The strong U.S. dollar and an unsteady

global economy are emerging as primary concerns for Federal Reserve

officials as they prepare for a policy meeting next week to consider the

timing of the first interest-rate increase since before the financial

crisis.

The Fed already has said it is unlikely to raise rates next week and officials in recent interviews and public comments have signaled a rate increase in June has become less likely because the economy slowed in the first quarter.

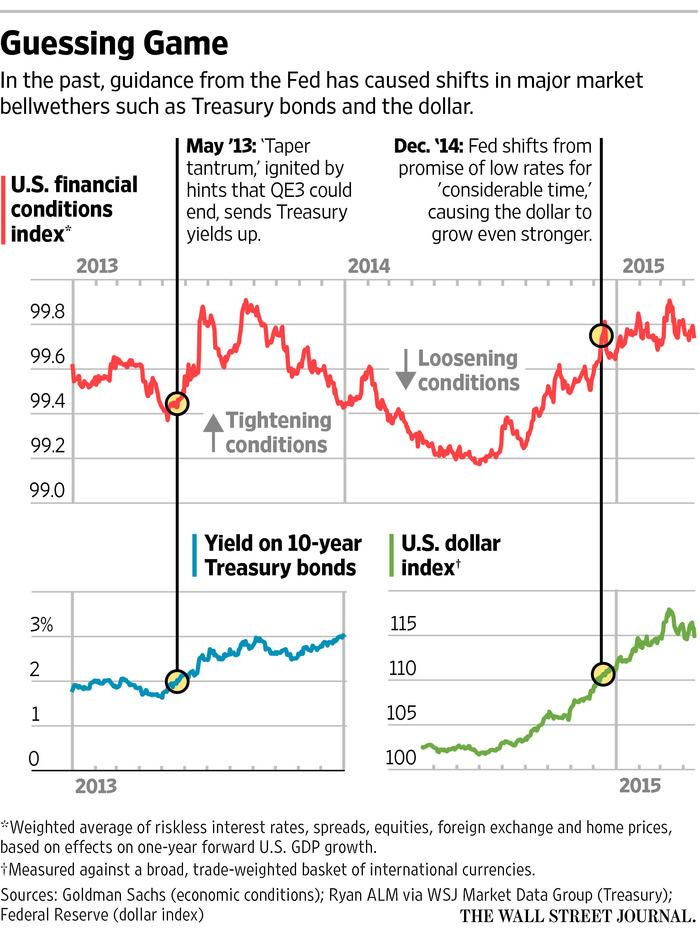

As they discuss the outlook beyond midyear, officials are increasingly weighing how much the strong dollar might have hurt the prospects of achieving their economic forecast of annual growth of around 2.5%, gradual increases in inflation and continued declines in unemployment.

Fed officials have said they won’t raise rates until they’re confident inflation is on track to rise toward their 2% target, and they want to see the job market keep improving. A stronger currency tends to undermine exports because it makes them more expensive. That slows growth and potentially hiring. Meantime, the strong currency holds down the prices of imports and broader inflation.

http://www.wsj.com/articles/feds-rate-decisions-hang-on-dollar-growth-concerns-1429695005

The Fed already has said it is unlikely to raise rates next week and officials in recent interviews and public comments have signaled a rate increase in June has become less likely because the economy slowed in the first quarter.

As they discuss the outlook beyond midyear, officials are increasingly weighing how much the strong dollar might have hurt the prospects of achieving their economic forecast of annual growth of around 2.5%, gradual increases in inflation and continued declines in unemployment.

Fed officials have said they won’t raise rates until they’re confident inflation is on track to rise toward their 2% target, and they want to see the job market keep improving. A stronger currency tends to undermine exports because it makes them more expensive. That slows growth and potentially hiring. Meantime, the strong currency holds down the prices of imports and broader inflation.

http://www.wsj.com/articles/feds-rate-decisions-hang-on-dollar-growth-concerns-1429695005

America's unintended strong-dollar policy worries top Fed officials, and may delay rate hikes http://on.wsj.com/1PwLvwi

No comments:

Post a Comment