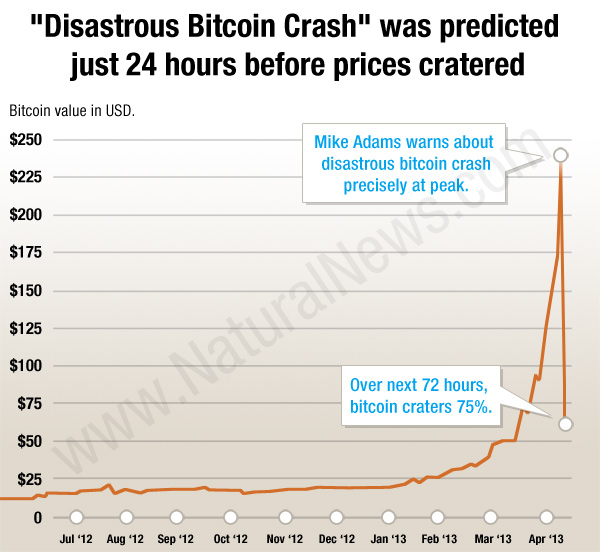

As bitcoin skyrocketed in value, I saw unmistakable signs of "irrational exhuberance" kicking in, with bitcoin hypsters starting to talk more like charlatans and cult members than rational investors. So I published an urgent warning and repeated the same warning live on national radio.

The very next day, bitcoin cratered from $266 to $105. Self-deluded bitcoin cultists called this "50% off Wednesdays" and urged everyone to "buy and hold." (Because that's how the con works.)

But the selloff had already picked up steam, and while Thursday saw some support around the $110 - $120 level, by Friday morning the bitcoin bubble accelerated its downfall, plummeting to $61.11, a loss of over 75% from its high.

Bitcoin investors are delusional fools

Even at $61, bitcoin is wildly over-valued. The crypto currency now has almost no practical use whatsoever in the world of e-commerce because its extreme volatility means no large merchant will ever accept it.Any currency that can drop 60% (or more) in a few hours is not a reliable currency for exchange, period. You can't argue with mathematics, although bitcoin cult members are certainly trying.

Here's a video of the bold bitcoin crash prediction I made on the Alex Jones Show a full day before the crash began, where I said:

Eventually it's going to crash hard. I bet my reputation on that, Alex. I am 100% sure we are going to see a massive bitcoin crash at some point with an ultra-accelerated velocity. It will be the fastest crash of any currency in the history of human civilization. It will be a high-velocity crash. People are buying bitcoins who don't know what bitcoins are and who have no use for them. These are speculators.

Here's the video:

Bitcoin cultists prove they are a band of fools

Immediately after this prediction, I was branded a "conspiracy theorist" and a "doom and gloomer" by the now-crazed bitcoin community which was becoming more delusional and insane by the hour.Every drop in price was called nothing more than a "buying opportunity" or a "discount," and it was repeatedly stated that bitcoins would keep going sky-high because "20,000 new people are buying bitcoins every day."

In truth, bitcoins became a runaway pyramid scheme. The only purpose for buying bitcoins was to sell bitcoins. The entire market became purely speculative, resembling the tulip bulb mania of 1637. And it was headed for certain disaster.

This is why I wrote, two days before the bitcoin crash:

"Bitcoin has become a speculative bubble now driven primarily by greed and risk rather than utilitarian value... Today, bitcoin looks and feels a lot like the dot-com bubble of 2000... When the bitcoin crash comes, it will be wildly accelerated. The entire thing may unravel in mere hours... Be warned that if you buy bitcoins today, you are essentially playing the lottery because you're joining other greed-driven speculators who are all unwittingly playing out a repeat of the dot-com bubble. A crash seems inevitable."

And then, one day before the bitcoin crash, I wrote:

"Mark my words: Bitcoin is headed for a disastrous crash. All the signs are there. It's undeniable. When speculative investors, driven by greed, flood a particular investment vehicle creating a fast-expanding bubble, a crash is inevitable... Bitcoin has now become a casino. If you are buying bitcoin right now, you are gambling with your money. There's a sucker born every minute... try not to be one of them... If you are buying bitcoins right now and thinking to yourself, "I'm gonna buy today, hold them, and sell at the top!" then look in the mirror and mouth the word "SUCKER" to yourself ten times until it sinks in.

Like everyone else, you will fail to sell at the top. You will ride the losses down to nothing, and you will lose almost everything you put into the system. Why? Because you're only human, and when it comes to the fear and greed of markets, human psychology is pathetically predictable."

Never argue with mathematics

Bitcoin fanboys (i.e. cult members) are learning the hard way that you should never argue with mathematics. If you try to, you will lose.I wrote previously that I could see a bitcoin crash coming because I knew that 2+2=4. Yes, it was that obvious. But just like all the suckers who lost their shirts in the dot-com bubble and the housing bubble, the bitcoin bubble players thought the laws of economics did not apply to them. They thought they could all become wealthy without expending effort. They were fools.

They were, technically, the "greater fools" always described in market dynamics textbooks. They got suckered by greed while abandoning mathematical reality.

The only way bitcoin could have continues to climb was if more and more people were suckered into the pyramid scheme. But now, with bitcoin's reputation in ruins, no intelligent person is going to buy until the bitcoin price crashes another 75% or so if they do their research, meaning the bitcoin mania has been shattered.

And the bitcoin cult has been exposed as pure delusion.

We should all be happy that bitcoin crashed before it spiraled too far out of control in terms of valuation, otherwise the impact of the crash could have been much, much worse.

Introducing Sh!tcoin

By the way, I'm going to be announcing a brand new virtual currently called "sh!tcoin," where every coin equals exactly one piece of sh!t.Very strong passwords will be required so that people don't "steal your sh!t" and the people who hold the greatest number of sh!tcoins will be called the "sh!theads."

That sparked anticipation of further appreciation this year and stoked inflationary pressure on the mainland and Hong Kong.

That sparked anticipation of further appreciation this year and stoked inflationary pressure on the mainland and Hong Kong.