Ron Paul is a medical doctor, a US Congressman and a Presidential candidate. He is also an investor and apparently a very good one. While his portfolio may lack some diversification, Paul has had a focused buy and hold strategy over the last decade. His strategy has worked out well for him, largely because the focus of his investments has been gold.

Ron Paul has consistently argued that high inflation was coming on the back of loose monetary policy. Paul has claimed that this coming inflation could hurt the lower classes worst of all, because they will have few options to protect themselves from inflation other than keeping some of their savings in gold and silver.

For over 15 years, Congressman Paul has held shares of gold and silver miners such as Agnico Eagle Mines (AEM), Barrick Gold (ABX), Newmont Mining (NEM), AngloGold Ashanti (AU), IAM Gold (IAG), Goldcorp (GG), Pan American Silver (PAAS) and Silver Wheaton (SLW), among others. Paul rarely sold shares over the last decade, and bought more of many miners as the United States expanded its diplomacy into Iraq in 2003.

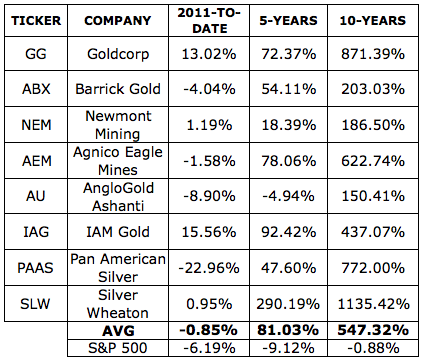

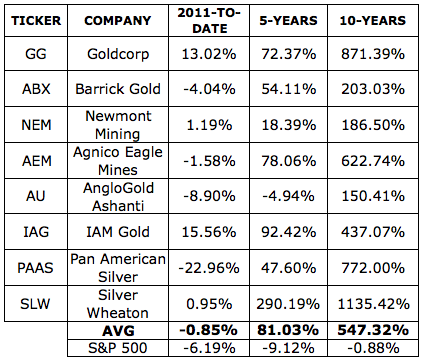

Below are the 2011-to-date, 5-year and 10-year returns for the gold and silver miners mentioned above, all of which are within Ron Paul's top holdings.

As the numbers show, these holdings have largely outperformed the broader market as defined by the S&P 500. Over the last five and ten years, every one of the above-mentioned companies beat the S&P 500, and most by a significant level.

Last week, Barron's called Ron Paul's investment portfolio a "big bet against the U.S. economy" and noted that the Congressman voted against the recent plan to raise the debt ceiling, arguing that a failure to raise the debt ceiling would have benefited Paul's portfolio. This argument ignores Paul's history of voting against government spending and arguing that this very type of action is what will cause that feared inflation.

Beyond shortsightedness regarding Ron Paul's lengthy history of voting against inflationary legislation, Barron's showed bias against the portfolio by choosing to provide readers with 1-year and 3-year return numbers for Paul's portfolio holdings, and the claim that "Paul's 'stopped clock' portfolio looks like it's finally paying off."

In particular, one may wonder what a 3-year return has to do with Paul's holdings, especially within an article that explains Ron Paul acquired most of those holdings between 8 and 15 years ago. Taking a look at the chart for the Gold Miners ETF (GDX), it appears the industry lost a significant amount of value about 2.9 years ago, though, and that Barron's used that time-frame in order to show the portfolio from a poor and biased perspective. The reluctance to actually consider Paul's historic performance appears to be intentional blindness to the facts.

An investment in the worst performing above-named miner over the last ten years would have returned over 150%, with the average miner's return being over 547%. Compare that to the S&P 500, which is down just under 1% over the last ten years. The five year average return for these miners was over 81%, compared to a loss of over 9% for the S&P 500. These returns also indicate that Paul's portfolio is not finally paying off, but that it had been paying off for quite a while. Not bad for a stopped clock.

Over the last decade, Paul's portfolio has beaten the market as well as the vast majority of hedge funds, yet Barron's labeled Paul's investment strategy a "financial planner's nightmare." Okay, so what? After all, should an investor's priority be how soundly their financial planner sleeps or the identification of suitable and timely investments that present a value proposition. Perhaps Barron's feels Paul was too focused on winners, and needed to diversify into some losers.

While it may be true that a financial planner may sleep easier knowing clients are broadly invested in fee-based instruments and market-linked baskets, such a move would have cost Ron Paul essentially all of his substantial profit over the last decade. Do keep in mind that a financial planner's daydreams cost about 1-2% in annual fees that are not included in the S&P 500's performance, and that about half underperform the S&P 500 before fees anyway.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: This article is intended to be informative, and should not be construed as personalized advice, as it does not take into account your specific situation or objectives.

Ron Paul has consistently argued that high inflation was coming on the back of loose monetary policy. Paul has claimed that this coming inflation could hurt the lower classes worst of all, because they will have few options to protect themselves from inflation other than keeping some of their savings in gold and silver.

For over 15 years, Congressman Paul has held shares of gold and silver miners such as Agnico Eagle Mines (AEM), Barrick Gold (ABX), Newmont Mining (NEM), AngloGold Ashanti (AU), IAM Gold (IAG), Goldcorp (GG), Pan American Silver (PAAS) and Silver Wheaton (SLW), among others. Paul rarely sold shares over the last decade, and bought more of many miners as the United States expanded its diplomacy into Iraq in 2003.

Below are the 2011-to-date, 5-year and 10-year returns for the gold and silver miners mentioned above, all of which are within Ron Paul's top holdings.

As the numbers show, these holdings have largely outperformed the broader market as defined by the S&P 500. Over the last five and ten years, every one of the above-mentioned companies beat the S&P 500, and most by a significant level.

Last week, Barron's called Ron Paul's investment portfolio a "big bet against the U.S. economy" and noted that the Congressman voted against the recent plan to raise the debt ceiling, arguing that a failure to raise the debt ceiling would have benefited Paul's portfolio. This argument ignores Paul's history of voting against government spending and arguing that this very type of action is what will cause that feared inflation.

Beyond shortsightedness regarding Ron Paul's lengthy history of voting against inflationary legislation, Barron's showed bias against the portfolio by choosing to provide readers with 1-year and 3-year return numbers for Paul's portfolio holdings, and the claim that "Paul's 'stopped clock' portfolio looks like it's finally paying off."

In particular, one may wonder what a 3-year return has to do with Paul's holdings, especially within an article that explains Ron Paul acquired most of those holdings between 8 and 15 years ago. Taking a look at the chart for the Gold Miners ETF (GDX), it appears the industry lost a significant amount of value about 2.9 years ago, though, and that Barron's used that time-frame in order to show the portfolio from a poor and biased perspective. The reluctance to actually consider Paul's historic performance appears to be intentional blindness to the facts.

An investment in the worst performing above-named miner over the last ten years would have returned over 150%, with the average miner's return being over 547%. Compare that to the S&P 500, which is down just under 1% over the last ten years. The five year average return for these miners was over 81%, compared to a loss of over 9% for the S&P 500. These returns also indicate that Paul's portfolio is not finally paying off, but that it had been paying off for quite a while. Not bad for a stopped clock.

Over the last decade, Paul's portfolio has beaten the market as well as the vast majority of hedge funds, yet Barron's labeled Paul's investment strategy a "financial planner's nightmare." Okay, so what? After all, should an investor's priority be how soundly their financial planner sleeps or the identification of suitable and timely investments that present a value proposition. Perhaps Barron's feels Paul was too focused on winners, and needed to diversify into some losers.

While it may be true that a financial planner may sleep easier knowing clients are broadly invested in fee-based instruments and market-linked baskets, such a move would have cost Ron Paul essentially all of his substantial profit over the last decade. Do keep in mind that a financial planner's daydreams cost about 1-2% in annual fees that are not included in the S&P 500's performance, and that about half underperform the S&P 500 before fees anyway.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: This article is intended to be informative, and should not be construed as personalized advice, as it does not take into account your specific situation or objectives.

No comments:

Post a Comment