There are many sad components of the Greek crisis and only on the 9th of this month I pointed out how the whole episode is like groundhog day or more realistically year. An example of this occurred late last night. Here is Eurogroup President Jeroen Dijesselbloem.

We achieved a major breakthrough onWe have learned to be very careful with phrases like “major breakthrough” as the original hype of “shock and awe” reminds us. The Financial Times also decided to join in with the hype.#Greece which enables us to enter a new phase in the Greek financial assistance programme.

Greece reaches breakthrough deal with creditorsCare is needed with headlines written at 5 am after a long night and as discussed above particular care is needed with Greece so let us take a look at the deal.

Greece needs more funding

This is a regular feature of the ongoing story where despite all the

hype Greece remains unable to fund itself in the financial markets but

needs to refinance in debt. In particular the first rule of Greek fight

club is on its way. That is that the ECB (European Central Bank) must

always be repaid whatever the circumstances! Some 3.5 billion Euros is

required by July if we include a component for the IMF (International

Monetary Fund) as well. This meant that Greece did have something of a

hold on its creditors but it has not used it. Also it is hard to avoid

the thought that two of the main creditors the ECB and the IMF always

insist on 100% repayment of capital which of course blocks debt relief.The details of the funding to be provided are shown below.

The second tranche under the ESM programme amounting to EUR 10.3 bn will be disbursed to Greece in several disbursements, starting with a first disbursement in June (EUR 7.5 bn) to cover debt servicing needs and to allow a clearance of an initial part of arrears as a means to support the real economy. The subsequent disbursements to be used for arrears clearance and further debt servicing needs will be made after the summer.You may note that this only mentions debt servicing and clearing arrears and not boosting the Greek economy for example. This is a rather dystopian style future which seems to be all about the debt and not about the people. Indeed those who have claimed that this whole process is like something from the world of the novel Dune do get support from this.

Do the Greek people get anything?

This does not seem to be much of a reward.

The Eurogroup also welcomes the adoption by the Greek parliament of most of the agreed prior actions for the first review, notably the adoption of legislation to deliver fiscal parametric measures amounting to 3% of GDP that should allow to meet the fiscal targets in 2018,Ah so austerity is now spelt “fiscal parametric measures” in the way that the leaky Windscale nuclear processing plant became the leak-free Sellafield. What do the Greeks have to do? Well here it is.

the pension reformBack on the 9th of this month I pointed out what this actually means in practice.

Sunday night of overhauls of the Greek tax and pension systems…..All 153 coalition lawmakers backed the legislation, which is worth 5.4 billion euros in budget savings.In other words the Greek economy will be given another push downwards. This is happening in a country which has not be growing at over 2% per annum since 2012 in the original “shock and awe” “breakthrough” but as of the latest data has done this.

Available seasonally adjusted data indicate that in the 1 st quarter of 2016 the Gross Domestic Product (GDP) in volume terms decreased by 0.4% in comparison with the 4 th quarter of 2015, while it decreased by 1.3% in comparison with the 1 st quarter of 2015.The economy is still shrinking in what we must now call a DEPRESSION. This is a human crisis on a large-scale which seems to have been forgotten in the hype above. Also anyone with any sense can see that such a situation makes the debt ever more unaffordable and in that sense is self-defeating.

What about debt relief?

The cat was put amongst the pigeons by this from the IMF.

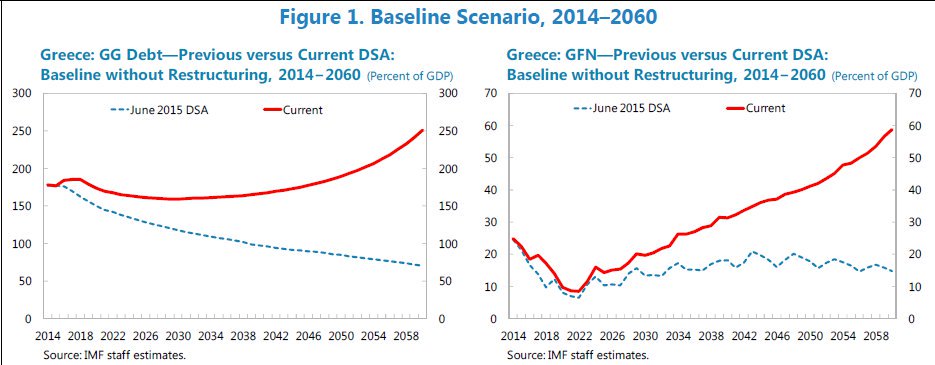

So Greece is the new Japan or at least it would be. Except of course Japan has surpluses elsewhere and can finance itself extremely cheaply and these days even be paid to finance itself. Of the two graphs it is the second which is the most significant and let me show you the IMF text on it.

Gross financing needs cross the 15 percent-of-GDP threshold already by 2024 and the 20 percent threshold by 2029, reaching around 30 percent by 2040 and close to 60 percent of GDP by 2060.Firstly the situation is now so bad the numbers which first went to 2020 and then 2040 now go to 2060 in a confirmation of my To Infinity! And Beyond! Theme. But also there is a debt filled future where in 2060 Greece will be spending 60% of its GDP on financing its GDP. This even had the IMF singing along to the nutty boys.

Madness, madness, they call it madnessWhat have they done?

Madness, madness, they call it madness

I’m about to explain

A-That someone is losing their brain.

Right now they have done nothing at all except make sure that the left hand of the Euro area taxpayer ( represented by the European Stability Mechanism) pays out the right hand of the Euro area taxpayer as represented by the ECB. Or an example of round-tripping.

Of course the last effort at debt restructuring did not go so well mostly because of the first rule of ECB fight club. Here is the Jubilee Debt Strategy.

At the end of 2011, before the ‘debt relief’, Greece’s government debt was 162% of GDPAh so the “breakthrough” is for it to rise to 250% by 2060?! Most people can see the problem there. However rather than a solution what we have seen overnight is yet more can-kicking as nothing will be done until 2018. As Oasis so aptly put it Definitely Maybe.

For the medium term, the Eurogroup expects to implement a possible second set of measures following the successful implementation of the ESM programme.Oh and considering the track record so far this is simply breath-taking.

For the long-term, the Eurogroup is confident that the implementation of this agreement on the main features for debt measures, together with a successful implementation of the Greek ESM programme and the fulfilment of the primary surplus targets as mentioned above, will bring Greece’s public debt back on a sustainable path over the medium to long run.Comment

So we see that the “breakthrough” is in fact yet another example of kicking the problem a couple of years ahead. This passes a few elections and the UK Brexit referendum but will weaken the Greek economy even more. It is a particular shame that at least part of the Financial Times seems to have joined the trend to copy and pasting official communiques.

Meanwhile ever more heroic efforts are required from the ordinary Greek for what exactly? Every number is fudged as for example the IMF view on trend growth goes from -0.6% per annum to 1.3%. If this were true it would be an oasis of good news in a desert but the truth is that this is backwards financial engineering so that the debt numbers do not look even worse. A bit like this really from the IMF.

it is no longer tenable to base the DSA on theHands up anyone who actually believed that?

assumption that Greece can quickly move from having one of the lowest to having the highest productivity growth rates in the eurozone.

Meanwhile let me end with some lighter relief even if it is of the wry variety. I need to pick my words carefully so let me say that there have been rumours that the Clintons ( yes those 2…) never had a loss making futures trade putting them ahead of Buffett and Soros. Well this does not apparently apply to all the family. as if their son-in-law had not closed large losses on his Greek bond fund he might be in profit today.

No comments:

Post a Comment