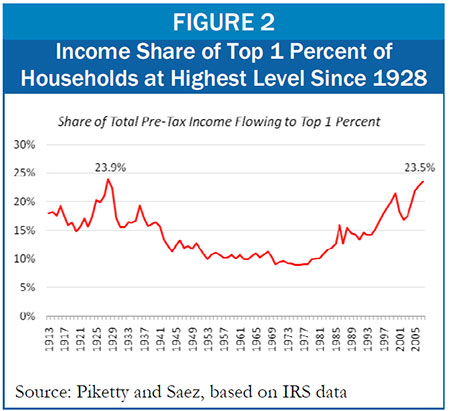

Christina Romer, former member of President Obama's Council of Economic Advisors, accuses the administration of "shamefully ignoring" the unemployed. Paul Krugman echoes her concerns, observing that Washington has lost interest in "the forgotten millions." America's unemployed have been ignored and forgotten, but they are far from superfluous. Over the last two years, out-of-work Americans have played a critical role in helping the richest one percent recover trillions in financial wealth.

Obama's advisers often congratulate themselves for avoiding another Great Depression - an assertion not amenable to serious analysis or debate. A better way to evaluate their claims is to compare the US economy to other rich countries over the last few years.

On the basis of sustaining economic growth, the United States is doing better than nearly all advanced economies. From the first quarter of 2008 to the end of 2010, US gross domestic product (GDP) growth outperformed every G-7 country except Canada [5].

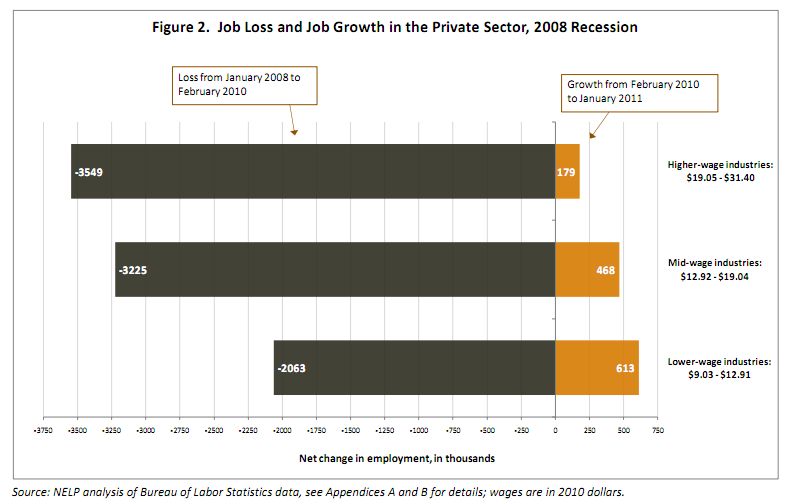

But when it comes to jobs, US policymakers fall short of their rosy self-evaluations. Despite the second-highest economic growth, Paul Wiseman of the Associated Press (AP) reports: [6] "the U.S. job market remains the group's weakest. U.S. employment bottomed and started growing again a year ago, but there are still 5.4 percent fewer American jobs than in December 2007. That's a much sharper drop than in any other G-7 country." According to an important study by Andrew Sum and Joseph McLaughlin, the US boasted one of the lowest unemployment rates in the rich world before the housing crash - now, it's the highest.[1]

The gap between economic growth and job creation reflects three separate but mutually reinforcing factors: US corporate governance, Obama's economic policies and the deregulation of US labor markets.

Old economic models assume that companies merely react to external changes in demand - lacking independent agency or power. While executives must adapt to falling demand, they retain a fair amount of discretion in how they will respond and who will bear the brunt of the pain. Corporate culture and organization vary from country to country.

In the boardrooms of corporate America, profits aren't everything - they are the only thing. A JPMorgan research report [7] concludes that the current corporate profit recovery is more dependent on falling unit-labor costs than during any previous expansion. At some level, corporate executives are aware that they are lowering workers' living standards, but their decisions are neither coordinated nor intentionally harmful. Call it the "paradox of profitability." Executives are acting in their own and their shareholders' best interest: maximizing profit margins in the face of weak demand by extensive layoffs and pay cuts. But what has been good for every company's income statement has been a disaster for working families and their communities.

Obama's lopsided recovery also reflects lopsided government intervention. Apart from all the talk about jobs, the Obama administration never supported a concrete employment plan. The stimulus provided relief, but it was too small and did not focus on job creation.

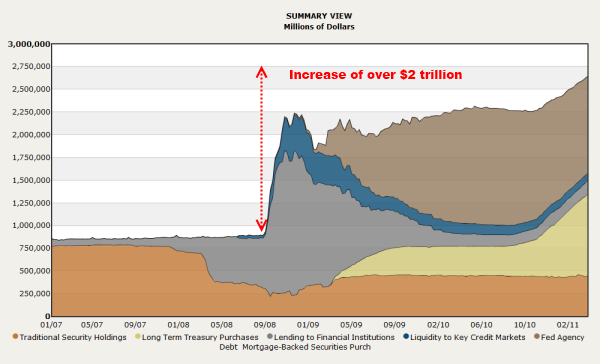

The administration's problem is not a question of economics, but a matter of values and priorities. In the first Great Depression, President Roosevelt created an alphabet soup of institutions - the Works Progress Administration (WPA), the Tennessee Valley Authority (TVA) and the Civilian Conservation Corps (CCC) - to directly relieve the unemployment problem, a crisis the private sector was unable and unwilling to solve. In the current crisis, banks were handed bottomless bowls of alphabet soup - the Troubled Asset Relief Program (TARP), the Public-Private Investment Program (PPIP) and the Term Asset-Backed Securities Loan Facility (TALF) - while politicians dithered over extending inadequate unemployment benefits.

The unemployment crisis has its origins in the housing crash, but the prior deregulation of the labor market made the fallout more severe. Like other changes to economic policy in recent decades, the deregulation of the labor market tilts the balance of power in favor of business and against workers. Unlike financial system reform, the deregulation of the labor market is not on President Obama's agenda and has escaped much commentary.

Labor-market deregulation boils down to three things: weak unions, weak worker protection laws and weak overall employment. In addition to protecting wages and benefits, unions also protect jobs. Union contracts prevent management from indiscriminately firing workers and shifting the burden onto remaining employees. After decades of imposed decline, the United States currently has the fourth-lowest private sector union membership [8] in the Organization for Economic Cooperation and Development (OECD).

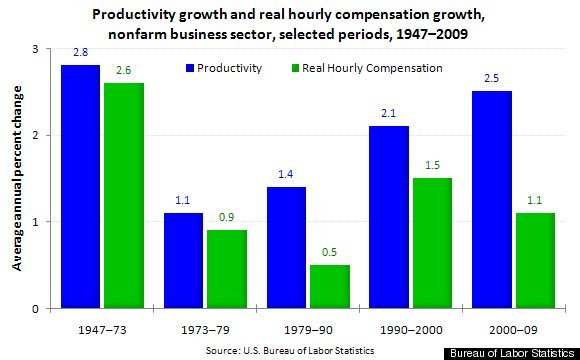

America's low rate of union membership partly explains why unemployment rose so fast and, - thanks to hectic productivity growth - hiring has been so slow.

Proponents of labor-market flexibility argue that it's easier for the private sector to create jobs when the transactional costs associated with hiring and firing are reduced. Perhaps fortunately, legal protections for American workers cannot get any lower: US labor laws make it the easiest place in the word to fire or replace employees, according to the OECD. [9]

Another consequence of labor-market flexibility has been the shift from full-time jobs to temporary positions. In 2010, 26 percent of all news jobs were temporary [10] - compared with less than 11 percent in the early 1990's recovery and just 7.1 percent in the early 2000's.

The American model of high productivity and low pay has friends in high places. Former Obama adviser and General Motors (GM) car czar Steven Rattner argues [11] that America's unemployment crisis is a sign of strength:

Perversely, the nagging high jobless rate reflects two of the most promising attributes of the American economy: its flexibility and its productivity. Eliminating jobs - with all the wrenching human costs - raises productivity and, thereby, competitiveness.

Unusually, US productivity grew right through the recession; normally, companies can't reduce costs fast enough to keep productivity from falling.

That kind of efficiency is perhaps our most precious economic asset. However tempting it may be, we need to resist tinkering with the labor market. Policy proposals aimed too directly at raising employment may well collaterally end up dragging on productivity.

Rattner comes dangerously close to articulating a full-unemployment policy. He suggests unemployed workers don't merit the same massive government intervention that served GM and the banks so well. When Wall Street was on the ropes, both administrations sensibly argued, "doing nothing is not an option." For the long-term unemployed, doing nothing appears to be Washington's preferred policy.

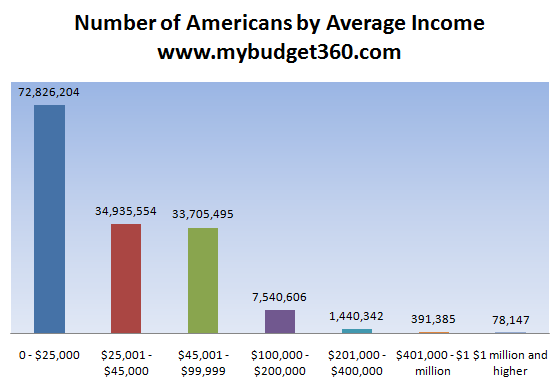

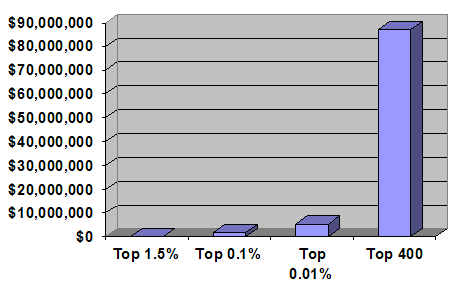

The unemployment crisis has been a godsend for America's superrich, who own the vast majority of financial assets - stocks, bonds, currency and commodities.

Persistent unemployment and weak unions have changed the American workforce into a buyers' market - job seekers and workers are now "price takers" rather than "price makers." Obama's recovery shares with Reagan's early years the distinction of being the only two post-war expansions where wage concessions have been the rule rather than the exception. The year 2009 marked the slowest wage growth on record, followed by the second slowest in 2010.[2]

America's labor market depression propels asset price appreciation. In the last two years, US corporate profits and share prices rose at the fastest pace in history - and the fastest in the G-7. Considering the source of profits, the soaring stock market appears less a beacon of prosperity than a reliable proxy for America's new misery index. Mark Whitehouse of The Wall Street Journal describes [12]Obama's hamster wheel recovery:

From mid-2009 through the end of 2010, output per hour at U.S. nonfarm businesses rose 5.2% as companies found ways to squeeze more from their existing workers. But the lion's share of that gain went to shareholders in the form of record profits, rather than to workers in the form of raises. Hourly wages, adjusted for inflation, rose only 0.3%, according to the Labor Department. In other words, companies shared only 6% of productivity gains with their workers. That compares to 58% since records began in 1947.

Workers' wages and salaries represent roughly two-thirds of production costs and drive inflation. High inflation is a bondholders' worst enemy because bonds are fixed-income securities. For example, if a bond yields a fixed five percent and inflation is running at four percent, the bond's real return is reduced to one percent. High unemployment constrains labor costs and, thus, also functions as an anchor on inflation and inflation expectations - protecting bondholders' real return and principal. Thanks to the absence of real wage growth and inflation over the last two years, bond funds have attracted record inflows and investors have profited immensely. [13]

The Federal Reserve has played the leading role in sustaining the recovery, but monetary policies work indirectly and disproportionately favor the wealthy. Low interest rates have helped banks recapitalize, allowed businesses and households to refinance debt and provided Wall Street with a tsunami of liquidity - but its impact on employment and wage growth has been negligible.

CNBC's Jim Cramer provides insight [14] into the counterintuitive link between a rotten economy and soaring asset prices: "We are and have been in the longest 'bad news is good news' moment that I have ever come across in my 31 years of trading. That means the bad news keeps producing the low interest rates that make stocks, particularly stocks with decent dividend protection, more attractive than their fixed income alternatives." In other words, the longer Ben Bernanke's policies fail to lower unemployment, the longer Wall Street enjoys a free ride.

Out-of-work Americans deserve more than unemployment checks - they deserve dividends. The rich would never have recovered without them.

1. "The Massive Shedding of Jobs in America." Andrew Sum and Joseph McLaughlin. Challenge, 2010, vol. 53, issue 6, pages 62-76.

2. David Wessel, Wall Street Journal, January 30, 2010. "Wage and Benefit Growth Hits Historic Low" [15]; Chris Farrell, Bloomberg Businessweek, February 5, 2010. " US Wage Growth: The Downward Spiral." [16]

Global Research Articles by Mark Provost

omen, ¼ tsp to 1 litre water for men. Fortunately, red wine and coffee are significant sources of boron, as well as non-citrus fruits, red grapes, plums, pears, apples, avocados, legumes and nuts! Boron is known to be non-carcinogenic, non-mutagenic and has been used internally to protect the astronauts in space as they leave the earth’s protective magnetic field.

omen, ¼ tsp to 1 litre water for men. Fortunately, red wine and coffee are significant sources of boron, as well as non-citrus fruits, red grapes, plums, pears, apples, avocados, legumes and nuts! Boron is known to be non-carcinogenic, non-mutagenic and has been used internally to protect the astronauts in space as they leave the earth’s protective magnetic field.