Alicia Nesbitt has just two more unemployment checks—for a total amount of $348—coming to her before the end of the year.

The 56-year-old college financial aid administrator, who lives in Connecticut, has been out of work since being laid off last New Year's Eve. She has been receiving long-term unemployment benefits since June, when her state benefit checks ran out.

"If anyone had told me I would be unemployed and uncertain as to my future at my age, I would not have believed it," said Nesbitt, who is divorced and lives with her boyfriend to help with expenses.

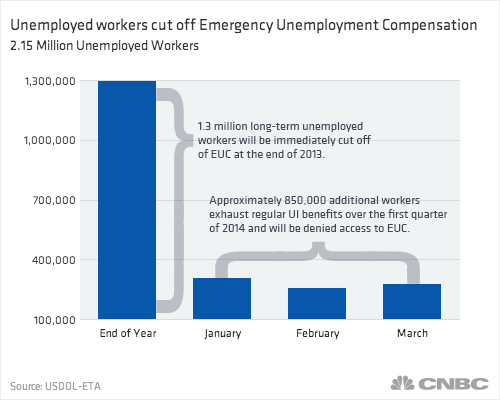

Nesbitt is one of the 1.3 million people likely to be left with no unemployment benefits just three days after Christmas.

That's because a budget deal proposal in Congress fails to extend the Emergency Unemployment Compensation Program, which provides federal funds for those who have run out of state unemployment benefits.

The program ends Dec. 28, and it will take a separate move by Congress to extend it.

(Read more: Cramer: 'Something up' with DC budget deal)

"It's frustrating Congress didn't include the extension," said Claire McKenna, a policy analyst at the National Employment Law Project.

"The White House is in favor of it and so are some in Congress, so we're hoping for a separate measure to get passed," she said. "But it's hard to predict what will happen."

The 56-year-old college financial aid administrator, who lives in Connecticut, has been out of work since being laid off last New Year's Eve. She has been receiving long-term unemployment benefits since June, when her state benefit checks ran out.

"If anyone had told me I would be unemployed and uncertain as to my future at my age, I would not have believed it," said Nesbitt, who is divorced and lives with her boyfriend to help with expenses.

Nesbitt is one of the 1.3 million people likely to be left with no unemployment benefits just three days after Christmas.

That's because a budget deal proposal in Congress fails to extend the Emergency Unemployment Compensation Program, which provides federal funds for those who have run out of state unemployment benefits.

The program ends Dec. 28, and it will take a separate move by Congress to extend it.

(Read more: Cramer: 'Something up' with DC budget deal)

"It's frustrating Congress didn't include the extension," said Claire McKenna, a policy analyst at the National Employment Law Project.

"The White House is in favor of it and so are some in Congress, so we're hoping for a separate measure to get passed," she said. "But it's hard to predict what will happen."

Without an extension, the number of people in Nesbitt's shoes would only increase.

Besides those in December, 850,000 people will run out of state unemployment benefits in the first quarter of 2014. If they are still out of work, they will have no access to federal benefits. About 1 million more without work will lose state benefits by June.

According to the Bureau of Labor Statistics, 4.1 million people are counted as long-term unemployed (those who have been out of a job for six months or more). They make up 36.1 percent of the total unemployed, which is at a national overall rate of 7 percent, the lowest in five years.

That number of long-term unemployed is higher than in any month of the Great Recession, which economists say ended in 2009. And it's more than three times the percentage of long-term unemployed in 2007, which was 17.5 percent.

Some of the improvement in the employment picture results from people dropping out of or not entering the workforce because of weak job opportunities, according to the Economic Policy Institute (EPI), a think tank that studies the issues of low- and middle-income workers.

The better numbers have actually hurt the long-term jobless: Because the jobless rate is part of the formula used to calculate unemployment benefits, states cut those benefits and their duration when the rate is lower.

Besides those in December, 850,000 people will run out of state unemployment benefits in the first quarter of 2014. If they are still out of work, they will have no access to federal benefits. About 1 million more without work will lose state benefits by June.

According to the Bureau of Labor Statistics, 4.1 million people are counted as long-term unemployed (those who have been out of a job for six months or more). They make up 36.1 percent of the total unemployed, which is at a national overall rate of 7 percent, the lowest in five years.

That number of long-term unemployed is higher than in any month of the Great Recession, which economists say ended in 2009. And it's more than three times the percentage of long-term unemployed in 2007, which was 17.5 percent.

Some of the improvement in the employment picture results from people dropping out of or not entering the workforce because of weak job opportunities, according to the Economic Policy Institute (EPI), a think tank that studies the issues of low- and middle-income workers.

The better numbers have actually hurt the long-term jobless: Because the jobless rate is part of the formula used to calculate unemployment benefits, states cut those benefits and their duration when the rate is lower.

The Emergency Unemployment Compensation

Program (EUC) began in June 2008, when the national unemployment rate

was 5.6 percent.

The EUC extends federal benefits to people still out of work when their state benefits—averaging about $300 a week for 26 weeks—are exhausted.

The program has been expanded or reauthorized 11 times, most recently on Jan. 2 as part of the overall budget deal between the White House and Congress that avoided the "fiscal cliff."

(Read more: Job openings rise slightly in October)

But even with the current EUC program, the unemployed saw their benefits slashed this summer because of the forced sequester cuts. All federal unemployment benefits were trimmed by about $42 a week, to $256.

The length of EUC benefits has also been reduced. In May 2012, all 50 states and the District of Columbia offered up to 34 weeks of federal benefits, with 40 states offering 47 weeks of EUC funds.

Now, 49 states and the District of Columbia offer up to 14 weeks, with 36 states offering up to 28 weeks. Only two states, Nevada and Illinois, offer the maximum 47 weeks.

The EUC extends federal benefits to people still out of work when their state benefits—averaging about $300 a week for 26 weeks—are exhausted.

The program has been expanded or reauthorized 11 times, most recently on Jan. 2 as part of the overall budget deal between the White House and Congress that avoided the "fiscal cliff."

(Read more: Job openings rise slightly in October)

But even with the current EUC program, the unemployed saw their benefits slashed this summer because of the forced sequester cuts. All federal unemployment benefits were trimmed by about $42 a week, to $256.

The length of EUC benefits has also been reduced. In May 2012, all 50 states and the District of Columbia offered up to 34 weeks of federal benefits, with 40 states offering 47 weeks of EUC funds.

Now, 49 states and the District of Columbia offer up to 14 weeks, with 36 states offering up to 28 weeks. Only two states, Nevada and Illinois, offer the maximum 47 weeks.

The cost to extend the EUC for one year would not be low. The Congressional Budget Office estimates the price tag at $25.7 billion.

But the CBO also said that extending the program would increase direct spending by consumers by the same amount—$25.7 billion over 2014-15. An extension also would increase government revenues modestly, about $500 million, over the 2014-23 period, office said.

According to the Economic Policy Institute, a benefits extension creates spending that supports 310,000 jobs—jobs that will be lost if the program is discontinued.

Critics often cite long-term benefits as a deterrent to people who should be looking for work, but many who depend on them challenge that assertion.

"Who wants to live on unemployment checks?" asked Nesbitt, who is taking part in state-sponsored job search programs.

"I'm looking for work and have been ever since I was let go," she said. "I know people who are lawyers and accountants who can't find work. It's just not easy."

But the CBO also said that extending the program would increase direct spending by consumers by the same amount—$25.7 billion over 2014-15. An extension also would increase government revenues modestly, about $500 million, over the 2014-23 period, office said.

According to the Economic Policy Institute, a benefits extension creates spending that supports 310,000 jobs—jobs that will be lost if the program is discontinued.

Critics often cite long-term benefits as a deterrent to people who should be looking for work, but many who depend on them challenge that assertion.

"Who wants to live on unemployment checks?" asked Nesbitt, who is taking part in state-sponsored job search programs.

"I'm looking for work and have been ever since I was let go," she said. "I know people who are lawyers and accountants who can't find work. It's just not easy."

Several top Democrats say they support extending the EUC, while some Republicans have been vocal about opposing any attempt to extend it.

A spokesman for House Speaker John Boehner, R-Ohio, has said that the GOP would look at extension plans but that it would "be better if the president would provide more jobs."

(Read more: US Congress budget talks could produce Tuesday deal, aides say)

Nesbitt said she's preparing for the worst—and a bleak holiday season.

"I know if Congress decides to eat Christmas goose without extending benefits," she said, "2014's outlook is not what we asked Santa for under our tree."

—By CNBC's Mark Koba. Follow him on Twitter

A spokesman for House Speaker John Boehner, R-Ohio, has said that the GOP would look at extension plans but that it would "be better if the president would provide more jobs."

(Read more: US Congress budget talks could produce Tuesday deal, aides say)

Nesbitt said she's preparing for the worst—and a bleak holiday season.

"I know if Congress decides to eat Christmas goose without extending benefits," she said, "2014's outlook is not what we asked Santa for under our tree."

—By CNBC's Mark Koba. Follow him on Twitter

@MarkKobaCNBC

No comments:

Post a Comment