The big dips

The S&P 500, a much better of stock wealth in the US than the DOW has seen some major volatility in the last decade:

Source: ZeroHedge

This is an interesting chart. The dip in the early 2000s was led by the tech bust and the recent dip was brought on by the massive housing bubble. The Federal Reserve is back at it inflating their balance sheet to over $3.1 trillion buying mortgage backed securities as if it were a clearance sale. Yet the market being up is a good thing for Americans, right? Well a big part of the gains has come from cutting wages and squeezing productivity of remaining workers. Wealth inequality in the US is now reviving memories of the Gilded Age.

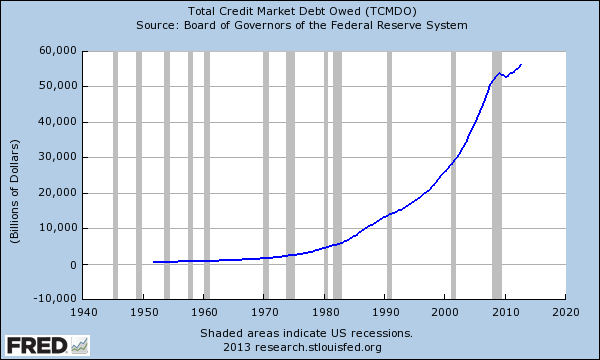

What is underlying a large part of this growth is massive debt expansion. We are quickly on our way to approaching a total credit market of debt of $60 trillion. The recession barely stunted this path:

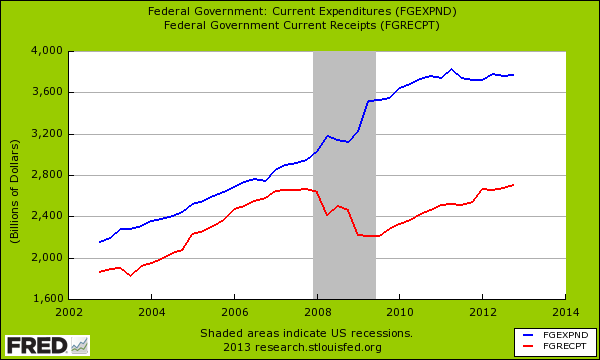

Those who can get their hands on debt are buying things up from real estate to other investments. Banks are leveraging up and bonuses are back in fashion. The government continues to spend way more than it is bringing in:

Yet the Fed is also allowing banks to leverage back up and go back into their black box models of investing. It seems like a large portion of the population is simply not interested in why the financial crisis took place. Our politicians are certainly not interested and prevention is rarely a good selling point.

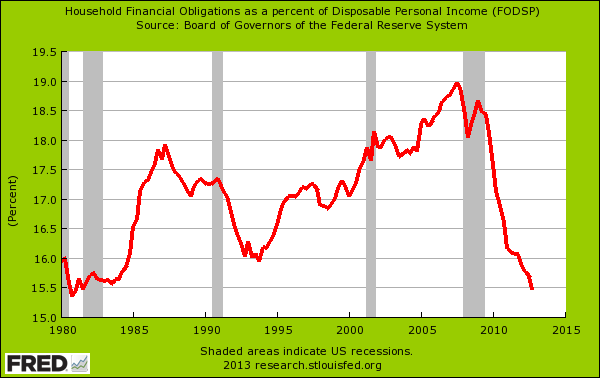

The stock market is operating under a system of casino economics. A boom and bust system is nearly inevitable with the Federal Reserve flooding the market with cheap interest rates. Yet using the word “market” may not be right here. They are providing member banks with easy money to speculate. The public is actually seeing tighter standards on lending:

A big part of this adjustment has come from foreclosures but also a tighter credit market. From the first chart regarding total debt outstanding, you realize that what applies to the average household is not the norm. I’m sure many people look at the stock market and think about buy and hold philosophies. Yet the market stands today where it did in 2000 (actually lower if we adjust for inflation). Unfortunately the market is setup for boom and bust cycles and those that create them are usually the people that profit. Take a look at Japan for a case in long-term quantitative easing after a housing bust. Ironically, some of the banks that caused the housing bust are now using cheap Fed money to buy up properties as rentals or for other investment ventures. This is simply part of the plan in casino economics. The house always wins.

No comments:

Post a Comment