Catherine J. Frompovich

Activist Post

Everyone always is impressed when someone accomplishes that coveted award or title of Number One—

Numero Uno,

which defines the epitome of accomplishment. For many years the USA

stood proud at the Olympics, taking home more gold medals than any

country. The USA many times has had the honor of being number one in

many more categories. However, in recent years,

Old Glory may be

somewhat embarrassed by many of the Number One spots USA statistics has

had her flying in. Let’s take a closer look to see where we shine as

Number One.

First and foremost, it seems that the USA quickly is becoming a

police-controlled population or state. That dubious recognition is

attained from incarceration statistics, which certainly are not

enviable. Back in October of 2012,

Salon featured the article

“US has more prisoners, prisons than any other country.” [1]

According to the International Centre for Prison Studies, the USA had

730 incarcerated persons for every 100,000 in population. We ‘towered’

over the second-best rival, the Czech Republic, which had slightly over

200 incarcerations per 100,000 population. The USA outshined Mexico for

Numero Uno; Mexico’s rate was 200 per 100,000.

According to the Federation of American Scientists, [2, 3] the USA was

Number One in arms deliveries to the world by supplier for the years 1999 through 2006 inclusive. Taxpayers forked over a grand sum totaling $107,672

Millions of constant 2006 U.S. dollars. The USA outshined and outspent its nearest contender, Russia, several times over, since Russia ponied up a measly $38,754

Millions of constant 2006 U.S. dollars.

Was that money well spent? Who knows, since it represents what many

consider the Republican “Bush-2” war horse machine that got us into

inextricable military action. But, it did get us to be

Numero Uno!

Probably where the USA ‘shines’ the brightest as

Number One is in healthcare statistics. No one beats us in many of the various aspects of those statistics. Let’s see how well we do there.

Regarding percentage of

Gross Domestic Production (GDP)

spent on healthcare, the USA outranks every country as of 2007 data from

the Organization for Economic Co-operation and Development (OECD) with a

whopping 15.3%. Next is Switzerland with 11.6%; then Germany at 10.7%;

the United Kingdom at 8.3%; and Japan at 8% -- almost half the U.S.

GDP. [4] Notation ought to be made that the U.S. Congressional Budget

Office projects that total U.S. healthcare spending will reach 31% of

GDP by 2035. [5]

Now, let’s compare what we are getting for our GDP outlay as a return on

longevity or life expectancy at birth and compared with:

- Japan 82.1 years

- Switzerland 81.3 years

- United Kingdom 79 years

- Germany 79 years

- The USA slips to 77 years

So,

it looks like Japan’s 8% GDP in 2007, which was almost half the USA,

secured for the Japanese a life expectancy of 5.1 years more than the

USA, who spent 15.3% GDP. [6]

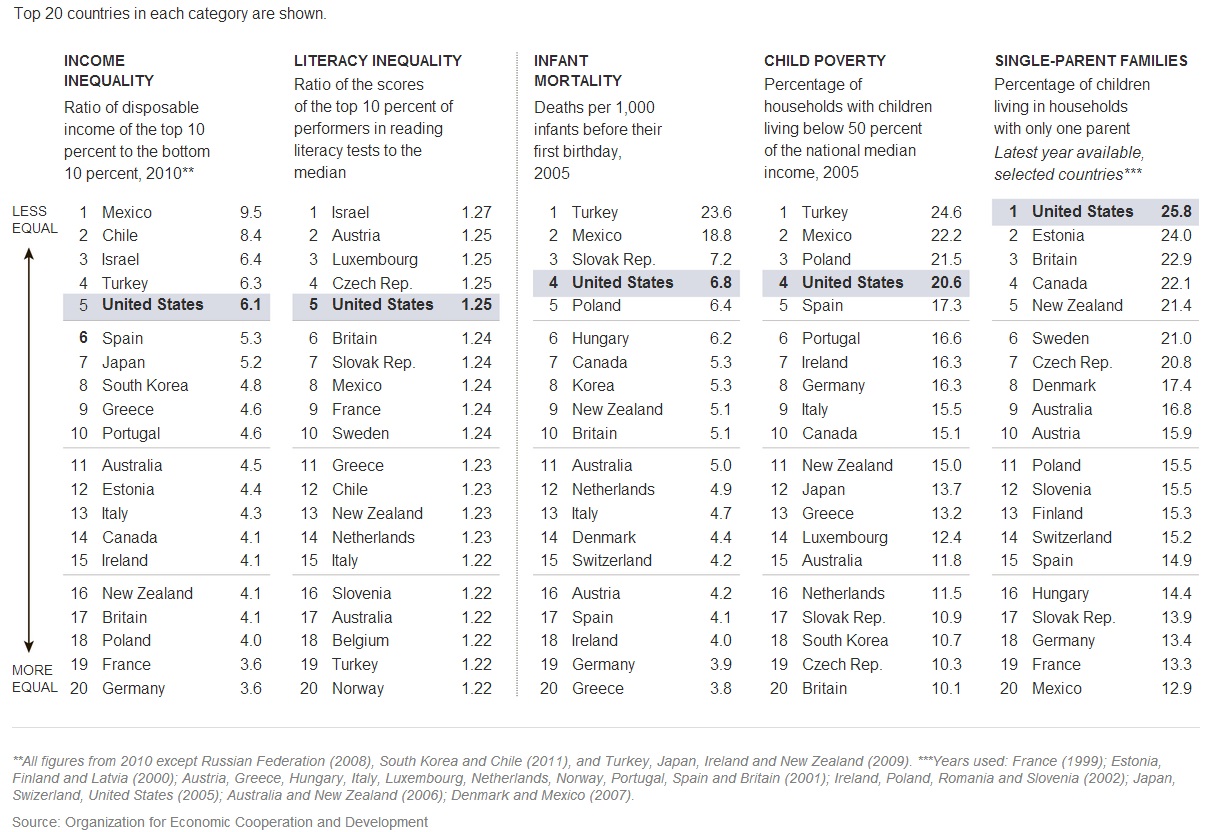

According to OECD statistics for 2007, infant mortality rates place the

USA into a position it should not be in, i.e., considering all the money

spent, our advanced medical technology, and vaccines, which are touted

to prevent childhood and other diseases.

In the category

Infant Mortality (Deaths per 1000 Live Births): [7]

- United States 6.8

- United Kingdom 5.1

- Switzerland 4.2

- Germany 3.9

- Japan 2.8

In trying to weigh the benefits of healthcare parameters that

affect overall health outcomes, we need to consider the role that

vaccines play in health. Let’s check out this chart for starters.

[8]

Although the base year in the above chart is 2009, not 2007 used in

prior statistics, it graphically illustrates something we need to

consider seriously: The country of Japan has one of the lowest number of

vaccinations given to children before 5 years of age, i.e., 11

vaccinations. Whereas, the United States mandated children before 5

years of age in 2009 receive 36 vaccinations, more than three times the

vaccines given to children in Japan in 2009. And yet, we don’t hear of

outbreaks or pandemics of contagious infectious childhood diseases in

Japan, which the U.S. media would be only too obliging to report. Isn’t

that rather remarkable?

Now, for sake of argument, consider the

Lifespan Rankings

in 2009. Japan was Number 4; the USA was Number 34! Moreover, did you

notice that the 2011 statistic for USA’s Life Ranking slipped to 39?

Here is something else to ponder. Let’s examine another chart to see some extremely interesting data.

The Mortality Increase Trendline climbs

from a low end of mandated vaccines of 11 to the high end of mandated

vaccines: 36 in the United States in 2009. How does that vaccine

mandate affect healthcare costs from several perspectives, i.e., costs

of vaccines and their administration, including costs of healthcare

services and vaccine failures for premature birth, sick, and dying

children, who may be impacted by the very vaccines they receive, since

the graph below seems to associate mortality and number of vaccines

given? Questions should be airborne in science and the U.S. court

system about the possible role of vaccines in Sudden Infant Death

Syndrome (SIDS) and Shaken Baby Syndrome (SBS

[9]

Another journalist,

Cynthia A. Janak,

published information from the U.S. Census Bureau that is no longer

available on Census Bureau servers. Question: Why? Janak points out the

apparent ‘hidden’ costs vaccines will saddle healthcare with for

numerous countries, including the USA, in the coming years. Janak

addresses two vaccines in particular: Cervarix® and Gardasil®.

According to

WHY IS HEALTH SPENDING IN THE UNITED STATES SO HIGH? by the OECD,

The United States spends two-and-a-half times

more than the OECD average health expenditure per person (Chart

1). It even spends twice as much as France, for example, a

country which is generally accepted as having very good health services.

At 17.4% of GDP in 2009, US health spending is half as much again

as any other country, and nearly twice the average. [10]

If we examine the chart at

http://www.oecd.org/unitedstates/49084355.pdf , we see how the USA is

Number One in health expenditures per capita,

but apparently: (a) not very healthy; (b) not getting our money’s

worth; and (c) in need of a complete overhaul for better quality of

care, something that the Patient Protection and Affordable Care Act

(Obamacare) may not provide but, in actuality, will result in an

escalation of health insurance costs enforced by the IRS.

According to About.com,

The Obamacare ruling

allows the IRS to tax you 1% of adjusted gross income (above the

taxable minimum income), but no less than $95 per adult/$47.50 per child

in 2013.

These taxes rise in 2015 and 2016. For more, see Obamacare Taxes. [11]

Before we leave the vaccine component in this article, here’s a chart that needs to be studied since it implicates

the role of chemicals in disease, and seemingly with polio. Please study this chart.

|

| click to enlarge [12] |

We note that there is no indication of paralytic polio

epidemic(s) worldwide prior to the 1886 epidemic in Sweden. Polio

starts to escalate during the World War I years when mustard gas and

phosgene [13] were used in combat. Then polio intensifies into pandemic

proportions with the introduction of many DDT-like chemicals. Note

that “DDT was discovered to cause nerve damage, paralysis and death by

respiratory failure in calves, via milk. 1953, confirmed by Swiss.”

So, let’s see where the USA stands on the production of chemicals.

Again, the USA is

Numero Uno in chemical shipments per Wikipedia’s “Chemical Industry.” [14]

What impact do all those chemicals have on our health, the quality and

safety of the air we breathe, and the food and water we take into our

bodies? What percentage of those shipments pertains to glyphosate and

other chemicals used in GMO agriculture? This writer discusses chemical

issues in her book,

Our Chemical Lives And The Hijacking Of Our DNA, A Probe Into What’s Probably Making Us Sick.

According to the United Nations Survey Report [15], the United States is

Number One in total number of crimes! Numero Uno, again, according to the map showing the top ten countries with the highest reported crime rates.

The Washington Post in June of 2005 reported,

“Study:

U.S. Leads in Mental Illness, Lags

in Treatment.” [16] "We lead the world in a lot of good things, but

we're also leaders in this one particular domain that we'd rather not

be,” according to Ronald Kessler, the Harvard professor of health care

policy who led the study.

What about

pharmaceutical drugs? How does the USA stack up with them? Well, according to bls.gov,

Total value of U.S. consumption of

pharmaceutical drugs in 2009 was $300 billion, or about 40 percent

of the worldwide market share, and reflected a 37-percent increase since

2003. [17]

With close to 306 million people in the USA in

January of 2009 and an estimated 6 billion 8 hundred thousand plus

people world-wide in March of 2009, we realize just how disproportionate

a use—40% of the worldwide pharmaceutical drug market share—there is in

the USA. Why? Are pharmaceuticals over-prescribed in the U.S., or are

we just sicker than the rest of the world? With that amount of

pharmaceutical consumption, we undoubtedly have to be Number One.

After

reviewing these statistics, U.S. healthcare consumers, taxpayers,

voters, and those who regulate and govern in the United States need to

take a long, hard,

conscientious look at how the U.S. excels

where it should not. Everyone ought to realize that being Number One in

so many areas where we would rather not be—and should not be

considering capital outlay in healthcare, especially—is cause for major

concern, plus definite confirmation of the desperate need for

fundamental reform and the change we were promised, not the same old lip

service with higher taxes, especially those coming in the name of

healthcare insurance.

Notes:

[1]

http://www.salon.com/2012/10/15/us_has_more_prisoners_prisons_than_any_other_country/

[2]

http://www.photius.com/rankings/arms_sales_major_suppliers_1999_2006.html

[3]

http://www.fas.org/asmp/campaigns/smallarms/Statefactsheet29jun06.htm

[4]

http://www.pbs.org/wgbh/pages/frontline/sickaroundtheworld/etc/graphs.html

[5]

http://www.cnbc.com/id/44180042

[6]

http://www.pbs.org/wgbh/pages/frontline/sickaroundtheworld/etc/graphs.html

[7] Ibid.

[8]

http://www.google.com/search?q=charts+of+vaccines+in+usa+and+other+countries&tbm=isch&tbo=u&source=univ&sa=X&ei=yh33UfvoDMz_4AOYl4DYCA&ved=0CFgQsAQ&biw=1012&bih=650#facrc=_&imgdii=_&imgrc=a_dXjwustv2AKM%3A%3BglZ8zmU_fVjn_M%3Bhttp%253A%252F%252Fwww.newautism.com%252Fwp-content%252Fuploads%252F2011%252F12%252FVaccinesChart.png%3Bhttp%253A%252F%252Fwww.newautism.com%252Fcuba-vaccines-and-autism-vs-usa%252F1555%252F%3B713%3B294

[9] Ibid.

[10]

http://www.oecd.org/unitedstates/49084355.pdf

[11]

http://useconomy.about.com/od/healthcarereform/f/What-Is-Obama-Care.htm

[12]]

http://www.wellwithin1.com/pol_all.htm

[13]

http://www.historylearningsite.co.uk/poison_gas_and_world_war_one.htm

[14]

http://en.wikipedia.org/wiki/Chemical_industry

[15]

http://www.mapsofworld.com/world-top-ten/countries-with-highest-reported-crime-rates.html

[16]

http://www.washingtonpost.com/wp-dyn/content/article/2005/06/06/AR2005060601651.html

[17]

http://www.bls.gov/ppi/pharmpricescomparison.pdf

Catherine J Frompovich (website)

is a retired natural nutritionist who earned advanced degrees in

Nutrition and Holistic Health Sciences, Certification in Orthomolecular

Theory and Practice plus Paralegal Studies.

Her work has been published in national and airline magazines since the

early 1980s. Catherine authored numerous books on health issues along

with co-authoring papers and monographs with physicians, nurses, and

holistic healthcare professionals. She has been a consumer healthcare

researcher 35 years and counting.

Catherine’s latest book, A Cancer Answer, Holistic BREAST Cancer Management, A Guide to Effective & Non-Toxic Treatments, is available on Amazon.com and as a Kindle eBook.

Two of Catherine’s more recent books on Amazon.com are Our Chemical Lives And The Hijacking Of Our DNA, A Probe Into What’s Probably Making Us Sick (2009) and Lord, How Can I Make It Through Grieving My Loss, An Inspirational Guide Through the Grieving Process (2008).

CNBC News – by John W. Schoen

CNBC News – by John W. Schoen Breitbart – by REBEL PUNDIT

Breitbart – by REBEL PUNDIT