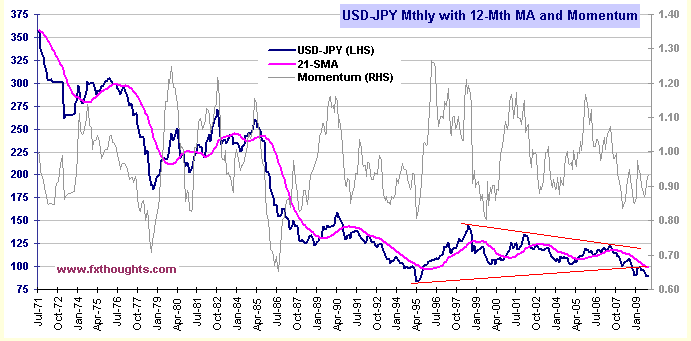

The U.S. dollar index /quotes/comstock/11j!i:dxy0 (DXY 75.84, +0.36, +0.48%) rose to 75.579, up from 75.480 in North American trade late Thursday after sliding to a series of 14-month lows earlier in the week.

The dollar bought 91.10 yen, up from 90.59 yen. The euro traded at $1.4913 versus the dollar, down slightly from $1.4933 after failing so far to breach the psychologically important $1.50 level.

The U.S. dollar also bought 1.0330 Canadian dollars, little changed from 1.0333 Canadian dollars late Thursday.

But the greenback slipped against the British pound, which was at $1.6315, up from $1.6270.

The greenback lost ground to the Australian dollar, with the Aussie rising to $0.9219, up from $0.9201.

The battered pound was the biggest winner, continuing to power higher versus the euro and the greenback a day after a Bank of England policy maker signaled satisfaction with the impact of the central bank's quantitative-easing strategy. Read more on pound.

The British pound gained ground versus the dollar rising to $1.6315, up from $1.6270 Thursday. The euro slipped 0.5% versus sterling to 91.40 pence.

Traders said the remarks by Paul Fisher, the bank's director of markets and member of the Monetary Policy Committee, were sufficient to trigger an explosive round of short covering. U.S. Commodity Futures Trading Commission data released last week showed a historic build-up of short positions against British pound futures, noted analysts at Brown Brothers Harriman.

"The fundamentals for the pound are still negative, with interest rate differentials favoring other currencies," they wrote. "Next week's minutes of the Bank of England meeting may also reinforce the fragile nature of the economic recovery, and the likelihood of rates remaining at this low level for some time."

Others cautioned that betting against the pound in the midst of a run of unexpectedly strong third-quarter earnings report by major banks could prove perilous.

"We would caution against being short GBP [selling the British pound] when U.S. bank earnings are again generally beating expectations, as markets treat GBP as a proxy for the performance of the financial sector," said Adam Cole, global head of FX strategy at RBC Capital Markets in London.

"Our short-term models also continue to show GBP heavily oversold relative to short rate expectations and bank stocks, consistent with other evidence that short-GBP is a seriously overcrowded trade currently," he wrote in emailed comments.

August trade data for the euro zone showed the 16-nation region swung to a larger-than-expected 4 billion euro ($5.98 billion) deficit with the rest of the world, following a 12.3 billion euro surplus in July. Economists had forecast a 300 million euro deficit. The statistics agency Eurostat said seasonally-adjusted exports fell by 5.8% between July and August, while imports dropped 1.3%.

The figures come amid rising unease among euro-zone officials and businesses over the strength of the euro.

The data "highlight the fact that the external recovery remains fragile and is why the euro's strength is so unwelcome," said Ben May, European economist at Capital Economics. "Nonetheless, the continued weakness of imports should ensure that the external sector boosted [gross domestic product in the third quarter], but this is hardly encouraging."

From a technical standpoint, the euro remains "slightly overbought" versus the dollar, "so perhaps its time to take a breather today," wrote Nicole Elliott, a technical analyst at Mizuho Corporate Bank, adding that "even half-baked stockbrokers are becoming aware of the U.S. dollar's weakness."

Nonetheless, a "weekly close above $1.4800 would confirm that the next leg of the (euro) rally has started," she said.

Meanwhile, the People's Bank of China set the yuan's official rate 6.8270 against the dollar Friday, according to reports, down slightly from 6.8267 Thursday. The yuan is allowed to fluctuate on 0.5% on either side of the official daily rate.

China's foreign-exchange policy risks "unwinding" some of the progress made in reducing global trade imbalances during the financial crisis, the U.S. Treasury said Thursday in its latest report on foreign-exchange trading.

But the Treasury repeated its previous finding that China was not formally manipulating its currency. See full story on U.S. views on the yuan policy.