by

GoldCore

Today’s AM fix was USD 1,229.50, EUR 892.62

and GBP 754.57 per ounce.

Friday’s AM fix was USD 1,222.75, EUR 891.22 and GBP 750.89 per ounce.

Friday’s AM fix was USD 1,222.75, EUR 891.22 and GBP 750.89 per ounce.

Gold rose $11.10 or 0.91% Friday, closing at

$1,237.60/oz. Silver climbed $0.18 or 0.92% closing at $19.70/oz.

Platinum fell $1.05, or 0.1%, to $1,357.70/oz and palladium fell

$0.72 or 0.1%, to $714/oz. Gold and silver were both up for the week

at 0.72% and 1.13%.

All eyes are on the FOMC this week and

speculation is high that the Federal Reserve may taper. Fed

policymakers gather for the last time in 2013 for a two day policy

meeting that concludes this Wednesday.

The dreaded ‘taper’ is becoming a bit of a

caper as the death of QE is greatly exaggerated. While a taper is

indeed possible, any reduction in bond buying is likely to be small

and of the order of less than $15 billion. This means that the Fed is

likely to keep its bond buying program at close to $70 billion per

month which is still very high and unprecedented for any industrial

nation in modern history.

This still high level of debt monetisation, in

conjunction with continuing zero percent interest rate policies is

bullish for gold.

Gold was higher last week which was positive

from a technical perspective but as of late morning trading in

London, there has been, as of yet, little follow through.

The dollar looks overvalued, considering the

overly indebted U.S. consumer and government, and is likely to come

under pressure again in 2014 which will support gold and could lead

to a resumption of gold’s bull market.

2013 has been a torrid year for gold and it is

down 26%. Given the still strong fundamentals, we are confident that

in a few years, 2013 will be seen as a mere blip in the context of a

long term, secular bull market which will likely see gold prices have

a parabolic peak between 2016 and 2020.

ETP liquidations have been one of the primary

reasons for gold’s weakness in 2013. ETP holdings may continue to

fall as more speculative investors reduce allocations to gold and

some ETP buyers sold in order to move to the safety of allocated

gold.

However, the supply demand data clearly shows

that ETP liquidations are being matched by robust global demand,

especially in China. Even if ETP holdings dropped by another 300 plus

tonnes in 2014, average Chinese imports through Hong Kong alone are

running at well over 100 tonnes per month.

Outflows of gold from ETFs amounted to 24.3

million ounces, nearly 700 metric tonnes, in 2013 from their peak at

the end of 2012. Much of this gold was taken out of ETF holdings in

London and shipped to refineries in Switzerland, where it was melted

down and made into kilogramme bars, then sent to Hong Kong and

ultimately to China.

Imports from Hong Kong to China totaled 26.6

million ounces or 754 metric tonnes through September alone. It is

unknown where the gold would come from to replenish these ETF

holdings were there a sudden surge in demand in the West in the event

of a new sovereign debt crisis or a Lehman Brothers style contagion

event.

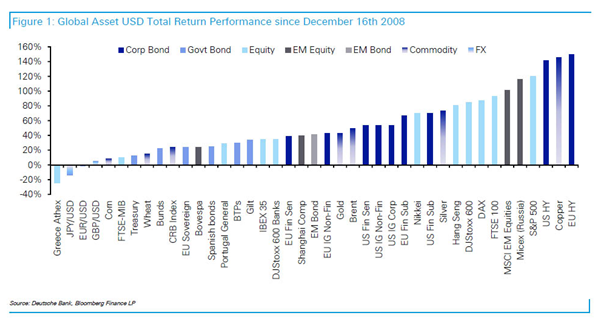

Despite the 26% fall in 2013, gold is 44%

higher in the last five years and has protected those who have bought

it as a long term hedge and financial insurance against

macroeconomic, systemic and monetary risks.

There is much negative noise and sentiment

towards gold due to the recent price falls. The smart money ignores

this noise and continues to focus on the long term. We are confident

that gold will again perform well in the coming five years and

protect investors from the considerable risks lurking out there

today.

It is worth noting that gold fell 25.2% in 1975

(from $187.50/oz to $140.25/oz) and many experts pronounced the death

of the gold bull market. Experts such as economist Milton Friedman

warned that gold prices could fall further.

Gold subsequently rose 6 times in the next 4

years – from January 1976 to January 1980 - proving many

extremely wrong.

A historical perspective is valuable today and

history does not always repeat but often rhymes.

The death of the gold bull market is greatly

exaggerated.

Download Protecting

your Savings In The Coming Bail-In Era (11 pages)

No comments:

Post a Comment