by

GoldCore

Today’s AM fix was USD 1,327.75, EUR 961.65

and GBP 793.21 per ounce.

Yesterday’s AM fix was USD 1,331.00, EUR 974.81 and GBP 799.88 per ounce.

Yesterday’s AM fix was USD 1,331.00, EUR 974.81 and GBP 799.88 per ounce.

Gold climbed $1.50 or 0.11% yesterday to

$1,330.50/oz. Silver rose $0.04 or 0.19% at $21.28/oz.

Gold headed for its first back to back monthly

gain since August as concern that the U.S. recovery may be losing

momentum, concerns about the Chinese economy and turmoil in emerging

markets is leading to haven demand. Assets in gold exchange-traded

products are set for the first monthly increase in 14 months. Gold

ETF holdings climbed 0.4% this month through yesterday and are set

for their first monthly gain since December 2012.

China’s economy may exert an important

influence on markets again next week. A poor PMI number on Saturday

could lead to a renewed bout of ‘risk off’ in markets next week.

A two-week slide in China’s yuan accelerated

today when it had its biggest tumble since 2005 on speculation the

the central bank is stepping up efforts to push it lower. A 0.9% drop

against the U.S. dollar Friday brought the week’s losses to 1.2%,

more than twice the 0.5% loss that spooked the market last week,

coming as it did after years of steady gains.

The weakness in the yuan is likely to be

temporary as longer term the yuan looks set to appreciate against

major currencies – intervention or no manipulation by the PBOC.

Were there to be further weakness in the yuan and a prolonged bout of

weakness, currency wars will likely rear their ugly heads again as

other nations seek to devalue their currencies in order to maintain

export competitiveness.

The plunge in the Ukrainian hryvnia this week

and the risk of bank runs, not to mention the risk of contagion for

European banks exposed to Ukraine should support gold. The Ukrainian

currency has collapsed 22% versus gold this week – from 11,684

hryvnia per ounce on Monday to 14,235 hryvnia per ounce at 11:30 GMT

today.

Rising geopolitical tensions between Russia and

the West over developments in the Ukraine should also be supportive.

This morning Ukraine has accused Russia of invading Ukraine and is

considering a state of emergency after masked gunmen occupied two

Crimean airports.

Other geopolitical flash points include

Thailand, Venezuela and the Middle East which continue to quietly

simmer in the background. Tail-risks have increased and could lead to

a renewed safety bid for gold in the coming weeks.

The increasing scrutiny by regulators and the

media on the manipulation of the gold price should also support gold.

The FT’s story regarding manipulation and the likelihood of

lawsuits against banks engaged in manipulation was withdrawn from the

internet earlier in the week and overnight Bloomberg has again

covered the possible manipulation of gold at the London A.M. fix.

This story has been bubbling under the surface for years and may blow

up in the coming weeks leading to higher gold prices.

However, in the short term there are technical

risks and a lower weekly close this week – below $1,324.35/oz –

could lead to a quick and sharp retreat to support at $1,307/oz,

$1,300/oz and $1,280/oz.

Gold

in U.S. Dollars, 1 Year – (Bloomberg)

Gold

in U.S. Dollars, 1 Year – (Bloomberg)On balance, we are bullish for next week. However, a lower close today and for this week – could cause short term jitters and retracement. Gold analysts surveyed by Bloomberg are divided in their outlook for next week. Fourteen participants were bullish, sixteen were bearish and six were neutral.

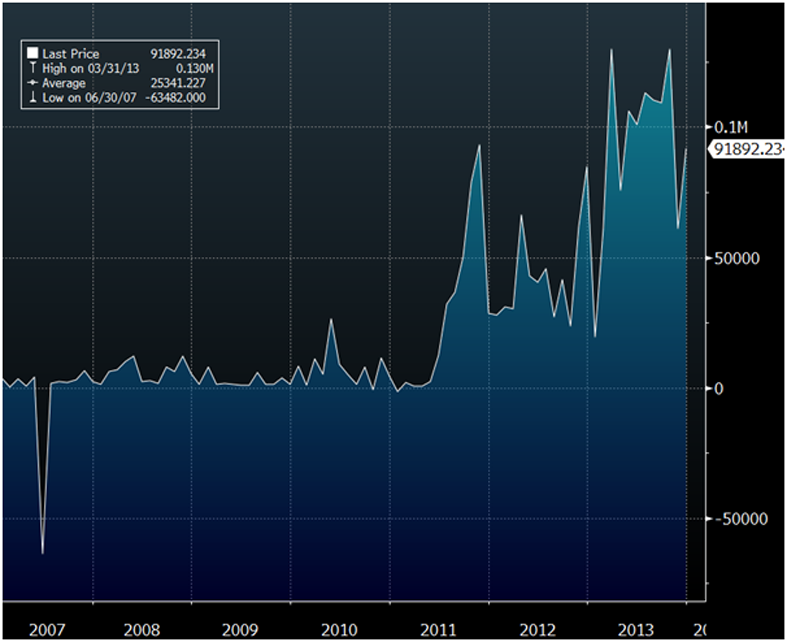

Chinese

Gold Imports Surge as Yuan Falls Most in Three Years

Chinese net gold imports surged in January and the 83,638 kilograms were more than the first two months of 2013 combined, when just 80,527 kg was imported. Strong Chinese demand may be fueled by concerns by the Chinese about their banking system, the value of the yuan and the risk of inflation.

Chinese net gold imports surged in January and the 83,638 kilograms were more than the first two months of 2013 combined, when just 80,527 kg was imported. Strong Chinese demand may be fueled by concerns by the Chinese about their banking system, the value of the yuan and the risk of inflation.

China’s gold imports from Hong Kong fell

month on month in January from December as some jewelers and

fabricators in the world’s largest consumer of the precious metal

reduced purchases from the record levels of demand seen in December,

and indeed in full year 2013.

Net imports totaled 83.6 metric tons last

month, compared with 91.9 tons in December and 19.6 tons a year

earlier, according to calculations by Bloomberg News based on data

from the Hong Kong Census and Statistics Department today. Exports to

Hong Kong from China declined to 19 tons in January from 34.8 tons in

December, the Statistics Department said in a separate statement.

Mainland China doesn’t publish such data.

IMF

Data Shows Turkey Joined Russia In Reducing Gold Reserves Marginally

in JanuaryTurkey’s

holdings dropped to 15.708 million ounces versus 16.71 million ounces

in December, data on the IMF website shows.*Russia’s

bullion reserves fall to 33.266M oz vs. 33.283M oz in Dec.:

IMF*Mexico’s

gold holdings decline to 3.955M oz vs. 3.958M oz in Dec.: IMF*Latvia

also reduced bullion reserves in Dec.: IMF*Kazakhstan’s

gold assets expand to 4.67M oz vs. 4.62M oz in Dec.: IMF

Given increasing geopolitical tensions and

monetary risk, we would expect the Russian central bank to continue

allocating foreign exchange reserves to gold bullion in the coming

months and indeed this trend could accelerate.

Ukraine

Bank Runs Could Soon Be Seen In EU and U.S.Bank

runs in the Ukraine and Thailand today and Venezuela earlier this

year, show the very fragile nature of our modern fractional reserve

banking system. If just a small percentage of depositors withdraw

some or all of their cash from the bank, there is not enough cash

available.

The newly appointed governor of Ukraine’s

central bank, Stepan Kubiv, said last Monday that as much as 7% of

total bank deposits were withdrawn from February 18th to February

20th. The $2.9 billion (30 billion hryvnias) in cash was gobbled up

by anxious depositors during a time of intense fighting between

protesters and government forces in Kiev.

The plunge in the currency this week is likely

to have exacerbated that trend and much more Ukrainian bank deposits

were likely to have been withdrawn this week.

People

line up to withdraw money from an ATM in the western Ukrainian city

of Lviv, Feb. 20. (Yuriy Dyachyshn/AFP/Getty Images)

People

line up to withdraw money from an ATM in the western Ukrainian city

of Lviv, Feb. 20. (Yuriy Dyachyshn/AFP/Getty Images)

In a fractional reserve banking system, if too

many depositors withdraw their cash, banks are forced to either

shutdown or declare bankruptcy. Typically, they don’t have enough

vault cash to pay their depositors. Ordinarily banks in Western

countries have just 10% of deposits in cash, although figures in

emerging markets may be higher.

But the modern version of a bank run often

involves capital flight. Depositors aren’t only going for their

cash, they are also wiring their savings out of the country in record

numbers through electronic wire transfers. This is a form of silent

or stealth bank run, as it is not visible in terms of angry

depositors queuing up outside banks as was seen with Northern Rock in

the UK and elsewhere in recent years.

On Wednesday evening, we interviewed the

publisher of the Trends Journal, Mr. Gerald Celente.

Celente is a contrarian commentator whose

opinions are sometimes controversial but always thought provoking. He

has a great track record at predicting many of the key financial,

economic and geopolitical events of the last 30 years.

In an interesting question and answer session

Celente addressed concerns about terrorism, a World War, financial

meltdown, the risks of bank runs and difficulties in accessing

savings in Europe and the U.S. in the coming months.

He

pointed out how Cypriot depositors lost savings in bail-ins and

that in the Ukraine today “massive bank withdrawals are going on.”

Celente said that the 9/11 attack and

subsequent restrictions on access to bank deposits in New York , when

Wall Street was closed down for a few days, may be seen again. He

warned of the risk that “ATM machines are not working anymore”

and the authorities are “putting restrictions on what you can draw

out.”

He advised owning physical gold and silver in

your possession and said that the precious metals are like a “cash

cow when you have the real deal”.

“If you have gold or silver, you are in a

golden position,” Celente said.

Despite the many risks of today, Celente saw

light at the end of the tunnel. He said that there are opportunities

in “clean food”, breakthrough alternative energy, alternative

medicine and in digital education and internet learning.

The

video of the question and answer webinar with Gerald Celente can be

watchedhere.

No comments:

Post a Comment