* China says paying attention to U.S. debt

* Backs Obama deficit proposal as basis for deal

* Says human rights discussion to be based on mutual respect

* Sets non-confronational tone ahead of dialogue (Adds details, quotes and background)

By Chris Buckley

BEIJING, May 6 (Reuters) - China, wielding its huge dollar holdings, on Friday pressed Washington to tackle its huge fiscal deficit and said it would raise the issue of discrimination against Chinese investors at high-level talks next week.

Senior Chinese officials also made clear that U.S. demands for Beijing to raise sharply the value of the yuan currency and to end a crackdown on dissent -- both irritants in ties between the world's two biggest economies -- would gain little ground at next week's Strategic and Economic Dialogue in Washington.

"We are paying a lot of attention to this (the fiscal deficit)," Chinese Vice Finance Minister Zhu Guangyao told reporters at a briefing about the talks.

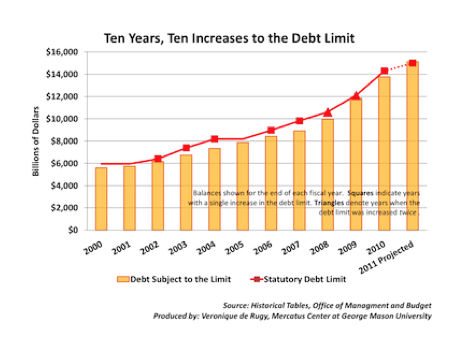

The White House is in tense negotiations with Republican lawmakers over rival proposals to tackle the budget deficit, expected to reach $1.4 trillion this year and a serious worry for governments like China that buy heavily in U.S. Treasury bonds and other dollar assets.

China's has the world's biggest foreign exchange reserves, with about two-thirds estimated to be held in dollars, and any sign it was alarmed by policy uncertainty could ripple through global markets.

"We hope that the United States in its fiscal clean-up will be able to adopt effective measures based on President Obama's proposal," Zhu said, giving unusually forthright backing to the Obama plan.

"For the present stage, we believe that the most crucial thing is that the U.S. economy maintains a vigorous impetus towards recovery and that this developing trend is maintained," Zhu said.

Zhu and Chinese Vice Foreign Minister Cui Tiankai, speaking to reporters ahead of the start on Monday of the two-day talks, laid out Beijing's positions on other economic and foreign policy disputes, stressing their desire for cooperation.

That included the yuan exchange rate, which Washington has repeatedly said is held too low, making Chinese exports unfairly cheap and deterring bigger Chinese purchases of U.S. goods.

The two agree on the direction of yuan reform, but differ on the pace of appreciation, said Zhu.

"On these specific issues, I frankly acknowledge that China and the United States have different views. Therefore, we need to have discussion."

China loosened its currency from a nearly two-year peg to the dollar last June, and this year has guided the yuan to record highs. It has appreciated about 5 percent since June.

Zhu said Vice-Premier Wang Qishan told U.S. Treasury Secretary Timothy Geithner that yuan exchange rate reform was in China's interest.

Wang and Geithner will lead the economic side of the dialogue next week, while U.S. Secretary of State Hillary Clinton and Chinese State Councilor Dai Bingguo, who advises top leaders on foreign policy, will lead the strategic discussions.

CHINA'S CONCERNS

Zhu said China had concerns of its own that would likely be aired in the discussions.

Beijing complains that Washington, while pushing for greater access for U.S. firms in the Chinese market, imposes unwarranted restrictions on Chinese investment in the United States, often citing national security concerns.

"We hope that the United States will provide a healthy legal and institutional setting for investment. In particular, we hope that the United States will not discriminate against Chinese state-owned companies." Zhu said.

The Obama administration has said it will use the strategic dialogue to press China about human rights -- a sensitive topic for Beijing, which fears potential unrest inspired by uprisings across the Arab world and which has taken an increasingly harsh line against dissidents in recent months.

China's response to questions about that on Friday suggested that it does not want a feud over the issue to spread.

Vice Foreign Minister Cui said that at the summit between President Obama and his Chinese counterpart Hu Jintao in January both sides had agreed to respect the paths of development that each country chooses, and that discussion of human rights would be "on a basis of equality and mutual respect."

"We hope that both sides will continue abiding by this spirit," Cui said.

"We hope that in observing the development of human rights in China, the outside world will stick to the facts, or to use a popular Chinese phrase, that it will adopt a sunnier disposition." (Reporting by Chris Buckley, Writing by Sui-Lee Wee; Editing by Ken Wills)