Today’s AM fix was USD 1,446.50, EUR 1,107.07 and GBP 937.64 per ounce.

Yesterday’s AM fix was USD 1,424.50, EUR 1,095.52 and GBP 932.63 per ounce.

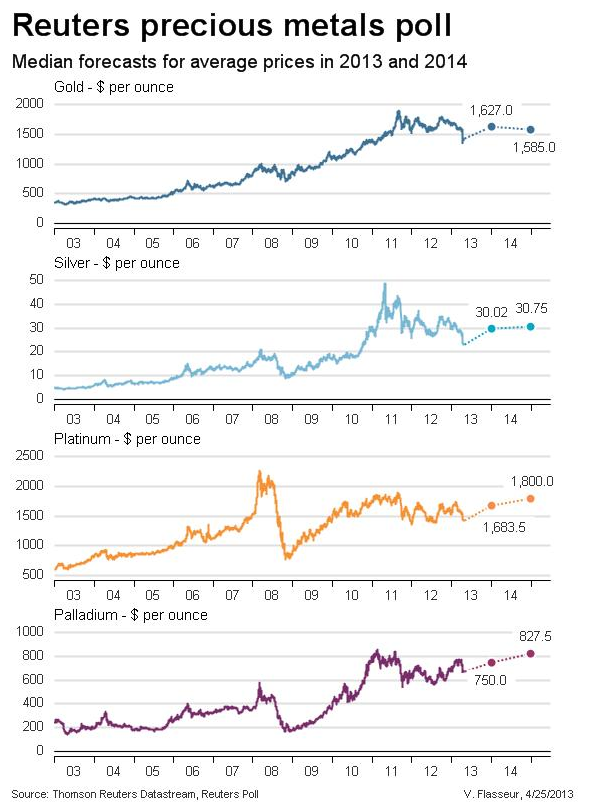

Reuters Precious Metals Poll – Year End Gold Price Forecasts

Gold climbed $15.50 or 1.09% yesterday to $1,430.40/oz and silver finished up 1.00%.

Gold climbed to its highest in more than a week on Thursday, boosted by physical demand from store of wealth buyers globally and from central banks.

Russia, Kazakhstan and Turkey raised their gold reserves in March, IMF data showed. Central bank gold buying is expected to increase as they see value in diversifying into gold after the recent sell off.

Premiums for gold bars soared to multi-year highs in Asia after a spate of physical buying ran down supplies, with dealers in top consumer India expecting a surge in imports this month.

Dealers also noted an increase in buying interest in second-largest buyer China, keeping premiums in Hong Kong at their highest level since October 2011 at up to $3 an ounce to spot London prices.

There are growing supply issues and a range of gold and silver coins and bars are in short supply internationally and premiums are rising globally. Many smaller dealers have been cleared out of their bullion inventories.

Demand had risen after the confiscation of deposits in Cyprus but the significant $200 price drop on April 12th and 15th has emboldened store of wealth buyers who see gold, and silver, as great value at these prices.

Britain’s Royal Mint, established in the 13th century, sold more than three times more gold coins this month than a year earlier as prices declined and sales are more than 150% higher than last month.

There are reports that certain Swiss banks are also prohibiting clients taking delivery of their gold bullion and will now only settle in paper currency. This in conjunction with the massive drawdown in COMEX gold inventories is leading to concerns of a default in the gold market which is further increasing demand.

Gold prices are expected to recover in the coming weeks and months according to the Reuters Precious Metals Poll of analysts.

Most of the 29 banking and brokerage analysts and consultants polled expected prices to find support and stay above the $1,400 mark. The majority of analysts, 20 out of 29, expect gold to end 2013 above $1,450 per ounce and 6 analysts, including GoldCore, saw gold above $1,650/oz by the end of 2013.

Interestingly, the majority are bullish at these price levels with average price forecasts for the year of 2013 much higher than today’s prices – at a mean of $1596/oz and a median of $1627/oz.

Many of the banks who were bearish on gold in recent years and spectacularly wrong continue to be bearish.

One of the more bearish analysts is ABN Amro who recently defaulted on their clients gold and silver accounts as they will no longer allow their clients to take delivery of their gold, silver, platinum and palladium coins and bars and instead will pay account holders in a paper currency equivalent to the current spot value of the precious metal.

Reuters Precious Metals Poll – Median Forecasts For Average Prices

The majority of analysts maintain a longer-term bullish outlook, expecting pent-up inflation from the wall of money created by expansive monetary policy to emerge.

Analysts were more bullish on silver after the brutal sell off and silver prices were seen at an average $30.02 an ounce this year, 28% higher than the $23.35/oz which silver is trading at today.

GoldCore April Insight

The recent fall in the price of gold has proved to be a gift to other investors as small denomination bars, at the time of writing, are now difficult to source in India, Singapore, Japan, China and Europe.

In this month’s edition of Insight Chris Sanders argues that the real issue is that we are not accumulating enough capital to replace depreciating assets, particularly with regard to the production of energy. Accompanying this alarming reality is the apparent reckless abandon with which the banking fraternity in the US is ‘bending’ COMEX’s rules and over in Cyprus, treating depositors’ savings as their own personal safety net.

In this edition of GoldCore Insight you will find out about:

• The Cyprus rubicon – depositors’ savings are fair game

• How energy will shape our future

• The importance of owning physical bullion

No comments:

Post a Comment