ECB Money Printers At Work: As Europe Slides Into Recession—–Lending Standards Keep Deteriorating

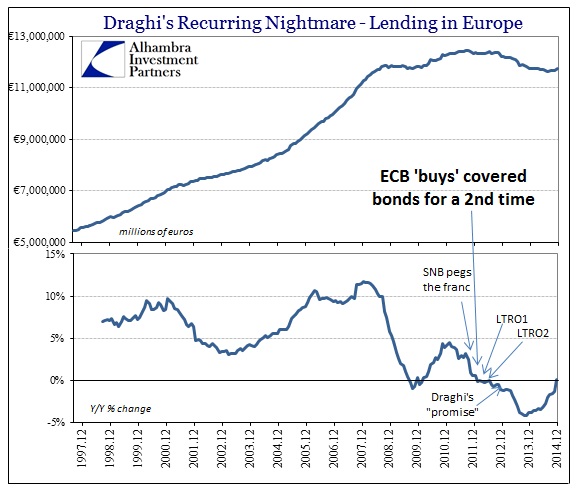

For the first time in thirty-five months, overall lending in Europe was higher year-over-year. Not since January 2012 had that been the case, as shrinking in lending was a de facto monetary limit on where the ECB wants the European economy to go. And while one month is not necessarily the start of a durable trend, indications had been for some time that total lending activity had at least been flattening out after the long decline.

image: http://www.alhambrapartners.com/wp-content/uploads/2015/02/ABOOK-Feb-2015-Europe-Lending.jpg

While we don’t know for sure how much the T-LTRO’s had as an effect

on any net increase in lending, however tiny, the disappointment over

the takeups in September and December does not mean there was no effect

at all. And that is precisely the problem, as the monetary pathway for

all of this monetarism is intended to ease any restraints on lending as

if restraint were everywhere and always a negative outcome. In other

words, the ECB practically begged banks to lend, to the tune of hundreds

of billions in indirect funding, including €212.44 billion in T-LTRO’s

cumulative, interbank rates persistently below zero, yield curves

collapsed everywhere and the result was December 2014 lending was just

€5.1 billion above December 2013.

While we don’t know for sure how much the T-LTRO’s had as an effect

on any net increase in lending, however tiny, the disappointment over

the takeups in September and December does not mean there was no effect

at all. And that is precisely the problem, as the monetary pathway for

all of this monetarism is intended to ease any restraints on lending as

if restraint were everywhere and always a negative outcome. In other

words, the ECB practically begged banks to lend, to the tune of hundreds

of billions in indirect funding, including €212.44 billion in T-LTRO’s

cumulative, interbank rates persistently below zero, yield curves

collapsed everywhere and the result was December 2014 lending was just

€5.1 billion above December 2013.

http://davidstockmanscontracorner.com/ecb-money-printers-at-work-as-europe-slides-into-recession-lending-standards-keep-deteriorating/

Currency Wars Heat up as Central Banks Race to Cut Rates

The Chinese Year of the Ram will kick off at the end of this month, but for now it looks as if 2015 will be the Year of the Central Banks.

I spend a lot of time talking about gold, oil and emerging markets, and it’s important to recognize what drives these asset classes’ performance. Government and fiscal policy often have much to do with it. But in the past three months, we’ve seen central banks take center stage to engage in a new currency war: a race to the bottom of the exchange rate in an attempt to weaken their own currencies and undercut competitor nations.

Indeed, amid rock-bottom oil prices, deflation fears and slowing growth, policymakers from every corner of the globe are enacting some sort of monetary easing program. Last month alone, 14 countries have cut rates and loosened borrowing standards, the most recent one being Russia.

A weak currency makes export prices more competitive and can help give inflation a boost, among other benefits.

“The U.S. seems to be the only country right now that doesn’t mind having a strong currency,” says John Derrick, Director of Research here at U.S. Global Investors.

Since July, major currencies have fallen more than 15 percent against the greenback.

image: http://67.19.64.18/news/2015/2-3fh/image002.png

http://news.goldseek.com/GoldSeek/1422975900.php

http://news.goldseek.com/GoldSeek/1422975900.php

For the first time in thirty-five months, overall lending in Europe was higher year-over-year. Not since January 2012 had that been the case, as shrinking in lending was a de facto monetary limit on where the ECB wants the European economy to go. And while one month is not necessarily the start of a durable trend, indications had been for some time that total lending activity had at least been flattening out after the long decline.

image: http://www.alhambrapartners.com/wp-content/uploads/2015/02/ABOOK-Feb-2015-Europe-Lending.jpg

While we don’t know for sure how much the T-LTRO’s had as an effect

on any net increase in lending, however tiny, the disappointment over

the takeups in September and December does not mean there was no effect

at all. And that is precisely the problem, as the monetary pathway for

all of this monetarism is intended to ease any restraints on lending as

if restraint were everywhere and always a negative outcome. In other

words, the ECB practically begged banks to lend, to the tune of hundreds

of billions in indirect funding, including €212.44 billion in T-LTRO’s

cumulative, interbank rates persistently below zero, yield curves

collapsed everywhere and the result was December 2014 lending was just

€5.1 billion above December 2013.

While we don’t know for sure how much the T-LTRO’s had as an effect

on any net increase in lending, however tiny, the disappointment over

the takeups in September and December does not mean there was no effect

at all. And that is precisely the problem, as the monetary pathway for

all of this monetarism is intended to ease any restraints on lending as

if restraint were everywhere and always a negative outcome. In other

words, the ECB practically begged banks to lend, to the tune of hundreds

of billions in indirect funding, including €212.44 billion in T-LTRO’s

cumulative, interbank rates persistently below zero, yield curves

collapsed everywhere and the result was December 2014 lending was just

€5.1 billion above December 2013.http://davidstockmanscontracorner.com/ecb-money-printers-at-work-as-europe-slides-into-recession-lending-standards-keep-deteriorating/

Currency Wars Heat up as Central Banks Race to Cut Rates

The Chinese Year of the Ram will kick off at the end of this month, but for now it looks as if 2015 will be the Year of the Central Banks.

I spend a lot of time talking about gold, oil and emerging markets, and it’s important to recognize what drives these asset classes’ performance. Government and fiscal policy often have much to do with it. But in the past three months, we’ve seen central banks take center stage to engage in a new currency war: a race to the bottom of the exchange rate in an attempt to weaken their own currencies and undercut competitor nations.

Indeed, amid rock-bottom oil prices, deflation fears and slowing growth, policymakers from every corner of the globe are enacting some sort of monetary easing program. Last month alone, 14 countries have cut rates and loosened borrowing standards, the most recent one being Russia.

A weak currency makes export prices more competitive and can help give inflation a boost, among other benefits.

“The U.S. seems to be the only country right now that doesn’t mind having a strong currency,” says John Derrick, Director of Research here at U.S. Global Investors.

Since July, major currencies have fallen more than 15 percent against the greenback.

image: http://67.19.64.18/news/2015/2-3fh/image002.png

http://news.goldseek.com/GoldSeek/1422975900.php

http://news.goldseek.com/GoldSeek/1422975900.php

Gregory Mannarino: Cracks in the Debt Bubble – World War III has Started

“This is being done on purpose to punish the Russian economy. This is

economic warfare 101, and it’s going to lead to a shooting war. Not

only is it going to lead to a shooting war, this is the grand plan…What

people need to understand is the collapse is here now. World War III has

started, so this is it people. There is no more waiting.”

Four Trade War Questions; PMI Reports; Currency Manipulation Chargeshttp://globaleconomicanalysis.blogspot.com/2015/02/four-trade-war-questions-pmi-reports.html#hfec9hOVdEhSAfbU.99

“A trade war brewing between India & the US?

http://www.livemint.com/Opinion/JJtdXFRyKSf87rTIQQoAKP/A-trade-war-brewing.html

S**t is getting real…this is the start of a trade war. NYT: New Rules in China Upset Western Tech Companies

http://www.nytimes.com/2015/01/29/technology/in-china-new-cybersecurity-rules-perturb-western-tech-companies.html

Superpowers Battle Over Greece As Europe Trembles With Fear Of World War III

http://kingworldnews.com/superpowers-battle-greece-europe-trembles-fear-world-war-iii/

U.S. Gov/Central Bankers Are Accelerating War To Cover Up The Economic Collapse

“A trade war brewing between India & the US?

http://www.livemint.com/Opinion/JJtdXFRyKSf87rTIQQoAKP/A-trade-war-brewing.html

S**t is getting real…this is the start of a trade war. NYT: New Rules in China Upset Western Tech Companies

http://www.nytimes.com/2015/01/29/technology/in-china-new-cybersecurity-rules-perturb-western-tech-companies.html

Superpowers Battle Over Greece As Europe Trembles With Fear Of World War III

http://kingworldnews.com/superpowers-battle-greece-europe-trembles-fear-world-war-iii/

U.S. Gov/Central Bankers Are Accelerating War To Cover Up The Economic Collapse

No comments:

Post a Comment