troika rule – and much has been done, to be fair.

As Mr Varoufakis told Die Zeit: “Why does a kilometer of freeway cost three times as much where we are as it does in Germany? Because we’re dealing with a system of cronyism and corruption. That’s what we have to tackle. But, instead, we’re debating pharmacy opening times."

The Troika pushed privatisation of profitable state assets at knock-down depression prices to private monopolies, to the benefit of an entrenched elite. To call that reforms invites a bitter cynicism.

The only reason that the Troika pushed this policy was in order to extract money. It was acting at a debt collector. “The reforms were a smokescreen. Whenever I tried talking about proposals, they were bored. I could see it in their body language," Mr Varoufakis told me.

Yanis Varoufakis, the Greek finance minister

The truth is that the creditor power structure never even looked at the Greek proposals. They never entertained the possibility of tearing up their own stale, discredited, legalistic, fatuous Troika script.

The decision was made from the outset to demand strict enforcement of the terms agreed in the original Memorandum, which even the last conservative pro-Troika government was unable to implement - regardless of whether it makes any sense, or actually increases the chance that Germany and other lenders will recoup their money.

At best, it is bureaucratic inertia, a prime exhibit of why the EU has become unworkable, almost genetically incapable of recognising and correcting its own errors.

At worst, it is nasty, bullying, insistence on ritual capitulation for the sake of it.

We all know the argument. The EU is worried about political “moral hazard”, about what Podemos might achieve in Spain, or the eurosceptics in Italy, or the Front National in France, if Syriza is seen to buck the system and get away with it.

But do the proponents of this establishment view – and one hears it a lot – really think that Podemos can be defeated by crushing Syriza, or that they can discourage Marine Le Pen by violating the sovereignty and sensibilities of a nation?

Do they think that the EU’s ever-declining hold on the loyalty of Europe’s youth can be reversed by creating a martyr state on the Left? Do they not realize that this is their own Guatemala, the radical experiment of Jacobo Arbenz that was extinguished by the CIA in 1954, only to set off the Cuban revolution and thirty years of guerrilla warfare across Latin America? Don’t these lawyers – and yes they are almost all lawyers - ever look beyond their noses?

The Versailles victors assumed reflexively that they had the full weight of moral authority on their side when they imposed their Carthiginian settlement on a defeated Germany in 1919 and demanded the payment of debts that they themselves invented. History judged otherwise.

It warned of an "uncontrollable crisis" if there is no creditor deal, followed by soaring inflation, "an exponential rise in unemployment", and a "collapse of all that the Greek economy has achieved over the years of its EU, and especially its euro area, membership".

The guardian of financial stability is consciously and deliberately accelerating a financial crisis in an EMU member state - with possible risks of pan-EMU and broader global contagion – as a negotiating tactic to force Greece to the table.

It did so days after premier Alexis Tsipras accused the creditors of "laying traps" in the negotiations and acting with a political motive. He more or less accused them of trying to destroy an elected government and bring about regime change by financial coercion.

I leave it to lawyers to decide whether this report is a prima facie violation of the ECB’s primary duty under the EU treaties. It is certainly unusual. The ECB has just had to increase emergency liquidity to the Greek banks by €1.8bn (enough to last to Monday night) to offset the damage from rising deposit flight.

In its report, the Bank of Greece claimed that failure to meet creditor demands would “most likely” lead to the country’s ejection from the European Union. Let us be clear about the meaning of this. It is not the expression of an opinion. It is tantamount to a threat by the ECB to throw the Greeks out of the EU if they resist.

Greece's central bank in Athens

This is not the first time that the ECB has strayed far from its mandate. It forced the Irish state to make good the claims of junior bondholders of Anglo-Irish Bank, saddling Irish taxpayers with extra debt equal to 20pc of GDP.

This was done purely in order to save the European banking system at a time when the ECB was refusing to do the job itself, betraying the primary task of a central bank to act as a lender of last resort.

It sent secret letters to the elected leaders of Spain and Italy in August 2011 demanding detailed changes to internal laws for which it had no mandate or technical competence, even meddling in neuralgic issues of labour law that had previously led to the assassination of two Italian officials by the Red Brigades.

When Italy’s Silvio Berlusconi balked, the ECB switched off bond purchases, driving 10-year yields to 7.5pc. He was forced from office in a back-room coup d’etat, albeit one legitimised by the ageing ex-Stalinist EU fanatic who then happened to be president of Italy.

Lest we forget, it parachuted in its vice-president – Lucas Papademos – to take over Greece when premier George Papandreou merely suggested that he might submit the EMU bail-out package to a referendum, a wise idea in retrospect. That makes two coups d’etat. Now Syriza fears they are angling for a third.

The creditor power structure has lost its way. The IMF is in confusion. It is enforcing a contractionary austerity policy in Greece – with no debt relief, exchange cushion, or offsetting investment - that has been discredited by its own elite research department as scientifically unsound.

The Fund’s culpability in this fiasco is by now well known. As I argued last week, its own internal documents show that the original bail-out in 2010 was designed to rescue the EMU banking system and monetary union at a time when it had no defences against contagion. Greece was sacrificed.

One should have thought that the IMF would wish to lower the political temperature, given that its own credibility and long-term survival are at stake. But no, Christine Lagarde has upped the political ante by stating that Greece will fall into arrears immediately if it misses a €1.6bn payment to the Fund on June 30.

In my view, this is a discretionary escalation. The normal procedure is to notify the IMF Board after 30 days. This period is a de facto grace period, and in a number of past cases the arrears were cleared up quietly during the interval before the matter ever reached the Board.

The IMF could have let this process run in the case of Greece. It has chosen not to do so, ostensibly on the grounds that the sums are unusually large.

Klaus Regling, head of the eurozone bail-out fund (EFSF), entered on cue to hint strongly that his organisation would trigger cross-default clauses on its Greek bonds – 45pc of the Greek package – even though there is no necessary reason why it should do so. It is an optional matter for the EFSF board.

He seems to be threatening an EFSF default, even though the Greeks themselves are not doing so, a remarkable state of affairs.

It is obvious what is happening. The creditors are acting in concert. Instead of stopping to reflect for one moment on the deeper wisdom of their strategy, they are doubling down mechanically, appearing to assume that terror tactics will cow the Greeks at the twelfth hour.

Personally, I am a Burkean conservative with free market views. Ideologically, Syriza is not my cup tea. Yet we Burkeans do like democracy – and we don’t care for monetary juntas – even if it leads to the election of a radical-Left government.

As it happens, Edmund Burke would have found the plans presented to the Eurogroup last night by finance minister Yanis Varoufakis to be rational, reasonable, fair, and proportionate.

They include a debt swap with ECB bonds coming due in July and August exchanged for bonds from the bail-out fund. They would have longer maturities and lower interest rates, reflecting the market borrowing cost of the creditors.

Syriza said from the outset that it was eager to work on market reforms with the OECD, the leading authority. It wants to team up with the International Labour Organisation on Scandinavian style flexi-security and labour reforms, a valid alternative to the German-style Hartz IV reforms that have impoverished the bottom fifth of German society and which no Left-wing movement can stomach.

It wished to push through a more radical overhaul of the Greek state that anything yet done under five years of Troika rule – and much has been done, to be fair.

As Mr Varoufakis told Die Zeit: “Why does a kilometer of freeway cost three times as much where we are as it does in Germany? Because we’re dealing with a system of cronyism and corruption. That’s what we have to tackle. But, instead, we’re debating pharmacy opening times."

The Troika pushed privatisation of profitable state assets at knock-down depression prices to private monopolies, to the benefit of an entrenched elite. To call that reforms invites a bitter cynicism.

The only reason that the Troika pushed this policy was in order to extract money. It was acting at a debt collector. “The reforms were a smokescreen. Whenever I tried talking about proposals, they were bored. I could see it in their body language," Mr Varoufakis told me.

Yanis Varoufakis, the Greek finance minister

The truth is that the creditor power structure never even looked at the Greek proposals. They never entertained the possibility of tearing up their own stale, discredited, legalistic, fatuous Troika script.

The decision was made from the outset to demand strict enforcement of the terms agreed in the original Memorandum, which even the last conservative pro-Troika government was unable to implement - regardless of whether it makes any sense, or actually increases the chance that Germany and other lenders will recoup their money.

At best, it is bureaucratic inertia, a prime exhibit of why the EU has become unworkable, almost genetically incapable of recognising and correcting its own errors.

At worst, it is nasty, bullying, insistence on ritual capitulation for the sake of it.

We all know the argument. The EU is worried about political “moral hazard”, about what Podemos might achieve in Spain, or the eurosceptics in Italy, or the Front National in France, if Syriza is seen to buck the system and get away with it.

But do the proponents of this establishment view – and one hears it a lot – really think that Podemos can be defeated by crushing Syriza, or that they can discourage Marine Le Pen by violating the sovereignty and sensibilities of a nation?

Do they think that the EU’s ever-declining hold on the loyalty of Europe’s youth can be reversed by creating a martyr state on the Left? Do they not realize that this is their own Guatemala, the radical experiment of Jacobo Arbenz that was extinguished by the CIA in 1954, only to set off the Cuban revolution and thirty years of guerrilla warfare across Latin America? Don’t these lawyers – and yes they are almost all lawyers - ever look beyond their noses?

The Versailles victors assumed reflexively that they had the full weight of moral authority on their side when they imposed their Carthiginian settlement on a defeated Germany in 1919 and demanded the payment of debts that they themselves invented. History judged otherwise.

Debt Problems: America’s Striking Resemblance to Greece

by Rodney Johnson

Will they default? Won’t they?

With Greece hot in the news, debt is on a lot of people’s minds. Large creditors all over the euro zone could be facing losses. Many countries are preparing themselves for the spillover effect as this situation develops.

But big investors aside, plenty of Greek citizens could get stiffed as well… specifically, those with pensions.

In relation to GDP, at 17.5% Greece spends more than any country in the euro zone fulfilling its pension obligations. With poverty and unemployment systemic issues in Greece, pensions are the sole source of income for many families.

America is no Greece, but we do have a debt problem of our own, and like Greece, much of it is thanks to pensions.

Just as many retirees rely on the government for their paycheck… the government relies on us, the taxpayers, for the funds necessary to write those checks.

That means — you have a lot more debt than you think.

The Government Accounting Standards Board (GASB) wants states to come clean about how much they really owe.

It’s doubtful it will even matter, since there’s almost no chance that better information would lead to prudent decision making. States will likely continue relying on other people to take care of their problems. By “other people,” I mean us.

The problems with state pensions are well known, and well-documented by us and other groups. Estimates show that governments must raise at least $500 billion to fund public pensions, with the problem growing as workers age and higher benefits accrue.

Years ago GASB required states to include their unfunded pension liabilities in their main financial statements instead of simply as footnotes. States — as well as cities, counties, etc. — are now acknowledging the pension problem and taking at least halting steps to fix the issue. It won’t work, but at least it’s getting some attention.

If only it stopped there. Another growing concern lies with state retiree health care, listed as Other Post Employee Benefits (OPEBs). This issue typically gets pushed aside, but the problem is just as big, with underfunding estimated at a similar $500 billion.

The GASB just ruled that states must treat these obligations the same as pensions. They can’t just shove them in the footnotes like they used to!

You might think this would settle the issue. It doesn’t. State officials brush aside retiree health care costs because they claim they can change the benefits with the stroke of a pen. Pension obligations, on the other hand, are often protected in state constitutions.

This reasoning is dangerously wrong-headed.

It is true that OPEBs are not constitutionally protected like pensions, but that doesn’t mean they will be easy to change.

Many state employees are unionized. These are not casual bystanders who will look on as one of their main benefits gets stripped away or reduced. They will fight tooth and nail, threatening to oust any politician that dares to support cutting benefits.

This fact is not lost on politicians, who might have a different trick up their sleeves.

An easy way to reduce the costs associated with OPEBs is to direct retirees to the new health exchanges.

One of the main costs associated with OPEBs is health insurance for workers that retire before they are eligible for Medicare, age 65.

Instead of carrying these former workers on their insurance rolls, states could direct the retirees to enter the new health exchanges. Given their status as retirees and likely income level at or below the median for all households, these people should qualify for subsidies when they purchase health care coverage.

This would move some of the responsibility for funding the costs of health care from the individual cities, states, and counties to the federal government.

Voila! States, cities, and counties have just found another source of support… us!

But just as with other things, this works well when one group does it, but not so much when everyone follows suit.

If all OPEB providers took this approach, the eventual outcome would hardly change. American citizens would still have to pay the cost of care for retirees.

However, the path of the payments would change dramatically. Much less would flow through cities, states, and counties, making them appear financially healthier than they are today.

Those costs would shift to the U.S. government, which tack them onto a growing list of unsustainable payments that we keep pretending will somehow all work out.

While I’ve no doubt that government will find some way to reduce many of these long-term, unpayable obligations in some form or fashion, it also seems certain that raising taxes will be part of the solution.

This is all the more reason to lower your taxable footprint.

image: http://economyandmarketscom.c.presscdn.com/wp-content/uploads/2014/11/rodney_sign.gif

Rodney

Rodney

Will they default? Won’t they?

With Greece hot in the news, debt is on a lot of people’s minds. Large creditors all over the euro zone could be facing losses. Many countries are preparing themselves for the spillover effect as this situation develops.

But big investors aside, plenty of Greek citizens could get stiffed as well… specifically, those with pensions.

In relation to GDP, at 17.5% Greece spends more than any country in the euro zone fulfilling its pension obligations. With poverty and unemployment systemic issues in Greece, pensions are the sole source of income for many families.

America is no Greece, but we do have a debt problem of our own, and like Greece, much of it is thanks to pensions.

Just as many retirees rely on the government for their paycheck… the government relies on us, the taxpayers, for the funds necessary to write those checks.

That means — you have a lot more debt than you think.

The Government Accounting Standards Board (GASB) wants states to come clean about how much they really owe.

It’s doubtful it will even matter, since there’s almost no chance that better information would lead to prudent decision making. States will likely continue relying on other people to take care of their problems. By “other people,” I mean us.

The problems with state pensions are well known, and well-documented by us and other groups. Estimates show that governments must raise at least $500 billion to fund public pensions, with the problem growing as workers age and higher benefits accrue.

Years ago GASB required states to include their unfunded pension liabilities in their main financial statements instead of simply as footnotes. States — as well as cities, counties, etc. — are now acknowledging the pension problem and taking at least halting steps to fix the issue. It won’t work, but at least it’s getting some attention.

If only it stopped there. Another growing concern lies with state retiree health care, listed as Other Post Employee Benefits (OPEBs). This issue typically gets pushed aside, but the problem is just as big, with underfunding estimated at a similar $500 billion.

The GASB just ruled that states must treat these obligations the same as pensions. They can’t just shove them in the footnotes like they used to!

You might think this would settle the issue. It doesn’t. State officials brush aside retiree health care costs because they claim they can change the benefits with the stroke of a pen. Pension obligations, on the other hand, are often protected in state constitutions.

This reasoning is dangerously wrong-headed.

It is true that OPEBs are not constitutionally protected like pensions, but that doesn’t mean they will be easy to change.

Many state employees are unionized. These are not casual bystanders who will look on as one of their main benefits gets stripped away or reduced. They will fight tooth and nail, threatening to oust any politician that dares to support cutting benefits.

This fact is not lost on politicians, who might have a different trick up their sleeves.

An easy way to reduce the costs associated with OPEBs is to direct retirees to the new health exchanges.

One of the main costs associated with OPEBs is health insurance for workers that retire before they are eligible for Medicare, age 65.

Instead of carrying these former workers on their insurance rolls, states could direct the retirees to enter the new health exchanges. Given their status as retirees and likely income level at or below the median for all households, these people should qualify for subsidies when they purchase health care coverage.

This would move some of the responsibility for funding the costs of health care from the individual cities, states, and counties to the federal government.

Voila! States, cities, and counties have just found another source of support… us!

But just as with other things, this works well when one group does it, but not so much when everyone follows suit.

If all OPEB providers took this approach, the eventual outcome would hardly change. American citizens would still have to pay the cost of care for retirees.

However, the path of the payments would change dramatically. Much less would flow through cities, states, and counties, making them appear financially healthier than they are today.

Those costs would shift to the U.S. government, which tack them onto a growing list of unsustainable payments that we keep pretending will somehow all work out.

While I’ve no doubt that government will find some way to reduce many of these long-term, unpayable obligations in some form or fashion, it also seems certain that raising taxes will be part of the solution.

This is all the more reason to lower your taxable footprint.

image: http://economyandmarketscom.c.presscdn.com/wp-content/uploads/2014/11/rodney_sign.gif

Rodney

RodneyRon Paul – “Our Sovereign Debt Is Unpayable, “Eventually Investors Will Lose Confidence In the Fed”

Ron Paul – “I think [the crash] is

going to be much greater [than 10 percent] and it will probably go a lot

lower than people say it should,I don’t think it’s going to be just a

correction.”Eventually investors will lose confidence” in the Fed, and

when they do, the market could witness a “very big crash.”

Paul on Bond’s – “I don’t think there’s any way to know what the [timeline] is, but after 35 years of a gigantic bull market in bonds, [the Fed] cannot reverse history and they cannot print money forever.” “Our Soverign Debt Is Unpayable”

“The Dollar Lost 90% Compared to Gold”, “When The Panick Sets in Gold will go to $2,400.00, $3,600.”

http://www.cnbc.com/id/102771518

Paul on Bond’s – “I don’t think there’s any way to know what the [timeline] is, but after 35 years of a gigantic bull market in bonds, [the Fed] cannot reverse history and they cannot print money forever.” “Our Soverign Debt Is Unpayable”

“The Dollar Lost 90% Compared to Gold”, “When The Panick Sets in Gold will go to $2,400.00, $3,600.”

http://www.cnbc.com/id/102771518

Texas Mobilizes state Militia against U.S Federal troops, wants Fed hands off everything Texas including its Gold

Texas Mobilizes state Militia against U.S Federal troops, wants Fed’s hands off everything Texas including it’s Gold

Bloomberg Headlines: TEXAS DON`T TRUST NY FEDERAL RESERVE! THEY want their GOLD!

Texas wants its gold back from the Yankees, wherever they’re keeping it.

Governor Greg Abbott signed a law last week to build a depository for its 5,600 bars of the precious metal and, as he said in a statement, “repatriate $1 billion of gold bullion from the Federal Reserve in New York.”

The gold, it turns out, isn’t at the New York Fed — it’s in a rented vault in midtown Manhattan — and is worth about $650 million. Regardless, Texas aims to bring it home.

“We want to show off our strength and resilience,” said Giovanni Capriglione, the Republican lawmaker who sponsored the repatriation bill. “This is to be able to say, ‘Hey, listen, Texas is unique, it’s stable, it’s strong and we can show that by letting other states and individuals know that, yes, Texas has a billion dollars worth of gold. Does your state have a billion dollars worth of gold?’”

http://www.bloomberg.com/news/articles/2015-06-19/there-s-a-pile-of-gold-in-manhattan-texas-wants-it-back-

SS

Governor Greg Abbott signed a law last week to build a depository for its 5,600 bars of the precious metal and, as he said in a statement, “repatriate $1 billion of gold bullion from the Federal Reserve in New York.”

The gold, it turns out, isn’t at the New York Fed — it’s in a rented vault in midtown Manhattan — and is worth about $650 million. Regardless, Texas aims to bring it home.

“We want to show off our strength and resilience,” said Giovanni Capriglione, the Republican lawmaker who sponsored the repatriation bill. “This is to be able to say, ‘Hey, listen, Texas is unique, it’s stable, it’s strong and we can show that by letting other states and individuals know that, yes, Texas has a billion dollars worth of gold. Does your state have a billion dollars worth of gold?’”

http://www.bloomberg.com/news/articles/2015-06-19/there-s-a-pile-of-gold-in-manhattan-texas-wants-it-back-

SS

Charlotte Church and Russell Brand join protesters at End Austerity Now rally in London

Last updated: 20 June 2015, 15:30 BST

Celebrities including singer Charlotte Church and comedian Russell Brand joined demonstrators as they brandished placards, blew whistles and chanted from the Bank of England to the Houses of Parliament.

Charlotte said: “I’m here today in a show of solidarity with everyone here – it is a massive turnout – everybody who thinks that austerity isn’t the only way and thinks it is essentially unethical, unfair and unnecessary.”

The 29-year-old added: “But I think that the Scottish have been able to galvanise themselves against the Westminster elite.

“We are in one of the richest nations in the world and social inequality is unacceptable.

“I’m immensely proud to be here. I think this is a brilliant movement and it is for the common good. We are here to make a stand.”

Speakers including Labour MP and London mayoral hopeful Diane Abbott addressed the crowd in the heart of the financial district before the march, which kicked off to the sounds of drum bands.

Sian Bloor, 45, a primary school teacher from Trafford, near Manchester, warned that children “are being robbed of their childhood” because of swingeing Government cuts.

She said: “We have seen a huge impact on our work at primary school.

“I regularly bring clothes and shoes for children and biscuits for their breakfast, just so they get something to eat.

Organisers said an estimated 250,000 people were on the march. There were also marches in Glasgow and Liverpool.

A spokesman for the People’s Assembly, which organised the protest, said: “It is clear this march has exceeded all expectations.

“Even the police are estimating that there are ‘several hundred thousand’ marching. Today is not the end of our campaign against austerity but the start of a mass movement prepared to take on this government.”

‘It’s time to hold physical cash,’ says one of Britain’s most senior fund managers

(Andrew Oxlade) The manager of one of Britain’s biggest bond funds has urged investors to keep cash under the mattress.

Ian Spreadbury, who invests more than £4bn of investors’ money across

a handful of bond funds for Fidelity, including the flagship

Moneybuilder Income fund, is concerned that a “systemic event” could

rock markets, possibly similar in magnitude to the financial crisis of

2008, which began in Britain with a run on Northern Rock.

“Systemic risk is in the system and as an investor you have to be aware of that,” he told Telegraph Money.

The best strategy to deal with this, he said, was for investors to

spread their money widely into different assets, including gold and

silver, as well as cash in savings accounts. But he went further,

suggesting it was wise to hold some “physical cash”, an unusual

suggestion from a mainstream fund manager.

His concern is that global debt – particularly mortgage debt – has

been pumped up to record levels, made possible by exceptionally low

interest rates that could soon end, and he is unsure how well banks

could cope with the shocks that may await.

He pointed out that a saver was covered only up to £85,000 per bank

under the Financial Services Compensation Scheme – which is effectively

unfunded – and that the Government has said it will not rescue banks in

future, hence his suggestion that some money should be held in physical

cash.

He declined to predict the exact trigger but said it was more likely to happen in the next five years rather than 10. The current woes of Greece, which may crash out of the euro, already has many market watchers concerned.

Mr Spreadbury’s views are timely, aside from Greece. A growing number of professional investors (see comment, right) and commentators are expressing unease about what happens next.

The prices of nearly all assets – property, shares, bonds – have been rising for years.

House prices have risen by 26pc since the start of 2009, and by 68pc in London. The FTSE 100 is up by 75pc.

Although it feels counter-intuitive, this trend of rising prices should continue if economies remain weak, because it gives central banks licence to keep rates low and to carry on with their “quantitative easing” programmes.

Conversely, if the economy does pick up and interest rates need to rise, the act of doing so is likely to stall the economy and force them to be reduced again. Once more, demand for those mainstream assets would be rekindled and the asset boom continues.

But then there is the shock event. Daily Telegraph columnist Jeremy Warner also captured some of the concerns this week when he wrote that the trigger for an “inevitable correction” could come from “a clear blue sky – a completely unanticipated event”.

How are fund managers preparing for this gloomy possibility?

Mr Spreadbury sticks to bonds because of the remit of his funds. Within that world, he said a shock to the system would cause a flight to safety and the price of British government bonds, or gilts, would rise sharply. He also holds bonds of companies that would be most protected in times of turmoil – water companies, power network operators – and those where the bonds are secured on a solid asset, such as land or buildings.

Examples include Center Parcs and Intu, which owns shopping centres.

Marcus Brookes, another well regarded fund manager who looks after billions of pounds worth of investments, is less constrained in where he invests, because of the different remit of his funds. Schroder Multi-Manager Diversity, for example, can pick and choose between assets.

Mr Brookes said the probability of a major shock event was small but even he holds 29pc of the Diversity portfolio in cash, a huge proportion compared with most funds. This decision is due to his concern that bonds are overvalued and may fall. He aims to deliver returns of 4pc above inflation so can’t afford to put too much in assets that he believes will lose money.

“The problem is that people are struggling to work out how to diversify if QE programmes stop,” he said.

Mr Spreadbury added: “We have rock-bottom rates and QE is still going on – this is all experimental policy and means we are in uncharted territory.

“The message is diversification. Think about holding other assets. That could mean precious metals, it could mean physical currencies.”

He declined to predict the exact trigger but said it was more likely to happen in the next five years rather than 10. The current woes of Greece, which may crash out of the euro, already has many market watchers concerned.

Mr Spreadbury’s views are timely, aside from Greece. A growing number of professional investors (see comment, right) and commentators are expressing unease about what happens next.

The prices of nearly all assets – property, shares, bonds – have been rising for years.

House prices have risen by 26pc since the start of 2009, and by 68pc in London. The FTSE 100 is up by 75pc.

Although it feels counter-intuitive, this trend of rising prices should continue if economies remain weak, because it gives central banks licence to keep rates low and to carry on with their “quantitative easing” programmes.

Conversely, if the economy does pick up and interest rates need to rise, the act of doing so is likely to stall the economy and force them to be reduced again. Once more, demand for those mainstream assets would be rekindled and the asset boom continues.

But then there is the shock event. Daily Telegraph columnist Jeremy Warner also captured some of the concerns this week when he wrote that the trigger for an “inevitable correction” could come from “a clear blue sky – a completely unanticipated event”.

How are fund managers preparing for this gloomy possibility?

Mr Spreadbury sticks to bonds because of the remit of his funds. Within that world, he said a shock to the system would cause a flight to safety and the price of British government bonds, or gilts, would rise sharply. He also holds bonds of companies that would be most protected in times of turmoil – water companies, power network operators – and those where the bonds are secured on a solid asset, such as land or buildings.

Examples include Center Parcs and Intu, which owns shopping centres.

Marcus Brookes, another well regarded fund manager who looks after billions of pounds worth of investments, is less constrained in where he invests, because of the different remit of his funds. Schroder Multi-Manager Diversity, for example, can pick and choose between assets.

Mr Brookes said the probability of a major shock event was small but even he holds 29pc of the Diversity portfolio in cash, a huge proportion compared with most funds. This decision is due to his concern that bonds are overvalued and may fall. He aims to deliver returns of 4pc above inflation so can’t afford to put too much in assets that he believes will lose money.

“The problem is that people are struggling to work out how to diversify if QE programmes stop,” he said.

Mr Spreadbury added: “We have rock-bottom rates and QE is still going on – this is all experimental policy and means we are in uncharted territory.

“The message is diversification. Think about holding other assets. That could mean precious metals, it could mean physical currencies.”

Real Estate Mortgages Expected to Become a Nightmare

As a result of Title XIV of the

Dodd-Frank Wall Street Reform and Consumer Protection Act, the Consumer

Financial Protection Bureau, another agency to complicate matters,

issued a number of mortgage-related rules that are not actually voted on

by Congress. They will impose far more paperwork and raise the cost of mortgages

while the Dodd-Frank portion to actually reform bank trading was

vacated. So we now have a new agency to comply with to get a mortgage as

of August 1st, 2015 and this should help to cap the real estate rally for the average American sending prices back down.

Government is great at expanding its own powers when it takes payoffs behind the curtan to allow the same conduct that created the problem to begin with. More government jobs and pensions. It never ends.

http://www.consumerfinance.gov/mortgage-rules-at-a-glance/

The Hunt For Money Is Everywhere

“I just bought a house in TN and I had the experience of proving where the money from a Vanguard account transferred into my checking account came from. The lender would not accept the Vanguard or bank account statements. I had to go to the bank and actually get the transmittal numbers and fax that to the lender. The personnel at my bank had never experienced this request before”.

The horror stories are pouring in. It is now evident that the government requires banks to trace every penny you have before getting a mortgage. This has NOTHING to do with terrorism; it is the entire purpose of the NSA grabbing every phone call, text message, and email. They are hunting YOU. The banks act as their agents, tracking what you are doing, and reporting back with the answers

http://armstrongeconomics.com/archives/33542

ND

Government is great at expanding its own powers when it takes payoffs behind the curtan to allow the same conduct that created the problem to begin with. More government jobs and pensions. It never ends.

http://www.consumerfinance.gov/mortgage-rules-at-a-glance/

The Hunt For Money Is Everywhere

“I just bought a house in TN and I had the experience of proving where the money from a Vanguard account transferred into my checking account came from. The lender would not accept the Vanguard or bank account statements. I had to go to the bank and actually get the transmittal numbers and fax that to the lender. The personnel at my bank had never experienced this request before”.

The horror stories are pouring in. It is now evident that the government requires banks to trace every penny you have before getting a mortgage. This has NOTHING to do with terrorism; it is the entire purpose of the NSA grabbing every phone call, text message, and email. They are hunting YOU. The banks act as their agents, tracking what you are doing, and reporting back with the answers

http://armstrongeconomics.com/archives/33542

ND

Fear of default being overtaken by more dangerous ticking time bomb: solvency of Greece banks

Fear of default being overtaken by more dangerous ticking time bomb: solvency of #Greece banks http://on.ft.com/1GVw6U1

Until this week, the big suspense surrounding Greece

was whether Athens would be able to meet a €1.6bn debt repayment to the

International Monetary Fund due at the end of June or go bankrupt.

But the fear of default is rapidly being overtaken by a separate — and possibly more dangerous — ticking time bomb: the solvency of Greece’s banks.

As anxious savers withdraw deposits,

economists warn that Greece’s precarious lenders could collapse. During

a meeting of eurogroup finance ministers on Thursday, Benoît Cœuré, a

member of the European Central Bank’s board, speculated that Greek banks

might not be able to open for business on Monday.

The European Central Bank has provided crucial, emergency

funding to Greek banks that has sustained them in recent months. Yet as

Greece’s finances continue to deteriorate, the ECB’s own rules may soon

prevent it from extending further help, paving the way for a Greek exit

from the eurozone.

“The fate of Greek banks hinges on political developments,

which will affect both their liquidity and their solvency,” said Jonas

Floriani, an analyst at KBW Research.

http://www.ft.com/intl/cms/s/0/265ceb78-15ae-11e5-8e6a-00144feabdc0.html#axzz3dacjii8vCollege For Sex: Students depending on sugar daddies to pay their tuition

(SANTA BARBARA)

NEARLY three-quarters of the graduates now leaving America’s colleges

are saddled with debt. On average, they owe $35,051. By comparison,

roughly half of all graduates carried debt in 1995 and it averaged less

than a third as much, says Edvisors, which tracks student aid (see

chart). As the cost of university has risen, so has the number of “sugar

babies” who pay for it by selling companionship and sex to wealthy

older men. Monthly pay for this is typically about $3,000, though some

“sugar daddies” offer much more. According to SeekingArrangement, a firm

based in Las Vegas, two-thirds of sugar-baby graduates have no student

debt.

Students who post profiles on SeekingArrangement.com know what they want, so “it’s almost like a business partnership”, says Angela Bermudo, a spokesman for the company. The site hosts some 900,000 profiles of sugar babies enrolled in American universities, up from 458,000 two years ago.

Their ranks swelled during the recession and are still growing fast, says Brandon Wade, the site’s founder. A year ago nearly 1,200 students with an e-mail account belonging to an American university posted a profile on the site every day; the daily average has risen to about 2,000. The site has even stopped advertising online. Its ads used to pop up with search results for terms such as “student loan”.The boom is fuelled by increased acceptance of “sugaring” (dating for money), says Steven Pasternack, the owner of a Miami firm known as Sugardaddie. The company’s site gets more than 5,000 new profile uploads worldwide every day.

A quarter are students. Astute marketing helps. Sugardaddie’s pitch notes that it does not “discriminate against people’s desires”. Sugar babies are increasingly advised to negotiate not an “allowance”, but rather a certain “lifestyle” in exchange for dates. These arrangements can remain discreet. New Yorker Keith and the younger woman he met online, seeking a sugar daddy to pay for college, both tell friends that they met in a bar. His weekly $500 deposits into her bank account will cease, he says, if she becomes unavailable.

Young men keen for cash from a “sugar mama” have few prospects. The vast majority of website sign-ups willing to pay for sex are men. This is how it should be, says Allison, a 23-year-old sugar baby near New York City whose online name is Barbiewithabrain. Her college, rent and car expenses have been covered since she was 18 by monthly allowances of $5,000-10,000 from three successive sugar daddies.

Might any of this qualify as prostitution? The websites say no. A sugar daddy doesn’t want his sugar baby to leave, whereas no client of a prostitute “wants the hooker to stick around”, as SeekingArrangement puts it. This argument has prevailed in America’s courts. If a relationship exists, payment can be labelled as compensation for companionship, not sex.

States that attempt to close that loophole fail, says Scott Cunningham, an economics professor at Baylor University in Texas who has studied prostitution markets. Proposed legislation against the practice might, he says, inadvertently prohibit marriage—which could, after all, be defined as intercourse for financial support. This is why, he adds, laws target streetwalking, pimping and other practices connected with types of prostitution. Finding a man online sidesteps all that. It is telling that PayPal, faced with a lawsuit, is dropping its refusal to process payments on SeekingArrangement, Mr Wade says. He expects the discreet payment option to become available this summer.

Students who post profiles on SeekingArrangement.com know what they want, so “it’s almost like a business partnership”, says Angela Bermudo, a spokesman for the company. The site hosts some 900,000 profiles of sugar babies enrolled in American universities, up from 458,000 two years ago.

Their ranks swelled during the recession and are still growing fast, says Brandon Wade, the site’s founder. A year ago nearly 1,200 students with an e-mail account belonging to an American university posted a profile on the site every day; the daily average has risen to about 2,000. The site has even stopped advertising online. Its ads used to pop up with search results for terms such as “student loan”.The boom is fuelled by increased acceptance of “sugaring” (dating for money), says Steven Pasternack, the owner of a Miami firm known as Sugardaddie. The company’s site gets more than 5,000 new profile uploads worldwide every day.

A quarter are students. Astute marketing helps. Sugardaddie’s pitch notes that it does not “discriminate against people’s desires”. Sugar babies are increasingly advised to negotiate not an “allowance”, but rather a certain “lifestyle” in exchange for dates. These arrangements can remain discreet. New Yorker Keith and the younger woman he met online, seeking a sugar daddy to pay for college, both tell friends that they met in a bar. His weekly $500 deposits into her bank account will cease, he says, if she becomes unavailable.

Young men keen for cash from a “sugar mama” have few prospects. The vast majority of website sign-ups willing to pay for sex are men. This is how it should be, says Allison, a 23-year-old sugar baby near New York City whose online name is Barbiewithabrain. Her college, rent and car expenses have been covered since she was 18 by monthly allowances of $5,000-10,000 from three successive sugar daddies.

Might any of this qualify as prostitution? The websites say no. A sugar daddy doesn’t want his sugar baby to leave, whereas no client of a prostitute “wants the hooker to stick around”, as SeekingArrangement puts it. This argument has prevailed in America’s courts. If a relationship exists, payment can be labelled as compensation for companionship, not sex.

States that attempt to close that loophole fail, says Scott Cunningham, an economics professor at Baylor University in Texas who has studied prostitution markets. Proposed legislation against the practice might, he says, inadvertently prohibit marriage—which could, after all, be defined as intercourse for financial support. This is why, he adds, laws target streetwalking, pimping and other practices connected with types of prostitution. Finding a man online sidesteps all that. It is telling that PayPal, faced with a lawsuit, is dropping its refusal to process payments on SeekingArrangement, Mr Wade says. He expects the discreet payment option to become available this summer.

Global Trend Forecaster Gerald Celente On $20,000 Gold: “Here’s What We’re Forecasting…”

If

there’s one thing everyone can agree on in an environment

where economic data has been skewed, repeatedly revised and outright

manipulated, it’s that we are seeing extreme volatility throughout

the global marketplace. “From Shanghai to New York”, says highly

acclaimed global trend forecaster Gerald Celente, “to stocks, bonds and oil prices, it’s swing time.”

If

there’s one thing everyone can agree on in an environment

where economic data has been skewed, repeatedly revised and outright

manipulated, it’s that we are seeing extreme volatility throughout

the global marketplace. “From Shanghai to New York”, says highly

acclaimed global trend forecaster Gerald Celente, “to stocks, bonds and oil prices, it’s swing time.”And while most retail investors around the world continue to pump their money into propaganda-built markets that include over bloated stocks and real estate investments, those in the know are preparing for the inevitable crash because, as Celente notes, “the worst is yet to come.”

In his latest interview Celente sheds more light on a recent report that China is preparing for something very big by hedging its bets against the real possibility of a global currency crisis stemming from a collapse in the U.S. dollar. The Chinese, along with Russia and other nations, are in the midst of an unprecedented accumulation of gold in advance of a paradigm shift that is sure to uproot the entire global monetary system as we know it today.

Via King World News:

Everybody knows what’s going on. The only reason the equity markets are moving up to the levels they are, are the record amounts of cheap money being pumped into the system.The Chinese know it. The Russians know it. And even leaders of the Federal Reserve and U.S. government know it.

…

So, when we look at why they’re [China] buying gold… what you’re looking at is virtually every day since the New Year began, volatility has been the name of the financial market game. So you see from Shanghai to New York, to stocks, bonds and oil prices, it’s swing time, man.

…

So the markets are moving on fake news that means nothing. The facts remain the same. There has been no recovery. It’s a cover-up.

It was a cover-up from the beginning when they came out with too-big-to-fails and TARP. They threw a tarp over the big lie to keep the Ponzi scheme going.

…

One of our keynote speakers was Nomi Prins, who wrote the book All the President’s Bankers… As it would have it, two days before our conference she was a keynote speaker at the Federal Reserve.

She spoke to members of the Federal Reserve, the IMF and the World Bank.

And I said to her, ‘Nomi what was the one thing you learned?’

She said, ‘I learned that they don’t know what they’re doing. They don’t have a clue. They’re in uncharted waters and they’re faking it.’

In response, despite the manipulations in the prices of precious metals through paper trading markets, countries and ultra-wealthy individuals around the world are rapidly acquiring the one asset that has stood the test of time for thousands of years as a store of value and wealth.

According to Celente, when the Ponzi scheme is finally revealed to the broader public, we’ll see a massive upswing in precious metals:

Here’s what we’re forecasting…The writing is on the wall. Trillions of dollars are being printed out of thin air to keep the system afloat for just a bit longer. Eventually, confidence in the U.S. dollar will be lost on a global scale. The Chinese and Russians will pull the plug. Investors will follow.

We’re forecasting a rapid rise in gold prices as speculators and survivors place their bets on safe haven assets… whether it’s gold or silver.

Because, when this next Ponzi scheme collapses we are forecasting that you’re going to see spikes up in gold that mirror the charts that you put up there and the spikes up in all the fake money that they’ve been printing. They’re going to follow it identically.

So, is $20,000 [per ounce of gold] on the horizon?

I don’t know.

But what we’re saying is… it’s going to go beyond the level it hit at the high in 2011 and start pumping way above $2,000 an ounce.

Source: Full audio interview at King World News – Click here to view related charts

The rush to gold as a safe haven asset will come next.

UK Readies for Massive Protest Against ‘Austerity on Steroids’

A massive and growing anti-austerity movement will take to the

streets of London on Saturday, June 20, with demonstrators demanding “an

alternative to austerity and to policies that only benefit those at the

top.”

Tens of thousands are expected to march from the Bank of England to Parliament Square on Saturday, protesting the conservative government’s “nasty, destructive cuts to the things ordinary people care about—the [National Health Service], the welfare state, education and public services.”

Organized by The People’s Assembly—a politically unaffiliated national campaign against austerity—the demonstration comes in the wake of UK elections in early May that saw the Conservative (Tory) Party seizing the majority of Parliamentary seats and Prime Minister David Cameron sweeping back to power.

“David Cameron and George Osborne can hardly contain their enthusiasm for the torrent of cuts and privatisations they are about to unleash,” wrote the Guardian‘s Seumas Milne on Wednesday. “This is to be austerity on steroids.”

In fact, Milne warned, “indefinite austerity, which transfers wealth from public to private and poor to rich, is Osborne’s aim.”

But “there’s no necessity to put up with the attacks they’re about to launch on millions of people’s living standards, and every reason to resist them,” Milne concluded. “The austerity programme needs to be opposed in parliament, but also with industrial action, demonstrations and local campaigns. That process is already kicking off, with a national anti-austerity march in London this Saturday.”

A separate but similarly themed rally is planned for Glasgow, Scotland on Saturday. As Al Jazeera explains, the political landscape is different in Scotland, where the Scottish National Party (SNP) won an overwhelming victory in May.

“The SNP’s victory was widely seen as an endorsement of nationalist leader Nicola Sturgeon’s anti-austerity stance,” Al Jazeera reports, while noting that “the party also benefited from a wave of grass-roots enthusiasm whipped up during last year’s referendum on independence from the U.K.—which generated unprecedented levels of political engagement among previously apathetic sections of Scottish society.”

Stephen Boyd, the assistant secretary of the Scottish Trades Union Congress, which represents more than 600,000 Scottish workers and is one of the main sponsors of Saturday’s event, told Al Jazeera: “We expect George Square [in central Glasgow] to be packed. The rally will reflect the significant anger in Scotland at Tory plans to widen and deepen austerity.”