Today’s AM fix was USD 1,375.25, EUR 1,031.39 and GBP 878.47 per ounce.

Friday’s AM fix was USD 1,360.75, EUR 1,020.59 and GBP 870.10 per ounce.

Gold rose $10.10 or 0.74% Friday, closing at $1,373/oz. Silver climbed $0.25 or nearly 1.09%, closing at $23.18. Platinum rose 0.2% to $1,524.49/oz, while palladium increased 0.3% or $2.47 to $761.47/oz.

Gold was up 4.60% and silver surged 13.3% for the week. Silver is up eight sessions in a row and is headed for the longest daily rally since March 2008.

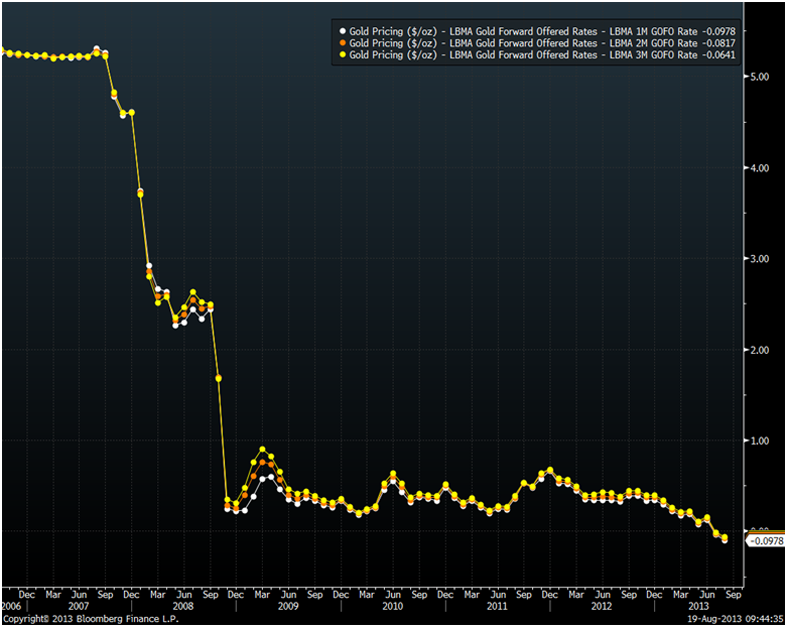

Gold remains in backwardation and gold lending rates dropped further last week which is bullish for prices in the coming weeks.

Gold in USD and LBMA Gold Forward Offered Rate – Bloomberg Precious Metals Mining

Gold traded near a two-month high after holdings in the largest ETP posted the first weekly expansion this year and markets digested the very robust global physical demand data reported last week . Demand from China and India is projected to to soar to 1,000 tonnes each in 2013 and mixed U.S. data has boosted gold’s safe haven appeal.

Gold forward offered rates (GOFO), remain negative and are becoming more negative. This shows that physical demand is leading to supply issues in the highly leveraged LBMA gold market.

GOFO rates are those which contributors may use to lend gold on a swap for dollars, according to the London Bullion Market Association and the negative gold interest rates show a preference to own gold over dollars by bullion banks.

LBMA 1 Month, 2 Month, 3 Month GOFO Rates (2006 to Today) – Bloomberg Precious Metals Mining

Negative 1, 2 and 3 month GOFO rates mean that bullion banks lent their customers, including other bullion banks, gold to obtain a positive return, thereby increasing the “paper” gold supply. Some may now may be struggling to get their gold back which may explain the significant decline in COMEX gold holdings of certain bullion banks (see commentary).

This is creating significant supply demand issues in the physical gold market which should lead to higher gold prices.

Gold Prices/ Fixes/ Rates / Volumes – (Bloomberg)

In the futures market, hedge-fund managers and other large speculators increased their net-long position in New York gold and silver futures in the week ended August 13, according to the U.S. Commodity Futures Trading Commission data.

Speculative long gold positions outnumbered short positions by 53,926 contracts on the Comex. Net-long positions rose by 2,291 contracts, or 4%, from a week earlier.

Gold miners, producers, jewelers and other commercial users were net-short 60,874 contracts, an increase of 6,715 contracts, or 12%, from the previous week.

Speculative long silver positions outnumbered short positions by 12,709 contracts. Net-long positions rose by 7,242 contracts, or 132%, from a week earlier.

Miners, producers, jewelers and other commercial silver users were net-short 20,276 contracts, an increase of 9,976 contracts, or 97%, from the previous week.

The potential for a short squeeze remains high. Dollar, euro and pound cost averaging into positions remains prudent.

This is especially the case as we are soon to enter the seasonally favourable autumn months.

No comments:

Post a Comment