Bond investors appear to have placed their faith in commodities exceptionalism, with many positing that the recent pick-up in U.S. default rates will defy historical trends and remain confined to that industry.

New research from Deutsche Bank AG pours cold water on that idea, arguing that there are already signs of contagion in junk-rated debt outside of the commodities space.

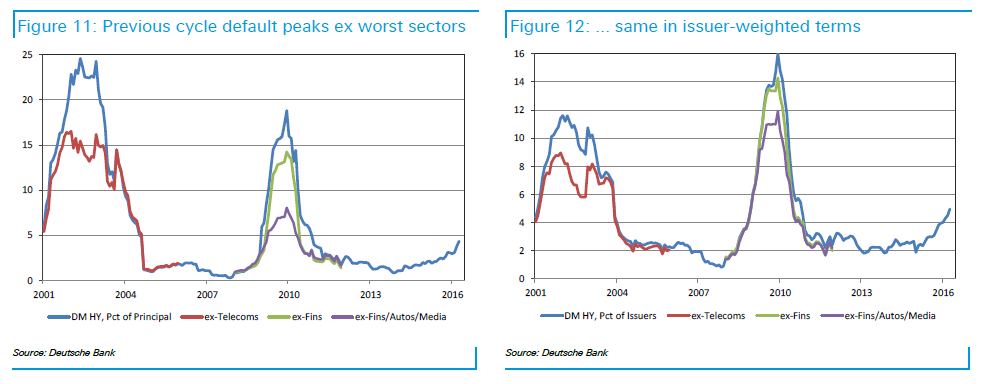

A look at previous peaks in default rates shows the potential for more pervasive corporate stress. While default rates were higher amongst particular sectors — such as telecoms in the early 2000s or financials during the 2008 crisis — the rate for junk bonds excluding these specialized industries also increased significantly.

The strategists highlight recent pressure in the retail sector, including the travails of Quicksilver Inc., American Apparel LLC, and Aeropostale Inc., as evidence that defaults have already taken place outside of the commodities realm.

While pervasively low interest rates around the world offer some hope to the exceptionalists, by potentially helping to ease corporate funding pressures and allowing companies to refinance their debt. The European Central Bank’s planned corporate debt-buying program has helped boost already hefty demand for corporate paper.

Still, Deutsche reckons that this time the debt cycle isn’t that different.

“A frequent argument is being made here how all problems are going to stay limited to commodity sector,” the analysts concluded. “Evidence like this, coupled with emerging credit pressures in retail and capital goods sectors, suggest a contained cycle to be a weak starting assumption.”

No comments:

Post a Comment