Manic

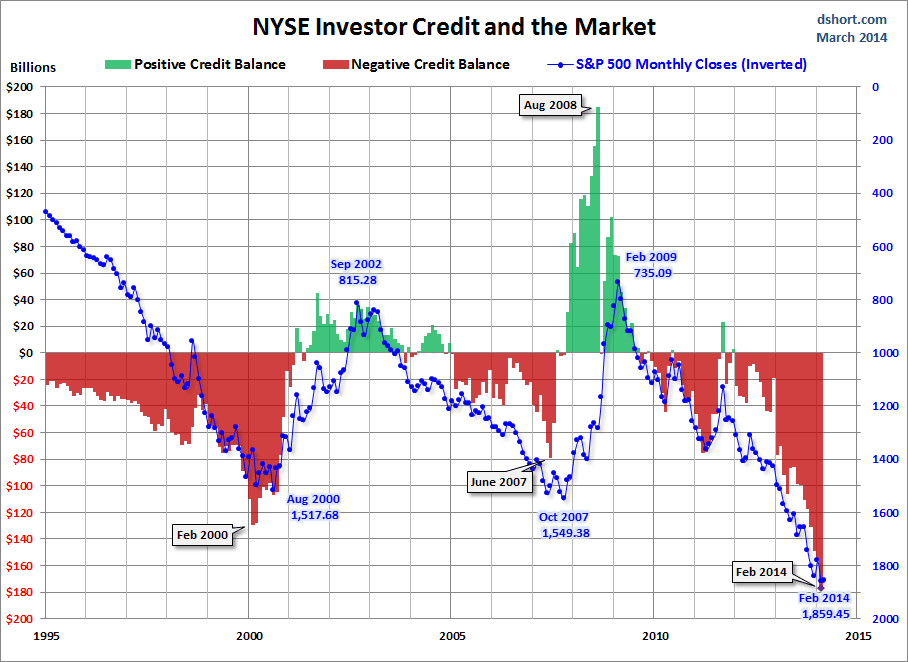

speculators betting on stocks with RECORD HIGH MARGIN DEBT in

conjunction with HOPIUM AND FALSE PERCEPTIONS is what has caused

stock prices to rise and they will FALL EVEN MORE QUICKLY AS REALITY

RETURNS.

WHY WORRY:? IT”S ONLY A MARKET CRASH

HAPPENING NOW…

It isn’t often that financial bubbles burst,

so the recent carnage in so-called momentum stocks ought to be front

page news. Former highflyers Tesla Motors, Netflix, Twitter,

and 3D Systems are 24%, 28%, 45% and 50% off their recent highs

respectively. Biotechnology stocks are in official bear market

territory, down 21%. Gracing the covers of popular business

magazines, one might expect to see an irritated bear, dejected

trader, or stock chart headed south, background in black. Yet a

quick scan of the financial headlines this past weekend shows little

concern:

- MarketWatch.com – “Stocks fall as volume rises, but here’s why not to worry”

- The Wall Street Journal – “Stock-Market Jitters Put Investors at Ease; Recent Turbulence Is Seen as a Healthy Sign”

- CNBC – “Last week’s big selloff ‘probably over’: Pro”

- MarketWatch.com – “Don’t let these stock market gyrations scare you; It’s likely that we’ve seen the end of recent declines”

The common theme

among investment pundits is that the momentum

bust is isolated, contained, healthy, and even predictable.

AMAZON STOCK PLUMMETS 10% – NEEDS TO FALL

97.5%…

Minyanville: What Amazon customers can expect

this year – USA TODAY

It had to happen sooner or later. Amazon stock

tanked nearly 10% in early trading Friday as investors absorbed the

company’s outlook for yet another quarter in which current profits

will be sacrificed for investment in the future.

AMAZON STOCK IS 3900% OVERVALUED…

Amazon stock is actually 3900% OVERVALUED based

on the math of its PE being 600 when the normal PE is 15. To

get the overvaluation percentage you divide 600 by 15 which equals 40

which equates to 4000%, and less the 100% of actual value that means

that those stocks are overvalued by 3900%.. The amount Amazon

stock needs to fall from its current PE valuations of 600 to the

normal PE valuation is 81.25% based on taking 600 and subtracting 15

and getting 585 and then dividing 585 by 600 which equals 97.5 which

equates to 97.5%. Math never lies and is always

absolute. Folks should try using it more often…

STOCK MARKETS ALWAYS CRASH FROM THE TOP WHEN

NEARLY ALL OF THE FOOLS SPECULATING IN THEM ARE CERTAIN THEY CAN DO

NOTHING BUT CONTINUE TO KEEP GOING UP FOWEVER. ALWAYS.

In the social media space, the bloodletting has

been ugly. The Social Media ETF SOCL is down 23%, but stronger stocks

like Facebook (down 16% from its high a month ago) paper over

individual fiascos, like Twitter, which has plummeted 48% from its

peak last year to below its IPO price.

We are now in the early stage of the biggest

crash stock markets have ever had in the US which will be

considerably worse than the crashes of 2000 and 2008. Margin

debt is at record high levels and that has ALWAYS preceded huge

market crashes.

Speculating with credit like there’s no

tomorrow – Bubble Bubble

STOCK CRASHES IN PROGRESS…The NASDAQ BioTech

Index has PLUMMETED 15% in the past 6 weeks and some bioltech stocks

are down as much as 60% since mid-March. Farcebook has plunged

16% over the past month and the Social Media ETF SOCL is down 23%,

while Twitter has plummeted 48% over the past 6 weeks.

The report on Friday from BLS confirmed that

NEARLY 92 MILLION AMERICANS ARE NOW UNEMPLOYED which is NEARLY

ONE-THIRD OF ALL AMERICANS and an ABSOLUTE RECORD HIGH FOR

UNEMPLOYMENT IN THE US that VASTLY EXCEEDS THAT OF THE GREAT

DEPRESSION in the 1930s.

Real

unemployment rate 59% – Labor Force Statistics from the Current

Population Survey

Official numbers from the Bureau of Labor

Statistics for April. Click on “civilian labor force level” to

see the numbers.

155,421,000 — that is 155 million willing and

able to work. If 92 million are out of work the unemployment rate is

59%

Margin debt takes a turn from all-time high

levels. Be concerned?

CLICK

ON CHART TO ENLARGE

It

doesn’t matter until it matters! Will a decline in margin debt from

all-time highs matter this time? Doug Short each month does an

excellent analysis on margin debt and the latest update is now out.

(see

current info here)

In the past margin debt at historical levels

didn’t seem to matter, until margin debt started decreasing. The

above chart highlights that at each (1), margin debt was at

historical highs and then turned south and the S&P 500 soon

followed.

In my humble opinion one should not look at

margin debt as the holy grail to portfolio construction. It has been

a good tool in helping to know when to overweight and underweight

towards risk assets.

Margin debt has been swiftly pushing higher for

the past 8 months in a row and now slipped a little this past month.

IF….IF margin debt should start decreasing swiftly, history would

suggest something different is taking place in the mind of aggressive

investors.

-

See more at:

http://blog.kimblechartingsolutions.com/2014/05/margin-debt-takes-a-turn-from-all-time-high-levels-be-concerned/#sthash.gI5cPF0J.dpuf

Chas Caldwell

No comments:

Post a Comment