Wednesday, April 20, 2011

Are Rising Oil and Food Prices a Scam?

Consortium News

Editor’s Note: International crises – from the earthquake/tsunami in Japan to the war in Libya – may be subjects for sympathy and concern among most people, but for financial speculators, they are opportunities to make money.

Yet, while investing in commodity futures also may have some broader economic value – by spreading risk – the question at a time of volatility is where does that purpose end and crass exploitation begin, as Danny Schechter asks in this guest essay:

The global economy and its recovery, and the living standards of millions of plain folks, are now at risk from the sudden rise in oil and commodity prices.

Gas at the pump is up, and going higher. Food prices are following. The consequences are catastrophic for the global poor as their costs go up while their income doesn’t.

It’s menacing American workers too, who in large part have not seen a meaningful raise since the days of Reagan (keeping it this way is clearly behind the current flurry of attacks on unions).

Already, unrest in the Middle East and many African countries is being blamed for these dramatic increases. It seems as if this threat to global stability is being largely ignored in our media, one that treats the oil business as just another mystical world of free market trading.

Why is it happening? Why all the volatility? Is oil getting scarcer, leading to price increases? Is the cost of food, similarly, a reflection of naturally increasing commodity prices?

While it’s true that natural disasters and droughts play some role in this unchecked price inflation, it also seems apparent that something else is attracting increasing attention, even if most of our media fails to explore what is a political time bomb while most political leaders shrug their shoulders and ignore it.

President Obama recently said there is nothing he can do about the hike in oil and food prices. But critics say the problem is that government and media alike refuse to recognize what’s really going on: unchecked speculation!

Read Full Article

US in rush to sell off GM stake: report

|

| The US government's $50 billion rescue of auto giant GM in 2009 was politically controversial © AFP/Getty Images/File Scott Olson |

NEW YORK (AFP) - The United States plans to sell off much of its remaining shares in General Motors this summer despite the lackluster performance of the company's stock, the Wall Street Journal has reported.

The newspaper said the sale within the next six months would "almost certainly" mean that US taxpayers would take a loss from a politically controversial $50 billion rescue of the auto giant in 2009.

The government would need to sell its roughly 500 million shares for $53 dollars each in order to break even, but GM's stock is currently hovering around 30 dollars per share, the newspaper said.

At the current price, the government would lose more than $11 billion, but the Obama administration is willing to accept the loss in order to cut its last ties to the auto manufacturer, the newspaper said, citing unnamed sources.

The summer sale would make it more likely that the government could unload the remainder of its shares before the 2012 election season, it said.

It said GM would also back the sell-off because it would lift restrictions on executive pay that remain in place as long as the government is part owner.

Marking its successful emergence from bankruptcy in July 2009, GM raised $23.1 billion last November in the largest public offering in history.

It posted a 9.6 percent increase in US auto sales in March, but it has also been hit by rising gas prices and its stock has suffered since the exit last month of chief financial officer Chris Liddell, a key architect of the revival.

© AFP -- Published at Activist Post with license

Debt warning rocks US economy

|

| © AFP/File Mandel Ngan |

WASHINGTON (AFP) - Ratings agency Standard & Poor's has cut the outlook on US sovereign debt to "negative", raising doubts about Washington's ability to tackle its huge debt and fiscal deficits.

The move, the first time S&P has ever placed such a warning on the US's gold-standard AAA rating, raised the stakes as Washington's political leaders began grappling over how to address the government's yawning budget shortfall over the long term.

Administration officials said S&P "underestimates" political leaders' ability to agree a path out of the country's worst financial jam since the 1930s.

But S&P said it could not foresee any deal between Democrats and Republicans until after the November 2012 presidential and congressional elections, and that without one, the problem was only going to worsen.

"Because... the path to addressing these (problems) is not clear to us, we have revised our outlook on the long-term rating to negative from stable," S&P said.

With no action, S&P officials warned, within two years it could cut the US rating for the first time, a move which would send Washington's debt costs sharply higher.

Other countries with the coveted AAA rating and deficit challenges, like France, Germany and Britain, had all moved last year on their fiscal problems, they said, said S&P's Nikola Swann.

But "the US has yet to agree on a plan," he said .

US stocks and bonds plunged at the news, although the bond market subsequently made up the ground.

President Barack Obama's administration rebuffed the rating agency's warnings.

"We think that the political process will outperform S&P expectations," said White House spokesman Jay Carney.

"The fact is, when the issues are important, history shows that both sides can come together and get things done."

Carney said, however, that S&P's negative outlook was a "reminder that it is important that we reach agreement on fiscal reform."

Republicans quickly linked the issue to the next political battle, the $14.29 trillion ceiling on government debt, which must be raised to allow the government to finance immediate fiscal shortfalls.

The limit will be reached by mid-May and lawmakers have to act by July or see the United States default on its debt.

Republicans want more budget cuts before they agree to hike the debt ceiling.

"As S&P made clear, getting spending and our deficit under control can no longer be put off for another day," said Eric Cantor, Republican majority leader in the House of Representatives.

"House Republicans will only move forward on the president's request to increase the debt limit if it is accompanied by serious reforms that immediately reduce federal spending and end the culture of debt in Washington."

But Cantor's words may have been more posturing than threat. On Sunday Treasury Secretary Timothy Geithner, already aware of S&P's coming announcement, said that the debt ceiling would be raised.

"I want to make it perfectly clear that Congress will raise the debt ceiling," Geithner told the ABC channel.

Republicans "told the president that on Wednesday in the White House," he said.

Still, S&P's move came as Washington feels rising pressure from markets and the international community to get its financial house in order.

Last week, the International Monetary Fund urged the United States to "urgently" address its problems, saying the country stands out as the only large advanced economy with a fiscal deficit that will increase in 2011 from 2010, despite the ongoing economic recovery.

With a federal budget gap estimated at 10.8 percent of GDP by the end if this year, it said Washington will find it difficult to achieve its goal of halving the deficit by 2013.

S&P made clear that if the US doesn't establish a credible plan to reduce medium and long-term imbalances, it could as earlier as 2013 lose its AAA rating, which helps it borrow at ultra-low levels.

The inference is that the S&P will not wait for the full election process to play itself... and that a plan must be in place before the (2012) presidential election to avoid a downgrade," said currency specialist Alan Ruskin of Deutsche Bank.

"This is a real shot across the bow for US politicians of all stripes, highlighting the necessity of coming together before the next presidential election."

© AFP -- Published at Activist Post with license

REPORT: In 12 Years, Income For Richest 400 Americans Quadruples, Tax Rate Nearly Halved

In 1995, just 12 of the 400 richest Americans paid an effective tax rat of between zero and 15%. By 2007, that number skyrocketed to over 150. The massive reduction is due to both Bush-era tax reductions for the wealthy and the aggressive exploitation of tax dodges and shelters.

As their tax rates plummeted, the total income of the richest 400 Americans skyrocketed. In 1995, the combined income of the richest 400 was just over $6 billion. By 2007, the combined income of the richest 400 was almost $23 billion.

If the richest 400 Americans simply paid the same effective rate in 2007 as they did in 1995, the government would have collected over $3 billion in additional revenue. Some millionaires agree that the reduction has been unfair and have formed a group, Patriotic Millionaires for Fiscal Strength, to demand higher taxes.

Scroll Down....

U.S. Gov't Agency Plans $2.84 Billion Loan for Oil Refinery—In Colombia

(CNSNews.com) - The U.S. Export-Import Bank, an independent agency of the federal government, is now planning a $2.84-billion loan for a massive project to expand and upgrade an oil refinery--in Cartagena, Colombia.

The money would go to Reficar, a wholly owned subsidiary of Ecopetrol, the Colombian national oil company.

“This is part of a $5.18 billion refinery and upgrade project in Cartagena, Colombia supplying petroleum products to the domestic and export markets,” the Export-Import Bank said in a statement.

The U.S. government-controlled bank says the $2.84-billion in financing it plans to undertake will be the second largest project it has ever done. The largest was $3 billion in financing for a liquid natural gas project in Papua New Guinea.

The statement released by the bank said that on April 7 the bank’s presidentially-appointed board of directors had “voted to grant preliminary approval for a $2.84 billion direct loan/loan guarantee” for the Colombian refinery project.

Export-Import Bank Spokesman Phil Cogan told CNSNews.com that the bank could not say at this time how much of the $2.84 billion would be directly loaned to the Colombian refinery company and how much would be in loans guaranteed by the bank--although he expected it to be a combination.

“It is conceivable it could be all a direct loan,” said Cogan. “Right now it is set up so that the board could do either a complete direct loan or a combination of direct loan and guarantee. That hasn’t been determined yet.”

Since December, the bank has also approved almost $880 million in other loans and loan guarantees to Reficar’s parent company, Ecopetrol. So, in total, if the new $2.84 billion in loans is finalized, the Columbian national oil company and its wholly owned subsidiaries will have received $3.72 billion in financing backed by a U.S.-government-controlled entity within a span of five months.

“Just last February and December the Bank approved nearly $880 million in export financing to help finance the sale of goods and services from various U.S. exporters to Ecopetrol S.A., Colombia's national oil company,” Export-Import Bank President Fred P. Hochberg said in the bank’s statement announcing preliminary approval of the refinery loan.

Export-Import Bank Spokesman Cogan stressed in an interview that although Reficar is wholly owned by Ecopetrol it remains a separate entity, and is considered as such for Export-Import Bank financing purposes

In its 2009 annual report, Ecopetrol says “we became 100% owners of Reficar, the company in charge of carrying out the Cartagena Refinery modernization plan.”

In its ordinary procedure for financing projects of this magnitude, the board of the Export-Import Bank votes its preliminary approval, notifies Congress of that preliminary approval, then waits five weeks before voting final approval of the deal. This allows members of Congress to comment on the planned financing project.

“The Reficar transaction is subject to congressional notification, with a final vote anticipated approximately 35 days following the expiration of the notification period,” says the bank’s press release on the loan.

When asked if Congress can veto the loan, Ex-Im Spokesman Cogan said, “No.”

The public-policy rationale for the $2.84 billion loan for the Colombian oil refinery project is the same as the rationale for all Export-Import Bank loans to foreign interests: to create jobs in the United States.

“The transaction will help create or sustain over 15,000 American jobs for a total of four years,” says the bank’s statement about the loan.

Spokesman Cogan says the bank calculates the jobs created or sustained by a loan or loan guarantee by using a formula that estimates how much money spent buying U.S. exports in a particular industry it takes to create a job.

If the $2.84 billion loan to Reficar to expand and upgrade its Colombian refinery creates or sustains the 15,000 jobs in the United States that the bank believes it will create or sustain that would work out to $189,333 per job.

According to the National Petrochemical & Refiners Association (NPRA), 95 percent of the gasoline purchased by U.S. consumers is refined inside the United States, meaning that expanding the gasoline refining capacity of Colombia is unlikely to have a significant impact on the supply of refined gasoline in the Untied States.

Also according to NPRA, the last time a new oil refinery was built in the United States was 1993, when a small facility was built in Valdez, Alaska. The last time a new large oil refinery was built in the United States was 1976, says NPRA. Older U.S. refineries, however, have been upgraded and expanded in recent years.

States see biggest revenue drop in 60 years

In a sign of the sluggish economy’s devastating impact, state government revenue across the country dropped by nearly one third in 2009 - the sharpest decline in 60 years, the Census Bureau said in a new report.

States saw record-breaking losses to their pension funds and in their tax revenues, as the recession wreaked havoc on payrolls and investments,

Revenues plummeted by 30.8 percent, from $1.6 trillion in 2008 to $1.1 trillion in 2009, according to the report.

It was the most dramatic drop the Census Bureau has seen since it began collecting state revenue data in 1951.

States reported a total $477 billion drop in “insurance trust revenue” - mostly money from pension funds, while tax collections fell by $66 billion.

And the worst may still be to come.

Fiscal 2012 “will actually be the most difficult budget year for states ever,” said Nicholas Johnson, director of the state fiscal project at the Center on Budget and Policy Priorities, in an interview with The Washington Post.

The center reported last month that states will see budget shortfalls totaling more than $140 billion next year as they continue to wrestle with depressed revenue levels while federal stimulus dollars and reserves run out.

Total US Debt Now Officially Above The Ceiling

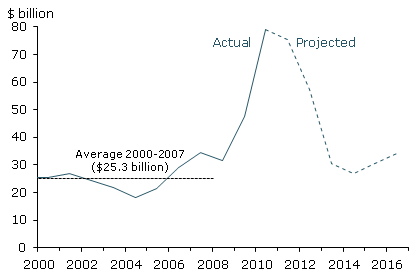

A quick look at today's just released total debt to the penny from the Treasury may crimp the artificial smile of even such die hard administration sycophants as Moodys. Why: because the total debt, as we predicted when we observed last week's 30 Year auction, is now at $14,305,336,580,992.11. This is a problem because as anyone who rails against the broken US fiscal apparatus should be able to tell you, the debt ceiling is $14.294 trillion. In other words we have now officially breached the debt ceiling by $11 billion. So why has the US not filed a notice of default yet? Because the actual debt that matters for legal purposes is the debt "subject to the limit", which is $52 billion less than the total debt primarily due to $10 billion held at the Federal Financing Bank, and $41 billion in unamortized discount: a number which fluctuates in time depending on how much over or under par bonds are issued, but which ultimately will be zero at maturity of all debt (haha). In other words, as of today, the US Treasury has dry powder for just another $41 billion in issuance, or just over your average 5 Year auction. This can be seen best on the following chart from the Treasury where the total debt line has just passed the limit.

So what does this mean for near term issuance? Also per the Treasury, there is a total of $55 billion in debt paydown in the next week primarily in bill redemptions, offset by $14 billion in issuance in the last week of April. The problem is that this week also happens to be a major tax refund week. We anticipate that tax refunds will likely total between $20 -25 billion net over tax revenues. Which means there will be a net cash need of about $75 billion. As we ended Thursday at about $30 billion, Friday's cash balance (released at 4pm by the FMS) could be very critical to determine if the Treasury will be forced to come up with some emergency form of 11th hour cash raise. It also means that the debt ceiling clock is ticking ever louder. The Treasury will have capacity for one more full weekly auction, to be completed in the first week of May, and then it is game over.

Update: cash as of Friday was $58 billion. With $55 billion in cash out this week and who knows how much of refund funding, it could get mightly close...

ake" MOST RECENT STORIES * I Used To Think Freddie Mac Was A Pimp * Matt Taibbi On Washington's "Shadow Budget" That Exists To Benefit Wa

- I Used To Think Freddie Mac Was A Pimp

- Matt Taibbi On Washington's "Shadow Budget" That Exists To Benefit Wall Street (Grazie Bernanke)

- Lobby For War, Profit From War, Lather Rinse Repeat

- So Bernanke, Who Got The Money?

- I Need More Quantitative Easin'

- Economists Hayek Vs. Keynes: A Hip Hop Battle (Video)

- End The Fed - Original Song From James Cobb

- F@#k The Fed (A Central Bank Love Song)

- Arlo Guthrie LIVE Performance - I'm Changing My Name To Fannie Mae - Price Of Gold Is Rising Out Of Sight

- Dylan Ratigan Exposes The Stealth Goldman Sachs Bailout: "Robbing And Thieving The American Sucker - Once Again"

- William Cohan: "Wall Street takes risks with our money, they count on getting bailed out, and they don't have any liability"

- New Car Engine Sends 'Shock Waves' Through Auto Industry

- Warren Buffett Sued Over Sokol's Trades, Total US Debt Now Officially Above The Ceiling, China Frets Over U.S. Debt, Taco Bell Beef Lawsuit, True Inflation (LINKS)

- Obama's Townhall Deficit Performance: Video

- Judge Blasts Government Opposition To Medical Marijuana

The IRS: Way Worse Than You Think

Video - The Onerous Compliance Cost of the Internal Revenue Code

This is not an attack on the IRS, as much as a rebuke of Congress for the creation of such a Byzantine and complicated tax code.

---

Keynesian Economics Is Wrong: Economic Growth Causes Consumer Spending, Not the Other Way

---

Video - Hiwa on Kudlow

Full Text Of S&P U.S. Downgrade

The following is the text of Standard & Poor’s release of its decision to downgrade the ratings outlook on U.S. debt to 'negative'.

--

Our ratings on the U.S. rest on its high-income, highly diversified, and flexible economy. It is backed by a strong track record of prudent and credible monetary policy, evidenced to us by its ability to support growth while containing inflationary pressures. The ratings also reflect our view of the unique advantages stemming from the dollar’s preeminent place among world currencies.

“Although we believe these strengths currently outweigh what we consider to be the U.S.’s meaningful economic and fiscal risks and large external debtor position, we now believe that they might not fully offset the credit risks over the next two years at the ‘AAA’ level,” said Standard & Poor’s credit analyst Nikola G. Swann.

“More than two years after the beginning of the recent crisis, U.S. policymakers have still not agreed on how to reverse recent fiscal deterioration or address longer-term fiscal pressures,” Mr. Swann added.

In 2003-2008, the U.S.’s general (total) government deficit fluctuated between 2% and 5% of GDP. Already noticeably larger than that of most ‘AAA’ rated sovereigns, it ballooned to more than 11% in 2009 and has yet to recover.

On April 13, President Barack Obama laid out his Administration’s medium-term fiscal consolidation plan, aimed at reducing the cumulative unified federal deficit by US$4 trillion in 12 years or less. A key component of the Administration’s strategy is to work with Congressional leaders over the next two months to develop a commonly agreed upon program to reach this target. The President’s proposals envision reducing the deficit via both spending cuts and revenue increases.

Key members in the U.S. House of Representatives have also advocated fiscal tightening of a similar magnitude, US$4.4 trillion, during the coming 10 years, but via different methods. House Budget Committee Chairman Paul Ryan’s plan seeks to balance the federal budget by 2040, in part by cutting non-defense spending. The plan also includes significantly reducing the scope of Medicare and Medicaid, while bringing top individual and corporate tax rates lower than those under the 2001 and 2003 tax cuts.

We view President Obama’s and Congressman Ryan’s proposals as the starting point of a process aimed at broader engagement, which could result in substantial and lasting U.S. government fiscal consolidation. That said, we see the path to agreement as challenging because the gap between the parties remains wide. We believe there is a significant risk that Congressional negotiations could result in no agreement on a medium-term fiscal strategy until after the fall 2012 Congressional and Presidential elections. If so, the first budget proposal that could include related measures would be Budget 2014 (for the fiscal year beginning Oct. 1, 2013), and we believe a delay beyond that time is possible.

Standard & Poor’s takes no position on the mix of spending and revenue measures the Congress and the Administration might conclude are appropriate.

But for any plan to be credible, we believe that it would need to secure support from a cross-section of leaders in both political parties. If U.S. policymakers do agree on a fiscal consolidation strategy, we believe the experience of other countries highlights that implementation could take time. It could also generate significant political controversy, not just within Congress or between Congress and the Administration, but throughout the country. We therefore think that, assuming an agreement between Congress and the President, there is a reasonable chance that it would still take a number of years before the government reaches a fiscal position that stabilizes its debt burden. In addition, even if such measures are eventually put in place, the initiating policymakers or subsequently elected ones could decide to at least partially reverse fiscal consolidation.

In our baseline macroeconomic scenario of near 3% annual real growth, we expect the general government deficit to decline gradually but remain slightly higher than 6% of GDP in 2013. As a result, net general government debt would reach 84% of GDP by 2013. In our macroeconomic forecast’s optimistic scenario (assuming near 4% annual real growth), the fiscal deficit would fall to 4.6% of GDP by 2013, but the U.S.’s net general government debt would still rise to almost 80% of GDP by 2013. In our pessimistic scenario (a mild, one-year double-dip recession in 2012), the deficit would be 9.1%, while net debt would surpass 90% by 2013. Even in our optimistic scenario, we believe the U.S.’s fiscal profile would be less robust than those of other ‘AAA’ rated sovereigns by 2013. (For all of the assumptions underpinning our three forecast scenarios, see “U.S. Risks To The Forecast: Oil We Have to Fear Is...,” March 15, 2011, RatingsDirect.

“Our negative outlook on our rating on the U.S. sovereign signals that we believe there is at least a one-in-three likelihood that we could lower our long-term rating on the U.S. within two years,” Mr. Swann said. “The outlook reflects our view of the increased risk that the political negotiations over when and how to address both the medium- and long-term fiscal challenges will persist until at least after national elections in 2012.”

Some compromise that achieves agreement on a comprehensive budgetary consolidation program--containing deficit-reduction measures in amounts near those recently proposed, and combined with meaningful steps toward implementation by 2013--is our baseline assumption and could lead us to revise the outlook back to stable. Alternatively, the lack of such an agreement or a significant further fiscal deterioration for any reason could lead us to lower the rating.

James Grant: 90 Seconds On The Fed (VIDEO)

Jim Grant tells a short story.

America's Military Expansion Funded by Foreign Central Banks

Preview from "The Global Economic Crisis: The Great Depression of the XXI Century"

To read more, order the book online. Help us spread the word: "like" the book on Facebook and share with your friends!

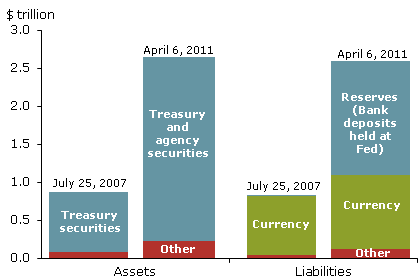

Large amounts of surplus dollars are pouring into the rest of the world.Central banks have recycled these dollar inflows towards the purchase of U.S. Treasury bonds, which serve to finance the federal U.S. budget deficit. Underlying this process is the military character of the U.S. payments deficit and the domestic federal budget deficit. Strange as it may seem and irrational as it would be in a more logical system of world diplomacy, the "dollar glut" is what finances America’s global military build-up. It forces foreign central banks to bear the costs of America’s expanding military empire: effective "taxation without representation".

Keeping international reserves in "dollars" means recycling their dollar inflows to buy U.S. Treasury bills, namely, U.S. government debt issued largely to finance the military.

To date, countries have been as powerless to defend themselves against the fact that this compulsory financing of U.S. military spending is built into the global financial system. Neoliberal economists applaud this as "equilibrium", as if it is part of economic nature and "free markets" rather than bare-knuckle diplomacy wielded with increasing aggressiveness by U.S. officials. The mass media chime in, pretending that recycling the dollar glut to finance U.S. military spending is showing their faith in U.S. economic strength by sending "their" dollars here to "invest". It is as if a choice is involved, not financial and diplomatic compulsion to choose merely between "Yes" (from China, reluctantly), "Yes, please" (from Japan and the European Union) and "Yes, thank you" (from Britain, Georgia and Australia).

It is not "foreign faith in the U.S. economy" that leads foreigners to "put their money here". This is a silly anthropomorphic picture of a more sinister dynamic. The "foreigners" in question are not consumers buying U.S. exports, nor are they private-sector "investors" buying U.S. stocks and bonds. The largest and most important foreign entities putting "their money" here are central banks, and it is not "their money" at all. They are sending back the dollars that foreign exporters and other recipients turn over to their central banks for domestic currency.

When the U.S. payments deficit pumps dollars into foreign economies, these banks are being given little option except to buy U.S. Treasury bills and bonds which the Treasury spends on financing an enormous, hostile military build-up to encircle the major dollar-recyclers: China, Japan and Arab OPEC oil producers. Yet these governments are forced to recycle dollar inflows in a way that funds U.S. military policies in which they have no say in formulating, and which threaten them more and more belligerently. That is why China and Russia took the lead in forming the Shanghai Cooperation Organization (SCO) a few years ago.

In Europe there is a clear awareness that the U.S. payments deficit is much larger than just the trade deficit. The deficit does not stem merely from consumers buying more imports than the United States exports as the financial sector de-industrializes its economy. U.S. imports are now plunging as the economy shrinks and consumers are finding themselves obliged to pay down the debts they have taken on.

Congress has told foreign investors in the largest dollar holder, China, not to buy anything except perhaps used-car dealerships and maybe more packaged mortgages and Fannie Mae stock. This is the equivalent of Japanese investors being steered into spending one billion dollars for the Rockefeller Center, on which they subsequently took a one hundred percent loss, and Saudi investment in Citigroup. That’s the kind of "international equilibrium" that U.S. officials love to see. "CNOOK go home" is the motto when it comes to serious attempts by foreign governments and their sovereign wealth funds (central bank departments trying to figure out what to do with their dollar glut) to make direct investments in American industry.

So we are left with the extent to which the U.S. payments deficit stems from military spending. The problem is not only the war in Iraq, now being extended to Afghanistan and Pakistan. It is the expensive build-up of U.S. military bases in Asian, European, post-Soviet and Third World countries. The Obama administration has promised to make the actual amount of this military spending more transparent. That presumably means publishing a revised set of balance of payments figures as well as domestic federal budget statistics.

The military overhead is much like a debt overhead, extracting revenue from the economy. In this case it is to pay the military-industrial complex, not merely Wall Street banks and other financial institutions. The domestic federal budget deficit does not stem only from "priming the pump" to give away enormous sums to create a new financial oligarchy; it contains an enormous and rapidly growing military component.

So Europeans and Asians see U.S. companies pumping more and more dollars into their economies, not only to buy their exports in excess of providing them with goods and services in return, and not only to buy their companies and "commanding heights" of privatized public enterprises without giving them reciprocal rights to buy important U.S. companies (remember the U.S. turn-down of China’s attempt to buy into the U.S. oil distribution business), and not only to buy foreign stocks, bonds and real estate. The U.S. media somehow neglects to mention that the U.S. Government is spending hundreds of billions of dollars abroad, not only in the Near East for direct combat, but to build enormous military bases to encircle the rest of the world, to install radar systems, guided missile systems and other forms of military coercion, including the "color revolutions" that have been funded and are still being funded all around the former Soviet Union. Pallets of shrink-wrapped hundred-dollar bills, adding up to tens of millions of dollars at a time, have become familiar "visuals" on some TV broadcasts, but the link is not made with U.S. military and diplomatic spending and foreign central-bank dollar holdings, which are reported simply as "wonderful faith in the U.S. economic recovery" and presumably the "monetary magic" being worked by Wall Street’s Tim Geithner at Treasury and "Helicopter Ben" Bernanke at the Federal Reserve.

Here’s the problem: the Coca-Cola Company recently tried to buy China’s largest fruit-juice producer and distributor. China already holds nearly two trillion dollars in U.S. securities, way more than it needs or can use, inasmuch as the United States government refuses to let it buy meaningful U.S. companies. If the U.S. buyout would have been permitted to go through, this would have confronted China with a dilemma:

Choice #1 would be to let the sale go through and accept payment in dollars, reinvesting them in what the U.S. Treasury tells it to do. With U.S. Treasury bonds yielding about one percent, China would take a capital loss on these when U.S. interest rates rise or when the dollar declines, as the United States alone is pursuing expansionary Keynesian policies in an attempt to enable the U.S. economy to carry its debt overhead.

Choice #2 is not to recycle the dollar inflows. This would lead the Renminbi to rise against the dollar, thereby eroding China’s export competitiveness in world markets.

So China chose a third way, which brought U.S. protests. It turned the sale of its tangible company for merely "paper" U.S. dollars, which went with the "choice" to fund further U.S. military encirclement of the SCO. The only people who seem not to be drawing this connection are the American mass media, and hence U.S. public opinion. I can assure you from personal experience, it is being drawn in Europe. (Here’s a good diplomatic question to discuss: Which will be the first European country besides Russia to join the SCO?)

Academic textbooks have nothing to say about how "equilibrium" in foreign capital movements, speculative as well as for direct investment, is infinite as far as the U.S. economy is concerned. The U.S. economy can create dollars freely, now that they no longer are convertible into gold or even into purchases of U.S. companies, inasmuch as America remains the world’s most protected economy. It alone is permitted to protect its agriculture by import quotas, having "grandfathered" these into world trade rules half a century ago. Congress refuses to let "sovereign wealth" funds invest in important U.S. sectors.

So we are confronted with the fact that the U.S. Treasury prefers foreign central banks to keep on funding its domestic budget deficit, which means financing the cost of America’s war in the Near East and encirclement of foreign countries with rings of military bases. The more "capital outflows" U.S. investors spend to buy up foreign economies’ most profitable sectors, where the new U.S. owners can extract the highest monopoly rents, the more funds end up in foreign central banks to support America’s global military build-up. No textbook on political theory or international relations has suggested axioms to explain how nations act in a way so adverse to their own political, military and economic interests. Yet this is just what has been happening for the past generation.

Read more of the chapter by Michael Hudson in the latest book by Global Research, "The Global Economic Crisis: The Great Depression of the XXI Century.

James Grant Lectures Bernanke & Greenspan, Says "QE Is Nothing But Blatant Money Printing!"

This is one of our favorite clips, which we're reposting given these comments from Greenspan over the weekend...

--

Video - Jim Grant with Tom Keene on QE2 - Bloomberg Aired Oct. 8, 2010

Outstanding discussion. Very first question from Tom Keene:

- "Is Alan Greenspan a good guy or a bad guy in your economic pantheon?"

When even cool, calm and collected pundits like Jim Grant fall into murderous paroxysm of blind rage when discussing the Fed, you know it is only a matter of time before the world's most destructive organization is eliminated.

Quote from Grant:

"H. Parker Willis was present at the creation of the Fed, he was one of the draftsmen of the Federal Reserve Act of 1913. Willis was also the first secretary of the Federal Reserve Board -- he knows this institution. He wrote a book in 1936, which was a lamentation about the low estate of Central Banking in America, the Fed had lost its way in 1936. It had opened its doors in 1914 and by 1936 it had eaten the forbidden fruit, it was in the business of guiding the economy, of managing the economy, of manipulating this aggregate and that, and Willis said: "For Pete's sake. You can't know that -- the GDP data are not reliable enough for you to do what you think you are doing." It's a wonderful tract against the tendency of the Fed to do what it has so lethally done to this economy in my opinion, which is to steer us, in the interest of raising the GDP it presses interest rates to zero, pouring out immense volumes of econometric studies in support of this dubious enterprise. Hey Fed: just attend to the dollar, that's it, no inflation, just do one thing! You've heard of mission creep, these guys are the mission creeps par excellence."

SF Fed On Interest Rate Risk, Gold Hits Record, 3-Card Monte Bernanke, Citigroup Profits Fall, Fed Charts, Ron Paul Wins Another GOP Presidential Poll

Federal Reserve charts are inside.

- SF Fed Economist On The Fed's Interest Rate Risk

- FDIC’s Bair: Banks may need new capital buffers

- BRICS Make Move to Replace Dollar

- Texas University Endowment Storing $1 Billion in Gold Bars

- GM shares hit lowest level since IPO

- CNBC Video - Analyst on Citigroup Earnings

- Ben Bernanke as Three Card Monte Dealer - FT

- More Admissions Of Lawbreaking By The Fed? - Denninger

- Crude Falls 3% Despite Saudi Move

- Gold sets another record high

- Dollar recovers after S&P warning

- WTF Was That Flash? - Denninger

- Treasurys rise after S&P cuts U.S. outlook

- Finland, Greece spark new Europe debt fears

- Fed Lies and No One Notices - Let Them Fail

- The world’s 10 most expensive militaries

- Nearly half of supermarket meat is tainted, says new study - NPR

- Texas Rep. Ron Paul wins another presidential straw poll

Shock employment figures: Fewer than 46% of Americans have jobs

The percentage of Americans who have jobs has fallen to the lowest point in three decades and now hovers just above 45 percent of the total population, according to an analysis of labor data published by USA Today.

The report, based on figures provided by the Census and the Bureau of Labor Statistics, showed that at 36.7 percent, Mississippi had the lowest percentage of population working.

Employment rates were also low in California and Arizona, where just over 37 percent had jobs. At 55.8 percent, North Dakota had the highest rate of employed residents.

Overall, 45.4 percent of Americans were working, the lowest since 1983. Employment peaked at 49.3 percent in 2000.

"The bad economy, an aging population and a plateau in women working are contributing to changes that pose serious challenges for financing the nation's social programs," the paper noted.

The news comes at a time when Republican senators have unveiled a plan to raise the retirement age, which would force more Americans to search for jobs that just aren't there.

Freshman tea party-backed Sens. Mike Lee (R-UT) and Rand Paul (R-KY) -- along with Sen. Lindsey Graham (R-SC) -- have joined the call, seeking to raise the retirement age to 70 in the next 20 years.

"If you talk to young people in America - they've already accepted this," Paul said Wednesday.

USA Today featured an interactive chart showing every individual state's total employment figures. Click here for the whole article.

Budget Cuts are Meaningless Without Fed Transparency

However, even the most generous estimate of the spending cut passed this week – $38.5 billion – is a paltry 3.5% of the $1.05 trillion in spending through the next 5 months. This hardly makes a dent in our government's mountain of debt. Even worse than that, the non-partisan Congressional Budget Office (CBO) stripped away the accounting sleights of hand and scored it as only $352 million in cuts, which works out to less than half of one percent of spending. Still, the tiniest cut is better than the massive increases we have become accustomed to in federal budgets.

Of course, our disastrous wars in Afghanistan and Iraq are not even included in this budget as they are considered emergency spending. They constitute $3.3 billion in spending in the same period of time, so they more than cancel out any small cuts the warmongers may crow about.

I voted against the legislation funding government for the remainder of this year, as well as next year's budget because, as in years past, government spends far too much on unconstitutional programs. In spite of any rhetoric about fiscal responsibility, a point three percent (0.3%) cut does not suddenly make the rest of the spending constitutional or responsible. And, if the American people do not continue to hold the politicians' feet to the fire, you can be sure we will see massive spending increases again in the future.

In addition to Congress' spending, many Americans are finally paying attention to the spending done by unelected banking cronies at the Federal Reserve. Recently the Fed was forced to reveal some details of loans given out during the financial crisis of 2008 and they are truly shocking. Matt Taibbi points out in a recent Rolling Stone article that two very well-connected Wall Street wives got together and formed a real estate investment company that garnered $220 million in so-called "loans" (free money) from the Fed. Compare this number to the $352 million in spending cuts the CBO says are in the current budget! A few months later, one of the wives bought a $13.5 million personal residence with her husband, the CEO of Morgan Stanley.

The unelected, unaccountable Fed hands out as much or more money this way as our federal government spends, and yet receives hardly any attention. This is why I believe transparency of the Fed is a critical step to regaining control of our financial situation in this country. We can never get meaningful reforms if all eyes are on the $352 million so-called cuts, and transactions like the $220 million given to Wall Street cronies are done in the shadows. This is why I have reintroduced my Audit the Fed bill to this Congress. HR 1207 is now HR 459 and is essential to true fiscal reform and responsibility.

US Nuclear Plant Without Power After Hit By Tornado – Two Reactors Without Electric — Thousands Of FEMA Workers Deployed

Breaking news coming across the news wires now.

The US Nuclear regulatory commission has reported that an “unusual event” has occurred after a Nuclear Power plant was hit by a tornado in Virginia causing it to lose power. It was the same loss of electricity that caused the Fukushima disaster leading to the meltdown of the reactors.

Updates will be posted here as they come in.

Update: 3:29 PM – The Guardian reports that Thousands of FEMA workers have been deployed to the area and two nuclear reactors are without power running on diesel generators as workers rush to restore power.

Update 1:46 PM EST – Still little news on this beside the news flash. Here is a short write-up from XE.com.

2011-04-18 14:57 (UTC)

WASHINGTON, April 18 (Reuters) – The U.S. nuclear safety regulator said on Monday it was monitoring a Virginia nuclear power plant in southeastern Virginia operated by Dominion Resources after a tornado cut its electrical power.

The Nuclear Regulatory Commission said the plant’s diesel generators and safety systems operated as required, and that plant operators have partially restored off-site power to the plants.

Dominion Virginia Power said the two nuclear reactors at its Surry Power Station shut down automatically when a tornado touched down and cut off an electrical feed to the station. The U.S. south was hit by violent storms over the weekend.

No radiation was released during the storm and shutdown, the NRC and the company said.

Source: XE

Update: 3:29 PM – A few news sites are starting to pick up this story. The Guardian gives us the best update so far.

US tornadoes force shutdown of two nuclear reactors in Virginia

Series of storms that hit states from Oklahoma to North Carolina left at least 45 people dead and caused widespread damage

US tornadoes were most destructive in North Carolina, where Deborah Dulow, above, was left to survey the damage to her father’s house. Photograph: Jim R Bounds/AP

US tornadoes were most destructive in North Carolina, where Deborah Dulow, above, was left to survey the damage to her father’s house. Photograph: Jim R Bounds/APA US nuclear power company has disclosed that one of the tornadoes that hit the US at the weekend, killing at least 45 people and causing widespread damage, forced the shutdown of two of its reactors.

The series of tornadoes that began in Oklahoma late last week barrelled across the country, with North Carolina, where 22 people died, the worst-hit state.

The US nuclear safety regulator said on Mondayit was monitoring the Surry nuclear power plant in Virginia. Dominion Virginia Power said the two reactors shut down automatically when a tornado cut off power to the plant. A backup diesel generator kicked in to cool the fuel. The regulator said no radiation was released and staff were working to restore electricity to the plant.

[...] At a nearby farm, winds were lifting pigs and other animals into the sky. “It looked just like The Wizard of Oz,” McKoy said….. They took shelter in their laundry room. After they emerged, disorientated, they realised that the tornado had turned their mobile home around.

The national weather centre in Raleigh issued detailed descriptions of the tornadoes and their paths of destruction.

One of them, with winds greater than 100mph, destroyed trees, ripped off roofs and wrecked power lines. It hit Shaw University in Raleigh and then strengthened to 110mph. “Snapped trees crashed on to and through numerous homes all along the path. It is in this area where three fatalities were reported when two mobile homes were thrown 30 to 50ft [nine to 15 metres]. Nearly all of the mobile homes in the park sustained some type of damage,” the weather report said.

Thousands of workers from the Federal Emergency Management Agency, the national disaster organisation, are being deployed in North Carolina to assess the damage.

[...]

Source: The Guardian