|

| Hurricane Katrina/Wikimedia Commons Image |

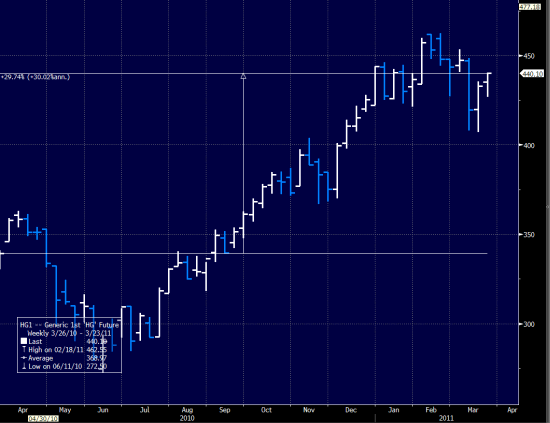

Gold Shark

Keynesian economists are propagandizing the media with a unified message; in one breath lightly touching on the human tragedy in Japan, while in the next anticipating with delight the economic recovery it will supposedly create. The natural disaster in Japan is tragic both on a human level and economically. Japan may, possibly, enjoy a GDP boost in six months or so as a result of some rebuilding, but the billions in present-day lost productivity will easily negate any future upside.

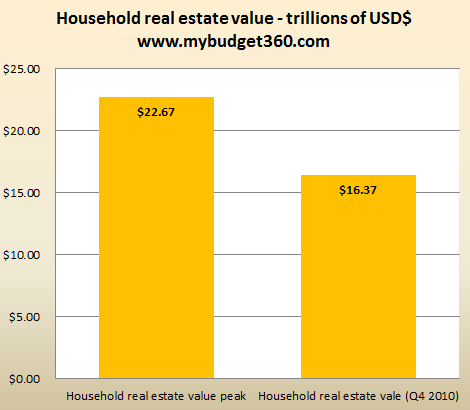

The buildings and businesses with billions in loans have, and will continue to, experience enormous losses. Who will realize these losses? Insurance losses – the capital that would be invested in other productive assets - now must cover billions in claims. And what about the economic impact resulting from the loss of nuclear efficiency? Consider the power situation in Japan over the coming months with 40% of electricity used in greater Tokyo historically originating from the Niigata and Fukushima prefectures. In totality, it is mystifying how any economist could predict a net economic positive.

But, then again, here come the Keynesians. Perhaps no statement has been more shocking than Larry Kudlow’s callous gem (he later apologized): "The human toll here looks to be much worse than the economic toll and we can be grateful for that . . . all these markets stocks, commodities, oil, gold, there is no major breakout or breakdown. I have to view that positively." Kudlow's comment may have been a slip up, but it is one example of many.

There’s Mohammed El-Erian writing in the Financial Times:

“Attention also turns towards the extent of the damage to the economy and its reconstruction and rehabilitation plans . . . Japan’s economic growth rate will fall in the immediate aftermath of the natural disasters before rising sharply due to reconstruction activities . . . Moreover, in a really good recovery scenario, Friday’s dreadful shock could even be a catalyst for internal political unity and for overcoming what has been two disappointing decades of economic performance.”

Not to be outdone, Goldman Sachs recently issued a report touting the likelihood of a Japanese recovery.

Let’s follow the Keynesian approach. I have come up with the top ten ways we can boost the US economy using that same Keynesian rationale.

1. Air Force Bombing Practice

For an entire day the Air Force can carpet bomb our interstates and highways. Why should Libya get the economic boost? Roads will be off limits to avoid human casualties (building up productivity for the lost work, right?) and we can kickstart the construction sector still reeling from the housing and commercial real estate nightmare.

2. National Food Fight

Let’s take it back to the college caf and have a food fight. Our processed food tastes terrible anyway. Rules are: any and all food may be thrown at other Americans, but under no circumstances may food be preserved. Think of the fun. Sure, our hybrid, pinkish, crossbred, Monsantified tomatoes aren’t quite as messy as they used to be, but boy do they hurt more. Anyway, this is America. We have drugs for that.

3. Public School Fire Day

Every kid wants to burn down his school, right? (Ok, ok, besides the homeschoolers.) Well, Keynesian Public School Burning Day is their chance. It can be a teaching experience for Keynesian economics. We can invite George W. Bush, so that no child is left behind.

4. Little Rascals Day

We'll give American children a bucket of baseballs and eight hours to break as many windows as possible - a national event with no spankings, groundings, or consequences. Let them loose on cars, houses, whatever. Think of all the fun in the neighborhoods. Red houses, blue houses, yellow houses. They could start with the White House.

5. Political Car Bashing Event

We'll have all senators and state representatives bring the cars in their household to Washington, where individuals can take free swings with a baseball bat. Call’em Porsche piñatas. With 100 senators and 435 state representatives, you’d have 1600 vehicles at a minimum. Besides economic stimulus, the electorate could let off some steam. It would be better than cash for clunkers – it would be the bash for flunkers.

6. Skyscraper Demolition

We could just take down the country the old-fashioned way, with a Marlboro and thermite.

7. Cut It Up

Afraid of cutting up credit cards, we can unleash the fiscally irresponsible on the lackluster retail sector and have them cut up, chop up, and rip up poor quality Chinese-made clothing that typically bleeds after one washing anyway. (This plan would actually be a good idea if all of the clothes manufactured for American Don Juans weren’t irrevocably produced in Dongguan).

8. The E-Party

We can develop a clay pigeon iphone app and finally give the gun-totin’ Palin-lovin’ domestic militiamen something to shoot at. We can call it the E-Party against smartphones. Actually -- this may not work. Doubtful the drug companies need more stimulus.

9. Bumper Planes

This one might not work either. I was thinking we could have some destructive fun on the tarmac with Boeings and Airbusses (ya know, to help boost the economy), but getting through security screeners would be a radiation hazard, and getting a rubdown from an agent would be worse.

10. Control-Alt-Delete Day

Now here’s one that will definitely boost the economy. We can dump the computers of air-head economists into a pool of highly fluoridated toxic tap water. Biggest splash wins! Let's begin with Paul Krugman.

In all seriousness, how can any economist interpret the tsunami disaster as economically positive without logically supporting the controlled demolition of the United States? How would the results not equate? This is the irrationality of Keynesian models. Regardless of debt levels, inflation levels, natural disasters, inventory gluts, etc. the answer to economic problems always culminates in further spending.

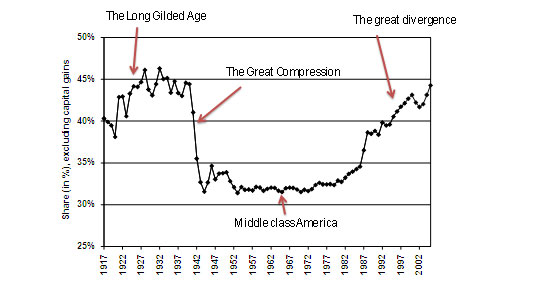

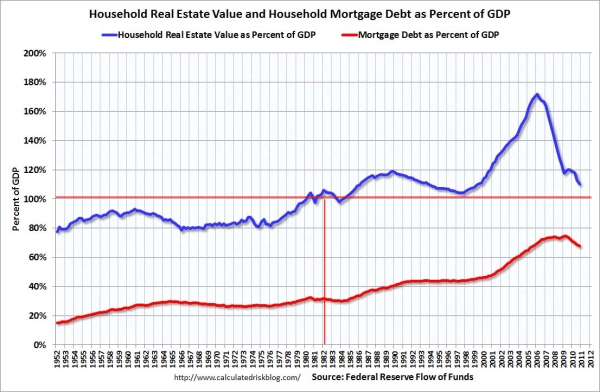

There can be positives and negatives to spending. During the Reagan years, the economy was not over leveraged, so spending created a net positive for growth. But when the economy is over leveraged (including governments) like it is today, and like it is in Japan, both destruction and spending can be catastrophic. When inflation accelerates, further spending becomes the problem and not the solution.

Many economists would laugh off my attempt at sarcasm with the top ten listed above, but inwardly their economic theories serve to justify such irrational policies, only they couch their theories under academic names. Debt spending can work for awhile….but it cannot work forever.

Jason Kaspar is the Chief Investment Officer for Ark Fund Capital Management, focusing on investment and portfolio management.