by GoldCore

Today’s AM fix was USD 1,602.50, EUR 1,238.41 and GBP 1,059.78 per ounce.

Yesterday’s AM fix was USD 1,599.50, EUR 1,236.09 and GBP 1,057.45 per ounce.

Silver is trading at $28.86/oz, €22.38/oz and £19.16/oz. Platinum is trading at $1,605.25/oz, palladium at $757.00/oz and rhodium at $1,250/oz.

Gold climbed $13.70 or 0.86% and closed yesterday at $1,578.10/oz. Silver hit a high of $29.05 finished +0.56%. A national holiday was observed in Ireland yesterday and markets were closed.

The Troika’s raid on the deposits of families and businesses in Cyprus is still being digested but it may be another watershed moment leading towards gold again becoming a foundation asset and key core holding of savers and investors internationally.

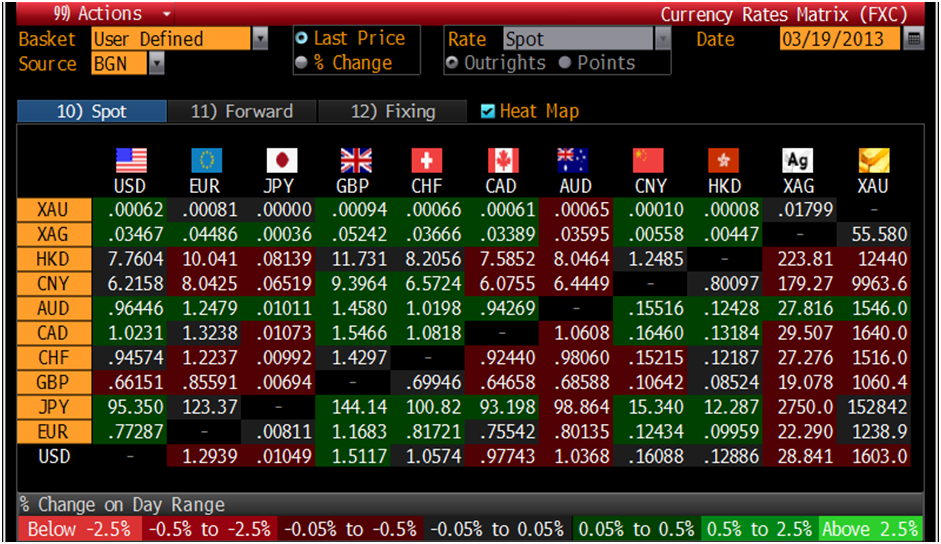

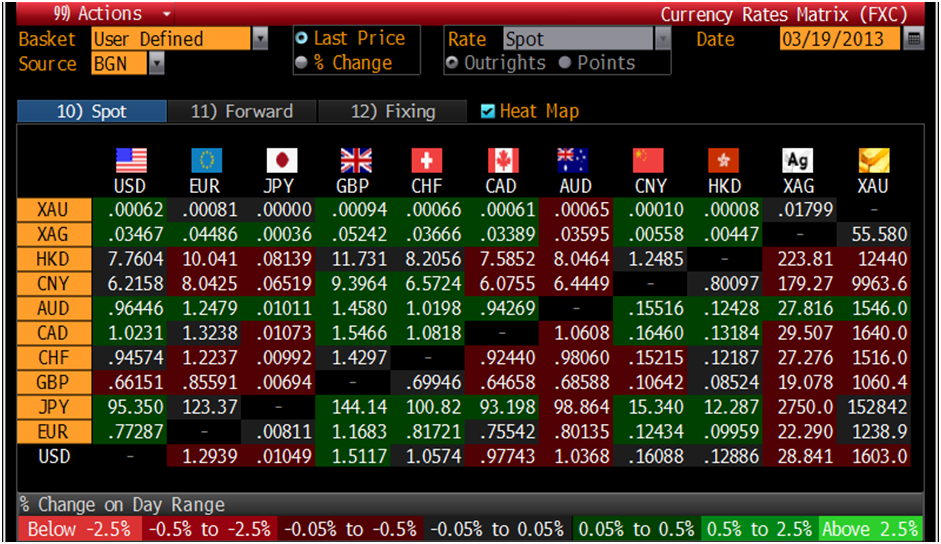

Cross Currency Table – (Bloomberg)

JP Morgan Chase & Co won their case of a nationwide investors’ lawsuit accusing them of conspiring to drive down silver prices.

U.S. District Judge Robert Patterson in Manhattan said the investors, who bought and sold COMEX silver futures and options contracts, failed to show that JPMorgan manipulated prices, by creating long short positions that were not in synch with market events at the time period.

The judge acknowledged that the firm could influence prices, but said that it was not proven that the bank “intended to cause artificial prices to exist” and acted accordingly.

Gold Commodity, 6March2013-19March2013 – (Bloomberg)

The plaintiffs had nearly 43 complaints filed from 2010-2011, which accused banks of profiteering in over $100,000,000 by illegally manipulating silver prices.

The lawsuits against major Wall Street firms were consolidated, naming JPMorgan and 20 unnamed individuals as defendants.

Gold in Euros, 6March2013-19March2013 – (Bloomberg)

The complaint had sought triple damages for what it saw as antitrust violations in jiggering silver prices from 2007-2010, including through alleged “fake” trades during low market volumes.

The CFTC began investigating queries of silver price manipulation in 2008, and after 2 years it tightened its regulations to foil traders who try to manipulate prices.

Silver remains a vital diversification and remains undervalued vis-à-vis gold and most assets.

NEWS

Gold hovers above $1,600/oz on Cyprus concerns - Reuters

JP Morgan wins dismissal of silver price-fixing lawsuit - Reuters

Gold Tops $1600; Silver Eagle Bullion Coins Top 13 Million – Coin News

Bullish Bets Jump Most Since July as Gold Rebounds - Bloomberg

COMMENTARY

Daylight robbery in Cyprus will come to haunt EMU – The Telegraph

Sinclair – Cyprus Disaster Is Much Bigger Than Being Reported – King World News

“All The Conditions For A Total Disaster Are In Place” – Zero Hedge

Risk, complacency, perception and gold - Mineweb

Today’s AM fix was USD 1,602.50, EUR 1,238.41 and GBP 1,059.78 per ounce.

Yesterday’s AM fix was USD 1,599.50, EUR 1,236.09 and GBP 1,057.45 per ounce.

Silver is trading at $28.86/oz, €22.38/oz and £19.16/oz. Platinum is trading at $1,605.25/oz, palladium at $757.00/oz and rhodium at $1,250/oz.

Gold climbed $13.70 or 0.86% and closed yesterday at $1,578.10/oz. Silver hit a high of $29.05 finished +0.56%. A national holiday was observed in Ireland yesterday and markets were closed.

The Troika’s raid on the deposits of families and businesses in Cyprus is still being digested but it may be another watershed moment leading towards gold again becoming a foundation asset and key core holding of savers and investors internationally.

Cross Currency Table – (Bloomberg)

JP Morgan Chase & Co won their case of a nationwide investors’ lawsuit accusing them of conspiring to drive down silver prices.

U.S. District Judge Robert Patterson in Manhattan said the investors, who bought and sold COMEX silver futures and options contracts, failed to show that JPMorgan manipulated prices, by creating long short positions that were not in synch with market events at the time period.

The judge acknowledged that the firm could influence prices, but said that it was not proven that the bank “intended to cause artificial prices to exist” and acted accordingly.

Gold Commodity, 6March2013-19March2013 – (Bloomberg)

The plaintiffs had nearly 43 complaints filed from 2010-2011, which accused banks of profiteering in over $100,000,000 by illegally manipulating silver prices.

The lawsuits against major Wall Street firms were consolidated, naming JPMorgan and 20 unnamed individuals as defendants.

Gold in Euros, 6March2013-19March2013 – (Bloomberg)

The complaint had sought triple damages for what it saw as antitrust violations in jiggering silver prices from 2007-2010, including through alleged “fake” trades during low market volumes.

The CFTC began investigating queries of silver price manipulation in 2008, and after 2 years it tightened its regulations to foil traders who try to manipulate prices.

Silver remains a vital diversification and remains undervalued vis-à-vis gold and most assets.

NEWS

Gold hovers above $1,600/oz on Cyprus concerns - Reuters

JP Morgan wins dismissal of silver price-fixing lawsuit - Reuters

Gold Tops $1600; Silver Eagle Bullion Coins Top 13 Million – Coin News

Bullish Bets Jump Most Since July as Gold Rebounds - Bloomberg

COMMENTARY

Daylight robbery in Cyprus will come to haunt EMU – The Telegraph

Sinclair – Cyprus Disaster Is Much Bigger Than Being Reported – King World News

“All The Conditions For A Total Disaster Are In Place” – Zero Hedge

Risk, complacency, perception and gold - Mineweb

No comments:

Post a Comment