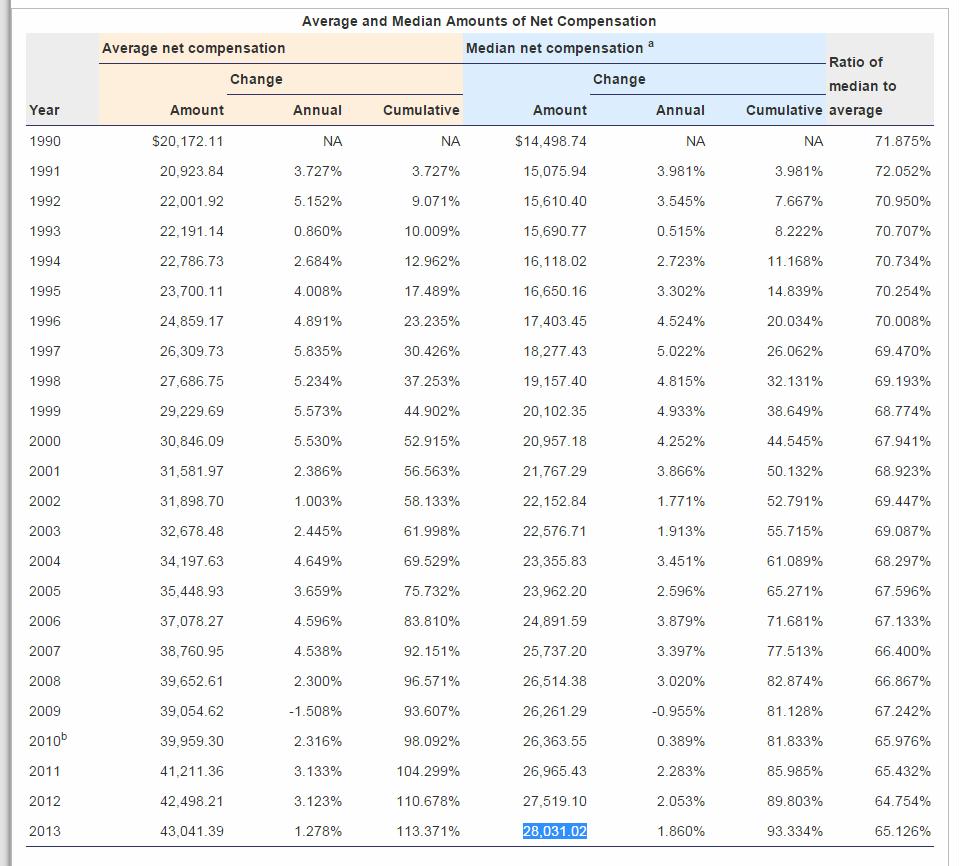

The national average wage index

(AWI) is based on compensation (wages, tips, and the like) subject to

Federal income taxes, as reported by employers on Forms W-2. Beginning

with the AWI for 1991, compensation includes contributions to deferred

compensation plans, but excludes certain distributions from plans where

the distributions are included in the reported compensation subject to

income taxes. We call the result of including contributions, and

excluding certain distributions, net compensation. The table below summarizes the components of net compensation for 2013.

http://www.ssa.gov/cgi-bin/netcomp.cgi?year=2013

| 70,000.00 — 74,999.99 | 2,968,987 | 134,057,680 | 86.06000 | 215,031,183,359.11 | 72,425.77 |

| 75,000.00 — 79,999.99 | 2,559,327 | 136,617,007 | 87.70299 | 198,162,943,189.00 | 77,427.75 |

| 80,000.00 — 84,999.99 | 2,179,245 | 138,796,252 | 89.10199 | 179,639,334,066.10 | 82,431.91 |

| 85,000.00 — 89,999.99 | 1,873,165 | 140,669,417 | 90.30449 | 163,773,160,357.76 | 87,431.25 |

| 90,000.00 — 94,999.99 | 1,617,254 | 142,286,671 | 91.34271 | 149,463,631,096.84 | 92,418.16 |

| 95,000.00 — 99,999.99 | 1,402,053 | 143,688,724 | 92.24277 | 136,614,877,209.07 | 97,439.17 |

| 100,000.00 — 104,999.99 | 1,229,162 | 144,917,886 | 93.03185 | 125,888,071,678.53 | 102,417.80 |

Social Security Administration: "half of the workers earned below this level": $28,031.02.

http://www.ssa.gov/oact/cola/central.html …

No comments:

Post a Comment