Russian Gold Reserves.

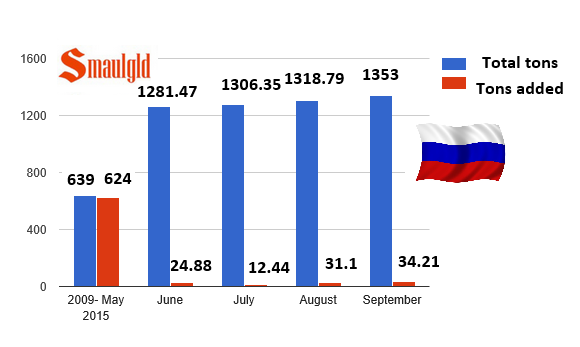

Russian Gold Reserves September 2015.

Russia added 1.1 million ounces (34.21 tons) of gold to its reserves in September.

Russia Boosts Gold Reserves and U.S. Treasury Holdings.

Russian Gold Reserves

Today, the Central Bank of the Russian Federation issued its official September, 2015 reserves and other foreign currency assets report. The report indicated that Russian gold reserves increased by1,100,000 ounces from its August 2015 report to 43.5 million ounces.

Since 2009 Russia has added more than 745 tons of gold to its reserves more than China who added (654 tons) during the same time period.

The 1.1 million ounce increase in Russia’s September gold reserves followed last month’s addition of one million ounces.

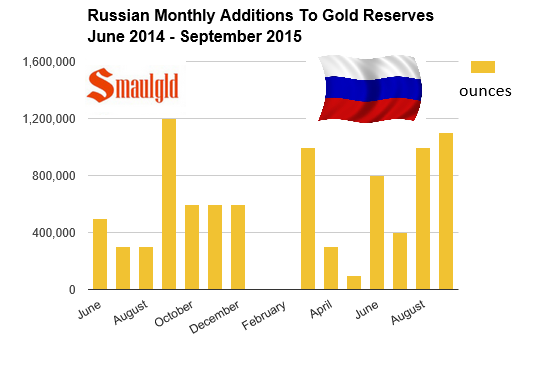

Russian Monthly Gold Purchases June 2014 – September 2015

Gold Bless the Russian Central Bank

In June, the Russian Central Bank announced that they would be boosting their foreign reserves by about 40% from $356 billion to about $500 billion.

“Recent experiences forced us to reconsider some of our ideas about sufficient and comfortable levels of gold reserves,” said Elvira Nabiullina, Chairwoman Russian Central Bank.

Russia has been rebalancing its foreign reserves to favor gold vs. U.S. Treasury Bonds. Russia’s gold buying binge had coincided with a steady sell off of her U.S. Treasuries. In the past four months through August 2015, however, Russia has also added to her U.S. Treasury holdings. Higher oil prices have helped the Russian Ruble stabilize in recent months, prompting some analysts to believe Russia’s central bank will cut its bench mark interest rate.

Currently, inflation is running close to 16% in Russia.

Russia’s Central Bank Governor Elvira Nabiullina said at a conference earlier this month regarding the possibility of further rate cuts “when inflation falls and when in our assessment inflation risks ease,” “If the situation will proceed as forecast and inflation will be at 7 percent in a year, that allows us to speak about rate reductions.”

Ms. Nabiullina also remarked that she believed that a four percent inflation rate is possible by 2017. To which, Russian President Vladimir Putin remarked “God Bless the Central Bank!”

Earlier this month Russia President Vladimir Putin noted “All this gives grounds to believe that the situation in the Russian economy will be stable and, despite the well-known decline in domestic demand, we will work hard to make it rise and become an essential factor in ensuring high rates of economic development,” adding “Russia’s economy will maintain a good development potential.”

It might be expected that as Russia increases its foreign reserves it would do so at least in proportion with that of its current gold reserves.

In August 2015, Russia added 1,000,000 ounces of gold to its reserves and $7.8 billion of U.S. Treasuries.

Russian U.S. Treasury Holdings

Russia’s U.S. Treasury Bond Holdings January 2014-August 2015

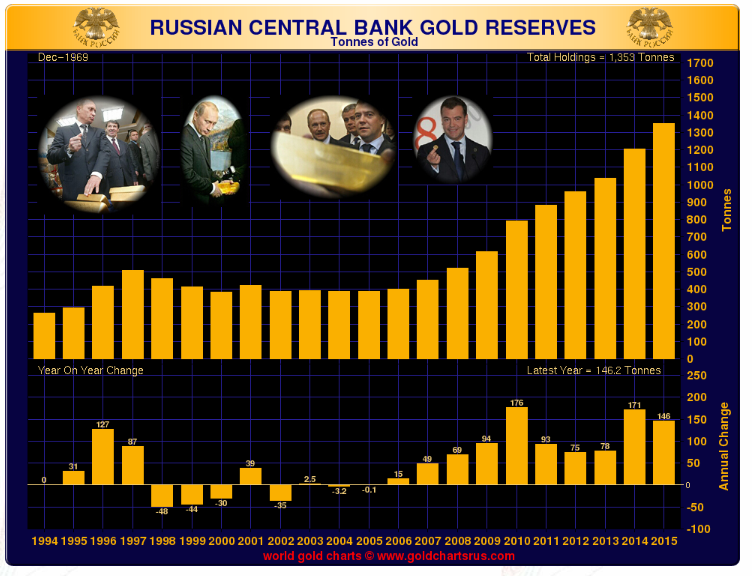

Russian Gold Reserves in Tons 1994-2015

Subscribe to Smaulgld.com for free (above right) to receive gold and silver updates and analysis.

Further Reading:

Russian Gold Reserves (monthly archive)

Russia’s U.S. Treasury Holdings vs. Gold Reserves

Top Foreign Holders of U.S. Treasuries

Gold Repatriation Requests (updated regularly)

Gold Supply and Demand

The Importance of Gold

Save our Swiss Gold

The Smaulgld Gold Buying Guide

The West Sells Paper Gold While the East Buys Physical Gold

Gold Continues to Move From West to East

Gold Reserves By Country – Top 20

Russia, Ukraine and the Dollar

Are Russia and China Moving Against the Dollar

Gold and Silver Price Manipulation – Suspected

Gold and Silver Price Manipulation – Actual

China Hoards its Gold Production and Ramps up its Imports

Please visit the Smaulgld Store for a large selection of recommended Kindles, books, music, movies and other items.

You can support Smaulgld.com by making all your Amazon purchases through the search widget below and by ordering your gold and silver by clicking on the JM Bullion, BGASC, Bullion Vault, Gold Broker, Golden Eagle Coin, GoldMoney, Perth and Royal Canadian Mint ads on the site.

DISCLOSURE: Smaulgld provides the content on this site free of charge. If you purchase items though the links on this site, Smaulgld LLC. will be paid a commission. The prices charged are the same as they would be if you were to visit the sites directly. Please do your own research regarding the suitability of making purchases from the merchants featured on this site.

Chart Disclaimer: Information presented here has been obtained from a third party and is presented for information purposes only. Smaulgld can not and does not guarantee the accuracy or timeliness of the data displayed on this site and therefor the data provided should not be used to make actual investment decisions. You should always consult a professional investment adviser before investing in precious metals or any type of investment. You acknowledge that Smaulgld assumes no responsibility for the integrity of data on this site.

The content provided here is for informational purposes only. Making investment decisions based on information published by Smaulgld (SG), or any Internet site, is not a good idea. Accordingly, users agree to hold SG, its owner and affiliates, harmless for all information presented on the site. SG presents no warranties. SG is not responsible for any loss of data, financial loss, interruption in services, claims of libel, damages or loss from the use or inability to access SG, any linked content, or the reliance on any information on the site.

The information contained herein does not constitute investment advice and may be subject to correction, completion and amendment without notice. SG assumes no duty to make any such corrections or updates. As with all investments, there are associated risks and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal and tax advisers to evaluate independently the risks, consequences and suitability of that investment. SG disclaims any and all liability relating to any investor reliance on the accuracy of the information contained herein or relating to any omissions or errors and as such disclaims any and all losses that may result.

No comments:

Post a Comment