million against investment-grade bonds, founder David Sherman said.

“I believe we’re in a market that can still be quite punishing,” said Andrzej Skiba, an investment-grade bond-fund manager at BlueBay Asset Management. He has stashed about 20% of his holdings in cash or supersafe government bonds, preparing to buy more corporate bonds when others are forced to sell and “babies get thrown out with the bath water,” he said.

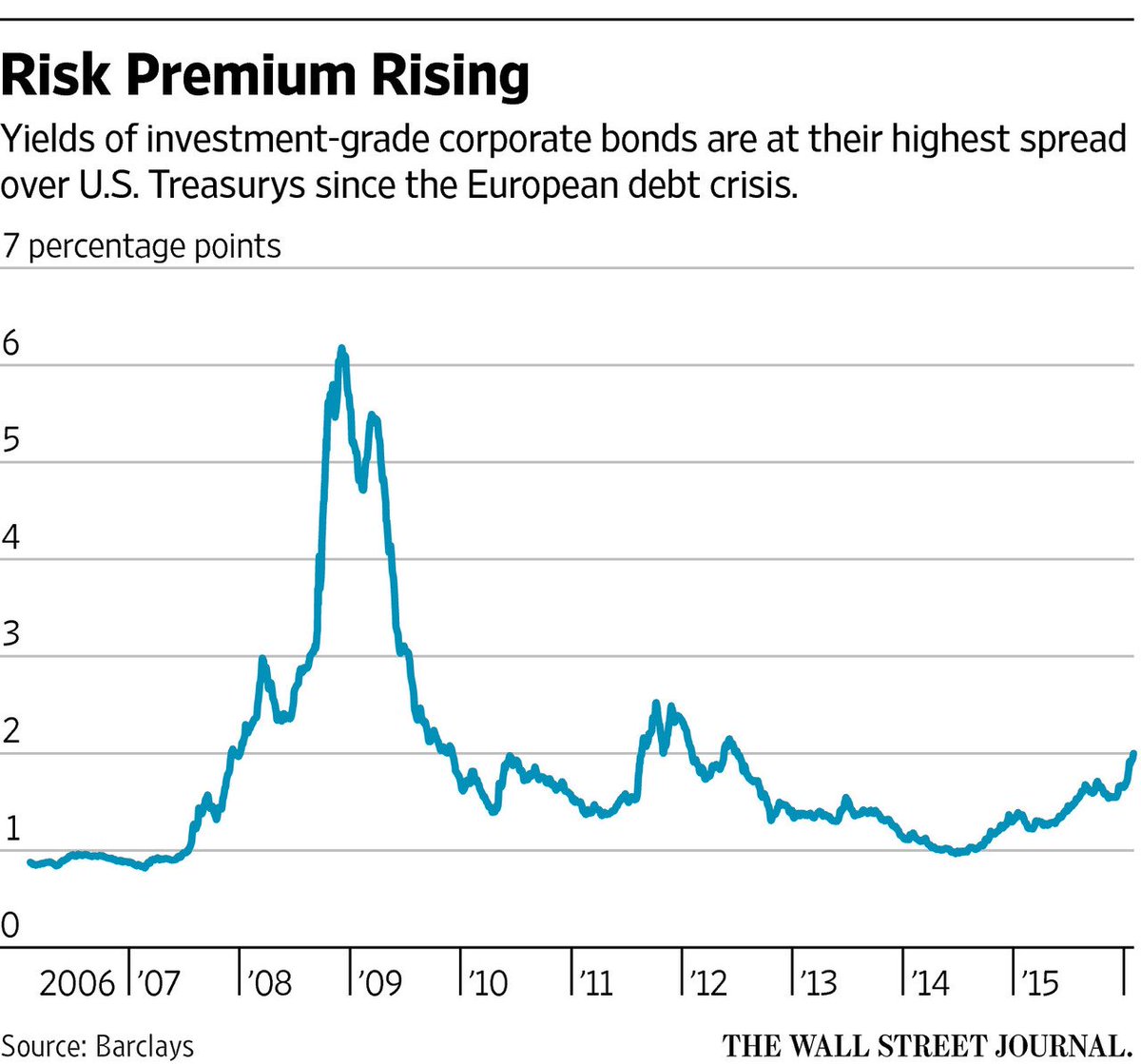

The bet has broader significance. If the funds are right and investment-grade debt weakens further, it would send a worrying signal about the health of the economy. Wider bond spreads make it more costly for companies to issue debt, directly crimping the supply of credit and economic growth.

“Credit spread is the single best predictor of economic activity within one year,” saidSimon Gilchrist, an economics professor at Boston University specializing in links between financial conditions and economic activity.

http://www.wsj.com/articles/hedge-funds-bet-on-risks-in-u-s-blue-chip-debt-1454880754

No comments:

Post a Comment