Among activists one often finds an aversion to even thinking about

money. Associating it with the opponent — who has lots of it —

they try to do without money themselves. Often, for as long as they

can, they try to organize and resist without it, until burning out,

quitting and getting into a different line of work just to keep up on

rent. But, as the 19th-century U.S. populist movement recognized,

money is also a battleground. Today, as a new wave of sophisticated

digital currencies are beginning to arise, this is perhaps more true

than ever before.

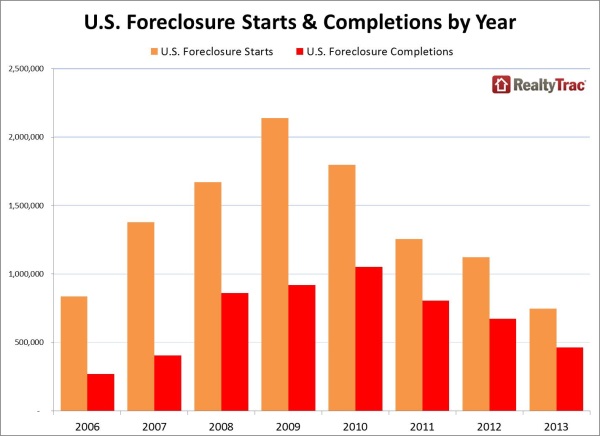

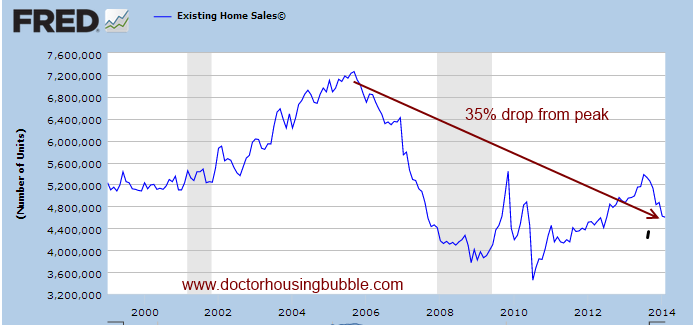

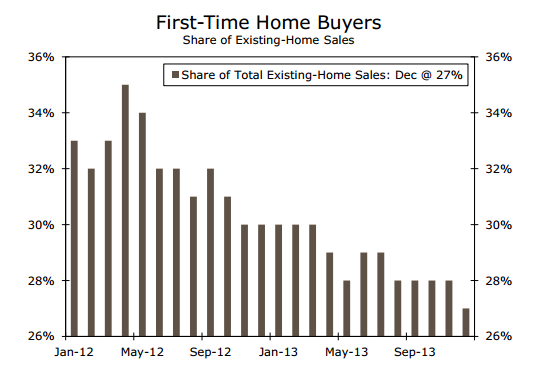

Bitcoin (the open-source software and peer-to-peer network) and

bitcoin (the currency) first appeared in early 2009 — just after

the housing bubble burst. It was heavily promoted by a tech-savvy,

anti-establishment, libertarian community concerned with the power of

big banks and government regulation. Critics have dismissed Bitcoin

as being “

by

the privileged, for the privileged,” while defenders have

claimed with an equal lack of subtlety that it is somehow

“

post-privilege”

altogether. Regardless of the label, however, Bitcoin and other

cryptocurrency platforms like it aren’t going away, and they are

poised to become increasingly disruptive.

To understand why, I turned to Devin Balkind, founder and director

of

Sarapis, which promotes

the use of free/libre/open-source software among non-profits and

popular movements. He has recently written (and is continuing to

write) a public working paper on cryptocurrency, “

Finance

Without Force.” Last year,

we

spoke about the role of open-source tools

in the Occupy Sandy relief effort, in which he played a leading

role. Before that, he had the distinction of being the first person

to tell me about cryptocurrency in the first place, insisting that

this was something I should be paying attention to. It has taken a

while, but I am finally coming back to him for more.

What do social justice activists need to know about

crypocurrency?

Cryptocurrency is open-source money. It lowers the cost of

producing a means of exchange — a money system — down to almost

zero. That means it’s easier than ever to organize alternative

monetary systems. Some activists know about time-banking and mutual

credit systems. Cryptocurrency makes it possible for people to turn

the hours or credits from systems like that into money that can

easily be sent around the world or spent at a local store. It

completely changes what’s possible from the perspective of

solidarity economics.

Where does the “crypto” come in? What role does

cryptography play, and why is it so important?

The primary challenge with creating cash is that you have to

produce a medium of exchange that can’t be spent more than once. If

you could simply photocopy a dollar bill to make more cash, the U.S.

monetary system wouldn’t work. The government uses security

features such as special paper, ink, designs and holograms to prevent

people from “double spending” cash. A unit of cryptocurrency, on

the other hand, is just a string of characters — letters, numbers,

symbols. This actually represents a “private key,” and when you

share it with someone, you give them the ability to upload it to the

network for authentication. Through a process of cryptography, every

transaction is checked against a public ledger on a peer-to-peer

network. If it’s illegitimate the transaction doesn’t execute.

What will it take to make cryptocurrency work in ways that

are more democratic and just than the economy we already have?

The existence of strong cryptocurrencies is already making the

economy more democratic simply by giving people a choice when it

comes to the type of money they want to use. Many people take for

granted that there is only one type of money used in the United

States, but this wasn’t always the case. Scrip, bank notes,

precious metals, whiskey and livestock have all been popular

currencies in the United States over the past 200 years. While these

might not seem like good currencies from a modern perspective, they

all made it possible for people without access to official currency

to trade and make deals with each other. From my perspective, that’s

precisely what we need today: more ways to exchange with and reward

people. Cryptocurrency makes that possible today, just as barter or

using silver made it possible 100 years ago. Cryptocurrency can be

money by the people and for the people.

A more open market doesn’t necessarily mean

democracy. It

has been observed, for instance, that many of those benefitting

most from cryptocurrencies are those who already have high-level

technical knowledge and lots of conventional capital to invest. Won’t

this just deepen the inequality we already have, while perhaps also

weakening the conventional social safety net? How can those most left

behind in the current system use cryptocurrencies to build power?

Yes, it’s true that most cryptocurrencies are being deployed by

privileged technologists, but so were websites in the 1990s, and I

think we can all agree that the Internet has been a positive

development for humanity. Over time these technologies democratize.

Cryptocurrencies, for instance, could fuel an underground economy in

which vendors can accept substantially lower prices for their goods

and services because they don’t report their transactions as

commercial activity and thus deny people consumers protections people

often expect from conventional transactions. For example, if you buy

a cookie from me with U.S. dollars and it gets you sick, you can sue

me, but if you buy it with bitcoin, I can deny the transaction ever

took place and make it very difficult for you to establish who is

liable and for what.

Does that type of scenario create more or less inequality? On one

hand prices are being reduced, enabling people with less to get more,

but on the other hand it creates a lot of potential for abuse because

of a lack of consumer protections. Indeed, it’s not hard to image a

dystopian future in which two separate economies co-exist: one for

the rich who use official currencies, and have consumer protections,

and one for everyone else who use alternative methods of exchange and

have fewer protections. In general, I think more choices are better

and that unregulated commerce, grassroots businesses and alternative

exchange practices are a great way for people left behind in the

current system to build their personal and communal power.

I hear a lot of talk about using cryptocurrency to bring

access to financing to under-banked communities. Is it hard to

get a cryptocurrency adopted? To what extent is this a community

organizing challenge?

It’s definitely hard to get a cryptocurrency adopted. Bitcoin

didn’t become popular just magically. People deliberately organized

an online community with the intention of making it popular; there

were forums, listservs, in-person meetups and apps built for the sole

purpose of spreading Bitcoin. One such app was the Bitcoin “faucet,”

which gave people tiny amounts of bitcoin so they could experience

it. The person who created that ultimately became one of the first

leaders of the Bitcoin Foundation — which shows how important

community engagement is for a project like this. But this is nothing

new. Ask Paul Glover — the inventor of Ithaca Hours time-banking

credits — what his secret to success was, and he’ll tell you the

key is relentless organizing. He’ll tell you that he spent a decade

calling businesses every day to discuss with them how they could meet

their needs without using U.S. dollars. For me, organizing

alternative money systems feels like a very natural and practical way

for social justice activists to help the communities in which they

live in material ways.

What particular examples of cyptocurrencies in action are

you most interested in?

First of all, we need to give Bitcoin its due credit. It went from

being worth pennies to hundreds of dollars in five years. Without

Bitcoin we wouldn’t be talking about cryptocurrency — so I’m

still very interested in it’s proliferation and success. People are

beginning to create all types of interesting “altcoins,” which

are modified Bitcoin software deployments that run on independent

networks, and have their own configurations and market values. I

really like

Devcoin, which

could theoretically fund lots of open source software production,

and

Permacredits, which

propose a way for people to invest in permaculture projects.

Maza

Coin is now the official currency of the Traditional Lakota

Nation, which has the potential to be really historic. The idea of

giving these “altcoins” national identies is really catching on,

with

dozens

of “national altcoins”

now in existence.

The other really interesting development that’s slowly maturing

is that people are beginning to use cryptocurrency’s components to

do things other than mere “currency.” The most promising of those

projects is Ethereum, a platform for coding cryptographically secured

contracts. The implications are immense when you consider how much of

our society depends on contracts — corporations, constitutions,

financial securities, laws, even games. Ethereum is being designed to

give us the ability to create machine-readable and executable

contracts that we can generate quickly, easily and at near zero cost,

and administered not by bureaucracies but by computers. People who

are interested should check out

the

project website. But first, they should read

your

article about it on Al

Jareeza.

It’s striking to me that enthusiasts describe

cryptocurrency as a “space” and an “ecosystem,” when it seems

so clearly divorced from physical space and ecology. But there has

also been discussion about usingcryptocurrencies to change how

we govern natural resources. Do you think they could help fight

climate change, for instance?

Yes — though in ways we haven’t thought of yet. Right now

groups could get funding through cryptocurrency

communities.

Dogecoin, for

instance, leveraged a meme to create a popular cryptocurrency, and

then used that popularity to fund do-good projects that got their

community excited, which then resulted in even higher values for

dogecoins. I also think we’ll see institutions that exist to

maintain common assets like art museums and land trusts figure out

how to generate valuable currencies that they’ll be able to use to

fund projects that align with their interests and support local

economies. While having art museums become cryptocurrency banks might

not sound revolutionary, it’s an example of how we can create money

systems around the resources we value most, rather than around

government fiat. In the future, systems like Ethereum will create

opportunities to rewrite how society operates. That process will

present a historic opportunity for laws to be changed. Will the

social justice activists be driving that change or will they be

hiding from it?

So this is really about power.

Whenever we talk about money we’re also talking about power. If

we want to focus solely on cryptocurrency, we’re talking about the

ability of normal people to take control over money, to make it their

own, to use it as a tool to better organize their communities and

meet their needs. If we expand the conversation to focus on

crypto-contracts, we’re also talking about the “refactoring” of

our society into something that can be read and processed by

machines. Cryptocurrency and crypto-contracts go hand in hand — so

yes, we’re talking about a lot more than money. We’re talking

about a machine-readable society and potentially the biggest shift in

law since the advent of lawyers. Society is poised to remake

itself.

What’s the best way for people to start learning more

about this scene and become involved?

There are lot of news sites out there for

cryptocurrency.

CoinDesk is

a good one. So is the

Bitcoin

subreddit. If you’re in New York City, you can go to an event

at the

Bitcoin Center,

but if hanging with libertarian men isn’t your idea of fun you

might not want to try that out. I highly recommend reading

Hayek’s

Denationalization

of Money for some economic, philosophical and

historical context. It was written in the 1970s and is a good

reminder that people have been thinking seriously about alternative

monetary systems for a long time, and that there is a lot of

knowledge already out there about how these systems could work. Read

part 8, “Putting Private Token Money Into Circulation,” for a

pretty simple plan for how to operate your own currency. Remarkable

stuff.

Remarkable, perhaps, but also profoundly destabilizing. It

sounds to me like we’re talking about not guaranteed liberation but

a new battleground, and the outcome will depend on who fights and

how.

I urge activists to think about cryptocurrency as a set of new

organizing tools — tools that the social justice community hasn’t

really begun to use. But when it does, it will find them quite

powerful on the battlegrounds on which it fights. Crypto-contracts

are also a tool, and with even wider implications because their

adoption will create new types of interactions, entities and

institutions. We’re still in the early days with these

technologies, but I urge people to start learning about them now so

they’re prepared to take advantage of the opportunities these tools

will surely create.

Nathan Schneider is an editor of Waging

Nonviolence. His first two books, both published in 2013 by

University of California Press, are Thank

You, Anarchy: Notes from the Occupy Apocalypse and God

in Proof: The Story of a Search from the Ancients to the Internet.

He has written about religion, reason and violence for publications

including The Nation, The New York

Times, Harper’s, Commonweal,Religion

Dispatches, AlterNet and others. He is also an editor

at Killing the

Buddha. Visit his website at TheRowBoat.com.

**This article originally appeared at WagingNonViolence.org,

an outspoken voice for peaceful change in our violent world.

Click here to

support their noble efforts.**

Delivered by The

Daily Sheeple

![General strike. Barcelona, March 2012. [Julien Lagarde/Flickr]](http://jpg.euractiv.com/files/styles/x-large/public/general_strike._barcelona_march_2012.jpg?itok=LZnu7q1y)