Keep out Californians

Many people need to stay in California because of work and family obligations. Yet when we look at the data we find that many homeowners are older in age. If you are able to find a lower cost of living state, you can truly maximize that equity lottery ticket you have. Taco Tuesday boomers are cashing in and are heading to various parts of the country. But when you have many people targeting one place, prices can and will get pushed up especially in the midst of a mania.

Portland has become one of those target areas and some residents are not happy:

“(Oregon Live) Portlanders apparently upset with the direction of the local housing market are slapping “no Californians” stickers on For Sale signs in the city, real estate agents say.”Of course Californians can only purchase so much real estate. The mania is forming across many metro areas thanks to low interest rates and tight inventory. Add in out-of-state buyers and you can understand why prices are moving up. But who does this benefit? It benefits those selling in California and leaving. It benefits the homeowner in the targeted location. But it makes it tougher for local families that didn’t benefit from the wild price gains of other states (i.e., San Francisco tech mania). Ultimately this trend simply adds more fuel to the growing number of renter households.

“A lot of these homes are going into bidding wars and going over ask price,” Irvine said. “And a lot of these guys are getting outbid. And I think they’re going around to agents who have properties that have sold over ask price and putting anti-California stickers.”

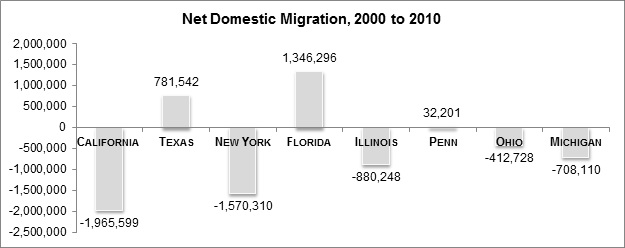

You also have other locations like Austin Texas. This hipster paradise has seen a lot of movement from Californians. Net migration out of California is very real especially to Texas:

Texas has become the number one destination for Californians leaving the state. Once in awhile we get the comment about “leaving the state” and when you look at the data, a large number of working class and middle class Californians have already done so.

“(The Daily Signal) About 5 million California residents left the Golden State during the past decade, marking an “unprecedented” number according to a report released this week.Yet the large group moving out is likely to be non-homeowners. Now we are seeing what lottery ticket homeowners are doing with their equity and they are continuing the tradition of inflating real estate prices in other markets. Some folks are not taking kindly to this:

The Sacramento Bee analyzed tax return data from the Internal Revenue Service between 2004 and 2013, the height of the housing crash and recession, which impacted California more sharply than most states.

During that time period, about 3.9 million people moved to California from other states, leaving a net migration population loss of more than 1 million people.

Texas attracted more Californians than any other state, drawing 600,000 residents.”

I’ve heard from people going to Portland, Tucson, Boulder, Austin, and Miami to leverage their big California equity. If you are heading into retirement, this is probably a very wise move to cut down on your cost of living expenses. I know we have a few readers from Oregon and Washington so I’d be curious to hear your experience.

No comments:

Post a Comment