Insight: U.S. corporations have been borrowing like billy-o, but now they’ve stopped, says Brett Arends

Everyone knows the stock market has skyrocketed in the past few years, but far too few understand why.

No, it hasn’t been magic. It hasn’t been levitation. It hasn’t been the natural state of affairs.

It’s been supply and demand.

U.S. corporations have been spending hundreds of billions of dollars a year buying in their own stock, simultaneously increasing the demand for the stock and reducing the supply.

And this matters right now because…er…they just stopped.

The amount spent on share buybacks plunged by more than 20% last quarter, strategists at SG Securities calculate. Even though stock prices in the Standard & Poor’s 500 were on average 25% higher than they were a year ago, the amount spent on share buybacks actually fell.

As SG notes, “US corporates (have) been the major net buyer of US equity in recent years, purchasing over $500 billion of stock last year alone.” But, notes the bank, this happy trend may be drawing to a close.

There are two reasons….

http://www.marketwatch.com/story/uh-oh-stock-buybacks-are-on-the-decline-2014-08-20?dist=beforebell

Subprime trouble? Car buyers struggle with loans

A new report shows a growing number of car and truck owners are

struggling to make their monthly auto loan payments. Experian, which

analyzes millions of auto loans, says the percentage of those loans that

were delinquent or ended up in default with the vehicle being

repossessed surged in the second quarter of this year.

“The number of delinquencies and repossessions rising is what we would expect as the auto industry sells more vehicles,” said Melinda Zabritski, senior director of automotive finance for Experian Automotive. “But this slight uptick is one to keep an eye on.”

The surge in delinquencies and repossessions is being driven primarily by borrowers with subprime and deep subprime credit scores. Experian considers subprime borrowers as those with credit scores of 550 to 619 while deep subprime borrowers are those with credit scores lower than 550. Combined, the two categories accounted for more than 12 million of the open auto loans in the second quarter, which is 19.6 percent of all open auto loans.

“The number of subprime auto loans has definitely increased, but overall, those loans make up a smaller percentage of all auto loans than they did during the start of the recession in 2008 and 2009,” Zabritski said.

“The number of delinquencies and repossessions rising is what we would expect as the auto industry sells more vehicles,” said Melinda Zabritski, senior director of automotive finance for Experian Automotive. “But this slight uptick is one to keep an eye on.”

The surge in delinquencies and repossessions is being driven primarily by borrowers with subprime and deep subprime credit scores. Experian considers subprime borrowers as those with credit scores of 550 to 619 while deep subprime borrowers are those with credit scores lower than 550. Combined, the two categories accounted for more than 12 million of the open auto loans in the second quarter, which is 19.6 percent of all open auto loans.

“The number of subprime auto loans has definitely increased, but overall, those loans make up a smaller percentage of all auto loans than they did during the start of the recession in 2008 and 2009,” Zabritski said.

Total balances of auto loans in America in the second quarter climbed

11.7 percent to an all-time high of $839 billion, according to

Experian.

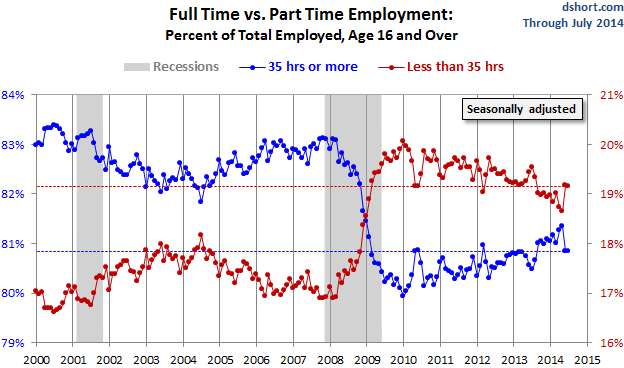

The trend for part-time work sweeping the world

Part-time work dominating jobs in the United States, Canada, and Japan.

The employment statistics do a good job

concealing the true nature of the workforce. The unemployment rate has

dropped dramatically since the recession ended largely because millions

of Americans are now no longer considered part of the workforce.

This is an easy way to boost the employment rate without actually

creating new jobs. Another trend that seems to be growing around the

world is that of part-time work. Part-time work and low wage labor go

hand and hand. Part-time workers usually are not afforded the same

benefits as those working full-time. They are also brought on with a

just in time attitude and are treated as such when no longer needed.

Part-time work has been growing before the recession and continues to do

so today. In Canada, part-time work has been the dominant sector of

employment growth. Low wage labor and part-time work go together like peas in a pod. Is this a trend we should be concerned about?

- August 20, 2014; Ambrose Evans-Pritchard: Euro Woe’s (McAlvany audio)

- Venezuela calls for greater “civic-military unity” to stabilize economy

- US Hospitals Have Had 68 Ebola Scares, CDC Says

- Moody’s South Africa Bank Downgrade Raising Sovereign Risk

- Argentina Farmers Struggle to Finance Crops After Default

- Hollande unveils measures to pep up stagnant French economy

- Russia economic funk ripples out through ex-Soviet states

No comments:

Post a Comment