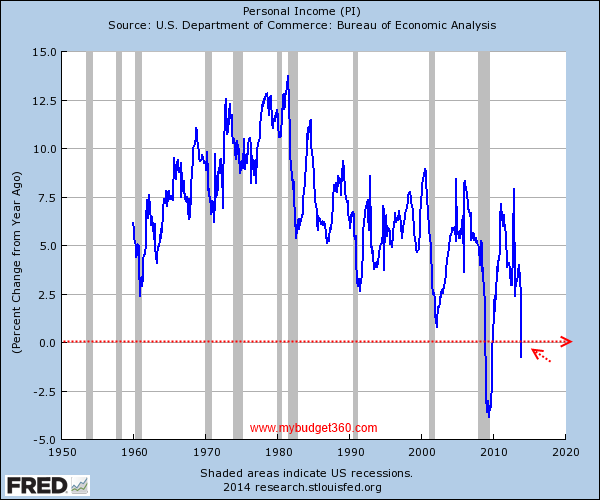

Personal

income faces first year-over-year drop since recession ended: As

incomes collapse, spending via consumer credit begins to increase

There

is little doubt that our economy runs on access to debt. Not a

tiny bit of debt. But Himalayan mountains of debt. The

banking crisis was pitched to the public as one of liquidity but in

reality, it was one of solvency. The difference? One is a

temporary inability to repay debts while the other is a complete

mathematical inabilityto support current debts based on income.

The Fed has done everything to increase access to debt to member

banks to re-inflate their balance sheets. Those that think

inflation is non-existent need only look at housing values, college

tuition, and healthcare costs and see how realistic that is based

on their income growth. This leads us to our current article in

terms of personal income. The latest reading shows that

personal income had its first year-over-year drop since the recession

ended. This further underscores the massive disconnect between

the stock market and regular American households. A large part

of boosting corporate profits involved slashing wages, benefits, and

households making due with less. This has increased the wealth

and income inequality in our nation as the stock market

reaches a new apex. What is troubling is that now that banks

are flooded with easy access to credit, they are starting to lend to

cash strapped households in a fashion similar to our last credit

bubble.

Personal incomes fall

I’m not sure if people are aware of how

rare it is for personal income to fall on a year-over-year basis in a

fiat system where inflation is championed.

Inflation

when it goes hand in hand with income growth is rarely felt by the

public at large. However, as we have discussed with the

shrinking middle class, inflation

with no subsequent wage growth translates to a declining

standard of living.

Going back to data form the 1950s personal

income never declined on a year-over-year timeframe. That is

until the Great Recession. So this recent reading showing

personal income declining year-over-year is notable:

Consumer Confidence Drops Most In 4 Months

This Will Stun The World & Bring Chaos To

Global Markets

Greyerz: “Eric,

the deflationary pressures are continuing in many areas. As an

example, the eurozone consumer confidence had the biggest drop in 18

months. And in Germany, the latest figures are showing wage

deflation of 0.6%. We also saw the same deflation in France of

0.6%….

Gov Report: Up To ONE MILLION Jobs Will Be Lost

Due to Minimum Wage Hike

A

few weeks ago the Congressional Budget Office, which is responsible

for the accounting and reporting associated with federal legislation

and regulations, estimated that the Affordable

Care Act would

raise national budget deficits by $1 trillion and lead to the

destruction of some 2.5 million jobs.

But the new health insurance mandates and the

pressure they will put on America’s businesses aren’t the only

challenges facing an already dwindling labor force.

Earlier

this month President Obama raised the minimum wage for

federal workersthrough an Executive Orders that will take effect

on January 1, 2015. He promised to push through a similar mandate for

the private sector. However, just because minimum wage workers in

America will see a roughly $3 increase in their hourly pay doesn’t

necessarily mean that they’ll be better off than today.

According to the CBO, the wage hike is going to

do exactly the opposite of its intended purpose. Not only can we

expect businesses to almost immediately raise prices on the goods and

services they offer in order to offset the wage hikes, but it will

end up costing the American economy even more jobs in the long run.

Once fully

implemented in the second half of 2016, the $10.10 option would

reduce total employment by about 500,000 workers, or 0.3

percent, CBO projects. As with any such estimates, however, the

actual losses could be smaller or larger; in CBO’s

assessment, there

is about a two-thirds chance that

the effect would be in the range between a very slight reduction

in employment and a

reduction in employment of 1.0 million workers.Congressional

Budget Office: The Effect of a Minimum Wage Increase (PDF)

Global Economy Collapses Despite 4th “Warmest”

January On Record

G-10

macro data is collapsing…

http://www.zerohedge.com/news/2014-02-23/global-economy-collapses-despite-4th-warmest-january-record

CLICK

ON CHART TO ENLARGE

The

Shanghai Index, Copper and Freeport McMoran look to be forming

Descending triangle patterns. If you are unfamiliar with this pattern

please read about them here Bottom

line to this pattern, a break of support suggests a decline, the size

of the triangle!

The key to this patterns is the support line,

which must hold, or sellers will step in. Commodities and the largest

country in the world don’t have much to brag about over the past

few years, other than poor performance and relative weakness! If

support breaks, the new thing they could get to brag about ….”we

sent a signal ahead of time that the macro picture was about to slow

down.”

Support at this time is STILL IN PLACE….

support has NOT broken. I am attempting to make you aware of this

pattern should it come true, so you could be thinking about portfolio

construction ahead of time.

No comments:

Post a Comment