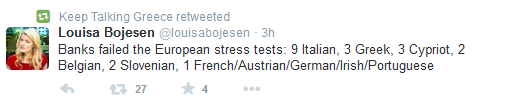

I cannot tell you the relief this tweet

gave me. Maybe it was hand relief – I’m not sure – but as Eckhart Tolle

would write, ‘It is the end of all pain’. For now I can sleep safe in

the knowledge that Greek banks have little shortfall on a dynamic basis.

Oh joy.

I mean, let’s get real here: if the ECB says the basis of dynamic fall is not only short but little, then surely we have nothing to worry about. Er, um, well…here’s another tweet:

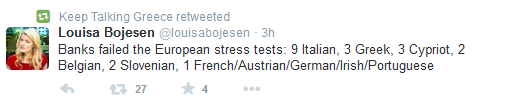

Oh dear, or something. Three Cypriot banks…that’s all of them, isn’t it?

Oh dear, or something. Three Cypriot banks…that’s all of them, isn’t it?

And two Belgian banks….don’t the Belgians have an economy 78% focused on running the EU?

And…OMG…NINE ITALIAN BANKS? Aaaarrrgggg.

Monte del Peische is, as I write, appointing outside advisors to help it look for a merger partner. This makes me wonder what the chances might have been of success had the Führerbunker appointed IG Farben to look for a Jewish American consortium with which to partner in May 1945.

And all this, we’re told, is an exercise through which (as one very sound observer suggests) ‘The ECB wants you to believe that the European banking sector is safe and sound’. No shit.

In pursuit of that aim, I can report that the capital shortfall of €25bn revealed at 25 euro area banks in 2013 has now been reduced to €15bn in 2014.

Result!

Just one problem: in carrying out this stress-test, the ECB unearthed an addditional €136bn in non-performing exposures…..which does cast something of a long, dark shadow across the €10bn shortfall improvement Thing.

I’m sorry folks, but this stress test is hoist by its own facade. It is a charade. A canard. A Cunard liner launched under the name of SS Titanic.

I am more than delighted to point out that this Slogpost borrows heavily for its maths upon this site.

I mean, let’s get real here: if the ECB says the basis of dynamic fall is not only short but little, then surely we have nothing to worry about. Er, um, well…here’s another tweet:

Oh dear, or something. Three Cypriot banks…that’s all of them, isn’t it?

Oh dear, or something. Three Cypriot banks…that’s all of them, isn’t it?And two Belgian banks….don’t the Belgians have an economy 78% focused on running the EU?

And…OMG…NINE ITALIAN BANKS? Aaaarrrgggg.

Monte del Peische is, as I write, appointing outside advisors to help it look for a merger partner. This makes me wonder what the chances might have been of success had the Führerbunker appointed IG Farben to look for a Jewish American consortium with which to partner in May 1945.

And all this, we’re told, is an exercise through which (as one very sound observer suggests) ‘The ECB wants you to believe that the European banking sector is safe and sound’. No shit.

In pursuit of that aim, I can report that the capital shortfall of €25bn revealed at 25 euro area banks in 2013 has now been reduced to €15bn in 2014.

Result!

Just one problem: in carrying out this stress-test, the ECB unearthed an addditional €136bn in non-performing exposures…..which does cast something of a long, dark shadow across the €10bn shortfall improvement Thing.

I’m sorry folks, but this stress test is hoist by its own facade. It is a charade. A canard. A Cunard liner launched under the name of SS Titanic.

I am more than delighted to point out that this Slogpost borrows heavily for its maths upon this site.

No comments:

Post a Comment