By

Michael

Lombardi, MBA for Profit Confidential

Finally

some good news in the U.S.

jobs

market?

The Bureau of Labor Statistics (BLS) reported Friday that, in

November, 203,000 jobs were added to the U.S. jobs market. As a

result, the unemployment rate went down to 7.0% from 7.3% in October.

In addition to this, the BLS also revised the job numbers from

October and September, saying 20,000 more jobs were created than

previously reported. (Source: Bureau of Labor Statistics, December 6,

2013.)

Yes, the jobs market report for November is a step in the right

direction. And, while I’m certain the politicians and the

mainstream will have a field day with this news, the underlying

statistics in the jobs market are not improving.

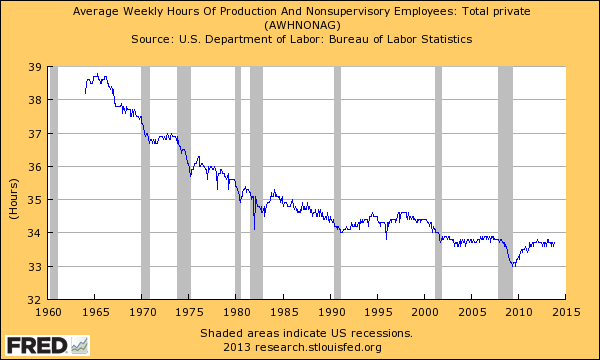

The underemployment rate, which includes people who have given up

looking for work and those who have part-time jobs that want

full-time jobs, still sits at 13.2%.

In addition, the number of long-term unemployed, those who are out

of work for more than six months, made up 37.3% of all unemployed in

November! There are

4.4 million long-term unemployed

people in the U.S. and the longer they stay out of work, the harder

it will be for them to get back into the market.

Finally, the majority of jobs created in the U.S. economy continue

to be created in the low-wage-paying sectors.

The bottom line here is that the “official” unemployment

numbers do not reflect what’s really going on in the jobs market.

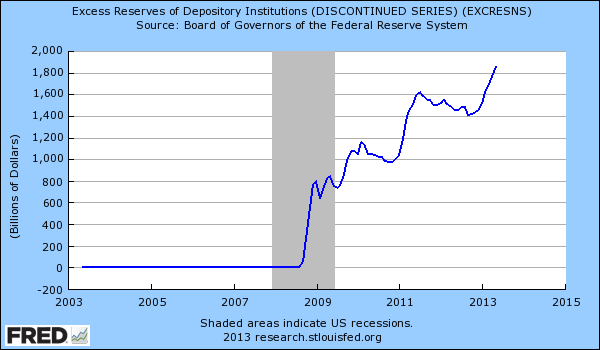

But the official rate is going in the right direction…and moving

close to the point (6.5% unemployment) where the Federal Reserve said

it would start pulling back on its money printing program.

As we all know, the stock market is terrified of the Fed pulling

back on money printing. So an improving official unemployment rate

has now become a bad thing for the stock market. A scary thought.

Michael’s

Personal Notes:

On the surface, the recent U.S.

GDP numbers

looked great. I hear the U.S. economy grew at a revised annual pace

of 3.6% in the third quarter of 2013—its fastest GDP growth rate

since at least the financial crisis. (Source: Bureau of Economic

Analysis, December 5, 2013.)

But when I look closer at the numbers released by the government,

I discover the U.S. economy didn’t grow due to

consumer

spending, the most important factor of economic growth, but

rather due to a lack of consumer spending!

Let me explain…

In the third quarter, real personal consumption expenditure (a

measure of consumer spending) increased by only 1.4%. That’s down

30% from the second quarter!

So how did GDP rise so much in the third quarter while consumer

spending pulled back?

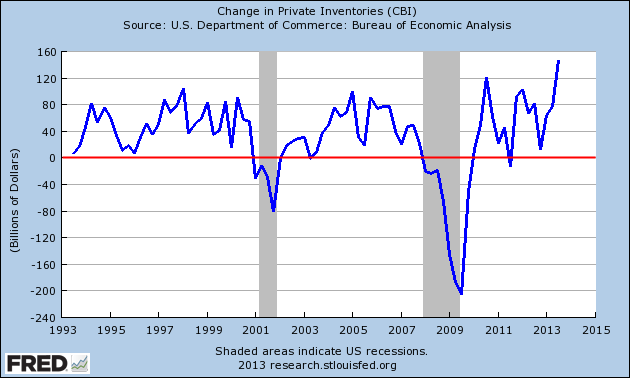

U.S. GDP increased in the third quarter because businesses

stockpiled more of their goods. In the third quarter, private

inventories increased by $116.5 billion; in the second quarter, they

increased by $56.6 billion; and, in the first quarter, they increased

by $42.2 billion.

The way GDP is calculated, an increase in business inventories

pushes up GDP growth! Now the kicker: almost 50% of the increase in

U.S. GDP in the third quarter came from an increase in business

inventories!

This worries me a lot.

Rapidly increasing business inventories is a major sign that

consumer spending isn’t growing. Those who say there’s economic

growth in the U.S. economy have to be very careful in their

conclusion. Consumer spending is the backbone of U.S. economy. If it

declines, we will have economic suffering across the board.

As some point, businesses will have to stop stockpiling the goods

they produce and start laying off staff if those inventories are not

taken down; they can’t just go on creating more and more inventory

if that inventory isn’t moving.

The statistics I see and interpret tell me that

consumer

spending in the U.S. economy is in trouble. Obviously, this

is not good for corporate earnings. But have no fear, dear reader.

The stock market is continuing to rise, the “official” government

statistics show that the unemployment picture is improving, and the

U.S. GDP is improving. Now, if I could only believe those statistics…

As predicted many months, Detroit’s bankruptcy filing has been

validated in a ruling by Bankruptcy Court Judge Steven Rhodes. He

rejected numerous objections posed by unions, pension funds and

retirees. They’re the big losers under any reorganization plan that

scales back Detroit’s long-term liabilities.

As predicted many months, Detroit’s bankruptcy filing has been

validated in a ruling by Bankruptcy Court Judge Steven Rhodes. He

rejected numerous objections posed by unions, pension funds and

retirees. They’re the big losers under any reorganization plan that

scales back Detroit’s long-term liabilities. Detroit’s emergency manager Kevyn Orr says a pension fund takeover is a

“right, if not an obligation” after Orr learned of extra, unwarranted

pension payments.

Detroit’s emergency manager Kevyn Orr says a pension fund takeover is a

“right, if not an obligation” after Orr learned of extra, unwarranted

pension payments.

Finally

some good news in the U.S.

Finally

some good news in the U.S.