How a $1 trillion market pops

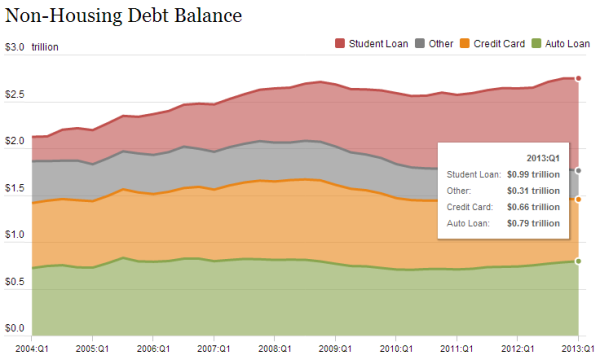

Student debt is now the biggest non-housing debt class in the United States:

Back in 2004, total outstanding student debt was at $260 billion. Today it is well over $1 trillion which is an incredible rate of increase in less than one decade. This is clearly an unsustainable path and the market is now facing some serious challenges.

The news by JP Morgan Chase is a very familiar song:

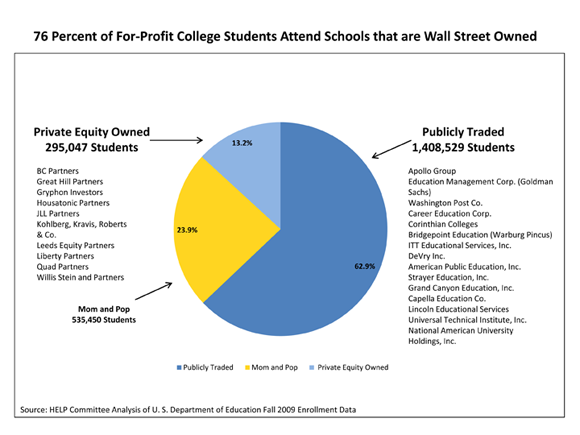

“(CNBC) “We just don’t see this as a market that we can significantly grow,” Thasunda Duckett tells Reuters. Duckett is the chief executive for auto and student loans at Chase, which means she’s basically delivering the news that a large part of her business is getting closed down.”This is an interesting development. Wall Street has been gorging at the trough for years here. In fact, many of the for-profits which amount to the subprime of the colleges are owned by Wall Street:

The move is eerily reminiscent of the subprime shutdown that happened in 2007. Each time a bank shuttered its subprime unit, the news was presented in much the same way that JPMorgan is spinning the end of its student lending.”

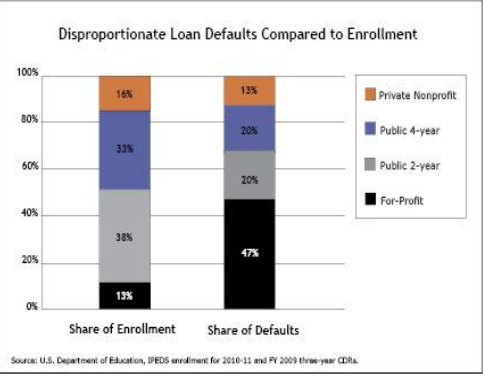

The exploits of the for-profits has been well documented for years and has now reached epic proportions. While for-profits enroll about 13 percent of students they make up nearly 50 percent of all student loan defaults. These schools fully rely on easy government student loans:

This portion of the market is bursting in spectacular fashion. The student loan sharks go after these students with the vigor of a middle ages land owner chasing struggling peasants off their land. The government (that is, the American public) essentially guarantees this debt so it has been a safe bet for Wall Street for many years. The way student debt compounds with fees and debts can turn a $20,000 debt into something like $40,000 or more over a lifetime since this debt cannot be discharged like a tax debt for example.

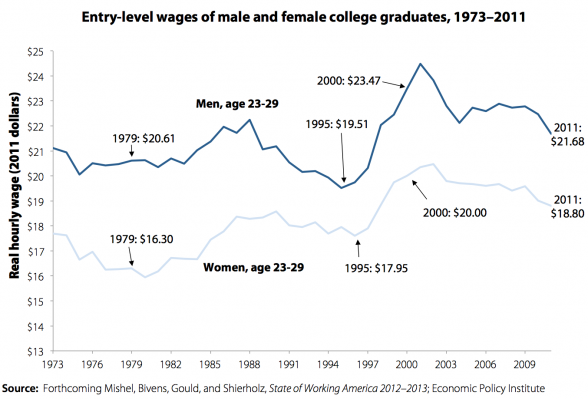

The problem with the high cost of college is that wages for college graduates simply have not kept up with tuition inflation:

So students are paying more to essentially earn less in this low wage system for the young. You have this odd case where people need skills for the jobs that are out there yet wages are stagnant and the cost to acquire those skills continues to go up. This is why young Americans are having such a tough time getting ahead. A recent study found that those 25 to 34 have a median of zero dollars saved for retirement. In other words, most have nothing to their name when it comes to their future economic well being. This is the same group shouldering a large burden of the $1 trillion in student debt.

So the fact that a big name is exiting the private student debt market is no surprise. It is incredibly similar to the trend of banks exiting the subprime trade in 2007 but then again, we are destined to repeat another bubble burst as Wall Street has turned everything into a pump and dump scheme.

No comments:

Post a Comment