- Medicare, Medicaid and Social Security now account for 44% of total federal spending and are steadily rising.

- Previous Congresses (and Administrations) have relied on the assumption that we can grow our way out of this onerous debt burden.

- Unless entitlements are substantially reformed, the U.S. will likely default on its debt; not in conventional ways, but via inflation, currency devaluation and low to negative real interest rates.

That adorable skunk, Pepé Le Pew, is one of my wife Sue’s favorite cartoon characters. There’s something affable, even romantic about him as he seeks to woo his female companions with a French accent and promises of a skunk bungalow and bedrooms full of little Pepés in future years. It’s easy to love a skunk – but only on the silver screen, and if in real life – at a considerable distance. I think of Congress that way. Every two or six years, they dress up in full makeup, pretending to be the change, vowing to correct what hasn’t been corrected, promising discipline as opposed to profligate overspending and undertaxation, and striving to balance the budget when all others have failed. Oooh Pepé – Mon Chéri! But don’t believe them – hold your nose instead! Oh, I kid the Congress. Perhaps they don’t have black and white stripes with bushy tails. Perhaps there’s just a stink bomb that the Congressional sergeant-at-arms sets off every time they convene and the gavel falls to signify the beginning of the “people’s business.” Perhaps. But, in all cases, citizens of America – hold your noses. You ain’t smelled nothin’ yet.

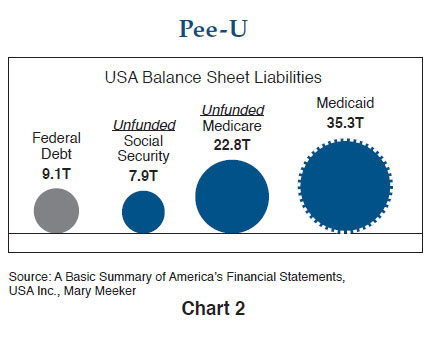

I speak, of course, to the budget deficit and Washington’s inability to recognize the intractable: 75% of the budget is non-discretionary and entitlement based. Without attacking entitlements – Medicare, Medicaid and Social Security – we are smelling $1 trillion deficits as far as the nose can sniff. Once dominated by defense spending, these three categories now account for 44% of total Federal spending and are steadily rising. As Chart 1 points out, after defense and interest payments on the national debt are excluded, remaining discretionary expenses for education, infrastructure, agriculture and housing constitute at most 25% of the 2011 fiscal year federal spending budget of $4 trillion. You could eliminate it all and still wind up with a deficit of nearly $700 billion! So come on you stinkers; enough of the Pepé Le Pew romance and promises. Entitlement spending is where the money is and you need to reform it.

---

March 11 (Bloomberg) -- Bill Gross, who runs the world's biggest bond fund at Pacific Investment Management Co., discusses the outlook for the U.S.'s AAA credit rating. Gross, speaking from Newport Beach, California, with Margaret Brennan on Bloomberg Television's "InBusiness," also talks about the 8.9-magnitude earthquake that struck Japan and the Federal Reserve's quantitative easing.

Summary from Bloomberg:

Gross Echoes Buffett Saying Treasuries Have ‘Little Value’ on Debt, Dollar