Spending money you don’t have

Americans love their credit cards. We rely on FICO scores for a wide variety of things including buying a home, car, or even applying for a loan for college. One of the funny things about these credit scores is that they actually look at you taking on credit card debt to boost your score. So in a way, to play in this debt based system you have to go into debt. No debt and no credit cards and you are likely going to have a poor credit score even though you are in good financial standing. In other words, we have created a system where consumers are brainwashed into being comfortable with debt merely to access loans that are required to pursue middle class trappings.

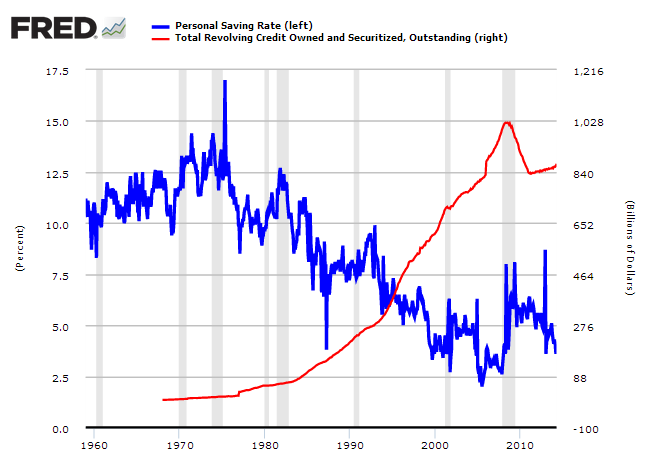

It is clear that credit card debt fell after the Great Recession:

Credit card debt peaked at over $1 trillion and quickly fell back. Americans have a very low savings rate and this is also another reason why we are confronting a looming retirement crisis. Live for the moment. YoLo. Credit cards are the opiate to easy spending. People forget that buying a $1,000 TV on a high rate card and paying minimum payments can actually turn that TV into a $3,000 purchase over many years. Where does that extra interest go? Into the banking system that largely does not create anything and we see this with big banks buying single family homes and pushing out regular families from being able to afford a house.

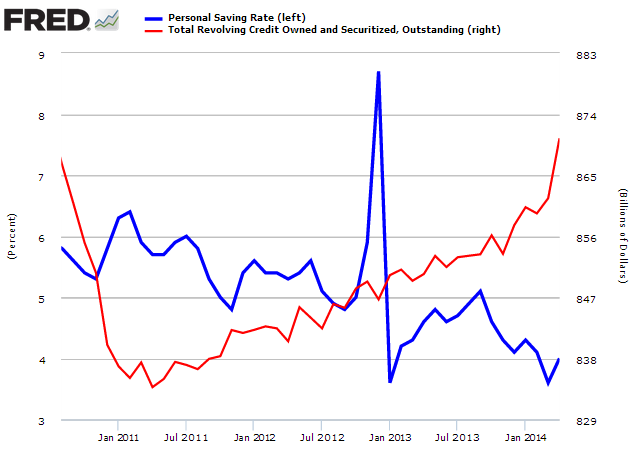

Yet credit card debt is now once again increasing:

The trend from the peak has been very clear as Americans de-leveraged. Today, it looks like households are re-leveraging up once again. The typical American household has something like $7,000 in student debt. That is a lot of debt to pay especially when a large portion of our society makes so little money annually.

Credit cards have their place in the current economic system but today people are using them like they did during the years prior to the Great Recession. They are using credit cards to pretend they are middle class while struggling to get by. People are going into massive mortgage debt, college debt, auto debt, and now credit card debt just to keep pretending they are wealthy when they truly are not. We don’t have to look far to know this. 1 out of 3 Americans has absolutely no savings but 9 out of 10 American adults has a credit card. Figure that one out.

During a casual conversation someone was mentioning how they are now trading stocks since the stock market is at a new peak. They of course mentioned a few hot stocks and how they plan on making more additional money moving forward. At the same time, they are living paycheck to paycheck with their expensive cars, big home, and constant eating out. They have a spending problem yet somehow, they suffer from the temporarily embarrassed millionaire syndrome. Most Americans are barely scratching by. Yet they want a piece of the action when the market heats up. They fail to realize that this low wage capitalism is slowly eroding their purchasing power. When the tide goes out as it did in 2007, these people realized what was truly going on for a short period. Yet the market is now up (most Americans don’t own one stock) and real estate is back-up (mostly because of investors). Now that prices are high, the public is ready to dive in (with debt) to get fleeced because they want to be the next millionaire while in reality, the economic facts show that wealth is aggregating in fewer and fewer hands.

The fact that the savings rate is so low yet credit card borrowing is up shows you that people simply don’t change. History doesn’t repeat but it certainly has a very familiar rhyme.

No comments:

Post a Comment