Before It’s News

Before It’s NewsEven with the most cursory examination, lending can be seen as mostly a no-risk, ‘asset-secured’ business, in its simplest form seeing borrowers liable only for the original loan, which is secured against the borrower’s assets, plus interest.

When the loan is payed back, the bank profits in the accepted perception of what a bank does for a living – it gives low interest to depositors and takes a slightly higher interest from borrowers, their profit being the difference in interest rates.

When borrowers default, they yield to the lender whatever securities they’ve put up, which normally have asset values far exceeding that of the original loan.

The lender still profits.

In the case of mortgage loans, (Mort = death, as in ‘mortuary’ and Gage = bond) the home itself secures the loan, which over the 20-30 year payback period often returns more than 100% interest as the borrower pays back at least twice the amount of the original home loan he commits his working life to – and can lose at any time, no matter how much he’s paid.

So on the simple loan side, the lender gets his money back, plus interest.

In a default situation, he gets the securities against the loan which he sells off to pay back the loan.

In the Trillion-dollar mortgage market, he doubles his money.

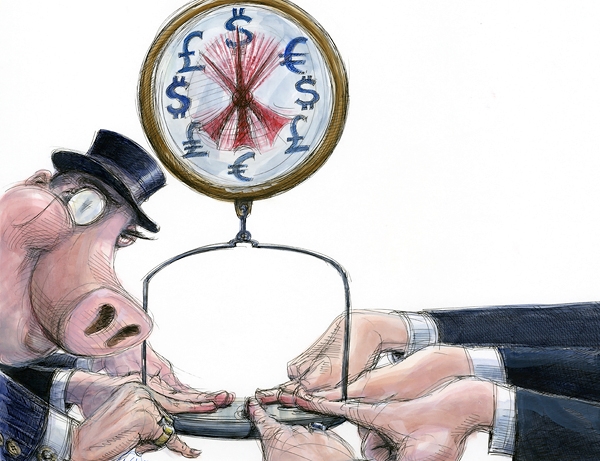

This appears to be an almost totally win-win situation for the banks.

Astonishingly, that’s not enough! Instead of getting a small interest on their money, depositors actuallypay banks to lend them their money today – it’s called a ‘deposit charge’ – which, along with all the other bank charges, means depositors see only between 80 and 90% of their income, when they used to see a small income from interest.

Things change… today’s problem with banks is their tendency to gamble:

By taking on the ‘moral hazard’ involved in the sale of debt derivatives, sacrificing long-term debt profit for today’s cash, they put the purchaser in harm’s way.

Their sale of ‘toxic’ derivatives, one of which is ‘securitized’ mortgage debts pooled with less secure, even unrecoverable debts and fraudulently labeled ‘Triple-A mortgage-backed securities’, led to the U.S. Sub-prime crash in 2008.

Step Right Up, Folks and pay, pay, pay…. we have hedge funds, Credit Default Swaps and many other chips in the game…

So on the simple loan side, the lender gets his money back, plus interest.

In a default situation, he gets the securities against the loan which he sells off to pay back the loan.

In the Trillion-dollar mortgage market, he doubles his money.

This appears to be an almost totally win-win situation for the banks.

Astonishingly, that’s not enough! Instead of getting a small interest on their money, depositors actuallypay banks to lend them their money today – it’s called a ‘deposit charge’ – which, along with all the other bank charges, means depositors see only between 80 and 90% of their income, when they used to see a small income from interest.

Things change… today’s problem with banks is their tendency to gamble:

By taking on the ‘moral hazard’ involved in the sale of debt derivatives, sacrificing long-term debt profit for today’s cash, they put the purchaser in harm’s way.

Their sale of ‘toxic’ derivatives, one of which is ‘securitized’ mortgage debts pooled with less secure, even unrecoverable debts and fraudulently labeled ‘Triple-A mortgage-backed securities’, led to the U.S. Sub-prime crash in 2008.

Step Right Up, Folks and pay, pay, pay…. we have hedge funds, Credit Default Swaps and many other chips in the game…

No comments:

Post a Comment