ARMs and Hope

Bloomberg had a really interesting piece on the jump in ARM usage. As it happens, many of these users are in bubble-mania central, California:

“Jung Lim plans to offset the cost of rising mortgage rates by using an adjustable-rate loan to buy a home for his expanding family. For the California endodontist, the money he’ll save makes up for the ARM’s risky reputation.Wait, it costs $1.12 million for a decent home to shelter a family with 2 kids? The California housing ladder is now fully in place. Sell a smaller place, use the wild appreciation in home prices, and move into the dream home and re-leverage. Of course, using an ARM is seeing as a logical step. Of course they are planning on staying put for a very long-time right?

Lim, 38, whose wife is expecting a second child in December, is leaving a two-bedroom condo in Los Angeles’s Hancock Park to buy a four-bedroom house in the city’s Sherman Oaks neighborhood for $1.12 million. His lender offered him a rate for an adjustable mortgage that is about a percentage point cheaper than a fixed loan.”

“If I could have gotten a 30-year fixed at the interest rate I’m getting the ARM for, I would have felt a lot more comfortable,” said Lim, who’s also a professor of endodontics at the University of California, Los Angeles. “But I’m hoping to refinance in five years or less. And we’ll be in the house for about 10 years so we could also sell. Hopefully prices have bottomed so we won’t be underwater then.”Wait. So they are getting an ultra-low rate loan so they can refinance later on in five years? To what? Heck, even the Fed is saying that they will taper off on QE and rates in the mortgage markets have already reacted because the Fed’s balance sheet is well over $3.4 trillion and we are already seeing the consequences of this action by causing a flood of banking money into the rental housing market. What is interesting is the amount of speculation now permeating the market in various flips and also, the mentality being taken on by buyers like the case above.

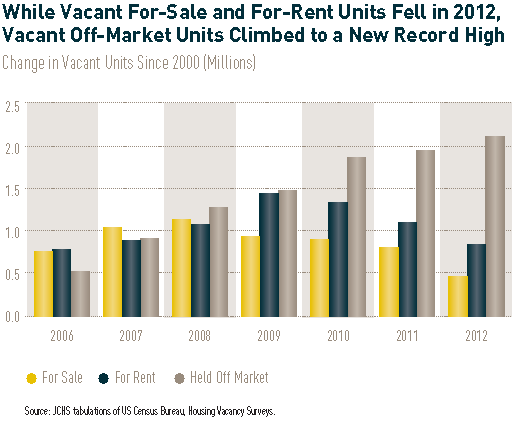

While the rigged market plays out, we have some concrete data showing the manipulation behind all of this. In 2012, for sale units hit a decade low while units held off the market reached a new record high:

And people are doing what they do best and are trying to mimic Wall Street behavior and are itching to get a piece of this pie.

Massive jump in ARMs

According to the Bloomberg report, in June the dollar amount of ARM applications reached 16 percent of all mortgage requests. This is the highest level since July 2008 or two months before Lehman Brothers bit the dust.

Of course many of the ARM borrowers are basing their decision on pure optimism:

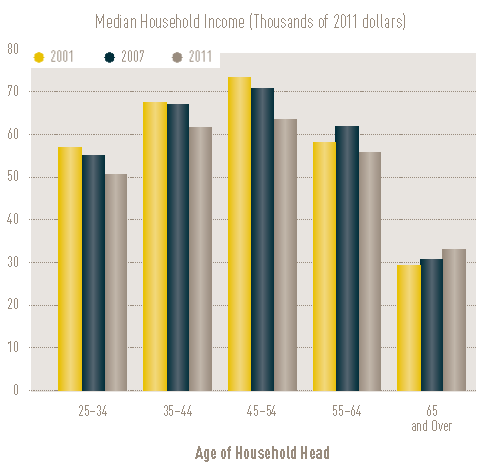

“Another assumption of ARM applicants is that their income will be higher by the end of the loan’s fixed period so they can handle higher payments if they can’t sell, said Henry Savage, president of PMC Mortgage Corp.Really? Let us look at how household income has done recently:

“When you start making those calculations, you’re playing golf in the dark,” said Savage.

Borrowers like Baudler say they don’t have to worry where home prices will be when their loans adjust. He has the assets to weather rate changes at the end of his seven-year fixed period and plans to use his mortgage savings to pay off the loan in nine years. It was a cheaper alternative to using a 15-year fixed mortgage, he said.”

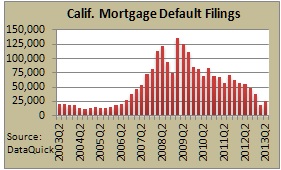

The mania is fully engaged. People crowd into open houses as if they were fighting for entry into a posh Hollywood club. And for what? So they can over-bid by tens of thousands of dollars? After the bid is taken, they close escrow with an ARM and the party begins. Yet as we have mentioned there are multiple signs a tipping point is being reached. For one, inventory is now finally rising. Another major point is foreclosure starts in California went up strongly last quarter:

California foreclosure starts went up by 38 percent in the last quarter. One big reason has to do with the first chart in this article. Now that banks and the Fed have manufactured an insane leveraged based mania, the crowd is now hungry to dive back in. So banks are acting on these foreclosures trying to exit at a prime time. A foreclosure start merely means a bank is moving on a non-paying “home-owner.” Given the massive jump in prices in the last year, some banks are sensing this is a perfect time to unload some of the held off market inventory.

The usage of ARMs in SoCal was 9.2 percent last month (up from 6.7 last year). This is a 34 percent increase in one year when fixed rates are still near all-time lows. Yet people are trying to squeeze every little penny out of this leveraged game. Many have to compete with flippers and the all cash Wall Street crowd. Like the example in the story, the bet is that prices will only go up and that there will be easy refinancing options available in a few short years (there is no scenario for problems).

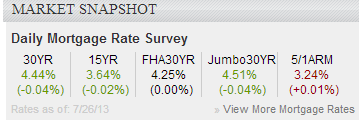

The difference is clear:

Save yourself 100 to 125 basis points on a $600,000 to $1,000,000 loan and you are talking about a good chunk of change. The leverage is real here.

What are your thoughts on the rise in ARM usage?

No comments:

Post a Comment