BY SKY WANDERER

– a stubborn deadlock that keeps the 99% in planned poverty –

In extant financial-economic system Banks keep “bailing out” Governments and Governments keep “bailing out” Banks, and in both cases the 99% of us – the Taxpayers – have to pay £ / € / $ trillions. Meanwhile the elites of each country, the “top 1%”, are getting richer by actually grabbing these £ / € / $ trillions.

This blog-post – specifically updated and offered as a starting point of investigation to seek legal remedies and Debt-relief for the long-suffering Greek people [9] – explains the REAL reason behind the global phenomenon of Public Debts, Crisis and Austerity.

Loaned Money is just IOU, Debt is a phantom, Austerity is planned poverty

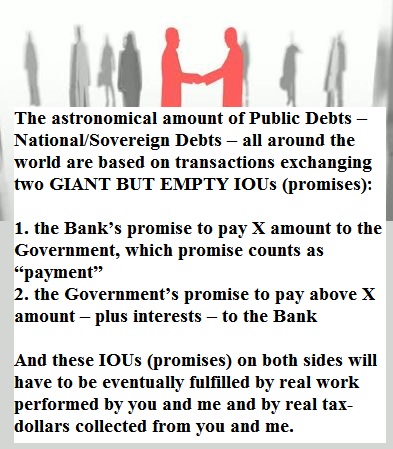

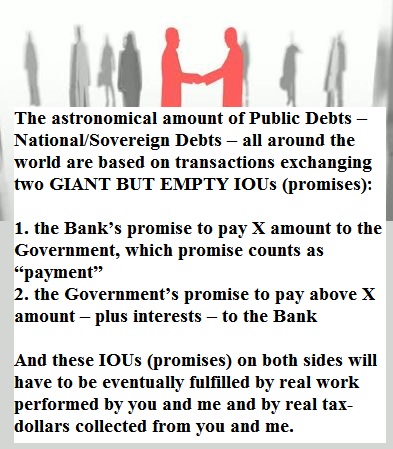

At the very core of the global Crisis and Debt-trap, we find a series of fictitious transactions – Government- bonds and Bank-bailouts – that result in the many £ / € / $ trillions of odious (illegitimate) Public Debts – also called Sovereign or National Debts – as well as in the increasing Tax-burden and intensifying Austerity and Cuts for the 99%.

The two sides of the sequence of fictitious (phony) transactions between Banks – via the agency of IMF and WB – and Governments that generate the ever-increasing Odious Public Debts, are in fact two empty but giant IOUs exchanged by Banks and Governments [1,2]:

– for Banks supposedly helping out Governments

– for Governments supposedly helping out Banks.

The second main point of the same relevance: how come that Banks need to be “bailed out” by Taxpayer money if the very same Banks are the very source of creating – out of thin air – ca. 97% of all money circulating in the economy? [1, 2] In current monetary system, private Banks create NEW money (in the form of mere IOUs/promises) every time they make loans, which implies, inter alia, that these transactions between Banks and Governments are responsible for issuing a large percentage of the money circulating in the economy.

Guardian: “The Bank of England’s dose of honesty throws the theoretical basis for austerity out the window” [1, 2]

Another equally shocking implication of the fact that NO real money is involved in the act of giving loans: The “borrowed” funds that enter the economy as Government-loans are newly created upon the transactions exchanging two fictitious IOUs [1, 2] yet, the Government Deficit arising from the Debts these transactions generate is referred to as the very “reason” for the subsequent Austerity and Government spending Cuts.

The neoliberal Austerity-policy is imposed on all affected countries as the “necessary” measures to compensate for the “monetary sacrifice” to be made in order to enable Governments and countries to properly function. These fictitious Government-loans are to deceive the citizens of affected countries that the “inevitable consequences” of these transactions that our societies must suffer are increasing Taxation for the 99%, Cuts of essential public services, severe Austerity-measures, Privatisations, loss of jobs, decreasing salaries and lower Government Spending.

In other words, these transactions are illegitimate, because they are empty / fictitious / no-value / phantom-transactions; they do NOT represent any pre-existing priorly earned funds; yet the astronomical amounts of Odious Public Debts created via such transactions are cited by Governments as the ‘reason’ to keep their countries entrapped in the unresolvable vicious cycle of increasing Public Debt, Deficit, intensifying Austerity, Poverty and Crisis [12]. Even if the cause of the Government Deficit and its alleged consequences were legitimate (they aren’t) the very policies via which the collaborating Governments attempt to “handle” the deficit-problem, further signify the lack of legitimacy of these Governments.

For all experts in Finance and Economics – and even for those with a minimal sense of logic – it is evident that:

All Governments that keep accumulating the Odious Public Debt/Deficit and keep imposing the “consequent” Austerity measures – under the disguise of “attempting to treat the Crisis” – are either fatally ignorant (lacking even basic common sense) or are deceiving their voters and deliberately keep them in planned poverty via the Crisis-Debt-Austerity vicious cycle. The net result of the Odious Public Debts and the ‘subsequently’ enforced Austerity and Privatisations is the accelerating process of transferring all lands, resources, values, strategic organisations such as the NHS, ie., all wealth, power and control, into the private ownership of the global elites: banks, corporations and richest individuals. (With the notable exception of Iceland [5, 6, 7, 8] who rejected the conditions of the IMF, suffered the first and WORST hit by the sinister revenge of the financial oligarchy, yet was first to recover and start economic growth, even outside the EU.)

As far as the principles of macroeconomics are concerned, recognition of the fact that Austerity only worsens economic recession and pushes an economy into a downward spiral, requires no more than basic knowledge of economics, and it is safe to assume that the respective decision-makers who still keep imposing these measures possess an advanced knowledge in economics and related field(s), hence we should indeed look for a more plausible explanation behind the idea of their attempting to “fix” the economy in a way – via Austerity – that would actually kill even a healthy economy, than the assumption of mere “honest mistake” on their behalf.

The actual answer is hidden somewhere else than in the elites’ mere ignorance or mistakes. The elites deliberately keep the 99% in Crisis because they gain £ / € / $ trillions on the ‘Crisis business‘ [10, 11]. They keep us locked into this scheme because this way the global elites can grab real tangible values – lands, buildings, resources, of all countries and continents – in exchange for empty computer digits. The most profitable business that one ever had or can ever imagine. This is the ultimate explanation behind the historically unprecedented inequality between the globally richest class and the rest of mankind.

This is why Banks were so willing to extend subprime loans to those countries and individuals who will certainly default on the loan [11]. This is why central banks, even though aware of the intensifying process of subprime loans, chose to allow it to continue; they merely pretend it that they made “mistakes” [11] They impose a system of Debt and Austerity on us in order to maintain the vicious cycle of Crisis so that they could continue grabbing these assets [10, 11].

An issue of constitutional democracy, democratic rule of law and national sovereignty

When loans are given to countries via their collaborating Governments, the demonstrated phony financial transactions entered by these Governments are the very cause of the Odious Public Debts accumulated in many £ / € / $ trillions on behalf of the 99%.

Even though this financial world-war appears to be a class-war, as one waged by the rich against the poor, it is not. It is neither a class-war nor an aspect of “left” or “right” party-politics. It is not even a question of finance and economics, since finance and economics in this regard are mere means to wage the war.

It is not a question of ethics and morality either. It is a constitutional, hence legal issue. All Governments who surrender their sovereign right to devise and control their respective country’s economic and monetary system and as elected bodies surrender their decision-making powers in fiscal and monetary policies to unelected bodies such as Banks, give up constitutional democracy in their country.Who surrender their country to the financial crime described herein, give up democratic rule of law. In addition, those Governments who surrender their own electorate-given rights to unelected international lobbies, give up their country’s sovereignty and surrender their country as a whole to foreign interests.

With special regard to the currently intensifying Greek crisis, a final note. From the facts and implications analysed in this post it is evident: it is not Greece – or any of the other affected countries who supposedly “owe” € billions, or even trillions, to Troika (EU/IMF /ECB) – it is the way around. The ongoing financial CRIME of unprecedented scope and magnitude described in this post, should be investigated, ended and prevented with utmost urgency, which however requires reinstating the democratic rule of law in all affected countries. The citizens of Greece – and of all countries subjected to this financial crime – should be compensated for the financial and other damages they suffered and/or still suffer.

image: http://globalpoliticalanalysis.files.wordpress.com/2014/04/banks-and-govs-debt-fraud.jpg?w=750

Related posts:

Related posts:

The story of how we are being conned by Banks and Governments

References:

[1] Bank of England: “Money creation in the modern economy”

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q102.pdf

How money is created and destroyed in the Eurozone monetary system:

http://sensiblemoney.ie/data/documents/How-Money-Is-Created-And-Destroyed.pdf

[2] Guardian: “The truth is out: money is just an IOU, and the banks are rolling in it”

http://www.theguardian.com/commentisfree/2014/mar/18/truth-money-iou-bank-of-england-austerity

[3] GlobalResearch: “The Moral Hazard of Modern Banking: How Banks Create and Destroy Money”

http://www.globalresearch.ca/the-moral-hazard-of-modern-banking-how-banks-create-and-destroy-money/25230

[4] Century of Enslavement: The History of The Federal Reserve

http://www.corbettreport.com/federalreserve/

[5] How to break free from the Debt-trap – explained by distinguished economics professor “Peoples of countries indebted without their consent should refuse to repay Odious Debts” – like Iceland did: http://www.youtube.com/watch?v=TjyuPRIoCeE

[6] 2008–11 Icelandic financial crisis

http://en.wikipedia.org/wiki/2008-11_Icelandic_financial_crisis

[7] Max Keiser: Icelandic people on economic terrorist bankers

http://www.youtube.com/watch?v=d0UHqQCqHTM

[8] Top Economists: “Iceland Did It Right … And Everyone Else Is Doing It Wrong”

http://www.washingtonsblog.com/2012/08/top-economists-iceland-did-it-right-everyone-else-is-doing-it-wrong.html

[9] Guardian: “Austerity in Greece caused more than 500 male suicides, say researchers”

http://www.theguardian.com/world/2014/apr/21/austerity-greece-male-suicides-spending-cuts

[10] ‘In a crisis assets return to their rightful owners’ (i.e. him) ~ Andrew Mellon (US banker, Secretary of the Treasury 1921-32)

[11] Global Financial Meltdown – One Of The Best Financial Crisis Documentary Film

https://www.youtube.com/watch?v=VQzEWeGJLP0

[12]

image: http://globalpoliticalanalysis.files.wordpress.com/2014/06/crisis-vs-recovery.jpg?w=895&h=450

– a stubborn deadlock that keeps the 99% in planned poverty –

In extant financial-economic system Banks keep “bailing out” Governments and Governments keep “bailing out” Banks, and in both cases the 99% of us – the Taxpayers – have to pay £ / € / $ trillions. Meanwhile the elites of each country, the “top 1%”, are getting richer by actually grabbing these £ / € / $ trillions.

This blog-post – specifically updated and offered as a starting point of investigation to seek legal remedies and Debt-relief for the long-suffering Greek people [9] – explains the REAL reason behind the global phenomenon of Public Debts, Crisis and Austerity.

Loaned Money is just IOU, Debt is a phantom, Austerity is planned poverty

At the very core of the global Crisis and Debt-trap, we find a series of fictitious transactions – Government- bonds and Bank-bailouts – that result in the many £ / € / $ trillions of odious (illegitimate) Public Debts – also called Sovereign or National Debts – as well as in the increasing Tax-burden and intensifying Austerity and Cuts for the 99%.

The two sides of the sequence of fictitious (phony) transactions between Banks – via the agency of IMF and WB – and Governments that generate the ever-increasing Odious Public Debts, are in fact two empty but giant IOUs exchanged by Banks and Governments [1,2]:

- 1) The Bank ‘buys’ Bonds from the Government – lends money to the Government – from the NEW money that the Bank creates out of thin air for the transaction; that is, the Bank ‘pays/lends’ funds by merely issuing an empty IOU to the Government; which means, the Bank promises to pay X amount + y interests to the Government.

- 2) The Government ‘sells’ Bonds to the Bank – borrows money from the Bank – that is, the Government issues an IOU to the Bank in exchange for the Bank’s IOU; which means, the Government promises to pay X amount + z interests to the Bank, in exchange for the Bank’s promise to pay X + y to the Government.

– for Banks supposedly helping out Governments

– for Governments supposedly helping out Banks.

- This fact is proof that NO real tangible help is given and/or received by either of the two parties, and that these transactions are phony.

The second main point of the same relevance: how come that Banks need to be “bailed out” by Taxpayer money if the very same Banks are the very source of creating – out of thin air – ca. 97% of all money circulating in the economy? [1, 2] In current monetary system, private Banks create NEW money (in the form of mere IOUs/promises) every time they make loans, which implies, inter alia, that these transactions between Banks and Governments are responsible for issuing a large percentage of the money circulating in the economy.

- What follows from above proven and given fact is the shocking truth, that Banks can NEVER go bankrupt, since they never posses money per se to begin with. When Banks create money, it is merely in the form of computer digits entered on their servers. When Crisis sets in, or the illusion thereof appears, it is merely due to the very act of fear-mongering, panic-generating and to the crowds’ consequent intensified rush into the Banks. And apparently this trick is used by Banks and Governments as the most effective means to blackmail all countries – a present case in point is Greece – thus force them to surrender to described phony Debt-creating transactions and to the consequent Austerity-dictates by the financial oligarchy.

- Another relevant angle of private banking: whenever Banks “lend”

money, they do NOT take any risks, since they do NOT draw funds from any

pre-existing money-base. Again: Banks newly create money upon lending

by simply entering the respective monetary units on the borrower’s bank

account on a bank-server. Since no risks are involved in these

transactions, no real creditors/stakeholders are behind them, who suffer

NO LOSSES whatsoever in case of the borrower defaulting on the loan.

The way referenced Guardian article [2] puts it: “Just consider what might happen if mortgage holders realised the money the bank lent them is not, really, the life savings of some thrifty pensioner, but something the bank just whisked into existence through its possession of a magic wand which we, the public, handed over to it.”

- By above consideration, another extra dimension of the ongoing hoax called “modern banking system” is to be seen via the fact that the same Banks that are allowed to create new money out of thin air upon extending loans to their clients, when are supposed to pay out deposits to their clients, they “run out of money” and “must” be bailed out by the very bank-account money of the Banks’ clients – which does NOT even exist as real cash – and by the Tax-money of the country’s citizens.

Guardian: “The Bank of England’s dose of honesty throws the theoretical basis for austerity out the window” [1, 2]

Another equally shocking implication of the fact that NO real money is involved in the act of giving loans: The “borrowed” funds that enter the economy as Government-loans are newly created upon the transactions exchanging two fictitious IOUs [1, 2] yet, the Government Deficit arising from the Debts these transactions generate is referred to as the very “reason” for the subsequent Austerity and Government spending Cuts.

The neoliberal Austerity-policy is imposed on all affected countries as the “necessary” measures to compensate for the “monetary sacrifice” to be made in order to enable Governments and countries to properly function. These fictitious Government-loans are to deceive the citizens of affected countries that the “inevitable consequences” of these transactions that our societies must suffer are increasing Taxation for the 99%, Cuts of essential public services, severe Austerity-measures, Privatisations, loss of jobs, decreasing salaries and lower Government Spending.

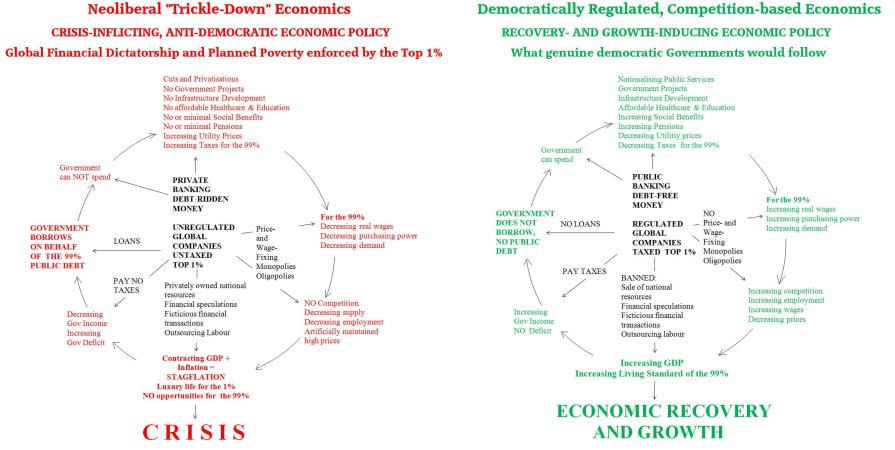

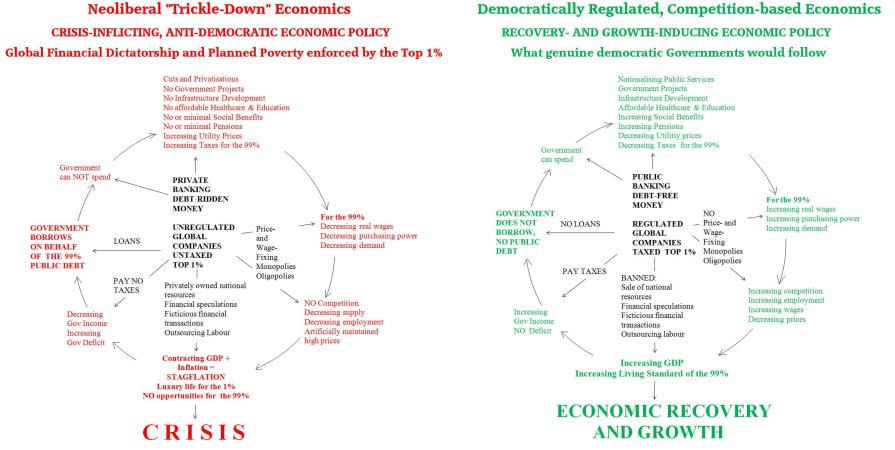

In other words, these transactions are illegitimate, because they are empty / fictitious / no-value / phantom-transactions; they do NOT represent any pre-existing priorly earned funds; yet the astronomical amounts of Odious Public Debts created via such transactions are cited by Governments as the ‘reason’ to keep their countries entrapped in the unresolvable vicious cycle of increasing Public Debt, Deficit, intensifying Austerity, Poverty and Crisis [12]. Even if the cause of the Government Deficit and its alleged consequences were legitimate (they aren’t) the very policies via which the collaborating Governments attempt to “handle” the deficit-problem, further signify the lack of legitimacy of these Governments.

For all experts in Finance and Economics – and even for those with a minimal sense of logic – it is evident that:

- Austerity only contracts any Economy, thus worsens any Crisis – triggers recession even in a healthy economy, as it is demonstrated on the Crisis side of flowcharts [12]

Constantly increasing the Debt/Deficit will obviously yield the exact opposite effect of what is “expected”; it will obviously increase the Deficit, obviously increase the Debt and will keep the Crisis in a downward spiral – even more so when an economy is further burdened with Austerity. A genuinely democratic, legitimate and responsible Government would implement policies as shown on the Recovery side of flowcharts [12]

All Governments that keep accumulating the Odious Public Debt/Deficit and keep imposing the “consequent” Austerity measures – under the disguise of “attempting to treat the Crisis” – are either fatally ignorant (lacking even basic common sense) or are deceiving their voters and deliberately keep them in planned poverty via the Crisis-Debt-Austerity vicious cycle. The net result of the Odious Public Debts and the ‘subsequently’ enforced Austerity and Privatisations is the accelerating process of transferring all lands, resources, values, strategic organisations such as the NHS, ie., all wealth, power and control, into the private ownership of the global elites: banks, corporations and richest individuals. (With the notable exception of Iceland [5, 6, 7, 8] who rejected the conditions of the IMF, suffered the first and WORST hit by the sinister revenge of the financial oligarchy, yet was first to recover and start economic growth, even outside the EU.)

As far as the principles of macroeconomics are concerned, recognition of the fact that Austerity only worsens economic recession and pushes an economy into a downward spiral, requires no more than basic knowledge of economics, and it is safe to assume that the respective decision-makers who still keep imposing these measures possess an advanced knowledge in economics and related field(s), hence we should indeed look for a more plausible explanation behind the idea of their attempting to “fix” the economy in a way – via Austerity – that would actually kill even a healthy economy, than the assumption of mere “honest mistake” on their behalf.

The actual answer is hidden somewhere else than in the elites’ mere ignorance or mistakes. The elites deliberately keep the 99% in Crisis because they gain £ / € / $ trillions on the ‘Crisis business‘ [10, 11]. They keep us locked into this scheme because this way the global elites can grab real tangible values – lands, buildings, resources, of all countries and continents – in exchange for empty computer digits. The most profitable business that one ever had or can ever imagine. This is the ultimate explanation behind the historically unprecedented inequality between the globally richest class and the rest of mankind.

This is why Banks were so willing to extend subprime loans to those countries and individuals who will certainly default on the loan [11]. This is why central banks, even though aware of the intensifying process of subprime loans, chose to allow it to continue; they merely pretend it that they made “mistakes” [11] They impose a system of Debt and Austerity on us in order to maintain the vicious cycle of Crisis so that they could continue grabbing these assets [10, 11].

An issue of constitutional democracy, democratic rule of law and national sovereignty

When loans are given to countries via their collaborating Governments, the demonstrated phony financial transactions entered by these Governments are the very cause of the Odious Public Debts accumulated in many £ / € / $ trillions on behalf of the 99%.

- The most relevant implication of the Public Debts is this consideration: Rather than exchanging empty IOUs thus accepting the burden of Debt on behalf of their citizens upon the act of financing a country, responsible and real democratic Governments could – and should – create the money-supply in the very amount that is necessary to be invested into the economy and they should make these necessary direct investments – via Public Banking and without the burden of Public Debt – into constructive projects, creating jobs, fostering green energy and human-centered economies, infrastructure, affordable healthcare, children-care, education, housing, etc.

Even though this financial world-war appears to be a class-war, as one waged by the rich against the poor, it is not. It is neither a class-war nor an aspect of “left” or “right” party-politics. It is not even a question of finance and economics, since finance and economics in this regard are mere means to wage the war.

It is not a question of ethics and morality either. It is a constitutional, hence legal issue. All Governments who surrender their sovereign right to devise and control their respective country’s economic and monetary system and as elected bodies surrender their decision-making powers in fiscal and monetary policies to unelected bodies such as Banks, give up constitutional democracy in their country.Who surrender their country to the financial crime described herein, give up democratic rule of law. In addition, those Governments who surrender their own electorate-given rights to unelected international lobbies, give up their country’s sovereignty and surrender their country as a whole to foreign interests.

With special regard to the currently intensifying Greek crisis, a final note. From the facts and implications analysed in this post it is evident: it is not Greece – or any of the other affected countries who supposedly “owe” € billions, or even trillions, to Troika (EU/IMF /ECB) – it is the way around. The ongoing financial CRIME of unprecedented scope and magnitude described in this post, should be investigated, ended and prevented with utmost urgency, which however requires reinstating the democratic rule of law in all affected countries. The citizens of Greece – and of all countries subjected to this financial crime – should be compensated for the financial and other damages they suffered and/or still suffer.

image: http://globalpoliticalanalysis.files.wordpress.com/2014/04/banks-and-govs-debt-fraud.jpg?w=750

Related posts:

Related posts:The story of how we are being conned by Banks and Governments

References:

[1] Bank of England: “Money creation in the modern economy”

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q102.pdf

How money is created and destroyed in the Eurozone monetary system:

http://sensiblemoney.ie/data/documents/How-Money-Is-Created-And-Destroyed.pdf

[2] Guardian: “The truth is out: money is just an IOU, and the banks are rolling in it”

http://www.theguardian.com/commentisfree/2014/mar/18/truth-money-iou-bank-of-england-austerity

[3] GlobalResearch: “The Moral Hazard of Modern Banking: How Banks Create and Destroy Money”

http://www.globalresearch.ca/the-moral-hazard-of-modern-banking-how-banks-create-and-destroy-money/25230

[4] Century of Enslavement: The History of The Federal Reserve

http://www.corbettreport.com/federalreserve/

[5] How to break free from the Debt-trap – explained by distinguished economics professor “Peoples of countries indebted without their consent should refuse to repay Odious Debts” – like Iceland did: http://www.youtube.com/watch?v=TjyuPRIoCeE

[6] 2008–11 Icelandic financial crisis

http://en.wikipedia.org/wiki/2008-11_Icelandic_financial_crisis

[7] Max Keiser: Icelandic people on economic terrorist bankers

http://www.youtube.com/watch?v=d0UHqQCqHTM

[8] Top Economists: “Iceland Did It Right … And Everyone Else Is Doing It Wrong”

http://www.washingtonsblog.com/2012/08/top-economists-iceland-did-it-right-everyone-else-is-doing-it-wrong.html

[9] Guardian: “Austerity in Greece caused more than 500 male suicides, say researchers”

http://www.theguardian.com/world/2014/apr/21/austerity-greece-male-suicides-spending-cuts

[10] ‘In a crisis assets return to their rightful owners’ (i.e. him) ~ Andrew Mellon (US banker, Secretary of the Treasury 1921-32)

[11] Global Financial Meltdown – One Of The Best Financial Crisis Documentary Film

https://www.youtube.com/watch?v=VQzEWeGJLP0

[12]

image: http://globalpoliticalanalysis.files.wordpress.com/2014/06/crisis-vs-recovery.jpg?w=895&h=450

No comments:

Post a Comment