The banking system has taken the country to the financial edge of the greatest recession since the depression. The enormous number of bad loans floating out in the economy only complicates the unemployment situation. When we look into the latest banking data, we realize that over 1,000 of current banks will fail or merge with a too big too fail bank. In fact, the total number will be over 1,000 simply because the “not too big” to fail banks heavily bet on commercial real estate loans that amount to $3 trillion.

Recent data shows that approximately 25% of all the banks insured by the FDIC are unprofitable. That number tells us that some 2,000 banks cannot turn a profit. Let us first look at the current data:

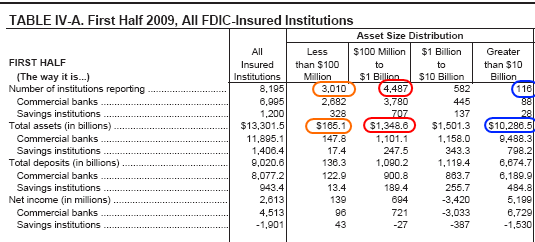

This is probably one of the more telling charts. We have 8,195 institutions. 3,010 of those have less than $100 million in assets. 4,487 have between $100 million to $1 billion. 582 fall between $1 billion and $10 billion. Those over $10 billion? 116. This is incredibly disturbing and shows the monopoly that a few big banks have. 116 banks make up 77 percent of all total banking assets in the United States! So you can have the lower 8,079 banks fail and you wouldn’t even lose 25 percent of the total assets of the banking system.

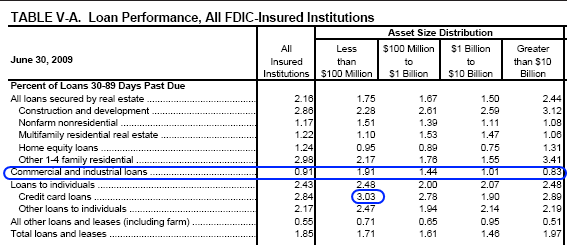

To show you the heavy weight of commercial real estate loans in the lower rung of banks, take a look at this data:

For commercial and industrial loans the banks with the lowest assets seem to have the highest non performing loans. This is bad news since there are $3 trillion in commercial loans floating out in the market and the U.S. Treasury has already mentioned plans to bail these loans out. Bad news of course for the taxpayer but more money thrown to the bigger banks. It would seem that politically we are letting smaller banks fail to placate the public with bread and circuses while the big banks get the real money. You’ll also notice that the banks with smaller assets are also facing higher credit card non-current loans. Given that many of these banks are small enough to fail by our government standards, you can expect that many will fail in the upcoming months. The government seems to be following one path right now. That path includes protecting those 116 banks.

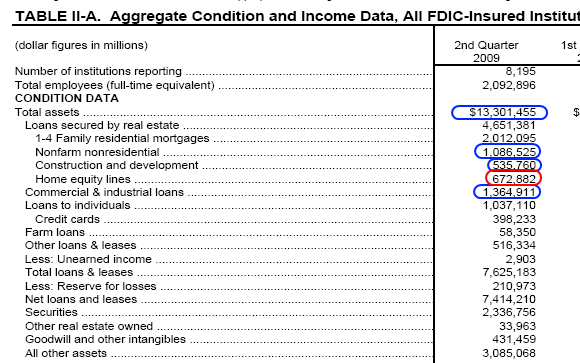

$13 trillion is a large number of total assets. It equates to approximately one year of our national GDP. The number is even more daunting when you realize much of the assets are secured by real estate. In addition, the 8,195 institutions employ over 2 million people. More bank failures mean more layoffs that will add to the already 26 million unemployed and underemployed Americans. But let us look at that balance sheet:

$1 trillion in non-farm residential loans

$535 billion in construction and development loans

$672 billion in home equity lines

$1.3 trillion in commercial and industrial loans

$398 billion in credit cards

Do you think these loans will do well in the current recession? But a more curious data point, in 2004 there were 8,976 FDIC insured institutions. Now it is down to 8,195. What has happened? The big banks keep swallowing up the smaller banks. Since 2004 we have 781 fewer FDIC insured banks. Not all these are failures. What is happening is that the banking sector is consolidating with the too big to fail. Did we not learn any lessons with the gigantic trusts in the early part of the 1900s? Monopolies are not good but it would appear that is our current philosophy. Let the small fail or be eaten up while the big banks are protected at all taxpayer costs. Recently, the FDIC started charging big and smaller banks, even those that were prudent higher fees because they need more money. More money to help the bigger banks not fail while closing the door on smaller banks. This is selective crony capitalism here. Lehman Brothers collapses yet Goldman Sachs remains. Now tell me, who has more political connections?

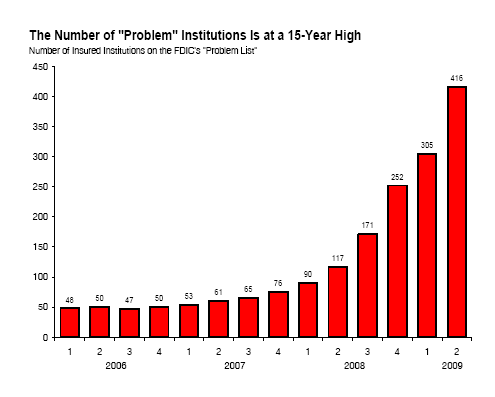

The number of problem institutions is steadily growing:

The FDIC has 416 institutions listed as “problem” banks. Keep in mind some of the biggest failures like IndyMac did not appear on this list. It is becoming clear that we may have over 1,000 bank failures since it has little consequence in the total asset size of the banking system of the country and our government seems set on protecting the big banks only.

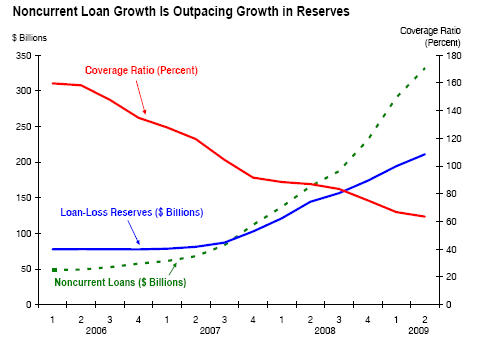

So far, the non-current loans are growing at a steady pace. This chart does not look like a green shoot:

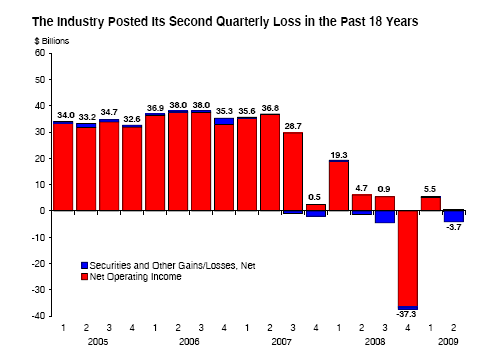

Over $300 billion in loans are currently non-current. The trend is still heading higher. So the obvious conclusion is more money is going to be launched at banks. Until we start seeing stability in this area we can expect more and more banks to fail. The banking sector posted its second quarterly loss in the last 18 years:

I find the Q1 data incredible. The only way banks turned a profit here was because of the trillions in taxpayer bailouts. This is where your mega banks started stating they turned profits even though they had taxpayer handouts and suspended mark to market accounting.

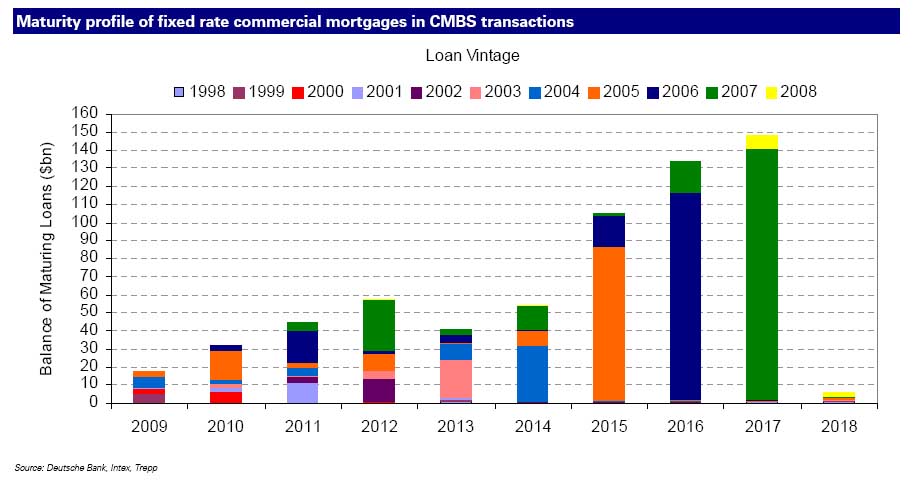

The charts above tell us that we are going to see a large number of bank failures. Many of those commercial real estate loans come up for refinancing in the next few years:

Source: Zero Hedge

Now you tell me who is going to refinance an empty strip mall in Arizona? Some of these are going to have massive losses. Many banks are carrying these toxic mortgages at close to face value. As the months go along, we are going to become very accustomed to bank failure Fridays. Get used to it.

by mybudget360 in FDIC, banks, commercial real estate, debt, economy, government, i-banking, us treasury

No comments:

Post a Comment