Highlights

Like yesterday’s existing home sales report, today’s report on new home sales came in below low-end expectations, down 1.6 percent in November to an annual sales rate of 438,000 vs expectations for 460,000 and Econoday’s low-end estimate for 440,000.

Also like yesterday’s existing home sales report, price data show weakness with the median price down 3.2 percent in the month to $280,000. Year-on-year, the median price is up only 1.4 percent which, in what at least doesn’t point to an imbalance, is largely in line with year-on-year sales which are down 1.6 percent.

Supply data are stable with 213,000 new homes on the market vs 210,000 in October. Supply relative to sales is up slightly, to 5.8 months from 5.7 and 5.5 months in the prior two months. Regional sales data show declines in 3 of 4 regions including the South, which is larger than all other regions combined in this report, and a gain in the West.

Housing had been showing some life going into the third quarter but the readings on November have been a surprising disappointment and won’t be good reading for the nation’s builders.

http://mam.econoday.com/byshoweventfull.asp?fid=461390&cust=mam&year=2014&lid=0&prev=/byweek.asp#top

The Housing Recovery Remains Cancelled Due To 6 Months Of Downward Revisions

Following last month’s surge to record high home prices, it is perhaps no surprise that for the6th month in a row, home prices have been revised lower. New Home Sales printed 438k, down from prior revised lower 445k and missing expectations of a surge to 460k…missing for 8 of the last 10 months. However, the key focus should be on the epic revisions of the (by now useless) home sales. For the period May – November, the initial new home sales prints amount to 2.779MM houses. Post revision, the number plunges by 22% to 2.168K. There goes the housing pillar of recovery (let’s hope economists are wrong and rates don’t rise next year eh?)

Spot the recovery…

http://www.zerohedge.com/news/2014-12-23/housing-recovery-remains-cancelled-due-6-months-downward-revisions

Another Hit To The ‘Escape Velocity’ Story——Rebound of Existing Home Sales Falters In November.

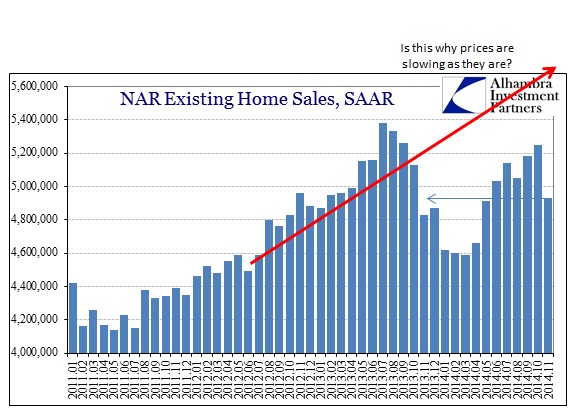

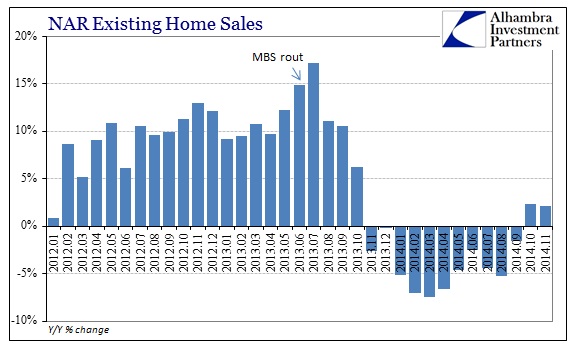

Adding to the disfavor in real estate and housing, the National Association of Realtor’s projection for existing home sales (resales) in November was just as ugly (if not more so) as home construction estimates. Resales were down a rather steep 6.5% from October (SAAR’s), and were up only 2.1% compared to November 2013. I say “only” because the calendar has wound into what should have been very favorable comparisons as the prior year period is well into last year’s epic decline. For November 2014 to be essentially flat with November 2013 is not a good sign.

http://davidstockmanscontracorner.com/another-hit-to-the-escape-velocity-story-existing-home-sales-rebound-falters-in-november/

Like yesterday’s existing home sales report, today’s report on new home sales came in below low-end expectations, down 1.6 percent in November to an annual sales rate of 438,000 vs expectations for 460,000 and Econoday’s low-end estimate for 440,000.

Also like yesterday’s existing home sales report, price data show weakness with the median price down 3.2 percent in the month to $280,000. Year-on-year, the median price is up only 1.4 percent which, in what at least doesn’t point to an imbalance, is largely in line with year-on-year sales which are down 1.6 percent.

Supply data are stable with 213,000 new homes on the market vs 210,000 in October. Supply relative to sales is up slightly, to 5.8 months from 5.7 and 5.5 months in the prior two months. Regional sales data show declines in 3 of 4 regions including the South, which is larger than all other regions combined in this report, and a gain in the West.

Housing had been showing some life going into the third quarter but the readings on November have been a surprising disappointment and won’t be good reading for the nation’s builders.

http://mam.econoday.com/byshoweventfull.asp?fid=461390&cust=mam&year=2014&lid=0&prev=/byweek.asp#top

The Housing Recovery Remains Cancelled Due To 6 Months Of Downward Revisions

Following last month’s surge to record high home prices, it is perhaps no surprise that for the6th month in a row, home prices have been revised lower. New Home Sales printed 438k, down from prior revised lower 445k and missing expectations of a surge to 460k…missing for 8 of the last 10 months. However, the key focus should be on the epic revisions of the (by now useless) home sales. For the period May – November, the initial new home sales prints amount to 2.779MM houses. Post revision, the number plunges by 22% to 2.168K. There goes the housing pillar of recovery (let’s hope economists are wrong and rates don’t rise next year eh?)

Spot the recovery…

http://www.zerohedge.com/news/2014-12-23/housing-recovery-remains-cancelled-due-6-months-downward-revisions

Another Hit To The ‘Escape Velocity’ Story——Rebound of Existing Home Sales Falters In November.

Adding to the disfavor in real estate and housing, the National Association of Realtor’s projection for existing home sales (resales) in November was just as ugly (if not more so) as home construction estimates. Resales were down a rather steep 6.5% from October (SAAR’s), and were up only 2.1% compared to November 2013. I say “only” because the calendar has wound into what should have been very favorable comparisons as the prior year period is well into last year’s epic decline. For November 2014 to be essentially flat with November 2013 is not a good sign.

http://davidstockmanscontracorner.com/another-hit-to-the-escape-velocity-story-existing-home-sales-rebound-falters-in-november/

No comments:

Post a Comment