From the Editor:

As 2013 draws to a close, state,

local, and federal governments are battling debt and

interest burdens that are greater than ever. Their receipts

are down and their bills are up. The only alternative has

been to borrow – at interest – creating an exponentially

growing debt. While "conservatives" express alarm at the

ever-increasing debt levels and "liberals" denounce calls

for austerity and cuts in essential services, there is one

concern that should be shared by the 99%: Borrowing at

interest increases costs and debt and transfers wealth out

of our communities and into the pockets of Wall Street

financiers, unless we borrow from our own

publicly-owned banks.

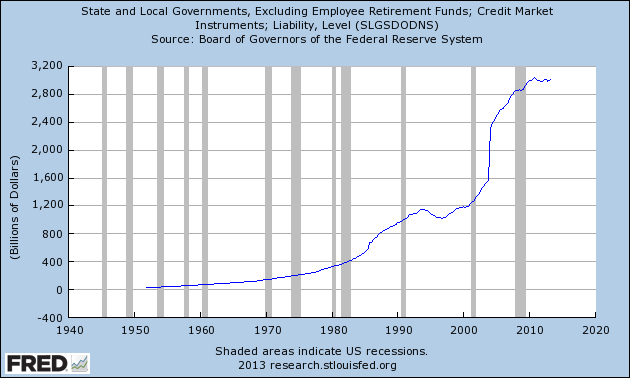

From 2000 to 2010, the

total debt of state

and local governments increased by a factor of 2.5 from $1.2

trillion to approximately $3 trillion. With burdening

compound interest, this increased debt has put a strain on

the

budgets of states

and local communities, which are required to balance their

budgets, forcing states and communities to not only cut

spending, but, in some cases, take on further debt. Some

states, including

California and

New York, have

worked to curb their debt spending as their debt burdens had

become increasingly unmanageable.

In 2011, according to the

US Census Report,

revenues for all state and local governments totaled $3.2

trillion, taxes totaled $1.3 trillion, and interest payments

on debt totaled $124 billion, or

9.2% of tax receipts and 3.9% of the total

revenues. This is bad enough but it is slated to get worse;

and the federal situation is already worse.

According

to the federal fiscal year

2013 budget report,

the total federal budget was $3.5 trillion, personal income

tax receipts were $1.3 trillion, and the interest on the

debt was $416 billion, or

31.6% of tax receipts. “Net interest” is often

quoted, since some of the debt is held by Social Security

and other government trust funds. For fiscal year 2013, the

net interest payments on the debt totaled $223 billion, or

16.9% of personal income tax receipts, or 6.4%

of the total budget.

Debt is an essential tool for

financing public infrastructure, spreading the costs over

several decades of use.

The problem is interest. Interest,

which is almost always

compounded, results

in exponentially increasing interest and debt, as well as

exponentially increasing bank assets and financial profits.

Even in times of economic stability, typical levels of debt,

at interest, increase costs unnecessarily and transfer huge

wealth over time out of our local states and communities,

enriching and empowering the Wall Street financiers.

In the article,

It's the Interest, Stupid! Why

Bankers Rule the World, Ellen Brown explains how

we can eliminate the burden of interest by recapturing it

with our own publicly-owned banks, at the state/local and

federal levels.

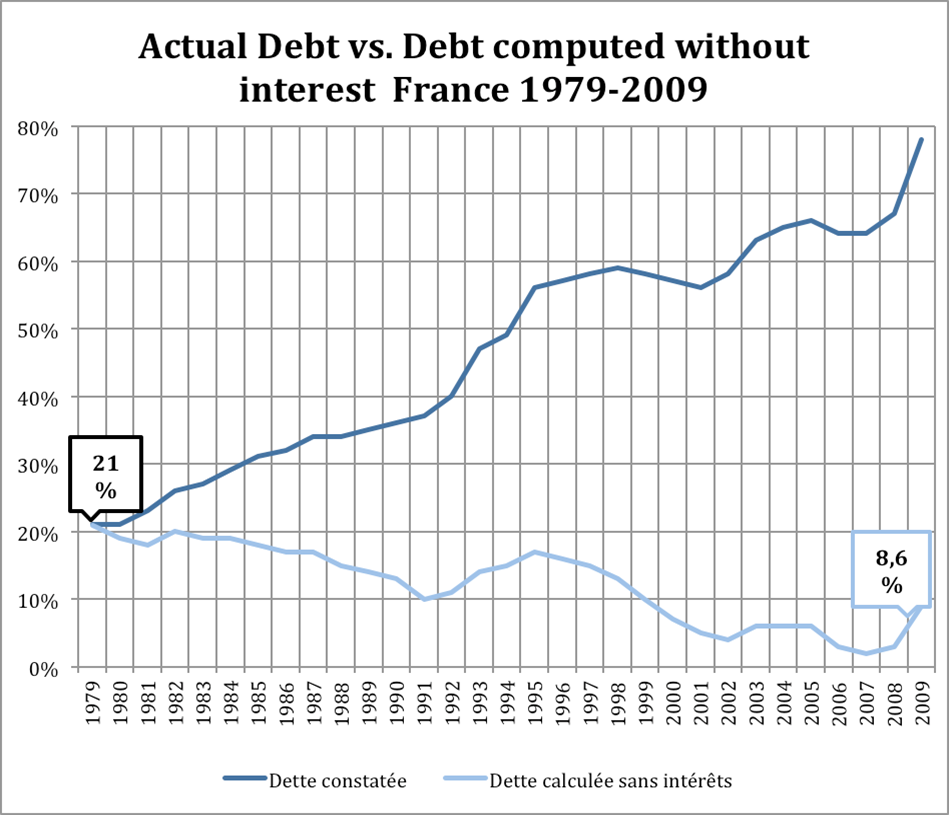

Borrowing from its own central bank interest-free might even

allow a government to eliminate its national debt

altogether. In

Money and Sustainability: The

Missing Link (at page 126), Bernard Lietaer and

Christian Asperger, et al., cite the example of France.

The Treasury borrowed interest-free from the nationalized

Banque de France from 1946 to 1973. The law then

changed to forbid this practice, requiring the Treasury to

borrow instead from the private sector. The authors

include a chart showing what would have happened if the

French government had continued to borrow interest-free

versus what did happen. Rather than dropping from 21%

to 8.6% of GDP, the debt shot up from 21% to 78% of GDP.

“No

‘spendthrift government’ can be blamed in this case,” write

the authors. “Compound interest explains it all!”

In fact, one state, North Dakota, has done just that. It

has stemmed the transfer of wealth via interest from the

state -- by owning its own bank. Under state law, the bank

is the State of North Dakota

doing business as the

Bank of North Dakota.

The Bank of North Dakota holds the state's deposits and

provides financing for the state and local economy, cutting

out out-of-state financiers. The North Dakota 2013-2015

approved

state budget has

no interest listed as an outlay, but

includes interest income instead.

Publicly-owned banks, as shown by the example of the

state-owned Bank of North Dakota, can eliminate

debt-servicing costs given to out-of-state financiers, and

use those savings to finance public projects themselves.

Further, publicly-owned banks can provide a source of

revenue for state and local communities, keeping state and

municipal deposits local, feeding the local economy rather

than feeding off of it.

Public banking advocates in

Vermont, so far

unsuccessful in their quest to get the Vermont Legislature

to study the feasibility of setting up a state-owned bank,

have taken the task upon themselves and released their own

preliminary

study. It is

expected that public banking advocates in other states and

communities will follow the example of those in Vermont and

others and perform their own studies.

Protectors of

the status quo argue that business as usual is acceptable

and prudent. However, we know that compound interest

increases costs and transfers wealth out of our communities,

creating power centers in Wall Street that make a charade of

our democracy. As

Glen Edens, former

HP executive, states: “...a strong financial services

industry is simply not good for society. Wall Street does

not improve productivity, the model is parasitic,

transferring huge resources out of the system...”

As

we approach the 100th year anniversary of the

Federal Reserve, established by the

Federal Reserve Act of 1913,

there are increasing calls to “federalize”

the private Federal Reserve -- to create a publicly-owned

central bank that operates in the public interest. As

Canada did from 1939

to 1974, and

France from 1946 to

1973, the US government could borrow essentially

interest-free from its own “federalized” Fed, resulting in a

sustainable economy and a manageably low (or no) federal

debt. Even a Harvard professor at the very recent 2013 IMF

conference has broached the idea of

opening the Fed to

accounts for the general public, leading others to take off

with the idea of the Fed as a real

people's bank.

Assessing the unnecessary interest burden that Main

Street endures, the evidence is clear: We the People need

public banking for a sustainable and shared prosperity.

Ann Tulintseff

Member of the Board, Public Banking

Institute |

|

No comments:

Post a Comment