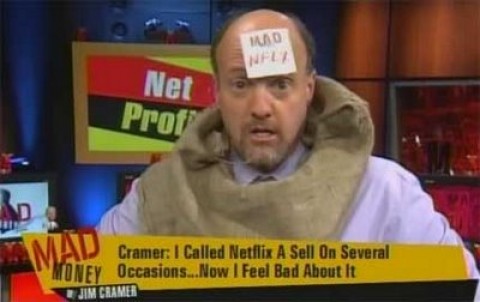

CNBC's Jim Cramer is a stock-picking buffoon, this is no secret to anyone beyond his call-in sycophants, who willingly scream 'booyah' for any chance to be on-air with their majesty, lord of all stupidity. However, when Cramer gets bearish and tells readers to short financials, as he did today, even going so far as to recommend using the double and triple short financial etfs, well then it's newsworthy, to a certain degree, if only for the uncomprising laughter at the late-to-the-party clown.

Yes, Jim we are laughing at you, not with you.

---

Cramer - Europe's Lehman Moment

Source - Real Money

NEW YORK -- At least it is no longer complicated. We know a European Lehman is upon us. Or, more like it, a European Lehman/Bear/Merrill/Washington Mutual/Wachovia/Citigroup.

That's the first proposition.

Second, we know that "they" have no plan to deal with it.

Third, we don't even know who "they" is anymore. Is it the Germans? The French? The IMF? The European Central Bank? Trichet?

Fourth, it is now too late for the banks to raise capital. As you recall, when the ratings agencies strike, it very quickly leads to Lehman. The banks can't get short-term funding and they collapse.

Fifth, the French banks in particular have been getting away with hiding their version of subprime debt, Greek debt, forever.

Sixth, our country isn't able to stop any of this. We are too weak and it is none of our business.

Seventh, because of how tightly correlated we are with Europe, individual stocks can't buck the trend, at least initially. Later on they will, because while our banking system won't collapse, it can't help but cause a worldwide recession if it all goes bad, which it looks like it is going to do.

So, the only battle plan is to brace yourself if you can't short. Raise some cash if you can. And short the S&P and double- and triple-short the financials -- the levered ETFs will certainly give you that chance.

No comments:

Post a Comment