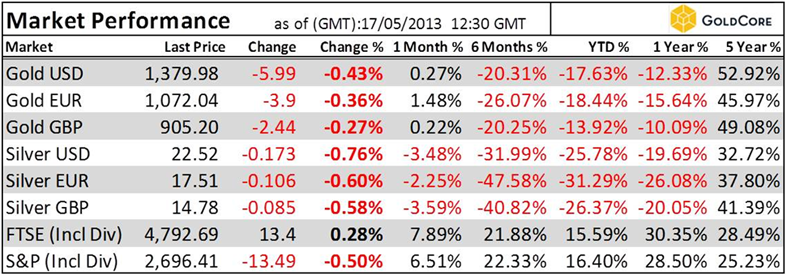

Today’s AM fix was USD 1,376.75, EUR 1,069.15 and GBP 903.62 per ounce.

Yesterday’s AM fix was USD 1,377.00, EUR 1,070.01 and GBP 904.32 per ounce.

Cross Currency Table – (Bloomberg)

Gold fell $6.00 or -0.43% yesterday to $1,386.70/oz and silver finished +0.71%.

Nothing has changed regarding the positive fundamentals of the physical gold market.

All that has changed is that the price of gold is again lower due to the machinations of technical traders and speculators. Paper gold sales are again trumping massive physical demand however this cannot go on for much longer and the patient will again be handsomely rewarded.

U.S. markets are again having a wild party and all speculators are invited. Stocks are at an all-time high, the country is basking in its new found energy ‘independence,’ there is a perception that the housing market is showing green shoots of recovery and the great bellwether, the employment numbers, showed better than expected gains in April.

Tragically, it appears, the U.S. and other investors are again borrowing to buy stocks, confident that prices can only go in only one direction. All of this euphoria can be traced to the monetary expansion policies of the U.S. Fed and across the sea to Europe to the Bank of England and the ECB, and over to Japan and the ‘la la land’ of ‘Abenomics’.

Does history repeat itself? Can we learn from money printing throughout history?

Of course we can.

Global currency debasement on a scale never before seen in history will not end well – for savers and most investors.

Currency wars are set to continue and deepen which will support gold.

The United States government is to rigorously enforce a ban on gold sales to Iran from July 1.

They are planning to block sales of gold to Iranians in order to undermine the Iranian currency, the rial, and to step up pressure on Tehran over its nuclear program, U.S. officials said yesterday according to Reuters and Bloomberg.

The Iranian rial is the official currency of the Islamic Republic of Iran. The conventional market quotation is the number of rials per U.S. dollar. The rial is a fiat currency which like most paper currencies today is a managed, floating currency. The Central Bank of Iran has abolished the multi-tier exchange rate regime and established a single rate in its place.

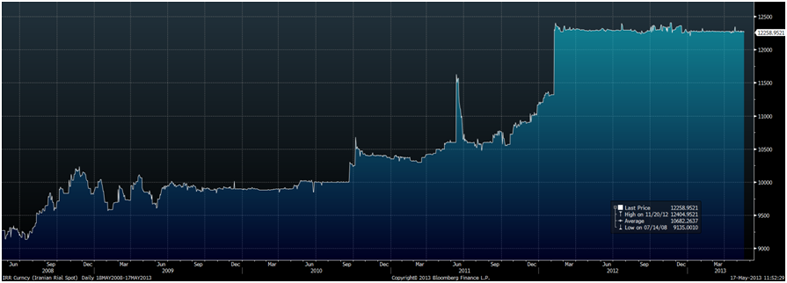

U.S. Dollar and Iranian Rial (USDIRR) Spot Exchange Rate – Price of 1 USD in IRR– 5 Years

The U.S. will now ban sales of gold by anyone to either the Iranian government or to Iranian citizens, a senior U.S. Treasury official said yesterday.

Washington has warned Iran’s neighbours Turkey and the United Arab Emirates, key regional centers of the gold trade, to stop gold sales to Iran, said David Cohen, treasury under-secretary for terrorism and financial intelligence.

“We have been very clear with the governments of Turkey and the UAE and elsewhere, as well as the private sector that is involved in the gold trade, that as of July 1 all must stop, not just trade to the government,” he said.

Cohen told the Senate Foreign Relations Committee that the U.S. government continues to find new ways to isolate Iran from the international financial system.

“In particular, we are looking carefully at actions that could increase pressure on the value of the rial,” he said.

“One thing that we have seen in the course of the last year is when the rial depreciates and depreciates rapidly, that begins to create a dynamic in Iran that has an effect.”

The rial has lost 34% against the dollar since 2008 having fallen from 9135 rial per $1.00 to 12258 per $1.00 today.

The dollar has fallen by 52% against gold in the same period having fallen from $920/oz to $1,380/oz.

XAU/USD Spot Exchange Rate – Price of 1 XAU in USD – 5 Years

Iranian people are suffering from the currency devaluation with the very significant increase in the cost of living.

“It has an effect on the elites and their perception of how the country is behaving.”

The move to block gold sales is part of the effort to further weaken the rial, he explained.

“There’s a tremendous demand for gold among private Iranian citizens, which in some respects is an indication of the success of our sanctions.”

“They are dumping their rials to buy gold as a way to try to preserve their wealth. That is I think an indication that they recognise that the value of their currency is declining.”

Cohen and another senior official, U.S. State Department Under Secretary for Political Affairs Wendy Sherman, told the committee that sanctions were having a deep impact on Tehran.

He said a ban on oil exports was costing Tehran between USD 3 and 5 billion a month and caused the economy to contract by as much as eight percent last year.

Sherman said 14 out of 20 importers of Iranian oil have ended their purchases, and the other six — China, India, Turkey, South Korea, Japan and Taiwan — have significantly reduced their imports.

“We are continuing, of course, to press them for further significant reductions as is required under the law,” she told the committee.

Senator Robert Menendez, chairman of the Foreign Relations Committee and sponsor of several Iran sanctions laws questioned whether the administration is doing enough to enforce its own prohibitions on Iran’s gold trade issued last summer.

He cited estimates in a report by the Foundation for Defense of Democracies and Roubini Global Economics that Iran has imported more than $6 billion in gold, mainly from Turkey and the United Arab Emirates, since the administration’s ban on gold trade with Iran’s government took effect last summer.

That’s equivalent to about 10% of Iran’s 2012 oil exports of $60 billion, Menendez said.

“We are actively enforcing” the gold ban, Cohen said. “We have been very clear with countries that are exporting gold to Iran, principally Turkey and the UAE, on precisely what the law permits and what it forbids, and we are following the information very carefully.”

Cohen reminded lawmakers that this July 1, the ban will extend to private sales.

To date, though, the administration hasn’t penalized any entity in Turkey or the UAE for trading in gold with the Iranian government.

This is another manifestation of the war on gold. Central banks and their minion banks have won the recent battles but the finite money par excellence gold and owners of physical gold will again win the war as they have throughout history.

No comments:

Post a Comment