To review what happened just over 40 years ago, I quote from Murray Rothbard’s fantastic little book, ‘What Has Government Done to Our Money?‘:

On August 15, 1971, at the same time that President Nixon imposed a price-wage freeze in a vain attempt to check bounding inflation, Mr. Nixon also brought the post-war Bretton Woods system to a crashing end. As European Central Banks at last threatened to redeem much of their swollen stock of dollars for gold, President Nixon went totally off gold. For the first time in American history, the dollar was totally fiat, totally without backing in gold. Even the tenuous link with gold maintained since 1933 was now severed. The world was plunged into the fiat system of the thirties—and worse, since now even the dollar was no longer linked to gold. Ahead loomed the dread spectre of currency blocs, competing devaluations, economic warfare, and the breakdown of international trade and investment, with the worldwide depression that would then ensue.For anyone who’s interested, here’s the video of Nixon’s announcement:

The Charts:

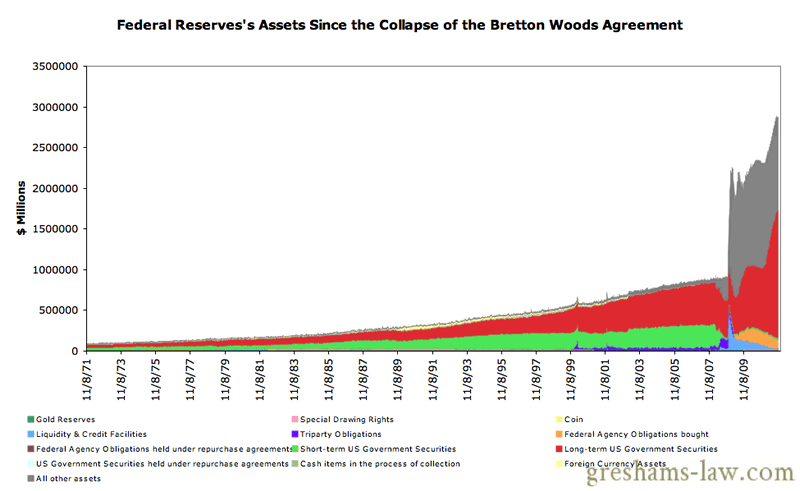

Federal Reserve's Assets Since the Collapse of the Bretton Woods Agreement Source: St Louis Fed

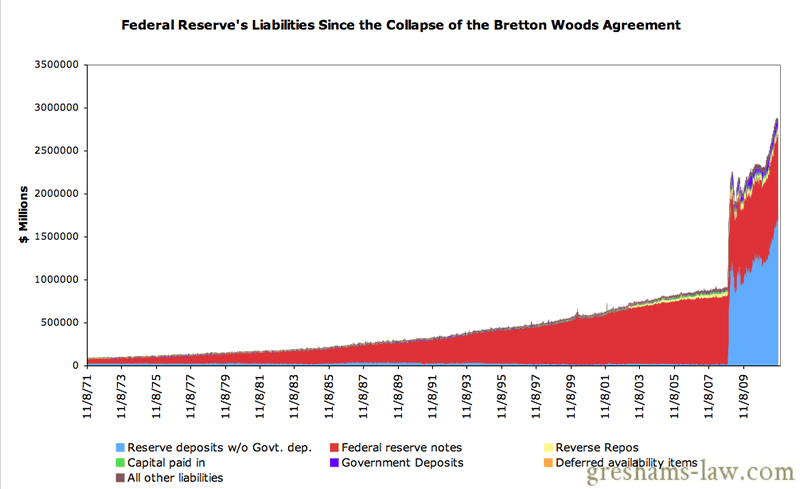

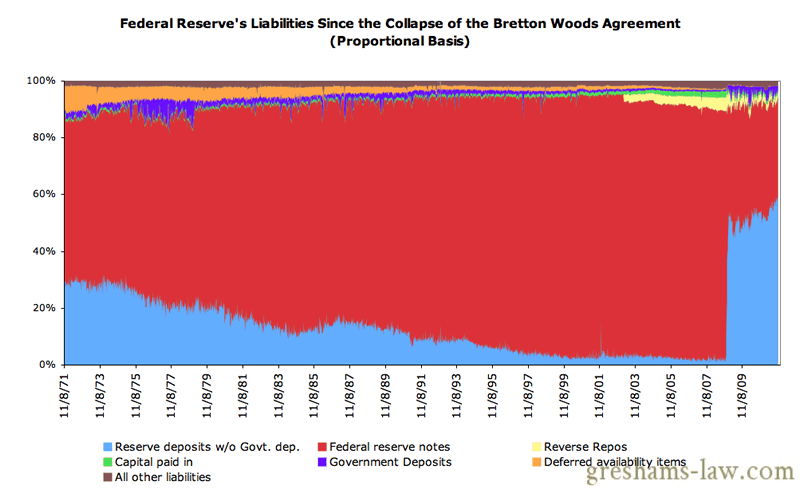

Federal Reserve's Liabilities Since the Collapse of the Bretton Woods Agreement. Source: St Louis Fed

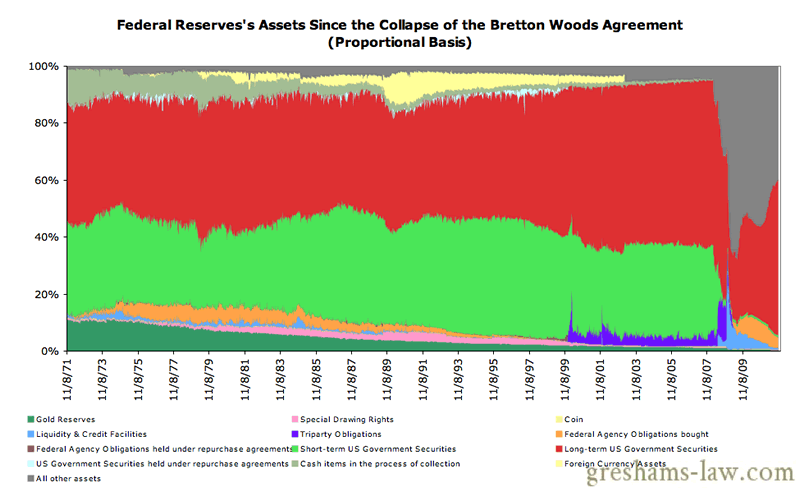

Federal Reserve's Assets Since the Collapse of the Bretton Woods Agreement (Proportional Basis) . Source: St Louis Fed

Federal Reserve's Liabilities Since the Collapse of the Bretton Woods Agreement (Proportional Basis) . Source: St Louis Fed

[NOTE: The following charts are available on the 'Long-Term Charts' page (where they go back to 1915). They are updated every week.]

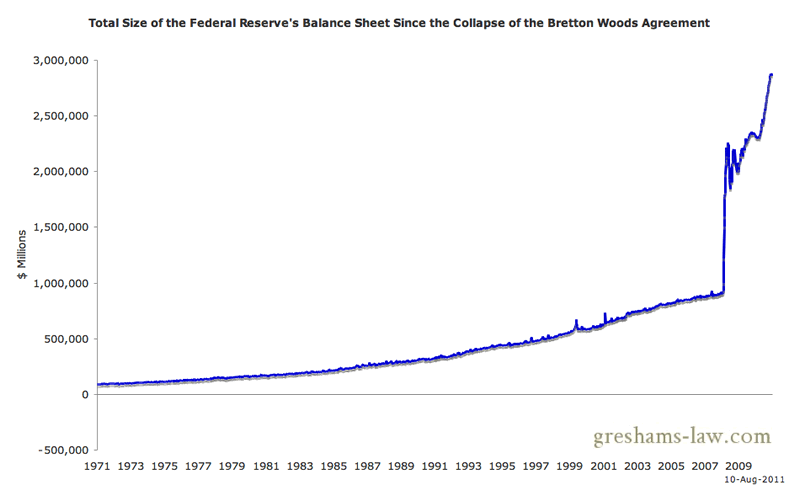

Total Size of the Federal Reserve's Balance Sheet Since the Collapse of the Bretton Woods Agreement - Click to enlarge. Source: St Louis Fed

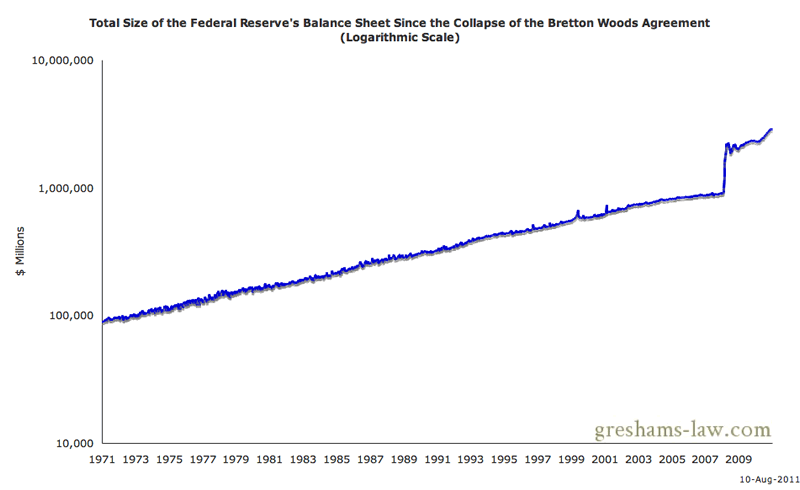

Total Size of the Federal Reserve's Balance Sheet Since the Collapse of the Bretton Woods Agreement (Log Scale) - Click to enlarge. Source: St Louis Fed

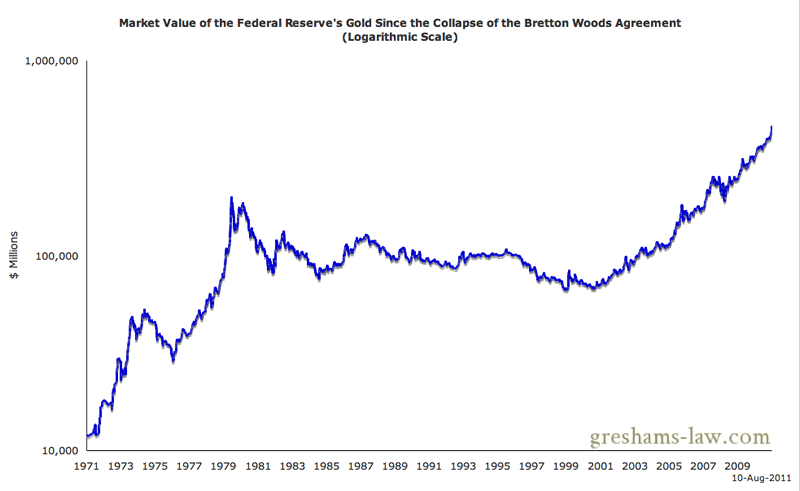

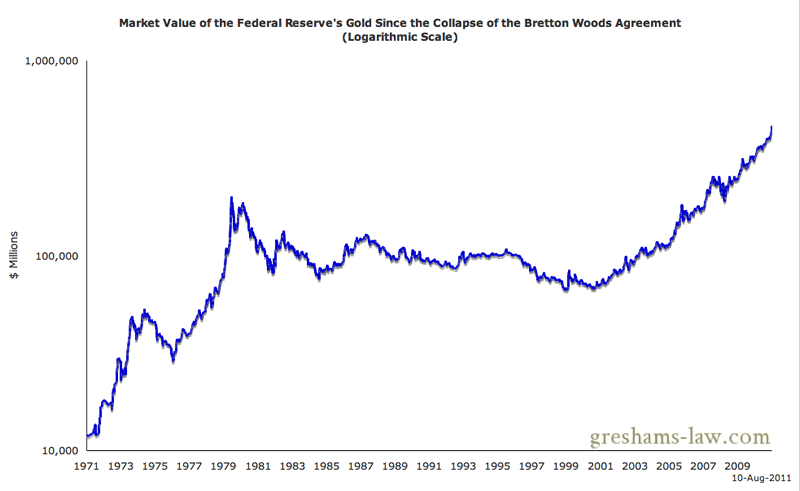

Market  Value of the Federal Reserve's Gold Since the Collapse of the Bretton Woods Agreement - Click to enlarge. Source: St Louis Fed

Value of the Federal Reserve's Gold Since the Collapse of the Bretton Woods Agreement - Click to enlarge. Source: St Louis Fed

Value of the Federal Reserve's Gold Since the Collapse of the Bretton Woods Agreement - Click to enlarge. Source: St Louis Fed

Value of the Federal Reserve's Gold Since the Collapse of the Bretton Woods Agreement - Click to enlarge. Source: St Louis Fed

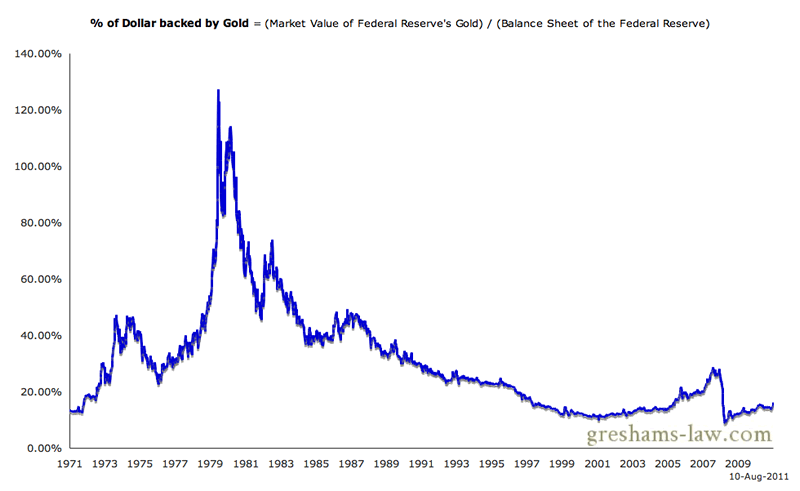

Gold Covering or Backing the Gold Since the Collapse of the Bretton Woods Agreement - Click to enlarge. Source: St Louis Fed

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2011 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

No comments:

Post a Comment