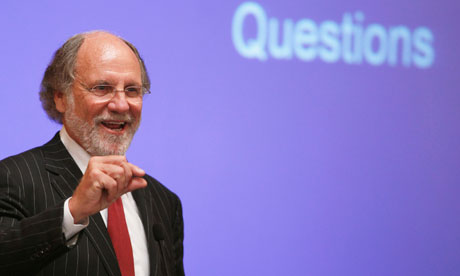

This is not looking good for former New Jersey Senator and Governor, and previously Goldman Sachs CEO Jon Corzine. More than $700 million of supposedly safeguarded client funds were stolen by MF Global to support besieged trading positions. Jon Corzine should go to prison. If Corzine escapes without a Federal ID number and associated orange jumpsuit due to fundraising ties with Obama and Eric Holder, then the game is over.

The rule of law is dead.

---

The admission is here:

AP

WASHINGTON (AP) — MF Global, the failed securities firm led by Jon Corzine, admitted using clients' money as its financial troubles mounted, a federal official says.

An MF Global executive admitted that to federal regulators in a phone call early Monday after regulators discovered money missing from clients' accounts, according to an official familiar with the conversation.

The official spoke on condition of anonymity because he wasn't authorized to discuss an investigation by federal regulators.

Government rules require securities firms to keep clients' money and company money in separate accounts. Violations can result in civil penalties.

The investigation of MF Global Holdings Ltd. is preliminary. A formal investigation by the company's main regulator, the Commodity Futures Trading Commission, requires a vote by its five commissioners.

It isn't clear whether the violations could lead to criminal charges. At a news conference, Manhattan U.S. Attorney Preet Bharara would not comment on whether a criminal investigation is underway involving the revelations at MF Global.

Continue reading...

---

1. Where were the regulators? By the time the Federal Reserve Bank of New York suspended MF Global, it was clear the firm was over leveraged, with some reports saying the ratio was 80-to-1. Client money is missing. At the very least, bookkeeping at MF Global was sloppy. Regulators and accountants should have stopped the madness before this point. The company was told to boost capital in August — but it’s clear the bank’s exposure was far greater than anticipated.

2. Where is the money? At least $700 million in client money is missing. This is a cardinal sin in the world of investment banking. Client money cannot be borrowed or mixed with house money. Should the suspicions prove true, this will be more embarrassment.

3. Why did Jon Corzine, MF Global’s CEO, claim everything was OK, in the company’s waning days? The former Goldman CEO was quoted less than a week ago saying “Reflecting the stressed markets in the quarter, we deliberately chose to reduce overall market exposure in most principal trading activities and focused on preserving capital and liquidity.”

http://www.marketwatch.com/story/3-big-questions-for-mf-global-fiasco-2011-11-01

---

No comments:

Post a Comment