As Lee Fang writes: The

possibility of an Iran nuclear deal depressing weapons sales was raised

by Myles Walton, an analyst from Germany’s Deutsche Bank, during a

Lockheed earnings call this past January 27. Walton asked Marillyn

Hewson, the chief executive of Lockheed Martin, if an Iran

agreement could “impede what you see as progress in foreign military

sales.” Financial industry analysts such as Walton use earnings calls as

an opportunity to ask publicly-traded corporations like Lockheed about

issues that might harm profitability.

Hewson replied that “that really isn’t coming up,” but stressed

that “volatility all around the region” should continue to bring in new

business. According to Hewson, “A lot of volatility, a lot of

instability, a lot of things that are happening” in both the Middle East

and the Asia-Pacific region means both are “growth areas” for Lockheed

Martin.

The Deutsche Bank-Lockheed exchange “underscores a longstanding

truism of the weapons trade: war — or the threat of war — is good for

the arms business,” says William Hartung, director of the Arms &

Security Project at the Center for International Policy. Hartung

observed that Hewson described the normalization of relations with Iran

not as a positive development for the future, but as an “impediment.”

“And Hewson’s response,” Hartung adds, “which in essence is ‘don’t

worry, there’s plenty of instability to go around,’ shows the perverse

incentive structure that is at the heart of the international arms

market.”

Former managing director of Goldman Sachs – and head of the

international analytics group at Bear Stearns in London (Nomi Prins) –

notes:

Throughout the century that I examined, which began with

the Panic of 1907 … what I found by accessing the archives of each

president is that through many events and periods, particular bankers were in constant communication [with the White House] — not just about financial and economic policy, and by extension trade policy, but also about aspects of World War I, or World War II, or the Cold War,

in terms of the expansion that America was undergoing as a superpower

in the world, politically, buoyed by the financial expansion of the

banking community.

***

In the beginning of World War I, Woodrow Wilson had adopted initially a policy of neutrality. But the Morgan Bank, which was the most powerful bank at the time, and which

wound up funding over 75 percent of the financing for the allied forces

during World War I … pushed Wilson out of neutrality sooner than he might have done, because of their desire to be involved on one side of the war.

Now, on the other side of that war, for example, was the National

City Bank, which, though they worked with Morgan in financing the

French and the British, they also didn’t have a problem working with

financing some things on the German side, as did Chase …

When Eisenhower became president … the U.S. was undergoing this

expansion by providing, under his doctrine, military aid and support to

countries [under] the so-called threat of being taken over by communism

… What bankers did was they opened up hubs, in areas such as

Cuba, in areas such as Beirut and Lebanon, where the U.S. also wanted to

gain a stronghold in their Cold War fight against the Soviet Union. And

so the juxtaposition of finance and foreign policy were very much

aligned.

So in the ‘70s, it became less aligned, because though America was pursuing foreign policy initiatives in terms of expansion, the

bankers found oil, and they made an extreme effort to activate

relationships in the Middle East, that then the U.S.

government followed. For example, in Saudi Arabia and so forth,

they get access to oil money, and then recycle it into Latin American

debt and other forms of lending throughout the globe. So that situation led the U.S. government.

Indeed, JP Morgan also

purchased control over America’s leading 25 newspapers in order to propagandize US public opinion in favor of US entry into World War 1.

And many big banks, in fact,

funded the Nazis.

BBC

reported in 1998:

Barclays Bank has agreed to pay $3.6m to

Jews whose assets were seized from French branches of the British-based

bank during World War II.

***

Chase Manhattan Bank, which has acknowledged seizing

about 100 accounts held by Jews in its Paris branch during World War II

….”Recently unclassified reports from the US Treasury about the

activities of Chase in Paris in the 1940s indicate that the local branch

worked “in close collaboration with the German authorities” in freezing

Jewish assets.

The New York Daily News

noted the same year:

The relationship between Chase and the Nazis apparently

was so cozy that Carlos Niedermann, the Chase branch chief in Paris,

wrote his supervisor in Manhattan that the bank enjoyed “very special esteem” with top German officials and “a rapid expansion of deposits,” according to Newsweek.

Niedermann’s letter was written in May 1942 five months after the

Japanese bombed Pearl Harbor and the U.S. also went to war with Germany.

The BBC

reported in 1999:

A French government commission, investigating the seizure

of Jewish bank accounts during the Second World War, says five American

banks Chase Manhattan, J.P Morgan, Guaranty Trust Co. of New York, Bank of the City of New York and American Express had taken part.

It says their Paris branches handed over to the Nazi occupiers about one-hundred such accounts.

One of Britain’s main newspapers – the Guardian –

reported in 2004:

George Bush’s grandfather [and George H.W. Bush’s

father], the late US senator Prescott Bush, was a director and

shareholder of companies that profited from their involvement with the

financial backers of Nazi Germany.

The Guardian has obtained confirmation from newly discovered files in the US National Archives that a firm of which Prescott Bush was a director was involved with the financial architects of Nazism.

His business dealings … continued until his company’s assets were seized in 1942 under the Trading with the Enemy Act

***

The documents reveal that the firm he worked for, Brown Brothers Harriman (BBH),

acted as a US base for the German industrialist, Fritz Thyssen, who

helped finance Hitler in the 1930s before falling out with him at the

end of the decade. The Guardian has seen evidence that shows Bush was

the director of the New York-based Union Banking Corporation (UBC) that represented Thyssen’s US interests and he continued to work for the bank after America entered the war.

***

Bush was a founding member of the bank [UBC] … The bank was set up by

Harriman and Bush’s father-in-law to provide a US bank for the

Thyssens, Germany’s most powerful industrial family.

***

By the late 1930s, Brown Brothers Harriman, which claimed to be the

world’s largest private investment bank, and UBC had bought and shipped

millions of dollars of gold, fuel, steel, coal and US treasury bonds to

Germany, both feeding and financing Hitler’s build-up to war.

Between 1931 and 1933 UBC bought more than $8m worth of gold, of

which $3m was shipped abroad. According to documents seen by the

Guardian, after UBC was set up it transferred $2m to BBH accounts and

between 1924 and 1940 the assets of UBC hovered around $3m, dropping to

$1m only on a few occasions.

***

UBC was caught red-handed operating a American shell company for the

Thyssen family eight months after America had entered the war and that

this was the bank that had partly financed Hitler’s rise to power.

Indeed, banks often finance

both sides of wars:

And they are one of the main sources of financing

for nuclear weapons.

(The San Francisco Chronicle also documents that leading financiers

Rockefeller, Carnegie and Harriman also funded Nazi eugenics programs … but that’s a story for another day.)

The Federal Reserve and other central banks also

help to start wars by financing them. Thomas Jefferson and the father of free market capitalism, Adam Smith, both noted that the financing wars by banks led to

more – and longer – wars.

And America apparently considers

economic rivalry to be a basis for war, and is

using the military to contain China’s growing economic influence.

Multi-billionaire investor Hugo Salinas Price

says:

What happened to [Libya’s] Mr. Gaddafi, many speculate the real reason he was ousted was that he was planning an all-African currency for conducting trade. The

same thing happened to him that happened to Saddam because the US

doesn’t want any solid competing currency out there vs the dollar. You know Gaddafi was talking about a gold dinar.

Senior CNBC editor John Carney

noted:

Is this the first time a revolutionary group has created a

central bank while it is still in the midst of fighting the entrenched

political power? It certainly seems to indicate how extraordinarily

powerful central bankers have become in our era.

Robert Wenzel of Economic Policy Journal thinks the central banking initiative reveals that foreign powers may have a strong influence over the rebels.

This suggests we have a bit more than a ragtag bunch of rebels

running around and that there are some pretty sophisticated influences.

“I have never before heard of a central bank being created in just a

matter of weeks out of a popular uprising,” Wenzel writes.

Indeed,

many claim that recent wars have really been about bringing all countries

into the fold of Western central banking, and that the wars against Middle Eastern countries are really about

forcing them into the dollar and private central banking.

The most decorated American military man in history said that

war is a racket, and

noted:

Let us not forget the bankers who financed the great war. If anyone had the cream of the profits it was the bankers.

The big banks have also been

laundering money for terrorists. The big bank employee

who blew the whistle on the banks’ money laundering for terrorists and drug cartels says that the giant bank is still aiding terrorists,

saying:

The public needs to know that money is still being

funneled through HSBC to directly buy guns and bullets to kill our

soldiers …. Banks financing … terrorists affects every single American.

He also

said:

It is disgusting that our banks are STILL financing terror on 9/11 2013.

And

see this.

According to the BBC and other sources, Prescott Bush, JP Morgan and

other leading financiers also funded a coup against President Franklin

Roosevelt in an attempt – basically – to implement fascism in the U.S.

See

this,

this,

this and

this.

Kevin Zeese

writes:

Americans are recognizing the link between the

military-industrial complex and the Wall Street oligarchs—a connection

that goes back to the beginning of the modern U.S. empire. Banks have always profited from war because

the debt created by banks results in ongoing war profit for big

finance; and because wars have been used to open countries to U.S.

corporate and banking interests. Secretary of State, William Jennings

Bryan wrote: “the large banking interests were deeply interested in the

world war because of the wide opportunities for large profits.”

Many historians now recognize that a hidden history for U.S. entry into World War I was to protect U.S. investors. U.S. commercial interests had invested heavily in European allies before

the war: “By 1915, American neutrality was being criticized as bankers

and merchants began to loan money and offer credits to the warring

parties, although the Central Powers received far less. Between 1915 and

April 1917, the Allies received 85 times the amount loaned to Germany.”

The total dollars loaned to all Allied borrowers during this period was

$2,581,300,000. The bankers saw that if Germany won, their loans to

European allies would not be repaid. The leading U.S. banker of the

era, J.P. Morgan and his associates did everything they could to push the United States into the war on

the side of England and France. Morgan said: “We agreed that we should

do all that was lawfully in our power to help the Allies win the war as

soon as possible.” President Woodrow Wilson, who campaigned saying he

would keep the United States out of war, seems to have entered the war

to protect U.S. banks’ investments in Europe.

The most decorated Marine in history, Smedley Butler,

described fighting for U.S. banks in many of the wars he fought in. He

said: “I spent 33 years and four months in active military service and

during that period I spent most of my time as a high-class muscle man

for Big Business, for Wall Street and the bankers. In short, I was a

racketeer, a gangster for capitalism. I helped make Mexico and

especially Tampico safe for American oil interests in 1914. I helped

make Haiti and Cuba a decent place for the National City Bank boys to

collect revenues in. I helped in the raping of half a dozen Central

American republics for the benefit of Wall Street. I helped purify

Nicaragua for the International Banking House of Brown Brothers in

1902-1912. I brought light to the Dominican Republic for the American

sugar interests in 1916. I helped make Honduras right for the American

fruit companies in 1903. In China in 1927 I helped see to it that

Standard Oil went on its way unmolested. Looking back on it, I might

have given Al Capone a few hints. The best he could do was to operate

his racket in three districts. I operated on three continents.”

In Confessions of an Economic Hit Man, John Perkins describes how

World Bank and IMF loans are used to generate profits for U.S. business

and saddle countries with huge debts that allow the United States to

control them. It is not surprising that former civilian military leaders

like Robert McNamara and Paul Wolfowitz went on to head the World Bank.

These nations’ debt to international banks ensures they are controlled

by the United States, which pressures them into joining the “coalition

of the willing” that helped invade Iraq or allowing U.S. military bases

on their land. If countries refuse to “honor” their debts, the CIA or

Department of Defense enforces U.S. political will through coups or

military action.

***

More and more people are indeed seeing the connection between corporate banksterism and militarism ….

Indeed,

all wars are bankers’ wars.

War Makes Banks Rich

Wars are the

fastest way for banks to create more debt … and therefore to make more profit. No wonder they love war.

After all, the banking system is founded upon the counter-intuitive but indisputable fact that

banks create loans first, and then create deposits later.

In other words, virtually all money is actually created as debt. For

example, in a hearing held on September 30, 1941 in the House Committee

on Banking and Currency, the Chairman of the Federal Reserve (Mariner S.

Eccles) said:

That is what our money system is. If there were no debts in our money system, there wouldn’t be any money.

And Robert H. Hemphill, Credit Manager of the Federal Reserve Bank of Atlanta, said:

If all the bank loans were paid, no one could have a bank

deposit, and there would not be a dollar of coin or currency in

circulation. This is a staggering thought. We are completely dependent

on the commercial Banks. Someone has to borrow every dollar we have in

circulation, cash or credit. If the Banks create ample synthetic money

we are prosperous; if not, we starve. We are absolutely without a

permanent money system. When one gets a complete grasp of the picture,

the tragic absurdity of our hopeless position is almost incredible, but

there it is. It is the most important subject intelligent persons can

investigate and reflect upon. It is so important that our present

civilization may collapse unless it becomes widely understood and the

defects remedied very soon.

Debt (from the borrower’s perspective) owed to banks is

profit and

income from

the bank’s perspective. In other words, banks are in the business of

creating more debt … i.e. finding more people who want to borrow larger

sums.

Debt is

central to our banking system. Indeed, Federal Reserve chairman Greenspan was so

worried that the U.S. would

pay off it’s debt, that he

suggested tax cuts for the wealthy to

increase the debt.

What does this have to do with war?

War is

the most efficient debt-creation machine. For starters, wars are

very expensive.

For example, Nobel prize winning economist Joseph Stiglitz estimated in 2008 that the Iraq war could cost America up to

$5 trillion dollars. A study by Brown University’s Watson Institute for International Studies says the Iraq war costs could exceed

$6 trillion, when

interest payments to the banks are taken into account.

This is nothing new … but has been going on for thousands of years. As a Cambridge University Press treatise on ancient Athens

notes:

Financing wars is expensive business, and the scope for initiative was regularly extended by borrowing.

So wars have been a huge – and regular – way for banks to create debt

for kings and presidents who want to try to expand their empires.

Major General Smedley Butler – the most decorated Marine in American history – was right when he

said:

Let us not forget the bankers who financed the great war. If anyone had the cream of the profits it was the bankers.

War is also good for banks because a

lot of material,

equipment, buildings and infrastructure get destroyed in war. So

countries go into massive debt to finance war, and then borrow a ton

more to rebuild.

The advent of central banks hasn’t changed this formula.

Specifically, the big banks (“primary dealers”) loan money to the Fed,

and

charge interest for the loan.

So when a nation like the U.S. gets into a war, the Fed pumps out

money for the war effort based upon loans from the primary dealers, who

make a killing in interest payments from the Fed.

War Is Horrible for the American People

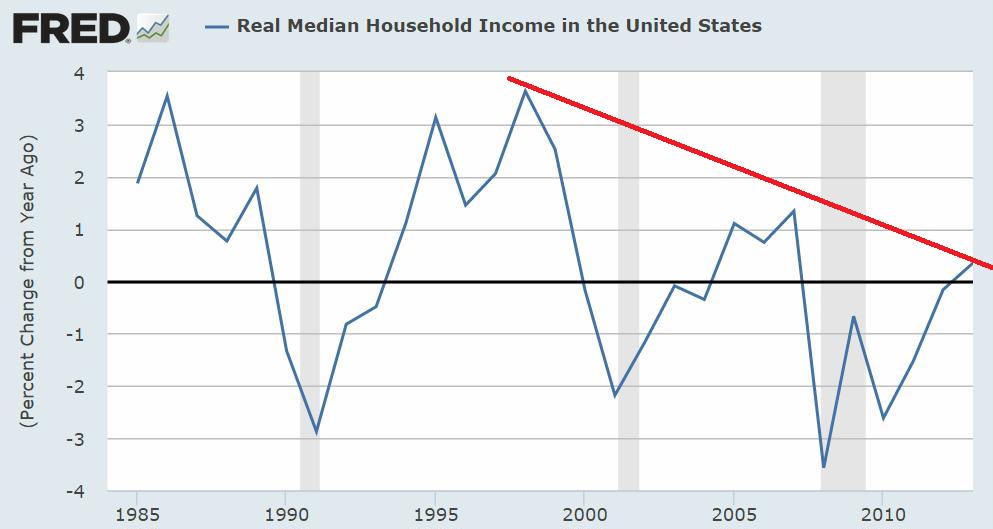

Top economists say that war is

destroying our economy. But war is

great for the

super-elites … so they want to keep it going.

And America’s never-ending wars are

hurting our national security.

Never-ending wars are also

destroying our freedom. The Founding Fathers

warned against standing armies, saying that they destroy freedom. (

update).

Perversely, our government – which is a

wholly-owned subsidiary of the big banks – treats

anti-war sentiment – or

protest of big banks (

and here) – as terrorism.

Casualties were more pronounced in European and Asian markets.

Casualties were more pronounced in European and Asian markets.

These are the annual phantom jobs added to the BLS calculations since 2008:

These are the annual phantom jobs added to the BLS calculations since 2008:

A bag cost $6.98. It had been this price for as long as I can

remember. This week I saw the price was $6.58 and thought to myself,

Wal-Mart really does lower prices. Then I picked up the bag. It was

different. It seemed smaller, but I couldn’t tell for sure. I brought

the new bag to work this morning and compared it to the old bag. The new

bag was only 12 ounces, while the old bag was 16 ounces.

A bag cost $6.98. It had been this price for as long as I can

remember. This week I saw the price was $6.58 and thought to myself,

Wal-Mart really does lower prices. Then I picked up the bag. It was

different. It seemed smaller, but I couldn’t tell for sure. I brought

the new bag to work this morning and compared it to the old bag. The new

bag was only 12 ounces, while the old bag was 16 ounces.