Markets crash not from “bad news” but from the exhaustion of temporary stability.

Yesterday I made the case for a Financial Singularity that will never allow stocks to crash. We can summarize this view as: the market and the economy are not systems, they are carefully controlled monocultures. There are no inputs that can’t be controlled, and as a result the stock market is completely controllable.

Today I make the case for a crushing stock market crash that isn’t just possible or likely–it’s absolutely inevitable.

The conceptual foundation of this view is: regardless of how much money

central banks print and distribute and how much they intervene in the

markets, these remain complex systems that necessarily exhibit the semi-random instability that characterizes all complex systems.

This is a key distinction, because it relates not to the power of central banks but to the intrinsic nature of systems.

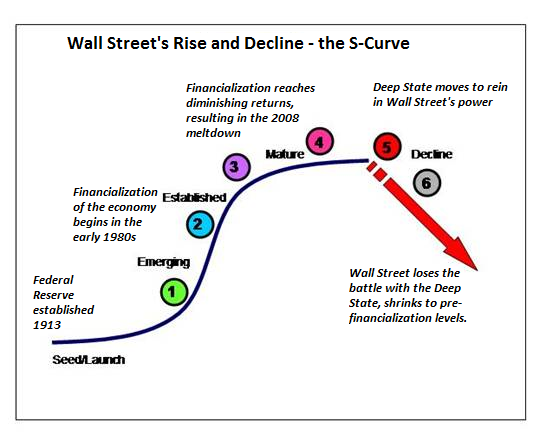

One of the primary

motivators of my work is the idea that systems analysis can tell us a

great deal about the dysfunctions and future pathways of the market and

economy. Systems analysis enables us to discern certain pathways of

instability that repeat over and over in all complex systems–for

example, the S-Curve of rapid growth, maturation and diminishing

returns/decline.

One ontological feature of

complex systems is that they are not entirely predictable. An

agricultural monoculture is a good example: we can control all the

visible inputs–fertilizer, seeds, water, pesticides, etc.–and conclude

that we can completely control the output, but evolution throws a monkey

wrench into our carefully controlled system at semi-random times: an

insect pest develops immunity to pesticides or the GMO seeds, a drought

disrupts the irrigation system, etc.

The irony of assuming that controlling all the visible inputs gives us ultimate control over all outputs is the more we centralize control of each input, the more vulnerability we introduce to the system.

Those arguing that central

banks (and their proxies) can control the stock market have the past six

years as evidence. Those of us who see this heavy-handed control as

increasing the risk of unpredictable instability have no

systems-analysis model that can pinpoint the dissolution of central bank

controlled stability. As a result, we seem to be waiting for something

that may never happen.

Despite its inability to

predict a date for the collapse of stability, I still see systems

analysis as providing the most accurate and comprehensive model of how

complex systems function in the real world. If the economy and the

market are indeed systems, then we can predict that any level of control

will fail no matter how extreme, and it will fail in an unpredictable

fashion that is unrelated to the power of the control mechanism.

Indeed, we can posit that

the apparent perfection of central-bank engineered stability (i.e. a low

VIX and an ever-rising market) sets up a crash that surprises

everyone who is confident that central-bank monocultures never crash. In

the real world, manipulated stability is so vulnerable to cascading

collapses that crashes are probabilistically inevitable.

That raises the question; why not crash now?

After all, all the good news is known and priced in, and all the bad

news has been fully discounted. Why shouldn’t global stock markets crash

big and crash hard, not in two years but right now?

Markets crash not from “bad news” but from the exhaustion of temporary stability. The longer that temporary stability is maintained by manipulation, the greater the severity of the resulting crash.

As I noted in The Coming Crash Is Simply the Normalization of a Mispriced Market, this line from songwriter Jackson Browne captures the ontological falsity of permanent market stability: Don’t think it won’t happen just because it hasn’t happened yet.

Read more at http://investmentwatchblog.com/heres-why-the-market-could-crash-not-in-two-years-but-now/#tBsHYEo84BRubjoF.99

No comments:

Post a Comment