Alex Jones talks with economic expert Max Keiser and model/activist Ancilla Tilia about the current world trends.

Friday, February 19, 2016

Gov’t Bankster Wants To Kill Cash

Alex Jones discusses the globalist bankster plan to destroy cash and move everyone over to electronic transactions.

Hungary Central Bank Stockpiles Guns, Bullets Citing “Terror Risk”

Hungary’s central bank, already facing criticism for a spending spree

ranging from real estate to fine art, is now beefing up its security

force, citing Europe’s migrant crisis and potential bomb threats among

the reasons.

The National Bank of Hungary bought 200,000 rounds of live ammunition and 112 handguns for its security company, according to documents posted on a website for public procurements.

Additional protection is needed due to the rise of “international security risks” including bomb and terror threats and migration, central bank Governor Gyorgy Matolcsy said in a written response to a lawmaker who asked about the purchases, posted on Parliament’s website Feb. 17. The central bank’s assumption of the role of financial regulator and the related increase in the number of its properties also contributed to the need for further defenses, he said.

The security measures added to public scrutiny

of the running of the bank, which under Matolcsy earmarked 200 billion

forint ($718 million) to set up foundations to teach alternatives to

what he called “outdated neoliberal” economics. Another $108 million

fund used for buying fine art including a painting by Titian also drew

criticism from opposition parties, as did a series of investments in

office buildings and villas.

Matolcsy, an ally of Prime Minister Viktor Orban, has argued the central bank has the right to spend its profits, which have been boosted in recent years as the weaker forint increased the value of its foreign currency reserves. The central bank has traditionally paid its profit into the government budget, while taxpayers are required to cover any losses by the regulator.

SOURCE

The National Bank of Hungary bought 200,000 rounds of live ammunition and 112 handguns for its security company, according to documents posted on a website for public procurements.

Additional protection is needed due to the rise of “international security risks” including bomb and terror threats and migration, central bank Governor Gyorgy Matolcsy said in a written response to a lawmaker who asked about the purchases, posted on Parliament’s website Feb. 17. The central bank’s assumption of the role of financial regulator and the related increase in the number of its properties also contributed to the need for further defenses, he said.

Matolcsy, an ally of Prime Minister Viktor Orban, has argued the central bank has the right to spend its profits, which have been boosted in recent years as the weaker forint increased the value of its foreign currency reserves. The central bank has traditionally paid its profit into the government budget, while taxpayers are required to cover any losses by the regulator.

SOURCE

Sports Authority to Close All Texas Stores, 140 Nationwide Over Next 3 Months

DENVER

– Sports Authority is closing three Colorado stores, including its

flagship store at the iconic Sports Castle in the Golden Triangle area.

A source close to the sporting goods company’s financials confirmed with Denver7 that 140 stores will be closing nationwide over the next three months.

The S.A. Elite store at the Twenty Ninth Street Mall in Boulder will close, as will the Greenwood Village Sports Authority at 9000 East Peakview Avenue.

Citing a Bloomberg news article, the Denver Post reported that Sports Authority is on the brink of bankruptcy. The source would not confirm a report out of Dallas that all 25 stores in Texas will close.

The Sports Castle at 10th Avenue and Broadway was built in 1926 and designed by Jules Jacques Benois Benedict, who also designed the Washington Park Boating Pavilion in 1913. The castle was home to a Chrysler dealership and Gart Sports, before Sports Authority merged with Gart.

Despite the history of the building, it is not currently designated a Denver landmark.

“People are always surprised to find out that there’s a lot of really great, classic, historic buildings in Denver that are not landmarked,” said Annie Levinsky, the executive director of Historic Denver. “Less than four percent of our city is a landmark or in a landmark district.”

According to the city’s planning and development office, the Sports

Castle could be designated a landmark at the request of the owner or if

three Denver residents submit an application and pay the $875 fee. The

ultimate landmark designation would need to be approved by Denver City

Council.

“We see it happen all over lower downtown; old warehouses are now lofts, sometimes old residential buildings become commercial. So for a building to survive for years and years, it’s going to change uses, and that’s pretty normal. We hope that this building would just be another candidate for that kind of use,” said Levinsky.

Becoming a landmark could give the owner some incentives for redeveloping the inside. It would also create roadblocks for getting rid of the castle façade or demolishing the building.

Mark Sidell, president of Gart Properties, which owns the Sports Castle and the adjacent parking structure where the SNIAGRAB sale normally happens, told Denver7 that he recognizes it’s a special property, but would not reveal what the future plans hold for the building.

Despite the pending closures of three out of every 10 Sports Authority stores, the company’s website lists more than 2,500 open jobs for stores across the nation. It also shows eight distribution jobs and 25 corporate jobs.

Sports Authority still has the naming rights to Mile High Stadium. AsDenver7 first reported, marketing experts believe the deal is still beneficial for the company. Since it took over naming rights from Invesco in 2011, Sports Authority has paid about $16 million. It owes $19 million more through August 2020. The company made its 2015 payment of $3.4 million. The next payment is due in August and is about $3.6 million.

The Denver assessor lists the market value of the Sports Castle and the adjacent parking structure at $3.6 million.

A source close to the sporting goods company’s financials confirmed with Denver7 that 140 stores will be closing nationwide over the next three months.

The S.A. Elite store at the Twenty Ninth Street Mall in Boulder will close, as will the Greenwood Village Sports Authority at 9000 East Peakview Avenue.

Citing a Bloomberg news article, the Denver Post reported that Sports Authority is on the brink of bankruptcy. The source would not confirm a report out of Dallas that all 25 stores in Texas will close.

The Sports Castle at 10th Avenue and Broadway was built in 1926 and designed by Jules Jacques Benois Benedict, who also designed the Washington Park Boating Pavilion in 1913. The castle was home to a Chrysler dealership and Gart Sports, before Sports Authority merged with Gart.

Despite the history of the building, it is not currently designated a Denver landmark.

“People are always surprised to find out that there’s a lot of really great, classic, historic buildings in Denver that are not landmarked,” said Annie Levinsky, the executive director of Historic Denver. “Less than four percent of our city is a landmark or in a landmark district.”

“We see it happen all over lower downtown; old warehouses are now lofts, sometimes old residential buildings become commercial. So for a building to survive for years and years, it’s going to change uses, and that’s pretty normal. We hope that this building would just be another candidate for that kind of use,” said Levinsky.

Becoming a landmark could give the owner some incentives for redeveloping the inside. It would also create roadblocks for getting rid of the castle façade or demolishing the building.

Mark Sidell, president of Gart Properties, which owns the Sports Castle and the adjacent parking structure where the SNIAGRAB sale normally happens, told Denver7 that he recognizes it’s a special property, but would not reveal what the future plans hold for the building.

Despite the pending closures of three out of every 10 Sports Authority stores, the company’s website lists more than 2,500 open jobs for stores across the nation. It also shows eight distribution jobs and 25 corporate jobs.

Sports Authority still has the naming rights to Mile High Stadium. AsDenver7 first reported, marketing experts believe the deal is still beneficial for the company. Since it took over naming rights from Invesco in 2011, Sports Authority has paid about $16 million. It owes $19 million more through August 2020. The company made its 2015 payment of $3.4 million. The next payment is due in August and is about $3.6 million.

The Denver assessor lists the market value of the Sports Castle and the adjacent parking structure at $3.6 million.

Bix Weir – The Bubble is Too Big… Key Your Eye on Deutsche Bank

from Financial Survival Network

Bix Weir

believes that the Good Guys have been trying to take the system down

and pretty soon they’ll be successful. Many dismiss Bix’s theories, but

the way things look now, he might just be right. Bix says no more

bailouts for the banks and that means disaster could be lurking around

the corner. He sees the recent statements about eliminating the 500 Euro

Note and the 100 Dollar Note as confirmation that things can’t go on

much longer. Bix says to watch out for Deutsche Bank and Royal Bank of

Scotland. But is he right?

Bix Weir

believes that the Good Guys have been trying to take the system down

and pretty soon they’ll be successful. Many dismiss Bix’s theories, but

the way things look now, he might just be right. Bix says no more

bailouts for the banks and that means disaster could be lurking around

the corner. He sees the recent statements about eliminating the 500 Euro

Note and the 100 Dollar Note as confirmation that things can’t go on

much longer. Bix says to watch out for Deutsche Bank and Royal Bank of

Scotland. But is he right?

Click Here to Listen to the Audio

Click Here to Listen to the Audio

Bix Weir

believes that the Good Guys have been trying to take the system down

and pretty soon they’ll be successful. Many dismiss Bix’s theories, but

the way things look now, he might just be right. Bix says no more

bailouts for the banks and that means disaster could be lurking around

the corner. He sees the recent statements about eliminating the 500 Euro

Note and the 100 Dollar Note as confirmation that things can’t go on

much longer. Bix says to watch out for Deutsche Bank and Royal Bank of

Scotland. But is he right?

Bix Weir

believes that the Good Guys have been trying to take the system down

and pretty soon they’ll be successful. Many dismiss Bix’s theories, but

the way things look now, he might just be right. Bix says no more

bailouts for the banks and that means disaster could be lurking around

the corner. He sees the recent statements about eliminating the 500 Euro

Note and the 100 Dollar Note as confirmation that things can’t go on

much longer. Bix says to watch out for Deutsche Bank and Royal Bank of

Scotland. But is he right? Click Here to Listen to the Audio

Click Here to Listen to the AudioExpanded Version: The Us Economy Has Not Recovered and Will Not Recover

Expanded Version: The US Economy Has Not Recovered And Will Not Recover

Paul Craig Roberts

The US economy died when middle class jobs were offshored and when the financial system was deregulated.

Jobs offshoring benefitted Wall Street, corporate executives, and shareholders, because lower labor and compliance costs resulted in higher profits. These profits flowed through to shareholders in the form of capital gains and to executives in the form of “performance bonuses.” Wall Street benefitted from the bull market generated by higher profits.

However, jobs offshoring also offshored US GDP and consumer purchasing power. Despite promises of a “New Economy” and better jobs, the replacement jobs have been increasingly part-time, lowly-paid jobs in domestic services, such as retail clerks, waitresses and bartenders.

The offshoring of US manufacturing and professional service jobs to Asia stopped the growth of consumer demand in the US, decimated the middle class, and left insufficient employment for college graduates to be able to service their student loans. The ladders of upward mobility that had made the United States an “opportunity society” were taken down in the interest of higher short-term profits.

Without growth in consumer incomes to drive the economy, the Federal Reserve under Alan Greenspan substituted the growth in consumer debt to take the place of the missing growth in consumer income. Under the Greenspan regime, Americans’ stagnant and declining incomes were augmented with the ability to spend on credit. One source of this credit was the rise in housing prices that the Federal Reserves low inerest rate policy made possible. Consumers could refinance their now higher-valued home at lower interest rates and take out the “equity” and spend it.

The debt expansion, tied heavily to housing mortgages, came to a halt when the fraud perpetrated by a deregulated financial system crashed the real estate and stock markets. The bailout of the guilty imposed further costs on the very people that the guilty had victimized.

Under Fed chairman Bernanke the economy was kept going with Quantitative Easing, a massive increase in the money supply in order to bail out the “banks too big to fail.” Liquidity supplied by the Federal Reserve found its way into stock and bond prices and made those invested in these financial instruments richer. Corporate executives helped to boost the stock market by using the companies’ profits and by taking out loans in order to buy back the companies’ stocks, thus further expanding debt.

Those few benefitting from inflated financial asset prices produced by Quantitative Easing and buy-backs are a much smaller percentage of the population than was affected by the Greenspan consumer credit expansion. A relatively few rich people are an insufficient number to drive the economy.

The Federal Reserve’s zero interest rate policy was designed to support the balance sheets of the mega-banks and denied Americans interest income on their savings. This policy decreased the incomes of retirees and forced the elderly to reduce their consumption and/or draw down their savings more rapidly, leaving no safety net for heirs.

Using the smoke and mirrors of under-reported inflation and unemployment, the US government kept alive the appearance of economic recovery. Foreigners fooled by the deception continue to support the US dollar by holding US financial instruments.

The official inflation measures were “reformed” during the Clinton era in order to dramatically understate inflation. The measures do this in two ways. One way is to discard from the weighted basket of goods that comprises the inflation index those goods whose price rises. In their place, inferior lower-priced goods are substituted.

For example, if the price of New York strip steak rises, round steak is substituted in its place. The former official inflation index measured the cost of a constant standard of living. The “reformed” index measures the cost of a falling standard of living.

The other way the “reformed” measure of inflation understates the cost of living is to discard price rises as “quality improvements.” It is true that quality improvements can result in higher prices. However, it is still a price rise for the consumer as the former product is no longer available. Moreover, not all price rises are quality improvements; yet many prices rises that are not can be misinterpreted as “quality improvements.”

These two “reforms” resulted in no reported inflation and a halt to cost-of-living adjustments for Social Security recipients. The fall in Social Security real incomes also negatively impacted aggregate consumer demand.

The rigged understatement of inflation deceived people into believing that the US economy was in recovery. The lower the measure of inflation, the higher is real GDP when nominal GDP is deflated by the inflation measure. By understating inflation, the US government has overstated GDP growth.

What I have written is easily ascertained and proven; yet the financial press does not question the propaganda that sustains the psychology that the US economy is sound. This carefully cultivated psychology keeps the rest of the world invested in dollars, thus sustaining the House of Cards.

John Maynard Keynes understood that the Great Depression was the product of an insufficiency of consumer demand to take off the shelves the goods produced by industry. The post-WW II macroeconomic policy focused on maintaining the adequacy of aggregate demand in order to avoid high unemployment. The supply-side policy of President Reagan successfully corrected a defect in Keynesian macroeconomic policy and kept the US economy functioning without the “stagflation” from worsening “Philips Curve” trade-offs between inflation and employent. In the 21st century, jobs offshoring has depleted consumer demand’s ability to maintain US full employment.

The unemployment measure that the presstitute press reports is meaningless as it counts no discouraged workers, and discouraged workers are a huge part of American unemployment. The reported unemployment rate is about 5%, which is the U-3 measure that does not count as unemployed workers who are too discouraged to continue searching for jobs.

The US government has a second official unemployment measure, U-6, that counts workers discouraged for less than one-year. This official rate of unemployment is 10%.

When long term (more than one year) discouraged workers are included in the measure of unemployment, as once was done, the US unemployment rate is 23%. (See John Williams, shadowstats.com)

Fiscal and monetary stimulus can pull the unemployed back to work if jobs for them still exist domestically. But if the jobs have been sent offshore, monetary and fiscal policy cannot work.

What jobs offshoring does is to give away US GDP to the countries to which US corporations move the jobs. In other words, with the jobs go American careers, consumer purchasing power and the tax base of state, local, and federal governments. There are only a few American winners, and they are the shareholders of the companies that offshored the jobs and the executives of the companies who receive multi-million dollar “performance bonuses” for raising profits by lowering labor costs. And, of course, the economists, who get grants, speaking engagements, and corporate board memberships for shilling for the offshoring policy that worsens the distribution of income and wealth. An economy run for a few only benefits the few, and the few, no matter how large their incomes, cannot consume enough to keep the economy growing.

In the 21st century US economic policy has destroyed the ability of real aggregate demand in the US to increase. Economists will deny this, because they are shills for globalism and jobs offshoring. They misrepresent jobs offshoring as free trade and, as in their ideology free trade benefits everyone, claim that America is benefitting from jobs offshoring. Yet, they cannot show any evidence whatsoever of these alleged benefits. (See my book, The Failure of Laissez Faire Capitalism and Economic Dissolution of the West.) http://www.amazon.com/Failure-Laissez-Faire-Capitalism/dp/0986036250/ref=sr_1_1?s=books&ie=UTF8&qid=1455746560&sr=1-1&keywords=paul+craig+roberts-the+failure+of+laissez-faire+capitalism

As an economist, it is a mystery to me how any economist can think that a population that does not produce the larger part of the goods that it consumes can afford to purchase the goods that it consumes. Where does the income come from to pay for imports when imports are swollen by the products of offshored production?

We were told that the income would come from better-paid replacement jobs provided by the “New Economy,” but neither the payroll jobs reports nor the US Labor Departments’s projections of future jobs show any sign of this mythical “New Economy.”

There is no “New Economy.” The “New Economy” is like the neoconservatives promise that the Iraq war would be a six-week “cake walk” paid for by Iraqi oil revenues, not a $3 trillion dollar expense to American taxpayers (according to Joseph Stiglitz and Linda Bilmes) and a war that has lasted the entirety of the 21st century to date, and is getting more dangerous.

The American “New Economy” is the American Third World economy in which the only jobs created are low productivity, low paid nontradable domestic service jobs incapable of producing export earnings with which to pay for the goods and services produced offshore for US consumption.

The massive debt arising from Washington’s endless wars for neoconservative hegemony now threaten Social Security and the entirety of the social safety net. The presstitute media are blaming not the policy that has devasted Americans, but, instead, the Americans who have been devasted by the policy.

Earlier this month I posted readers’ reports on the dismal job situation in Ohio, Southern Illinois, and Texas. In the March issue of Chronicles, Wayne Allensworth describes America’s declining rural towns and once great industrial cities as consequences of “globalizing capitalism.” A thin layer of very rich people rule over those “who have been left behind”—a shrinking middle class and a growing underclass. According to a poll last autumn, 53 percent of Americans say that they feel like a stranger in their own country.

Most certainly these Americans have no political representation. As Republicans and Democrats work to raise the retirement age in order to reduce Social Security outlays, Princeton University experts report that the mortality rates for the white working class are rising. The US government will not be happy until no one lives long enough to collect Social Security.

The United States government has abandoned everyone except the rich.

In the opening sentence of this article, I said that the two murderers of the American economy were jobs offshoring and financial deregulation. Deregulation greatly enhanced the ability of the large banks to financialize the economy. Financialization is the diversion of income streams into debt service. When debt service absorbs a large amount of the available income, the economy experiences debt deflation. The service of debt leaves too little income for purchases of goods and services and prices fall.

Michael Hudson, who I recently wrote about, is the expert on finanialization. His book, Killing the Host, which I recommended to you, tells the complete story. Briefly, financialization is the process by which creditors capitalize an economy’s economic surplus into interest payments to themselves. Perhaps an example would be a corporation that goes into debt in order to buy back its shares. The corporation achieves a temporary boost in its share prices at the cost of years of interest payments that drain the corporation of profits and deflate its share price.

Michael Hudson stresses the conversion of the rental value of real estate into mortgage payments. He emphasizes that classical economists wanted to base taxation not on production, but on economic rent. Economic rent is value due to location or to a monopoly position. For example, beachfront property has a higher price because of location. The difference in value between beachfront and nonbeachfront property is economic rent, not a produced value. An unregulated monopoly can charge a price for a service that is higher than the price that would bring that service unto the market.

The proposal to tax economic rent does not mean taxing you on the rent that you pay your landlord or taxing your landlord on the rent that you pay him such that he ceases to provide the housing. By economic rent Hudson means, for example, the rise in land values due to public infrastructure projects such as roads and subway systems. The rise in the value of land opened by a new road and housing and in commercial space along a new subway line is not due to any action of the property owners. This rise in value could be taxed in order to pay for the project instead of taxing the income of the population in general. Instead, the rise in land values raises appraisals and the amount that creditors are willing to lend on the property. New purchasers and existing owners can borrow more on the property, and the larger mortgages divert the increased land valuation into interest payments to creditors. Lenders end up as the major beneficiaries of public projects that raise real estate prices.

Similarly, unless the economy is financialized to such an extent that mortgage debt can no longer be serviced, when central banks lower interest rates property values rise, and this rise can be capitalized into a larger mortgage.

Another example would be property tax reductions and legislation such as California’s Proposition 13 that freeze in whole or part the property tax base. The rise in real estate values that escape taxation are capitalized into larger mortgages. New buyers do not benefit. The beneficiaries are the lenders who capture the rise in real estate prices in interest payments.

Taxing economic rent would prevent the financial system from capitalizing the rent into debt instruments that pay interest to the financial sector. Considering the amount of rents available to be taxed, taxing rents would free production from income and sales taxation, thus lowering consumer prices and freeing labor and productive capital from taxation.

With so much of land rent already capitalized into debt instruments shifting the tax burden to economic rent would be challenging. Nevertheless, Hudson’s analysis shows that financialization, not wage suppression, is the main instrument of exploitation and takes place via the financial system’s conversion of income streams into interest payments on debt.

I remember when mortgage service was restricted to one-quarter of household income. Today mortgage service can eat up half of household income. This extraordinary growth crowds out the production of goods and services as less of household income is available for other purchases.

Michael Hudson and I bring a total indictment of the neoliberal economics profession, “junk economists” as Hudson calls them.

Paul Craig Roberts

The US economy died when middle class jobs were offshored and when the financial system was deregulated.

Jobs offshoring benefitted Wall Street, corporate executives, and shareholders, because lower labor and compliance costs resulted in higher profits. These profits flowed through to shareholders in the form of capital gains and to executives in the form of “performance bonuses.” Wall Street benefitted from the bull market generated by higher profits.

However, jobs offshoring also offshored US GDP and consumer purchasing power. Despite promises of a “New Economy” and better jobs, the replacement jobs have been increasingly part-time, lowly-paid jobs in domestic services, such as retail clerks, waitresses and bartenders.

The offshoring of US manufacturing and professional service jobs to Asia stopped the growth of consumer demand in the US, decimated the middle class, and left insufficient employment for college graduates to be able to service their student loans. The ladders of upward mobility that had made the United States an “opportunity society” were taken down in the interest of higher short-term profits.

Without growth in consumer incomes to drive the economy, the Federal Reserve under Alan Greenspan substituted the growth in consumer debt to take the place of the missing growth in consumer income. Under the Greenspan regime, Americans’ stagnant and declining incomes were augmented with the ability to spend on credit. One source of this credit was the rise in housing prices that the Federal Reserves low inerest rate policy made possible. Consumers could refinance their now higher-valued home at lower interest rates and take out the “equity” and spend it.

The debt expansion, tied heavily to housing mortgages, came to a halt when the fraud perpetrated by a deregulated financial system crashed the real estate and stock markets. The bailout of the guilty imposed further costs on the very people that the guilty had victimized.

Under Fed chairman Bernanke the economy was kept going with Quantitative Easing, a massive increase in the money supply in order to bail out the “banks too big to fail.” Liquidity supplied by the Federal Reserve found its way into stock and bond prices and made those invested in these financial instruments richer. Corporate executives helped to boost the stock market by using the companies’ profits and by taking out loans in order to buy back the companies’ stocks, thus further expanding debt.

Those few benefitting from inflated financial asset prices produced by Quantitative Easing and buy-backs are a much smaller percentage of the population than was affected by the Greenspan consumer credit expansion. A relatively few rich people are an insufficient number to drive the economy.

The Federal Reserve’s zero interest rate policy was designed to support the balance sheets of the mega-banks and denied Americans interest income on their savings. This policy decreased the incomes of retirees and forced the elderly to reduce their consumption and/or draw down their savings more rapidly, leaving no safety net for heirs.

Using the smoke and mirrors of under-reported inflation and unemployment, the US government kept alive the appearance of economic recovery. Foreigners fooled by the deception continue to support the US dollar by holding US financial instruments.

The official inflation measures were “reformed” during the Clinton era in order to dramatically understate inflation. The measures do this in two ways. One way is to discard from the weighted basket of goods that comprises the inflation index those goods whose price rises. In their place, inferior lower-priced goods are substituted.

For example, if the price of New York strip steak rises, round steak is substituted in its place. The former official inflation index measured the cost of a constant standard of living. The “reformed” index measures the cost of a falling standard of living.

The other way the “reformed” measure of inflation understates the cost of living is to discard price rises as “quality improvements.” It is true that quality improvements can result in higher prices. However, it is still a price rise for the consumer as the former product is no longer available. Moreover, not all price rises are quality improvements; yet many prices rises that are not can be misinterpreted as “quality improvements.”

These two “reforms” resulted in no reported inflation and a halt to cost-of-living adjustments for Social Security recipients. The fall in Social Security real incomes also negatively impacted aggregate consumer demand.

The rigged understatement of inflation deceived people into believing that the US economy was in recovery. The lower the measure of inflation, the higher is real GDP when nominal GDP is deflated by the inflation measure. By understating inflation, the US government has overstated GDP growth.

What I have written is easily ascertained and proven; yet the financial press does not question the propaganda that sustains the psychology that the US economy is sound. This carefully cultivated psychology keeps the rest of the world invested in dollars, thus sustaining the House of Cards.

John Maynard Keynes understood that the Great Depression was the product of an insufficiency of consumer demand to take off the shelves the goods produced by industry. The post-WW II macroeconomic policy focused on maintaining the adequacy of aggregate demand in order to avoid high unemployment. The supply-side policy of President Reagan successfully corrected a defect in Keynesian macroeconomic policy and kept the US economy functioning without the “stagflation” from worsening “Philips Curve” trade-offs between inflation and employent. In the 21st century, jobs offshoring has depleted consumer demand’s ability to maintain US full employment.

The unemployment measure that the presstitute press reports is meaningless as it counts no discouraged workers, and discouraged workers are a huge part of American unemployment. The reported unemployment rate is about 5%, which is the U-3 measure that does not count as unemployed workers who are too discouraged to continue searching for jobs.

The US government has a second official unemployment measure, U-6, that counts workers discouraged for less than one-year. This official rate of unemployment is 10%.

When long term (more than one year) discouraged workers are included in the measure of unemployment, as once was done, the US unemployment rate is 23%. (See John Williams, shadowstats.com)

Fiscal and monetary stimulus can pull the unemployed back to work if jobs for them still exist domestically. But if the jobs have been sent offshore, monetary and fiscal policy cannot work.

What jobs offshoring does is to give away US GDP to the countries to which US corporations move the jobs. In other words, with the jobs go American careers, consumer purchasing power and the tax base of state, local, and federal governments. There are only a few American winners, and they are the shareholders of the companies that offshored the jobs and the executives of the companies who receive multi-million dollar “performance bonuses” for raising profits by lowering labor costs. And, of course, the economists, who get grants, speaking engagements, and corporate board memberships for shilling for the offshoring policy that worsens the distribution of income and wealth. An economy run for a few only benefits the few, and the few, no matter how large their incomes, cannot consume enough to keep the economy growing.

In the 21st century US economic policy has destroyed the ability of real aggregate demand in the US to increase. Economists will deny this, because they are shills for globalism and jobs offshoring. They misrepresent jobs offshoring as free trade and, as in their ideology free trade benefits everyone, claim that America is benefitting from jobs offshoring. Yet, they cannot show any evidence whatsoever of these alleged benefits. (See my book, The Failure of Laissez Faire Capitalism and Economic Dissolution of the West.) http://www.amazon.com/Failure-Laissez-Faire-Capitalism/dp/0986036250/ref=sr_1_1?s=books&ie=UTF8&qid=1455746560&sr=1-1&keywords=paul+craig+roberts-the+failure+of+laissez-faire+capitalism

As an economist, it is a mystery to me how any economist can think that a population that does not produce the larger part of the goods that it consumes can afford to purchase the goods that it consumes. Where does the income come from to pay for imports when imports are swollen by the products of offshored production?

We were told that the income would come from better-paid replacement jobs provided by the “New Economy,” but neither the payroll jobs reports nor the US Labor Departments’s projections of future jobs show any sign of this mythical “New Economy.”

There is no “New Economy.” The “New Economy” is like the neoconservatives promise that the Iraq war would be a six-week “cake walk” paid for by Iraqi oil revenues, not a $3 trillion dollar expense to American taxpayers (according to Joseph Stiglitz and Linda Bilmes) and a war that has lasted the entirety of the 21st century to date, and is getting more dangerous.

The American “New Economy” is the American Third World economy in which the only jobs created are low productivity, low paid nontradable domestic service jobs incapable of producing export earnings with which to pay for the goods and services produced offshore for US consumption.

The massive debt arising from Washington’s endless wars for neoconservative hegemony now threaten Social Security and the entirety of the social safety net. The presstitute media are blaming not the policy that has devasted Americans, but, instead, the Americans who have been devasted by the policy.

Earlier this month I posted readers’ reports on the dismal job situation in Ohio, Southern Illinois, and Texas. In the March issue of Chronicles, Wayne Allensworth describes America’s declining rural towns and once great industrial cities as consequences of “globalizing capitalism.” A thin layer of very rich people rule over those “who have been left behind”—a shrinking middle class and a growing underclass. According to a poll last autumn, 53 percent of Americans say that they feel like a stranger in their own country.

Most certainly these Americans have no political representation. As Republicans and Democrats work to raise the retirement age in order to reduce Social Security outlays, Princeton University experts report that the mortality rates for the white working class are rising. The US government will not be happy until no one lives long enough to collect Social Security.

The United States government has abandoned everyone except the rich.

In the opening sentence of this article, I said that the two murderers of the American economy were jobs offshoring and financial deregulation. Deregulation greatly enhanced the ability of the large banks to financialize the economy. Financialization is the diversion of income streams into debt service. When debt service absorbs a large amount of the available income, the economy experiences debt deflation. The service of debt leaves too little income for purchases of goods and services and prices fall.

Michael Hudson, who I recently wrote about, is the expert on finanialization. His book, Killing the Host, which I recommended to you, tells the complete story. Briefly, financialization is the process by which creditors capitalize an economy’s economic surplus into interest payments to themselves. Perhaps an example would be a corporation that goes into debt in order to buy back its shares. The corporation achieves a temporary boost in its share prices at the cost of years of interest payments that drain the corporation of profits and deflate its share price.

Michael Hudson stresses the conversion of the rental value of real estate into mortgage payments. He emphasizes that classical economists wanted to base taxation not on production, but on economic rent. Economic rent is value due to location or to a monopoly position. For example, beachfront property has a higher price because of location. The difference in value between beachfront and nonbeachfront property is economic rent, not a produced value. An unregulated monopoly can charge a price for a service that is higher than the price that would bring that service unto the market.

The proposal to tax economic rent does not mean taxing you on the rent that you pay your landlord or taxing your landlord on the rent that you pay him such that he ceases to provide the housing. By economic rent Hudson means, for example, the rise in land values due to public infrastructure projects such as roads and subway systems. The rise in the value of land opened by a new road and housing and in commercial space along a new subway line is not due to any action of the property owners. This rise in value could be taxed in order to pay for the project instead of taxing the income of the population in general. Instead, the rise in land values raises appraisals and the amount that creditors are willing to lend on the property. New purchasers and existing owners can borrow more on the property, and the larger mortgages divert the increased land valuation into interest payments to creditors. Lenders end up as the major beneficiaries of public projects that raise real estate prices.

Similarly, unless the economy is financialized to such an extent that mortgage debt can no longer be serviced, when central banks lower interest rates property values rise, and this rise can be capitalized into a larger mortgage.

Another example would be property tax reductions and legislation such as California’s Proposition 13 that freeze in whole or part the property tax base. The rise in real estate values that escape taxation are capitalized into larger mortgages. New buyers do not benefit. The beneficiaries are the lenders who capture the rise in real estate prices in interest payments.

Taxing economic rent would prevent the financial system from capitalizing the rent into debt instruments that pay interest to the financial sector. Considering the amount of rents available to be taxed, taxing rents would free production from income and sales taxation, thus lowering consumer prices and freeing labor and productive capital from taxation.

With so much of land rent already capitalized into debt instruments shifting the tax burden to economic rent would be challenging. Nevertheless, Hudson’s analysis shows that financialization, not wage suppression, is the main instrument of exploitation and takes place via the financial system’s conversion of income streams into interest payments on debt.

I remember when mortgage service was restricted to one-quarter of household income. Today mortgage service can eat up half of household income. This extraordinary growth crowds out the production of goods and services as less of household income is available for other purchases.

Michael Hudson and I bring a total indictment of the neoliberal economics profession, “junk economists” as Hudson calls them.

When cash is outlawed… only outlaws will have cash. And we intend to be among them.

by BILL BONNER

Deutsche Bank CEO John Cryan predicts that cash “probably won’t exist” 10 years from now.

And here is Mr. Summers in the Washington Post:

What makes Mr. Summers so confident that a ban on Ben Franklins would be a good thing?

It turns out that a research paper – presented by Peter Sands, the former CEO of British bank Standard Chartered, and published for the Harvard Kennedy School of Government – says so.

Mr. Sands should know about hiding money.

While he was CEO, New York’s top financial regulator threatened to strip Standard Chartered of its banking license. It claimed the bank “schemed” with the Iranian government to hide at least 60,000 illegal transactions – involving at least $250 billion.

Here at the Diary, we don’t pretend to know how to improve the world. We just know what we like. And we don’t like other people telling us what to do.

Last year, we traveled all around the world. We went where we wanted to go. We did more or less what we wanted to do. Rarely did we feel that someone was bossing us around.

But back in the USA…

“Take your belt off. Take your shoes off. Anything in your pockets? Take it out…”

“Turn on lights. Fasten seat belts. Turn on windshield wipers.”

This morning, walking through the park, we found this sign:

Curb Your Pets

Not just a courtesy to your neighbors

IT’S THE LAW

People who insist you follow their ideas are always the same people whose ideas are idiotic.

“Always do the opposite of what they tell you do,” said a friend in France whose father was mayor of a small town during World War II.

“There had been ‘an incident.’” he explained. “I think the Resistance had killed a German soldier in the area. It was that time, late in the war, when the Nazis were retaliating against civilians. So, they told my father to get everyone in town to assemble in the town square.

“Instead, my father told everyone to run for the woods. They all did. They were lucky. They survived the war.”

Instead of $100 bills, he wants to force us to use electronic notations faithfully recorded in a federally regulated bank.

Have you ever seen one of these “electronic dollars,” dear reader?

We have not. We don’t know what they look like. And we’re deeply suspicious of the whole thing.

The European Central Bank and the Bank of Japan – along with central banks in Denmark, Sweden, and Switzerland have already imposed a negative interest rate “tax” on the accounts commercial banks hold with them (known as “reserve accounts”).

These central banks are hoping banks will pass on this new tax to their customers.

This has already happened in Switzerland…

As colleague Chris Lowe told Bonner & Partners Family Office members at our recent annual meeting in Rancho Santana in Nicaragua, Alternative Bank Schweiz (ABS) will begin charging a negative interest rate on customers’ deposits this year.

ABS will levy an annual penalty of 0.125% on deposits of less than 100,000 Swiss francs ($101,173) and an annual penalty of 0.75% on deposits of more than 100,000 Swiss francs.

Essentially, ABS is charging its customers to keep their money on deposit.

If you put $1 million in the bank, at 0.75% negative interest, you come back a year later, and you have $992,500 left. The bank has confiscated the other $7,500.

At a negative rate of, say, 3%… you pay $30,000 a year just to keep your money on deposit.

It sounds like a scam…

Governments abolish cash. You have no choice but to leave your savings on deposit. And you’re forced to pay banks for storing your money.

Banks are not really storing “your” money at all. A bank deposit is an IOU from your bank. There is no vault cash backing it up… just 1s and 0s on a database somewhere.

If the bank decides not to give you “your” money, you’re out of luck.

It’s as though someone offers to store your cherry pie. Then he goes and eats the pie, promising to give you one just like it when you want it. He then has the cheek to charge you every month for “storing” the pie.

And when you want it, he won’t be able to give it to you. “I don’t have any baking powder. You’ll have to come back tomorrow,” he says.

Or, “I’m sorry. But the federal government has declared cherries an endangered species. I’m not allowed to give you your pie back. It was very tasty, though.”

How much could this electronic pie be worth anyway… if you have to pay someone to eat it for you?

Imagine the automobile you have to pay someone to drive away. Or the rental unit you have to pay someone to live in.

When you have to pay someone to take it off your hands, you can imagine how much your money is really worth.

And when your bank – or the Deep State – wants to confiscate your money, who will stop it?

At least if you have your money in cold, hard cash, they will have to come and physically get it from you. When it is “in the bank” – existing as nothing but electronic account balances – all they have to do is push a button.

That’s what happened in Cyprus. The banks were going to the wall. So, they confiscated deposits to help make themselves whole again.

Who will stop the same thing from happening in America?

The judge the Deep State appointed? The police on the Deep State’s payroll? The politicians the Deep State bought and paid for?

When cash is outlawed… only outlaws will have cash. And we intend to be among them.

Regards,

Bill

Control, Tax, Confiscate

The Deep State wants you to use money it can easily control, tax, and confiscate. And paper currency is getting in its way…

France has already banned residents from making cash transactions of

€1,000 ($1,114) or more. Norway and Sweden’s biggest banks urge the

outright abolition of cash. And there are plans at the highest levels of

government in Israel, India, and China to remove cash from circulation.Deutsche Bank CEO John Cryan predicts that cash “probably won’t exist” 10 years from now.

And here is Mr. Summers in the Washington Post:

Illicit activities are facilitated when a million dollars weighs 2.2 pounds as with the 500 euro note rather than more than 50 pounds, as would be the case if the $20 bill was the high denomination note.He proposes “a global agreement to stop issuing notes worth more than say $50 or $100. Such an agreement would be as significant as anything else the G7 or G20 has done in years.”

What makes Mr. Summers so confident that a ban on Ben Franklins would be a good thing?

It turns out that a research paper – presented by Peter Sands, the former CEO of British bank Standard Chartered, and published for the Harvard Kennedy School of Government – says so.

Idiotic Ideas

“High denomination notes,” said the report, “play little role in the functioning of the legitimate economy, yet a crucial role in the underground economy.”Mr. Sands should know about hiding money.

While he was CEO, New York’s top financial regulator threatened to strip Standard Chartered of its banking license. It claimed the bank “schemed” with the Iranian government to hide at least 60,000 illegal transactions – involving at least $250 billion.

Here at the Diary, we don’t pretend to know how to improve the world. We just know what we like. And we don’t like other people telling us what to do.

Last year, we traveled all around the world. We went where we wanted to go. We did more or less what we wanted to do. Rarely did we feel that someone was bossing us around.

But back in the USA…

“Take your belt off. Take your shoes off. Anything in your pockets? Take it out…”

“Turn on lights. Fasten seat belts. Turn on windshield wipers.”

This morning, walking through the park, we found this sign:

Curb Your Pets

Not just a courtesy to your neighbors

IT’S THE LAW

“Always do the opposite of what they tell you do,” said a friend in France whose father was mayor of a small town during World War II.

“There had been ‘an incident.’” he explained. “I think the Resistance had killed a German soldier in the area. It was that time, late in the war, when the Nazis were retaliating against civilians. So, they told my father to get everyone in town to assemble in the town square.

“Instead, my father told everyone to run for the woods. They all did. They were lucky. They survived the war.”

Electronic Dollars

And now, Mr. Summers wants us to bring our cash to the town square.Instead of $100 bills, he wants to force us to use electronic notations faithfully recorded in a federally regulated bank.

Have you ever seen one of these “electronic dollars,” dear reader?

We have not. We don’t know what they look like. And we’re deeply suspicious of the whole thing.

The European Central Bank and the Bank of Japan – along with central banks in Denmark, Sweden, and Switzerland have already imposed a negative interest rate “tax” on the accounts commercial banks hold with them (known as “reserve accounts”).

These central banks are hoping banks will pass on this new tax to their customers.

This has already happened in Switzerland…

As colleague Chris Lowe told Bonner & Partners Family Office members at our recent annual meeting in Rancho Santana in Nicaragua, Alternative Bank Schweiz (ABS) will begin charging a negative interest rate on customers’ deposits this year.

ABS will levy an annual penalty of 0.125% on deposits of less than 100,000 Swiss francs ($101,173) and an annual penalty of 0.75% on deposits of more than 100,000 Swiss francs.

Essentially, ABS is charging its customers to keep their money on deposit.

If you put $1 million in the bank, at 0.75% negative interest, you come back a year later, and you have $992,500 left. The bank has confiscated the other $7,500.

At a negative rate of, say, 3%… you pay $30,000 a year just to keep your money on deposit.

It sounds like a scam…

Governments abolish cash. You have no choice but to leave your savings on deposit. And you’re forced to pay banks for storing your money.

Cash Outlaw

But wait…Banks are not really storing “your” money at all. A bank deposit is an IOU from your bank. There is no vault cash backing it up… just 1s and 0s on a database somewhere.

If the bank decides not to give you “your” money, you’re out of luck.

It’s as though someone offers to store your cherry pie. Then he goes and eats the pie, promising to give you one just like it when you want it. He then has the cheek to charge you every month for “storing” the pie.

And when you want it, he won’t be able to give it to you. “I don’t have any baking powder. You’ll have to come back tomorrow,” he says.

Or, “I’m sorry. But the federal government has declared cherries an endangered species. I’m not allowed to give you your pie back. It was very tasty, though.”

How much could this electronic pie be worth anyway… if you have to pay someone to eat it for you?

Imagine the automobile you have to pay someone to drive away. Or the rental unit you have to pay someone to live in.

When you have to pay someone to take it off your hands, you can imagine how much your money is really worth.

And when your bank – or the Deep State – wants to confiscate your money, who will stop it?

At least if you have your money in cold, hard cash, they will have to come and physically get it from you. When it is “in the bank” – existing as nothing but electronic account balances – all they have to do is push a button.

That’s what happened in Cyprus. The banks were going to the wall. So, they confiscated deposits to help make themselves whole again.

Who will stop the same thing from happening in America?

The judge the Deep State appointed? The police on the Deep State’s payroll? The politicians the Deep State bought and paid for?

When cash is outlawed… only outlaws will have cash. And we intend to be among them.

Regards,

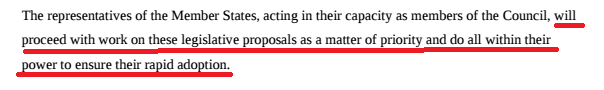

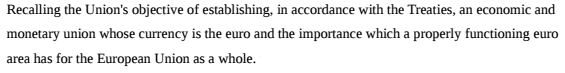

Why Keynesian Market Wreckers Are Now Coming For Even Your Ben Franklins

Larry Summers is a pretentious

Keynesian fool, but I refer to him as the Great Thinker’s Vicar on Earth

for a reason. To wit, every time the latest experiment in Keynesian

intervention fails——as 84 months of ZIRP and massive QE clearly have—–he

can be counted on to trot out a new angle on why still

another interventionist experiment or state sponsored financial fraud is

just the ticket.

Right now he is leading the charge for the greatest stroke of

foolishness yet conceived. Namely, negative interest rates based on

the rubbish theory that the “natural” money market rate of interest is

at an extraordinarily low point. Accordingly, the central bank should

drive the “policy rate” to sub-zero levels in order to achieve the

appropriate level of “accommodation” in an economy that refuses to

attain “escape velocity”.As can’t be pointed out often enough, however, there is no such economic ether as “accommodation”. It’s just a blanket cover story for what Keynesian central bankers believe they are accomplishing by pegging interest rates below market clearing levels and by bending and mangling the yield curve to cause more investment.

But after 86 months it is evident that all of this putative monetary “accommodation” has failed. Falsifying the cost of money and capital can only work if it causes households and businesses to borrow more than they would otherwise; and to then lay credit based spending for consumption and investment goods on top of what can be funded out of current production and income. Another name for that is leveraging private balance sheets and thereby stealing production and income from the future.

With $62 trillion of public and private debt outstanding the US economy has hit a economic barrier called Peak Debt. For all practical purposes, it can be measured as the macroeconomy’s aggregate leverage ratio at 3.5X national income. That represents fully two turns of extra debt on the economy relative to the stable 1.50X ratio that prevailed during periods of war and peace and boom and bust during the century before 1970.

Stated differently, the Fed and other central banks have led the world economy into a planetary LBO over the last two decades or so. In the case of the US, the two extra turns of debt resulting from that rolling LBO amount to about $35 trillion.

Yes, that’s a load of anti-growth ballast that explains why there has been no “escape velocity”, and why the rate of real final sales growth since Q4 2007 is only 1.2% compared to peak-to-peak historical rates of 2.5% to 3.5%. And I use peak-to-peak advisedly because it is now clear after the recently released December business sales and inventory numbers that we are on the verge of a recession, if not already in one.

Yet the Vicar and his compatriots in the Eccles Building and on Wall Street insist on pushing harder on the credit string——even though Peak Debt means that household debt is still $400 billion below its pre- crisis peak and that the entire $2 trillion gain in business debt has been recycled back into the Wall Street casino via stock buybacks and mindless M&A deals. Real net investment in business plant, equipment and technology, in fact, is actually still below its 2007 peak, and even the level which had been attained at the turn of the century.

So that brings us to the harebrained theory of negative interest rates and the supposed collapse of the natural rate of interest in the money market. The latter is just unadulterated economic voodoo. It makes Art Laffer’s magic napkin look like a model of scientific formulation by comparison.

The truth is, there is only one “natural rate” of interest, and that’s the one produced in an honest financial marketplace via the interaction of savers and borrowers. No such rate now exists and hasn’t for decades owing to the massive intrusion of the Fed in the money market. Indeed, as a purely physical matter, even the so-called Federal funds market no longer exists because the Fed has asphyxiated it under a flood of $3.5 trillion of bond-buying and the resulting giant surplus of bank deposits.

So Summers is apparently speaking for the kid who killed his parent and then threw himself on the mercy of the courts on the grounds that he was an orphan. That is, interest rates are in the graveyard of history because the central banks buried them there.

Interest rate pegging and the Fed’s wealth effects doctrine have failed completely, but now Keynesians like Summers claim the contra-factual.

That means the Keynesian medicine didn’t work because the Fed didn’t pump enough drugs into the nation’s quasi-comatose body economic. So now we have to dig even deeper into the netherworld of financial repression in order to align borrowing costs with a non-existent natural rate of interest.

It’s another case of a policy target confected from whole cloth just like the 2% inflation target. But there is one overwhelming practical problem with NIRP. To wit, if pushed deeper and broader than just a few basis points of negative yield on deposits of excess bank reserves at the central bank, NIRP will surely cause a flight to old-fashioned bank notes.

Lo and behold, after all these years of doctoring the economy, Professor Summers and fellow travelers like Professor Sands at Harvard, have up and joined the war on crime!

But their newfound abhorrence of crime amounts to an economist’s version of the NRA mantra that guns don’t kill, people do. In this case, it might be said that criminals don’t launder money, avoid taxes and commit act of terrorism, large denomination bills do!

Of course, the latter have been around for centuries. Yet suddenly every NIRP advocate on the planet has joined the campaign to abolish large bills including the Benjamin Franklin here and the EUR 500 note on the other side of the pond.

Thus, Professor Summers opined as followed in a recent Washington Post op ed:

The fact that — as Sands points out — in certain circles the 500 euro note is known as the “Bin Laden” confirms the arguments against it. Sands’ extensive analysis is totally convincing on the linkage between high denomination notes and crime. He is surely right that illicit activities are facilitated when a million dollars weighs 2.2 pounds as with the 500 euro note rather than more than 50 pounds as would be the case if the $20 bill was the high denomination note. And he is equally correct in arguing that technology is obviating whatever need there may ever have been for high denomination notes in legal commerce.Let’s see. A million dollars worth of weed currently weighs about200 pounds. If push came to shove couldn’t El Chapo have the mules who deliver it to the street carry 50 pounds of bills on the backhaul? Better still, if drug money laundering is such a huge social blight, why not legalize the drug trade and turn the business over to Phillip Morris?

They would surely use digital money to pay their vendors. And if we want to get rid of tax evasion does the good professor really believe that Wall Street high rollers and silicon valley disrupters or just every day rich people actually get paid for whatever they do in bank notes?

The fact is, it is gardeners, waitresses and delivery boys who get paid in cash, not people with meaningful incomes. Yet bringing such slackers to justice doesn’t require the abolition of cash in any event. Just exempt them from income and payroll taxes entirely and let them pay their social dues at the cash register when they purchase goods and services.

In short, there is one reason alone for the sudden campaign to abolish large denomination bills. It is a necessary predicate for the imposition of NIRP. That is to say, it would pave the way for central bank mandated confiscation of the wealth and savings of millions of American citizens in the pursuit of a cockamamie theory that would bring about the final destruction of honest price discovery and financial discipline in the Wall Street casino.

Surely, there is not much more of such destructive intervention that can be tolerated before the booby-traps of leverage and risk that have been built up over the last two decades, but especially since the financial crisis, blow sky high. Indeed, the very idea that the foolish advocates of Keynesian central banking would even entertain the notion of providing outright subsidies to carry trade gamblers—–and that’s where money market NIRP would end up——is a warning sign of the danger that lurks in the financial misty deep.

Central bankers have been massively and relentlessly deforming financial markets and rewarding the most outlandish and unstable forms of leveraged gambling and risk-taking throughout the warp and woof of the financial system, but have no more clue about the financial time bombs they have planted than they did last time around when CDS and CDOs squared were erupting everywhere.

It is only a matter of time, and a few more bear market rallies before the meltdown commences again. Indeed, when the impending global recession becomes fully evident, the gamblers in the Wall Street casino will panic like never before.

After a 30-year bubble, they have come to believe that the central banks are infallible and that all economic downturns and market corrections are quickly remedied with new rounds of monetary stimulus. But that is not a permanent financial truth; it’s a false generalization based on a fabulous one-time monetary trick that is already played out.

To wit, central banks have used up their dry powder. After more than two decades of reckless monetary pumping, they are now stranded on the zero bound and possessed of hideously bloated balance sheets.

So the correction scenario this time will be very different. There will be no quick reflation, meaning that the liquidation of economic malinvestments and overvalued financial assets will run for years.

In fact, during the coming down-cycle, the central banks may turn out to be wreckers, not saviors. As they resort to increasingly novel and illogical maneuvers such as negative interest rates (NIRP) they are generating fear, not confidence.

There can be no better proof than what has transpired in Japan since its lunatic central banker, Haruhiko Kuroda, announced a shift to NIRP within days after he said it was off the table. Since his January 29 statement, however, the Japanese stock market has plunged by 16% from its early January level and 25% since last summer’s peak, thereby wiping out much of the three-year long stock bubble generated by Abenomics.

^N225 data by YCharts

Nor is Japan’s stumble an isolated case. Warning signs on the epochal shift now underway continue to accumulate on all fronts. The bellwether economies of Asia started the year with a sharp plunge including a 11.5% export decline compared to last January in China, a 13.5% drop in India and an 18.5% plunge in South Korea.

Likewise, Germany ended 2015 with an unexpected decline in exports and industrial production, while Japan’s trade figures also slipped badly—-with exports down 8% and imports off by 18% versus prior year. Consequently, the Japanese economy posted a recessionary 1.4% contraction of GDP in Q4.

There is no better weathervane on the global economy than the Baltic Dry Index because it captures the daily pulse of global shipments of grains, iron ore and the rest of the commodity complex. The fact that it has now plunged to an all-time low since records began in 1985 underscores that worldwide industrial activity is sinking rapidly.

In response to these deflationary currents, financial markets have retreated sharply on a worldwide basis. Among 44 significant international equity markets, nearly half are already in bear market territory as signaled by a drop of 20% or more from recent highs. And some of the most pivotal markets in the world——-Germany (DAX), Japan and China—–are down by 30% or more.

Not surprisingly, these drastic declines have so far only dented the surface on Wall Street. The unreconstructed bulls are already saying that the correction is over and are urging their clients to once again buy the dip. Nearly ever one of the major banking houses have year-end price targets for the S&P 500 well above current levels. These include a gain of 11% at Goldman, 15% at Morgan Stanley, 16% at Barclay’s and 17% at RBC Capital.

A cynic might dismiss this ebullience as merely an exercise in the usual Wall Street hockey stick game. After all, you can’t sell stock, ETFs and other financial products to investors when you are projecting a down market, and so they never do.

Yet chalking these dubious targets off to salesmanship would be to underestimate the magnitude of the coming crash.The truth of the matter is that Wall Street gamblers, like the Jim Carrey character in The Truman Show, have lived in the bubble for so long that they no longer even remotely grasp the artificiality and unsustainability of the entire financial system.

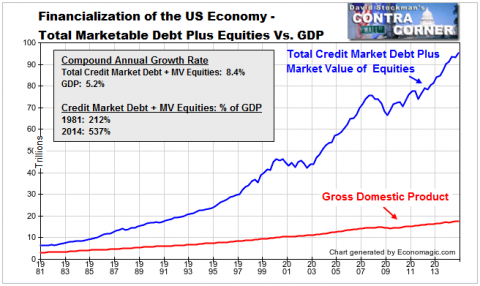

We think the chart below puts this in perspective. For the better part of three decades, the financial system in the US has been expanding at nearly twice the rate of GDP growth. Even a vague familiarity with the laws of compound arithmetic reminds us that the resulting ever-widening gap between economic output and the market value of stock and debt obligations can’t continue.

But there is an even larger point. Namely, that the weakening performance of the US economy during the last two decades did not warrant the drastic increase in the capitalization rate implied by the chart in the first place.

Stated differently, equities and debt must ultimately be supported by interest and dividends extracted from the flow of national income (GDP). Historically, the stable US financial capitalization rate—that is, the combined value of debt and equity outstanding— had been about 2.0X national income. But beginning with Greenspan’s conversion to money printing after the financial meltdown of October 1987, the capitalization rate begin to steadily climb and never looked back.

Now it amounts to nearly 5.4X national income. Yet this has occurred during a period when the trend growth rate of the US economy has been cut in half——from more than 3.0% per annum to less than 1.5% during the last decade or so.

Measured in dollar totals, the sum of equity and debt outstanding in the US in 1987 was $11 trillion. Today it exceeds $93 trillion. No wonder asset gatherers like BLK have exploded in scale!

But that’s also why they are heading for a big fall. As the post-bubble epoch of global recession and financial deflation and liquidation unfolds, the $93 trillion US financial bubble shown below will contract sharply, as will its equivalent worldwide total of $300 trillion.

So we are looking at tens of trillions financial asset shrinkage in the years ahead. And nowhere will that implosion be more dramatic than in the ETF sector.

As shown in the chart below, the number of these entities has grown from about 600 to 5,500 in the last 12 years, and AUM has exploded from $450 billion to $3 trillion. That’s a 17% compound rate of growth since 2003.Even more significantly, almost all of that growth occurred after the 2008 financial crisis.

So let’s cut to the chase. Prior to Greenspan’s dotcom bubble, ETFs did not even exist, and they would never thrive on an honest free market. That’s because their fundamental appeal is to professional speculators and traders and to homegamers who like to bet on the financial ponies.

By contrast, there is no reason why real long-term investors would want to own a huge, motely basket of banking stocks or energy stocks or the likes of the biotech ETF’s portfolio. The latter includes 150 different stocks including nearly 100 start-ups whose science is extremely difficult to assess and whose P&Ls are largely non-existent.

The sole purpose of the IBB, therefore, was to enable speculators to pile on to the momentum trade in biotech stocks which incepted in about 2012. This momentum trend was then turbo-charged by the inflow of speculative capital into this sector through IBB and other ETF’s.

The same thing happened with the energy ETFs. One of the major ETF baskets in this sector is called XLE and it includes 40 energy companies ranging from giant integrated producers like Exxon to refiners like Valero, to oilfield services companies like Halliburton, to small E&P companies like Newfield Exploration. The iShares equivalent is called IXC and it even more diversified with 96 companies spread among an even greater diversity of sizes, specializations and geographies.

Needless to say, no long-term investor would possibly believe that such a dog’s breakfast can be rationally analyzed or diligenced at the company specific level. After all, the whole point of competitive markets is to sort out the winners, losers and also-rans at the sector, industry and sub-industry level. So buying the entire industry amounts to embracing self-cancelling financial noise and undoing all the hard work of Mr. Market at the operating performance level.

Exchange traded funds, at bottom, are a product of the financial casinos, not the free market. They offer traders and speculators the chance to “bet on black” for just hours, days or weeks at a time based on little more than headlines and momentum. Not surprisingly, the XLE has now completed a round trip to nowhere during the last five years as the oil bubble re-erupted and then collapsed.

XLE data by YCharts

The implication is straight forward. The ETF boom functioned as a market accelerator on the way up. Speculative capital poured into these proliferating funds, and then was intermediated by Wall Street market makers into incremental demand for the thousands of individual stocks that comprise them.

This magnifying effect is important to understand because it highlights the artificiality and instability of today’s stock markets. To wit, every time an ETF started trading above the net asset value of the underlying stocks, fund providers issued new ETF shares to market makers. The latter, in turn, bought up a basket of shares on the stock exchanges representing the asset mix of the fund and swapped them for the ETF shares.

We call this the Big Fat Bid that helped undermine the two-way market forces that ordinarily keep speculation in check. But now that the worldwide financial bubble is cracking, we believe the dynamic will begin playing out in reverse. That is, ETFs will now become the Big Fat Offer that takes the market down at an accelerating pace.

The reason is straight forward. The $3 trillion world of ETFs is not an investor marketplace. It is a casino where the fast money moves in and out of short term rips, bubbles and flavors of the moment; and also a dangerous place where naïve retail investors have been lured to roll the dice on their home trading stations.

So as the global economy and financial markets slide into the long, deflationary cycle ahead, the hot money will flee sinking ETFs at an accelerating pace, thereby leaving homegamers shocked to find that they have been fleeced by Wall Street yet again. At length, retail level panic will ensue, causing a thundering implosion of the ETF sector.

What lies ahead for retail investors is probably worse. That’s because ETFs inherently embody a liquidity mismatch. Almost invariably the underlying stocks are not as liquid as the ETF shares which represent them.

This means that retail investors may be faced with painful episodes in which ETF shares gap down violently to deep discounts relative to their net asset value. Accordingly, if shareholders have attempted to protect their portfolios with stop orders, they may handed sharp losses; or they may just panic and sell.

The market plunge on August 26th last year provided a foretaste. In today’s markets, “trading halts” occur when a stock moves up or down too quickly relative to the trading range contained in market circuit breakers. Ordinarily, about 40 such trading halts occur each day, but during the August 26th plunge there were almost 1,300 such occurrences. And 78% involved ETFs, not individual stocks.

This is crucial because ordinarily only one-third of trading halts involved ETF shares. Stated in round numbers, there are ordinarily about 15 ETF trading halts per day, but on August 26th that number soared to 1,000.

Moreover, during this trial panic, the risk of large pricing gaps was painfully evident. The Vanguard consumer staples ETF called VDC. for example, plunged by 32% that day while the underlying holdings of the fund dropped by only 9%. Retail investors who panicked or who were sold out by stop loss orders were taken to the cleaners by the market makers.

The point here is not a plea for SEC regulation. Far from it!

Instead, the implication is that after a few more such episodes during the unfolding bear market——-which must inexorably happen due to the liquidity mismatch—–retail investors will become thoroughly disgusted with ETFs. They will then head for the hills right behind the fast money on Wall Street.

Yet ETF are only one of the many FEDs (financially explosive devices) that have been fostered by our rogue central bankers. Wait until $700 trillion of financial derivatives start living up to the name Warren Buffett gave them before he went all in using them (“financial WMDs”).

Come to think of it. The crime does not lie in the anti-social behavior our Ben Franklin’s may occasionally facilitate. The crime is that we are ruled by a self-perpetuating elite of monetary cranks who have become so desperate that they want to eliminate something so irrelevant and harmless as hand-to-hand currency.

Thousand Point Thursday – Dow Erases 2 Weeks of Losses in 3 Days!

by Phil

And we’re back!

And we’re back!

Another day, another 250-point rally on the Dow is now business as usual, if by usual we mean since Friday. Generally, it’s considered UNusual for the Dow to go up 1,000 points (6.4%) in a month, let alone 3 days but we just did it in October – so why not again in February? In October we actually made a 2,000-point move – all the way to 18,000 and now it took us 1,000 just to get back to 16,500 but we went down on stupid sell-offs in Apple (AAPL) and Boeing (BA) that never should have happened in the first place(we’re long on both).

As I noted back on 1/14, when we called 16,000 the fair bottom for the Dow (based on our valuation study of each individual component) and our 10% range for this year should be from there to 17,600 so we’re not terribly impressed at 16,500 but at least it’s progress. The spectacular gains we’ve had in our 4 Member Tracking Portfolios since then have been BECAUSE we stuck to our valuation guns and got more bullish while others were panicking.

Now

we’re a little nervous because this is like a date that’s starting out

really well and we’re hoping we can go all the way but we don’t want to

blow it so a little bit of caution is advised here –

Now

we’re a little nervous because this is like a date that’s starting out

really well and we’re hoping we can go all the way but we don’t want to

blow it so a little bit of caution is advised here –

. Last time we blew it at 16,500, it was right after the last Fed meeting and we thought the markets (thanks to Hilsenrath) were wrongly interpreting the statement and that caused us to be even more bullish on our second sell-off of the year.

Another day, another 250-point rally on the Dow is now business as usual, if by usual we mean since Friday. Generally, it’s considered UNusual for the Dow to go up 1,000 points (6.4%) in a month, let alone 3 days but we just did it in October – so why not again in February? In October we actually made a 2,000-point move – all the way to 18,000 and now it took us 1,000 just to get back to 16,500 but we went down on stupid sell-offs in Apple (AAPL) and Boeing (BA) that never should have happened in the first place(we’re long on both).

As I noted back on 1/14, when we called 16,000 the fair bottom for the Dow (based on our valuation study of each individual component) and our 10% range for this year should be from there to 17,600 so we’re not terribly impressed at 16,500 but at least it’s progress. The spectacular gains we’ve had in our 4 Member Tracking Portfolios since then have been BECAUSE we stuck to our valuation guns and got more bullish while others were panicking.